false

0000899629

0000899629

2024-09-12

2024-09-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

September 12, 2024

Acadia Realty Trust

(Exact name of registrant as specified in its

charter)

| Maryland |

|

1-12002 |

|

23-2715194 |

| (State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

411

Theodore Fremd Avenue

Suite

300

Rye,

New York 10580

(Address of principal

executive offices) (Zip Code)

(914) 288-8100

(Registrant’s telephone

number, including area code)

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

symbol |

|

Name of exchange on which

registered |

| Common shares of beneficial interest, par value $0.001 per share |

|

AKR |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01. | Entry into a Material Definitive Agreement. |

On September 12,

2024, Acadia Realty Limited Partnership, a Delaware limited partnership (the “Operating Partnership”), and its general

partner, Acadia Realty Trust, a Maryland real estate investment trust (the “Company”), entered into a Consent and Second

Amendment (the “Amendment”) to the Third Amended and Restated Credit Agreement, dated as of April 15, 2024, by and among

the Operating Partnership, as borrower, the Company and certain subsidiaries of the Operating Partnership from time to time party

thereto, as guarantors, Bank of America, N.A., as administrative agent, and the lenders and letter of credit issuers party thereto

(the “Credit Facility”).

The Amendment provides

for an increase in the revolving credit facility under the Credit Facility from $350.0 million to $525.0 million, on the same terms and

conditions as the existing revolving credit facility. The Amendment also increases the capacity limit on the accordion feature under the

existing Credit Facility from $900.0 million to $1.1 billion, on the same terms and conditions otherwise set forth in the Credit Facility.

The above summary of

the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, a copy

of which is attached hereto as Exhibit 10.1 and incorporated by reference herein.

| Item 1.02. | Termination of a Material Definitive Agreement. |

On September 12, 2024,

using cash on hand and borrowings under the amended Credit Facility, the Operating Partnership repaid in full all outstanding obligations

in the amount of $175.0 million under the Credit Agreement dated as of April 6, 2022, by and among the Company, the Operating Partnership,

Bank of America, N.A., as administrative agent and the other lenders party thereto (the “Term Loan Agreement”), and all obligations

of the Company and its subsidiaries under the Term Loan Agreement were released (other than with respect to customary provisions and agreements

that are expressly specified to survive the termination). The Company and its subsidiaries did not incur any early termination penalties

in connection with repayment of the indebtedness or termination of the Term Loan Agreement.

| Item 2.03. | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance

Sheet Arrangement of a Registrant. |

The information set forth under Item 1.01 of this

Current Report on Form 8-K is hereby incorporated in this Item 2.03 by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit

Number |

|

Description |

| 10.1 |

|

Consent and Second Amendment, dated September 12, 2024, to the Third Amended and Restated Credit Agreement, dated April 15, 2024, by and among Acadia Realty Limited Partnership, Acadia Realty Trust, Bank of America, N.A., as administrative agent, Wells Fargo Bank, National Association, Truist Bank, and PNC Bank, National Association, as syndication agents, BofA Securities, Inc. and Wells Fargo Securities, LLC, as joint bookrunners, and BofA Securities, Inc., Wells Fargo Securities, LLC, Truist Securities, Inc. and PNC Capital Markets LLC, as joint lead arrangers, and the lenders and letter of credit issuers party thereto. |

| 104 |

|

Cover Page Interactive Data File (formatted as inline XBRL with applicable taxonomy extension information contained in Exhibits 101.) |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has

duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ACADIA REALTY TRUST |

| Dated: |

(Registrant) |

| September 13, 2024 |

|

|

| |

By: |

/s/ John Gottfried |

| |

Name: |

John Gottfried |

| |

Title: |

Executive Vice President and Chief Financial Officer |

Exhibit 10.1

CONSENT AND SECOND AMENDMENT

TO THIRD AMENDED AND RESTATED CREDIT AGREEMENT

CONSENT AND SECOND AMENDMENT,

dated as of September 12, 2024 (this “Amendment”), to the Third Amended and Restated Credit Agreement, dated as

of April 15, 2024, by and among Acadia Realty Limited Partnership, a Delaware limited partnership (the “Borrower”),

Acadia Realty Trust, a Maryland real estate investment trust (the “REIT”) and certain subsidiaries of the Borrower

from time to time party thereto, as guarantors, the Lenders and L/C Issuers from time to time party thereto, and Bank of America, N.A.,

as Administrative Agent (as heretofore amended, modified, extended, restated, replaced, or supplemented from time to time, the “Credit

Agreement” and, as amended by this Amendment, the “Amended Credit Agreement”). Any term used herein and not

otherwise defined herein shall have the meaning assigned to such term in the Amended Credit Agreement.

