Alibaba Group Announces Completion of US$5 Billion Offering of Convertible Senior Notes

29 Mayo 2024 - 6:30PM

Business Wire

Alibaba Group Holding Limited (NYSE: BABA and HKEX: 9988 (HKD

Counter) and 89988 (RMB Counter), “Alibaba,” “Alibaba Group” or the

“Company”) today announced the completion of its private offering

of US$5 billion aggregate principal amount of 0.50% Convertible

Senior Notes due 2031 (the “Notes”), which amount includes the

exercise in full by the initial purchasers of their option to

purchase an additional US$500 million aggregate principal amount of

the Notes (the “Option Exercise”). In connection with the Option

Exercise, the Company also entered into additional capped call

transactions with one or more of the initial purchasers and/or

their affiliates and/or other financial institutions, using

US$63.75 million of the net proceeds from the sale of the

additional Notes. The capped call transactions are generally

expected to reduce potential dilution to the ADSs and the ordinary

shares of the Company upon conversion of the Notes by effectively

increasing the conversion premium from approximately 30% to 100%

over the last reported sale price of US$80.80 per ADS on the New

York Stock Exchange on May 23, 2024. The Notes have been offered to

persons reasonably believed to be qualified institutional buyers

pursuant to Rule 144A under the Securities Act of 1933, as amended

(the “Securities Act”) and to certain non-U.S. persons in offshore

transaction in reliance on Regulation S under the Securities

Act.

The initial conversion rate for the Notes is 9.5202 ADSs per

US$1,000 principal amount of the Notes, which is equivalent to an

initial conversion price of approximately US$105.04 per ADS. The

initial conversion price represents a premium of approximately 30%

over the last reported sale price of US$80.80 per ADS on the NYSE

on May 23, 2024. The conversion rate is subject to adjustment in

some events, but will not be adjusted for any accrued and unpaid

interest. In addition, following certain corporate events that

occur prior to the maturity date or following our delivery of a

notice of redemption, we will, in certain circumstances, increase

the conversion rate for a holder who elects to convert its Notes in

connection with such a corporate event or such notice of

redemption, as the case may be.

The Notes, the ADSs deliverable upon conversion of the Notes, if

any, and the ordinary shares represented thereby or deliverable

upon conversion of the Notes in lieu thereof, have not been and

will not be registered under the Securities Act or any state

securities laws, and are being offered and sold in the United

States only to persons reasonably believed to be qualified

institutional buyers pursuant to Rule 144A under the Securities Act

and to certain non-U.S. persons in offshore transaction in reliance

on Regulation S under the Securities Act.

This press release shall not constitute an offer to sell or a

solicitation of an offer to purchase any securities, nor shall

there be a sale of the securities in any state or jurisdiction in

which such an offer, solicitation or sale would be unlawful.

About Alibaba Group

Alibaba Group’s mission is to make it easy to do business

anywhere. The Company aims to build the future infrastructure of

commerce. It envisions that its customers will meet, work and live

at Alibaba, and that it will be a good company that lasts for 102

years.

Safe Harbor Statement

This press release contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“may,” “will,” “expect,” “anticipate,” “future,” “aim,” “estimate,”

“intend,” “seek,” “plan,” “believe,” “potential,” “continue,”

“ongoing,” “target,” “guidance,” “is/are likely to” and similar

statements. In addition, statements that are not historical facts,

including statements about the Company’s beliefs, plans and

expectations, are or contain forward-looking statements. Alibaba

may also make forward-looking statements in its periodic reports to

the U.S. Securities and Exchange Commission (the “SEC”), in

announcements made on the website of The Stock Exchange of Hong

Kong Limited (the “Hong Kong Stock Exchange”), in press releases

and other written materials and in oral statements made by its

officers, directors or employees to third parties. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement. Further information

regarding these risks is included in Alibaba’s filings with the SEC

and announcements on the website of the Hong Kong Stock Exchange.

All information provided in this press release is as of the date of

this press release and are based on assumptions that we believe to

be reasonable as of this date, and Alibaba does not undertake any

obligation to update any forward-looking statement, except as

required under applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240529757385/en/

Investor Relations Contact Rob Lin Head of Investor

Relations Alibaba Group Holding Limited investor@alibaba-inc.com

Media Contacts Justine Chao justinechao@alibaba-inc.com

Ivy Ke ivy.ke@alibaba-inc.com

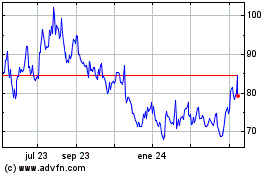

Alibaba (NYSE:BABA)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

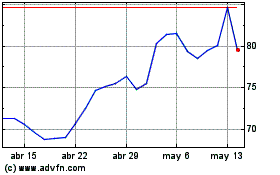

Alibaba (NYSE:BABA)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025