AXIS Report: How Risks Including Climate Change, Economic Uncertainty, and Investor Hesitancy Around Tech Innovation are Impacting the Energy Transition

13 Junio 2024 - 7:30AM

Business Wire

New research by global specialty insurance company AXIS

reveals factors helping and hindering the energy sector in the

shift towards net zero

AXIS Capital Holdings Limited (“AXIS Capital” or “AXIS” or the

“Company”) (NYSE: AXS) today published a new report, Navigating

Risk in the Energy Transition. Based on independent research,

the report explores views within the energy sector on how key areas

of risk are impacting the transition – from climate change and

economic volatility, to securing investment, insurance, and

governmental support for the expansion of renewable energy

technology.

Key findings from the report include:

- Climate change is both a driver of change and a source of risk.

Climate-related weather events pose a direct threat to companies’

physical assets and an indirect threat to their wider business

operations

- There is a gap between the urgent desire to advance the

transition and the logistical reality of meeting net zero

targets

- Global economic conditions have made securing finance for

renewable energy projects more expensive and challenging

- Although public policy has propelled the energy transition

forward, additional government support is deemed essential for

continued progress

- There is an opportunity for the insurance industry to take a

more proactive and strategic role in the energy transition, moving

beyond a transactional mindset towards supporting customers in a

more comprehensive way

Based on a survey of more than 600 energy producers, industrial

energy buyers, and specialist insurance brokers in the US and UK,

the report also offers insights into how insurers and other

stakeholders can more effectively enable the energy transition.

“The shift to a lower carbon economy is among the greatest

challenges of our day and requires all of us – businesses,

governments, communities, and individuals – to work together to

achieve our climate goals,” commented Vince Tizzio, President and

CEO at AXIS. “In publishing this report, AXIS aims to elevate

understanding of the risks and challenges involved in the energy

transition and to identify how energy industry stakeholders can

proactively and collaboratively support businesses on their

journeys.”

Read the full energy transition report from AXIS

here.

Among the insights to emerge from the research are:

Climate Action

- Climate change is a driver of change and a source of risk for

businesses –impacting the operational landscape while also

influencing other key risk factors

- These include energy price volatility, supply chain disruption,

evolving regulatory landscape, technology disruptions, and extreme

weather events

- Over two-thirds (69%) of industrial energy buyers anticipate

the climate crisis will impact their company’s business performance

including revenue, costs, and investments

- The most common drivers for businesses to take proactive

climate action are long-term business viability (49%), regulatory

compliance (49%), and climate concern (47%)

Strategic Investment

- Spending on improving energy efficiency is a crucial tool for

climate action and is the most popular form of transition

investment (73% US, 71% UK)

- This can be interpreted in the context of the recent energy

crisis and exposure to fossil fuel and commodity price

volatility

- Preparedness to respond to the urgency of the transition is

limited, with most respondents feeling only “somewhat prepared”

(55%) or “not too prepared” (4%)

Renewables Growth

- While the renewable energy sector continues to flourish, high

capital investments required for projects (35%) and global economic

conditions (33%) emerge as two of the most common barriers to

businesses increasing investment

- Nascent technologies require significant capital to scale-up,

often experience tougher financing challenges (40% of energy

producers cited as a challenge), and lack the proven return on

investment (33% of energy producers cited as a challenge)

- Solar technology emerges as the most popular current investment

area (63% UK, 54% US) compared to other forms of renewable energy

- Solar is followed by battery storage solutions (38% US, 35% UK)

and smart grid technology and modernization (36% US, 31% UK)

Economic Conditions

- Global economic conditions marked by rising interest rates and

inflation have made securing finance for renewable energy projects

more expensive and challenging

- Asked to identify the major risk factors facing their company,

energy price volatility was the most common response for industrial

energy buyers in both the UK (63%) and US (57%)

Additional report take-aways include:

- Public policy is recognized as having accelerated the energy

transition, however, further government support is deemed essential

for progress

- 92% of the energy producers surveyed pointed to governments and

regulatory bodies as pivotal players

- There is a clear call for governments to both continue creating

investment incentives and to help address the financing gap in the

renewable energy sector by providing an additional layer of

financial protection and guarantee in case of adverse events

- There is opportunity for the insurance industry to take a more

proactive and strategic role as a risk partner in the energy

transition, moving beyond a transactional mindset to offering more

comprehensive solutions

- Currently fewer than half of energy producers (49% US, 42% UK)

perceive insurers as strategic partners that help secure

investments related to the energy transition

- Further, the survey results show that close to a third (31%) of

energy producers believe the insurance industry currently hurts

innovation in the energy transition – and attribute this to the

lack of comprehensive and multiline coverage options

- Removing siloed perspectives can also remove financing

constraints – 94% of energy producers want more collaboration and

information sharing between project developers, insurers, brokers,

investors, and financers

Richard Carroll, Global Head of Energy Resilience at AXIS,

added: “The report highlights that energy firms recognize that

significant investment in technological innovation, risk

management, and long-term strategic thinking are key to achieving

net zero goals. The energy transition also requires an insurance

industry with deep specialty knowledge of the risks associated with

the transition, and of the complexities of deploying the

technologies to make global net zero ambitions a reality.

“Through our Global Energy Resilience division and AXIS Energy

Transition Syndicate 2050, AXIS is committed to working

collaboratively with customers and partners to address challenges

and seize opportunities to help to power a more resilient, lower

carbon future.”

About the Research

To compile this report, Navigating Risk in the Energy

Transition, AXIS commissioned APCO Insight, a global research

consultancy that conducts independent opinion research around the

world, to conduct an online survey of 400 energy producers and 200

industrial energy buyers in the US and the UK following qualitative

interviews with customers and brokers that work with AXIS. The

survey was conducted between March 7-16, 2024. Respondents were

randomly selected from Dynata’s online panel and were screened to

qualify for either audience. Further information is here.

About AXIS Global Energy Resilience and Syndicate 2050

Our Global Energy Resilience team of underwriting, claims, risk,

and data specialists is immersed in the energy industry, supporting

brokers and customers every day in building, creating, and

designing the right energy solutions. Learn more here.

Launched in April 2024, AXIS Energy Transition Syndicate 2050 is

a specialist insurance syndicate at Lloyd’s, providing cover for

risks that are moving from a reliance on fossil fuels to more

sustainable energy sources and practices. Further information is

here.

About AXIS Capital

AXIS Capital, through its operating subsidiaries, is a global

specialty underwriter and provider of insurance and reinsurance

solutions. The Company has shareholders’ equity of $5.5 billion at

March 31, 2024, and locations in Bermuda, the United States,

Europe, Singapore and Canada. Its operating subsidiaries have been

assigned a financial strength rating of "A+" ("Strong") by Standard

& Poor’s and "A" ("Excellent") by A.M. Best. For more

information about AXIS Capital, visit our website at

www.axiscapital.com.

Follow AXIS Capital on LinkedIn and X Corp.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240613889436/en/

Investor Contact Cliff Gallant AXIS Capital Holdings Limited

investorrelations@axiscapital.com +1 415 262 6843

Media Contact Mairi MacDonald AXIS Capital Holdings Limited

mairi.macdonald@axiscapital.com +44 7785 280 083

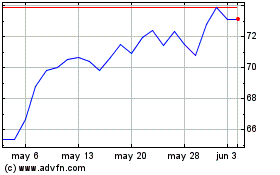

Axis Capital (NYSE:AXS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Axis Capital (NYSE:AXS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024