WHEREAS, the Borrower has requested

that the aggregate principal amount of the Facilities be increased by $175,000,000 through an increase in the existing Revolving Credit

Commitments from $350,000,000 to $525,000,000 (the “Incremental Revolving Commitment”).

WHEREAS, the Borrower has further

requested that the Credit Agreement be modified as herein set forth.

NOW THEREFORE, for good and

valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

SECTION 1.

Consent. Subject to all of the terms and conditions set forth in this Amendment, each of the Lenders appearing

on Annex I has agreed to participate in the Incremental Revolving Commitment (each an “Increasing Lender” and, collectively,

the “Increasing Lenders”) and hereby consents, as of the Second Amendment Effective Date (as hereinafter defined),

to increasing its Revolving Credit Commitment by the amount set forth opposite such Lender’s name on Annex I hereto under the caption

“Incremental Revolving Commitment”.

SECTION 2. Amendments

to Credit Agreement.

2.1 Amendment

to Section 2.15(a) of the Credit Agreement. Section 2.15(a) of the Credit Agreement is hereby amended by replacing

“$900,000,000” appearing in the first sentence of Section 2.15(a) with “$1,100,000,000”.

2.2 Schedules

to the Credit Agreement. The schedules to the Credit Agreement are hereby amended by replacing Schedule 2.01 in its entirety with

the Schedule 2.01 attached hereto as Annex II.

SECTION 3.

Conditions of Effectiveness. This Amendment shall become effective on the first date on which each of the following

conditions precedent shall have been satisfied or waived in writing (such date being referred to herein as the “Second Amendment

Effective Date”):

(a) the

Administrative Agent shall have received counterparts of this Amendment duly executed and delivered by each of the Loan Parties, the Administrative

Agent, each of the Increasing Lenders, each of the L/C Issuers, and Lenders constituting Required Lenders;

(b) the

Administrative Agent shall have received evidence in form and substance satisfactory to the Administrative Agent that certain Credit Agreement,

dated as of April 26, 2022 among the Borrower, the REIT and certain subsidiaries of the Borrower from time to time party thereto,

as guarantors, the lenders from time to time party thereto, and Bank of America, N.A., as administrative agent thereunder (the “Existing

Term Loan Agreement”) has been, or concurrently with the Second Amendment Effective Date is being, terminated and all obligations

under the Existing Term Loan Credit Agreement have been, or concurrently with the Closing Date are being, repaid in full;

(c) after

giving pro forma effect to the Incremental Revolving Commitment and the use of proceeds thereof, no Default or Event of Default has occurred

and is continuing on the Second Amendment Effective Date or would (giving effect to this Amendment) result therefrom;

(d) before

and after giving effect to the Incremental Revolving Commitment and the Credit Extensions, if any to be made on such Second Amendment

Effective Date (giving effect to this Amendment), the representations and warranties contained in Section 4 of this Amendment are

true and correct in all material respects, or, in the case of a representation and warranty that is qualified by materiality or a Material

Adverse Effect, are true and correct, on and as of the Second Amendment Effective Date;

(e) the

Administrative Agent shall have received a certificate of each Loan Party dated as of the Second Amendment Effective Date signed by a

Responsible Officer of such Loan Party certifying and attaching the resolutions adopted by such Loan Party approving or consenting to

Incremental Revolving Commitment, and (y) in the case of the Borrower, certifying that the conditions in clause (b) through

(d) above have been satisfied;

(f) all

fees required to be paid in connection with the Incremental Revolving Commitment on or before the Second Amendment Effective Date shall

have been paid; and

(g) upon

the reasonable request of the Administrative Agent or any Lender participating in the Incremental Revolving Commitment made at least 10

days prior to the Second Amendment Effective Date, the Borrower shall have provided to the Administrative Agent or such Lender, as applicable,

and such Lender shall be reasonably satisfied with, the documentation and other information so requested in connection with, the USA PATRIOT

Act, “know your customer” requirements, anti-money laundering requirements and the Beneficial Ownership Regulation (including

a Beneficial Ownership Certification) and other customary requirements, in each case at least five days prior to the Second Amendment

Effective Date.

