Brandywine Realty Trust to Redeem All Outstanding 4.10% Guaranteed Notes due 2024

23 Abril 2024 - 9:22AM

Brandywine Realty Trust (the “Company”) (NYSE:BDN) announced today

that its operating partnership, Brandywine Operating Partnership,

LP (the “Operating Partnership”), intends to redeem all of the

outstanding 4.10% Guaranteed Notes due October 1, 2024 (the

“Notes”) issued by the Operating Partnership and not purchased

pursuant to its previously announced tender offer for such Notes.

The expected redemption date will be June 7,

2024 (the “Redemption Date”).

The Notes will be redeemed at a redemption price

equal to the greater of: (a) 100% of the principal amount of the

Notes then outstanding to be redeemed; and (b) the sum of the

present values of the remaining scheduled payments of principal and

interest on the Notes to be redeemed (not including any portion of

such payments of interest accrued to the date of redemption)

discounted to the date of redemption on a semiannual basis

(assuming a 360-day year consisting of twelve 30-day months) at the

applicable treasury rate plus 25 basis points, in each case, plus

accrued and unpaid interest on the principal amount of Notes being

redeemed to the Redemption Date.

From and after the Redemption Date and the

payment of the redemption price, interest will cease to accrue, and

on and after the Redemption Date the only remaining rights of

holders of Notes will be to receive payment of the redemption price

and accrued and unpaid interest on the principal amount being

redeemed to the Redemption Date.

The notice of redemption and other materials

relating to the redemption of the Notes will be mailed on or about

April 23, 2024. As will be specified in the notice of redemption,

payment of the redemption price will be made only upon presentation

and surrender of the Notes to The Bank of New York Mellon by hand

or by mail at the address set forth in such notice. Notes that are

held through The Depository Trust Company (“DTC”) will be redeemed

in accordance with the applicable procedures of DTC.

About Brandywine Realty

Trust

Brandywine Realty Trust (NYSE: BDN) is one of

the largest, publicly traded, full-service, integrated real estate

companies in the United States with a core focus in the

Philadelphia and Austin markets. Organized as a real estate

investment trust (REIT), we own, develop, lease and manage an

urban, town center and transit-oriented portfolio comprising 156

properties and 22.3 million square feet as of March 31, 2024, which

excludes assets held for sale. Our purpose is to shape, connect and

inspire the world around us through our expertise, the

relationships we foster, the communities in which we live and work,

and the history we build together.

Forward-Looking Statements

The Private Securities Litigation Reform Act of

1995 (the “1995 Act”) provides a “safe harbor” for forward-looking

statements. This press release contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The Company intends

such forward-looking statements to be covered by the safe-harbor

provisions of the 1995 Act. Such forward-looking statements

can generally be identified by our use of forward-looking

terminology such as “will,” “strategy,” “expects,” “seeks,”

“believes,” “potential,” or other similar words. Because such

statements involve known and unknown risks, uncertainties and

contingencies, actual results may differ materially from the

expectations, intentions, beliefs, plans or predictions of the

future expressed or implied by such forward-looking statements.

These forward-looking statements are based upon the current beliefs

and expectations of our management and are inherently subject to

significant business, economic and competitive uncertainties and

contingencies, many of which are difficult to predict and not

within our control. Factors that might cause actual results to

differ materially from our expectations are set forth in the “Risk

Factors” section of the Company’s Annual Report on Form 10-K for

the year ended December 31, 2023. Accordingly, the Company cautions

readers not to place undue reliance on forward-looking statements.

The Company assumes no obligation to update or supplement

forward-looking statements that become untrue because of subsequent

events.

Company / Investor Contact: Tom

Wirth EVP & CFO 610-832-7434

tom.wirth@bdnreit.com

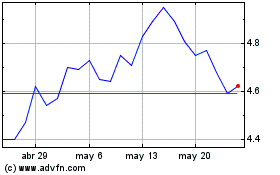

Brandywine Realty (NYSE:BDN)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

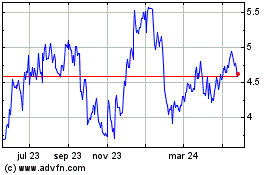

Brandywine Realty (NYSE:BDN)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025