Each Lender, by executing and delivering this

Amendment, agrees that the Borrower shall not be required to make any breakage payments in connection with any adjustment of Revolving

Credit Loans on the Second Amendment Effective Date pursuant to Section 2.15(d) of the Credit Agreement and the making of any

such breakage payments as a condition precedent to the Second Amendment Effective Date is hereby waived.

SECTION 4.

Representations and Warranties of Loan Parties. Each Loan Party represents and warrants (which representations and warranties

shall survive the execution and delivery hereof) to the Administrative Agent and each Lender that:

(a) the

representations and warranties made by it in Article V of the Amended Credit Agreement or any other Loan Document, or which

are contained in any document furnished at any time under or in connection therewith, shall be true and correct in all material respects

on and as of the Second Amendment Effective Date after giving effect to this Amendment (including the Incremental Revolving Commitment

and the Credit Extensions, if any, to be made on the Second Amendment Effective Date) (without duplication of materiality qualifiers

set forth in such representations and warranties), except (i) with respect to the representations and warranties set forth in Sections

5.15(b) and 5.19 of the Amended Credit Agreement, in which case they shall be true and correct in all respects, (ii) to

the extent that such representations and warranties expressly relate to an earlier date (in which case such representations and warranties

are true and correct in all material respects (or, in the case of Sections 5.15(b) and 5.19 of the Amended Credit Agreement

in all respects) on and as of such earlier date, without duplication of materiality qualifiers set forth in such representations and warranties),

and (iii) that for purposes of this Amendment, the representations and warranties contained in subsections (a) and (b) of

Section 5.05 of the Amended Credit Agreement shall be deemed to refer to the most recent statements furnished pursuant to

subsections (a) and (b), respectively, of Section 6.01 of the Credit Agreement. Each Loan Party represents

and warrants (which representations and warranties shall survive the execution and delivery hereof) to the Administrative Agent and the

Lenders that:

(b) it

has the requisite power and authority to execute, deliver and perform its obligations under this Amendment and has taken or caused

to be taken all necessary company action to authorize the execution, delivery and performance of this Amendment;

(c) no

consent of any Person (including, without limitation, any of its equity holders or creditors), and no action of, or filing with, any governmental

or public body or authority is necessary or required in connection with, the execution, delivery and performance of this Amendment;

(d) this

Amendment has been duly executed and delivered on its behalf by a duly authorized officer, and constitutes its legal, valid and binding

obligation enforceable in accordance with its terms, subject to bankruptcy, reorganization, insolvency, moratorium and other similar laws

affecting the enforcement of creditors’ rights generally and the exercise of judicial discretion in accordance with general principles

of equity;

(e) after

giving effect to this Amendment and the Incremental Revolving Commitment, no Default or Event of Default has occurred and is continuing;

and

(f) the

execution, delivery and performance of this Amendment will not violate any Law, or any order, injunction, writ or decree of any

Governmental Authority or any arbitral award to which such Person or its property is subject, or conflict with, or result in the breach

of, or constitute a default under, any Contractual Obligation of any Loan Party or any of its Subsidiaries.

SECTION 5.

Affirmation of Guarantors. Each Guarantor hereby approves and consents to this Amendment and the transactions contemplated

by this Amendment and agrees and affirms that its guarantee of the Obligations continues to be in full force and effect and is hereby

ratified and confirmed in all respects and shall apply to the Credit Agreement, as amended hereby, and all of the other Loan Documents,

as such are amended, restated, supplemented or otherwise modified from time to time in accordance with their terms.

SECTION 6.

Ratification.

(a) Except

as herein agreed, the Credit Agreement and the other Loan Documents remain in full force and effect and are hereby ratified and affirmed

by the Loan Parties. Each of the Loan Parties hereby (i) confirms and agrees that the Borrower is truly and justly indebted to the

Administrative Agent, the L/C Issuers and the Lenders in the aggregate amount of the Obligations without defense, counterclaim or offset

of any kind whatsoever, and (ii) reaffirms and admits the validity and enforceability of the Amended Credit Agreement and the other

Loan Documents.

(b) This

Amendment shall be limited precisely as written and, except as expressly provided herein, shall not be deemed (i) to be a consent

granted pursuant to, or a waiver, modification or forbearance of, any term or condition of the Amended Credit Agreement or any of the

instruments or agreements referred to therein or a waiver of any Default or Event of Default under the Amended Credit Agreement, whether

or not known to the Administrative Agent, any of the L/C Issuers or any of the Lenders, or (ii) to prejudice any right or remedy

which the Administrative Agent, any of the L/C Issuers or any of the Lenders may now have or have in the future against any Person under

or in connection with the Amended Credit Agreement, any of the instruments or agreements referred to therein or any of the transactions

contemplated thereby.

SECTION 7. Modifications.

Neither this Amendment, nor any provision hereof, may be waived, amended or modified except pursuant to an agreement or agreements

in writing entered into by the parties hereto.

SECTION 8.

Loan Document; References. The Loan Parties acknowledge and agree that this Amendment constitutes a Loan Document. Each

reference in the Amended Credit Agreement to “this Amendment,” “hereunder,” “hereof,” “herein,”

or words of like import, and each reference in each other Loan Document (and the other documents and instruments delivered pursuant to

or in connection therewith) to the “Credit Agreement”, “thereunder”, “thereof” or words of like import,

shall mean and be a reference to the Amended Credit Agreement as the Amended Credit Agreement may in the future be amended, restated,

supplemented or modified from time to time.

SECTION 9.

Electronic Execution; Electronic Records; Counterparts. Section 11.17 of the Amended Credit Agreement is

incorporated herein, mutatis mutandis, as if a part hereof.

SECTION 10.

Successors and Assigns. The provisions of this Amendment shall be binding upon and inure to the benefit of the parties

hereto and their respective successors and assigns.

SECTION 11.

Severability. If any provision of this Amendment shall be held invalid or unenforceable in whole or in part in any jurisdiction,

such provision shall, as to such jurisdiction, be ineffective to the extent of such invalidity or enforceability without in any manner

affecting the validity or enforceability of such provision in any other jurisdiction or the remaining provisions of this Amendment in

any jurisdiction.

SECTION 12.

Governing Law. This Amendment and any claims, controversy, dispute or

cause of action (whether in contract or tort or otherwise) based upon, arising out of or relating to this Amendment and the transactions

contemplated hereby shall be governed by, and construed in accordance with, the law of the State of NEW yORK.

SECTION 13.

Headings. Section headings in this Amendment are included for convenience of reference only and are not to affect

the construction of, or to be taken into consideration in interpreting, this Amendment.

SECTION 14.

Entire Agreement. This Amendment constitutes the entire contract among the parties relating to the subject matter hereof

and supersedes any and all previous agreements and understandings, oral or written, relating to the subject matter hereof. Without limitation

of the foregoing:

THIS AMENDMENT REPRESENTS THE FINAL AGREEMENT

AMONG THE PARTIES WITH RESPECT TO THE SUBJECT MATTER HEREOF AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR

SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS AMONG THE PARTIES.

[Signature pages immediately follow]

IN

WITNESS WHEREOF, the undersigned have caused this Amendment to be executed by their respective officers thereunto duly authorized

as of the date hereof.

| |

BORROWER: |

| |

|

| |

ACADIA REALTY LIMITED PARTNERSHIP,

a Delaware limited partnership |

| By: | ACADIA REALTY TRUST, its General Partner |

| By: | /s/ John Gottfried |

| Name: | John Gottfried |

| Title: | Executive Vice President and Chief Financial Officer |

Signature

Page to Second Amendment to Acadia Realty Third Amended and Restated Credit Agreement

| |

GUARANTORS: |

| |

|

| |

|

| |

Each of the Guarantors is hereby executing

this Amendment for the purposes of acknowledging its agreement to the representations and warranties made by such Guarantor under

Section 4 of this Amendment, the affirmations made by such Guarantor under Section 5 of this Amendment and the ratifications,

affirmations, confirmations and agreements made under Section 7 of this Amendment. |

| |

|

| |

|

| |

ACADIA REALTY TRUST, a Maryland

real estate investment trust |

| |

|

| |

|

| |

By: |

/s/ John Gottfried |

| |

|

Name: John Gottfried |

| |

|

Title: Executive Vice President and Chief Financial Officer |

| |

|

| |

|

| |

ACADIA 1520 MILWAUKEE AVENUE

LLC, a Delaware limited liability company |

| |

|

| |

ACADIA 2914 THIRD AVENUE LLC,

a Delaware limited liability company |

| |

|

| |

ACADIA 5-7 EAST 17TH STREET LLC,

a Delaware limited liability company |

| |

|

| |

ACADIA 83 SPRING STREET LLC,

a Delaware limited liability company |

| |

|

| |

ACADIA BARTOW AVENUE LLC, a Delaware

limited liability company |

| |

|

| |

ACADIA CHESTNUT LLC, a Delaware

limited liability company |

| |

|

| |

ACADIA GOLD COAST LLC, a Delaware

limited liability company |

| |

|

| |

ACADIA MAD RIVER PROPERTY LLC,

a Delaware limited liability company |

Signature

Page to Second Amendment to Acadia Realty Third Amended and Restated Credit Agreement

| |

|

|

| |

ACADIA MERCER STREET LLC, a Delaware limited liability company |

| |

|

|

| |

ACADIA RUSH WALTON LLC, a Delaware limited liability company |

| |

|

| |

ACADIA TOWN LINE, LLC, a Connecticut limited liability company |

| |

|

| |

ACADIA WEST 54TH STREET LLC, a Delaware limited liability company |

| |

|

| |

ACADIA WEST SHORE EXPRESSWAY LLC, a Delaware limited liability company |

| |

|

| |

MARK PLAZA FIFTY L.P., a Pennsylvania limited partnership |

| |

|

| |

|

By: |

ACADIA MARK PLAZA LLC, its General Partner |

| |

|

| |

ACADIA MARK PLAZA LLC, a Delaware limited liability company |

| |

|

| |

RD ABINGTON ASSOCIATES LIMITED PARTNERSHIP, a Delaware limited partnership |

| |

|

| |

|

By: |

ACADIA PROPERTY HOLDINGS, LLC, its General Partner |

| |

|

| |

RD ABSECON ASSOCIATES, L.P, a Delaware limited partnership |

| |

|

| |

|

By: |

ACADIA ABSECON LLC, its General Partner |

| |

|

| |

ACADIA ABSECON LLC, a Delaware limited liability company |

| |

|

| |

RD BLOOMFIELD ASSOCIATES LIMITED PARTNERSHIP, a Delaware limited partnership |

| |

|

| |

|

By: |

ACADIA PROPERTY HOLDINGS, LLC, its General Partner |

Signature

Page to Second Amendment to Acadia Realty Third Amended and Restated Credit Agreement

| |

RD HOBSON ASSOCIATES, L.P., a Delaware limited partnership |

| |

|

| |

|

By: |

ACADIA PROPERTY HOLDINGS, LLC, its General Partner |

| |

|

| |

MARK TWELVE ASSOCIATES, L.P., a Pennsylvania limited partnership |

| |

|

| |

|

By: |

ACADIA HOBSON LLC, its General Partner |

| |

|

| |

ACADIA HOBSON LLC, a Delaware limited liability company |

| |

|

| |

RD METHUEN ASSOCIATES LIMITED PARTNERSHIP, a Massachusetts limited partnership |

| |

|

| |

|

By: |

ACADIA PROPERTY HOLDINGS, LLC, its General Partner |

| |

|

| |

ACADIA PROPERTY HOLDINGS, LLC, a Delaware limited liability company |

| |

|

| |

ACADIA 181 MAIN STREET LLC, a Delaware limited liability company |

| |

|

| |

ACADIA CHICAGO LLC, a Delaware limited liability company |

| |

|

| |

ACADIA CONNECTICUT AVENUE LLC, a Delaware limited liability company |

| |

|

| |

8-12 EAST WALTON LLC, a Delaware limited liability company |

| |

|

| |

RD BRANCH ASSOCIATES, L.P., a New York limited partnership |

| |

|

| |

|

By: |

Acadia Property Holdings, LLC, its General Partner |

| |

|

| |

ACADIA WEST DIVERSEY LLC, a Delaware limited liability company |

| |

|

| |

868 BROADWAY LLC, a Delaware limited liability company |

Signature

Page to Second Amendment to Acadia Realty Third Amended and Restated Credit Agreement

| |

120 WEST BROADWAY LLC, a Delaware limited liability company |

| |

|

| |

11 EAST WALTON LLC, a Delaware limited liability company |

| |

|

| |

865 WEST NORTH AVENUE LLC, a Delaware limited liability company |

| |

|

| |

61 MAIN STREET OWNER LLC, a Delaware limited liability company |

| |

|

| |

252-264 GREENWICH AVENUE RETAIL LLC, a Delaware limited liability company |

| |

|

| |

2520 FLATBUSH AVENUE LLC, a Delaware limited liability company |

| |

|

| |

ACADIA CLARK-DIVERSEY LLC, a Delaware limited liability company |

| |

|

| |

ACADIA NEW LOUDON LLC, a Delaware limited liability company |

| |

|

| |

131-135 PRINCE STREET LLC, a Delaware limited liability company |

| |

|

| |

201 NEEDHAM STREET OWNER LLC, a Delaware limited liability company |

| |

|

| |

SHOPS AT GRAND AVENUE LLC, a Delaware limited liability company |

| |

|

| |

2675 GEARY BOULEVARD LP, a Delaware limited partnership |

| |

|

| |

|

By: |

2675 City Center Partner LLC, its General Partner |

| |

|

| |

2675 CITY CENTER PARTNER LLC, a Delaware limited liability company |

| |

|

| |

ACADIA NAAMANS ROAD LLC, a Delaware limited liability company |

| |

|

| |

ACADIA CRESCENT PLAZA LLC, a Delaware limited liability company |

Signature

Page to Second Amendment to Acadia Realty Third Amended and Restated Credit Agreement

| |

RD ELMWOOD ASSOCIATES, L.P., a Delaware limited partnership |

| |

|

| |

|

By: |

Acadia Elmwood Park LLC, its General Partner |

| |

|

| |

ACADIA ELMWOOD PARK LLC, a Delaware limited liability company |

| |

|

| |

ROOSEVELT GALLERIA LLC, a Delaware limited liability company |

| |

|

| |

ACADIA 56 EAST WALTON LLC, a Delaware limited liability company |

| |

|

| |

ACADIA SECOND CITY 843-45 WEST ARMITAGE LLC, a Delaware limited liability company |

| |

|

| |

ACADIA SECOND CITY 1521 WEST BELMONT LLC, a Delaware limited liability company |

| |

|

| |

ACADIA SECOND CITY 2206-08 NORTH HALSTED LLC, a Delaware limited liability company |

| |

|

| |

ACADIA SECOND CITY 2633 NORTH HALSTED LLC, a Delaware limited liability company |

| |

|

| |

HEATHCOTE ASSOCIATES, L.P., a New York limited partnership |

| |

|

| |

|

By: |

Acadia Heathcote LLC, its General Partner |

| |

|

| |

ACADIA HEATHCOTE LLC, a Delaware limited liability company |

| |

|

| |

152-154 SPRING STREET RETAIL LLC, a Delaware limited liability company |

| |

|

| |

ACADIA 152-154 SPRING STREET RETAIL LLC, a Delaware limited liability company |

| |

|

| |

165 NEWBURY STREET OWNER LLC, a Delaware limited liability company |

Signature

Page to Second Amendment to Acadia Realty Third Amended and Restated Credit Agreement

| |

ACADIA 639 WEST DIVERSEY LLC, a Delaware limited liability company |

| |

|

| |

ACADIA BRENTWOOD LLC, a Delaware limited liability company |

| |

|

| |

41 GREENE STREET OWNER LLC, a Delaware limited liability company |

| |

|

| |

47-49 GREENE STREET OWNER LLC, a Delaware limited liability company |

| |

|

| |

51 GREENE STREET OWNER LLC, a Delaware limited liability company |

| |

|

| |

53 GREENE STREET OWNER LLC, a Delaware limited liability company |

| |

|

| |

849 W. ARMITAGE OWNER LLC, a Delaware limited liability company |

| |

|

| |

912 W. ARMITAGE OWNER LLC, a Delaware limited liability company |

| |

|

| |

BEDFORD GREEN LLC, a Delaware limited liability company |

| |

|

| |

ACADIA 4401 WHITE PLAINS ROAD LLC, a Delaware limited liability company |

| |

|

| |

ACADIA MERRILLVILLE LLC, a Delaware limited liability company |

| |

|

| |

37 GREENE STREET OWNER LLC, a Delaware limited liability company |

| |

|

| |

907 W. ARMITAGE OWNER LLC, a Delaware limited liability company |

| |

|

| |

45 GREENE STREET OWNER LLC, a Delaware limited liability company |

| |

|

| |

8436-8452 MELROSE OWNER LP, a Delaware limited partnership |

| |

|

| |

|

By: |

8436-8452 MELROSE GENERAL PARTNER LLC, its General Partner |

Signature

Page to Second Amendment to Acadia Realty Third Amended and Restated Credit Agreement

| |

8436-8452 MELROSE GENERAL PARTNER LLC, a Delaware limited liability company |

| |

|

|

|

| |

917 W. ARMITAGE OWNER LLC, a Delaware limited liability company |

| |

|

| |

CALIFORNIA & ARMITAGE MAIN OWNER LLC, a Delaware limited liability company |

| |

|

| |

ACADIA TOWN CENTER HOLDCO LLC, a Delaware limited liability company |

| |

|

| |

ACADIA MARKET SQUARE, LLC, a Delaware limited liability company |

| |

|

| |

ACADIA NORTH MICHIGAN AVENUE LLC, a Delaware limited liability company |

| |

|

| |

565 BROADWAY OWNER LLC, a Delaware limited liability company |

| |

|

| |

ACADIA BRANDYWINE HOLDINGS, LLC, a Delaware limited liability company |

| |

|

| |

1324 14TH STREET OWNER LLC, a Delaware limited liability company |

| |

|

| |

1526 14TH STREET OWNER LLC, a Delaware limited liability company |

| |

|

| |

1529 14TH STREET OWNER LLC, a Delaware limited liability company |

| |

|

| |

121 SPRING STREET OWNER LLC, a Delaware limited liability company |

| |

|

| |

ACADIA 28 JERICHO TURNPIKE LLC, a Delaware limited liability company |

| |

|

| |

2622-2634 HENDERSON AVE OWNER LLC, a Delaware limited liability company |

| |

|

| |

HENDERSON AVE DEV 1 OWNER LLC, a Delaware limited liability company |

| |

|

| |

HENDERSON AVE DEV 2 OWNER LLC, a Delaware limited liability company |

Signature

Page to Second Amendment to Acadia Realty Third Amended and Restated Credit Agreement

| |

HENDERSON

AVE GRAND OWNER LLC, a Delaware limited liability company |

| |

|

| |

HENDERSON AVE LAND OWNER LLC, a Delaware limited liability company |

| |

|

| |

HENDERSON AVE LOTS OWNER LLC, a Delaware limited liability company |

| |

|

| |

HENDERSON AVE MAIN OWNER LLC, a Delaware limited liability company |

| |

|

| |

HENDERSON AVE SHOPS OWNER LLC, a Delaware limited liability company |

| |

|

| |

|

| |

By: |

/s/ John Gottfried |

| |

Name: |

John Gottfried |

| |

Title: |

Executive Vice President |

| |

|

on behalf of the 95 entities listed above |

| |

RD SMITHTOWN, LLC, a New York limited liability company |

| |

|

| |

|

By: |

ACADIA REALTY LIMITED PARTNERSHIP, a Delaware limited partnership |

| |

|

|

|

| |

|

|

By: |

ACADIA REALTY TRUST, its General Partner |

| |

|

|

|

|

| |

|

|

By: |

/s/ John Gottfried |

| |

|

|

Name: |

John Gottfried |

| |

|

|

Title: |

Executive Vice President and Chief Financial Officer |

Signature Page to Second Amendment to Acadia Realty

Third Amended and Restated Credit Agreement

| |

LENDERS: |

| |

|

| |

BANK OF AMERICA, N.A., as a Lender and an L/C Issuer |

| |

|

|

| |

|

|

| |

By: |

/s/ Gregory Egli |

| |

|

Name: |

Gregory Egli |

| |

|

Title: |

Senior Vice President |

Signature Page to Second Amendment to Acadia Realty

Third Amended and Restated Credit Agreement

| |

PNC BANK, NATIONAL ASSOCIATION, as a Lender and an L/C Issuer |

| |

|

|

| |

By: |

/s/ Michael Miller |

| |

|

Name: |

Michael Miller |

| |

|

Title: |

Senior Vice President |

Signature Page to Second Amendment to Acadia Realty

Third Amended and Restated Credit Agreement

| |

WELLS FARGO BANK, NATIONAL ASSOCIATION, as a Lender and an L/C Issuer |

| |

|

|

| |

|

|

| |

By: |

/s/ Craig V. Koshkarian |

| |

|

Name: |

Craig V. Koshkarian |

| |

|

Title: |

Executive Director |

Signature Page to Second Amendment to Acadia Realty

Third Amended and Restated Credit Agreement

| |

TRUIST BANK, as a Lender |

| |

|

|

| |

|

|

| |

By: |

/s/ Ryan Almond |

| |

|

Name: |

Ryan Almond |

| |

|

Title: |

Director |

Signature Page to Second Amendment to Acadia Realty

Third Amended and Restated Credit Agreement

| |

TD BANK, N.A., as a Lender |

| |

|

|

| |

|

|

| |

By: |

/s/ Gianna Gioia |

| |

|

Name: |

Gianna Gioia |

| |

|

Title: |

Vice President |

Signature Page to Second Amendment to Acadia Realty

Third Amended and Restated Credit Agreement

| |

JPMORGAN CHASE BANK, N.A., as a Lender |

| |

|

|

| |

|

|

| |

By: |

/s/ David Glenn |

| |

|

Name: |

David Glenn |

| |

|

Title: |

Authorized Signatory |

Signature Page to Second Amendment to Acadia Realty

Third Amended and Restated Credit Agreement

| |

M&T BANK, as a Lender |

| |

|

|

| |

|

|

| |

By: |

/s/ Cameron Daboll |

| |

|

Name: |

Cameron Daboll |

| |

|

Title: |

Senior Vice President |

Signature Page to Second Amendment to Acadia Realty

Third Amended and Restated Credit Agreement

| |

GOLDMAN SACHS BANK USA, as a Lender |

| |

|

|

| |

|

|

| |

By: |

/s/ Dan Martis |

| |

|

Name: |

Dan Martis |

| |

|

Title: |

Authorized Signatory |

Signature Page to Second Amendment to Acadia Realty

Third Amended and Restated Credit Agreement

| |

ADMINISTRATIVE AGENT: |

| |

|

| |

BANK OF AMERICA, N.A., as Administrative Agent |

| |

|

|

| |

|

|

| |

By: |

/s/ Teresa Weirath |

| |

|

Name: |

Teresa Weirath |

| |

|

Title: |

Vice President |

Signature Page to Second Amendment to Acadia Realty

Third Amended and Restated Credit Agreement

ANNEX I

TO CONSENT AND SECOND AMENDMENT

| Lender | |

Incremental

Revolving Commitment | |

| Bank of America, N.A | |

$ | 50,000,000 | |

| Wells Fargo Bank, National Association | |

$ | 25,000,000 | |

| PNC Bank, National Association | |

$ | 50,000,000 | |

| Truist Bank | |

$ | 50,000,000 | |

| | |

| | |

| TOTAL: | |

$ | 175,000,000 | |

ANNEX II

TO CONSENT AND SECOND AMENDMENT

(see attached)

Schedule 2.01

COMMITMENTS, APPLICABLE PERCENTAGES AND SUBLIMITS

| Lender | |

Revolving Credit

Commitment | | |

Applicable

Percentage

(Revolving Credit

Facility) | | |

Term

Commitment | | |

Applicable

Percentage

(Term Facility) | | |

Letter of Credit

Sublimit | |

| Bank of America, N.A. | |

$ | 115,250,000.00 | | |

| 21.952380952 | % | |

$ | 74,750,000.00 | | |

| 18.687500000 | % | |

$ | 30,000,000.00 | |

| Wells Fargo Bank, National Association | |

$ | 90,250,000.00 | | |

| 17.190476190 | % | |

$ | 74,750,000.00 | | |

| 18.687500000 | % | |

$ | 30,000,000.00 | |

| PNC Bank, National Association | |

$ | 105,250,000.00 | | |

| 20.047619048 | % | |

$ | 62,250,000.00 | | |

| 15.562500000 | % | |

$ | 0.00 | |

| Truist Bank | |

$ | 105,250,000.00 | | |

| 20.047619048 | % | |

$ | 62,250,000.00 | | |

| 15.562500000 | % | |

$ | 0.00 | |

| TD Bank, N.A. | |

$ | 39,000,000.00 | | |

| 7.428571429 | % | |

$ | 46,000,000.00 | | |

| 11.500000000 | % | |

$ | 0.00 | |

| JPMorgan Chase Bank, N.A. | |

$ | 39,000,000.00 | | |

| 7.428571429 | % | |

$ | 46,000,000.00 | | |

| 11.500000000 | % | |

$ | 0.00 | |

| M&T Bank | |

$ | 19,333,333.33 | | |

| 3.682539682 | % | |

$ | 20,666,666.67 | | |

| 5.166666667 | % | |

$ | 0.00 | |

| Goldman Sachs Bank, USA | |

$ | 11,666,666.67 | | |

| 2.222222223 | % | |

$ | 13,333,333.33 | | |

| 3.333333333 | % | |

$ | 0.00 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total | |

$ | 525,000,000.00 | | |

| 100.000000000 | % | |

$ | 400,000,000.00 | | |

| 100.000000000 | % | |

$ | 60,000,000.00 | |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

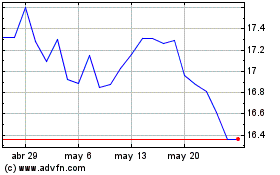

Acadia Realty (NYSE:AKR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Acadia Realty (NYSE:AKR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024