Buffett Reflects on Missing Out on the Amazon 'Miracle' -- Berkshire Hathaway Annual Meeting

05 Mayo 2018 - 4:16PM

Noticias Dow Jones

Warren Buffett and Charlie Munger reflected on having missed out

on investing on some of the high-flying tech focused stocks, such

as Amazon and Google-parent Alphabet.

"The truth is that I've watched Amazon from the start and I

think what Jeff Bezos has done is something close to a miracle, and

the problem is if I think something is going to be a miracle I tend

not to bet on it."

On Alphabet, Mr. Buffett said that when he originally looked at

the stock, he wasn't able to come to the conclusion that at its

present price, the prospects were far better than the price

indicated. Mr. Munger, in classic form, said he had been to the

colorful Google campus and it looks like a Kindergarten.

Though Berkshire now owns a big stake in Apple, Mr. Buffett has

long said that tech is not his area of expertise. Mr. Munger

concurred. But they noted that the arrival of portfolio managers

Todd Combs and Ted Weschler has brought more expertise on the

space.

Messrs. Buffett and Munger took their lack of foresight on

Amazon and Alphabet in stride. As Mr. Buffett put it: "There is not

a penalty in investing if you don't swing at a ball in the strike

zone as long as you swing at something eventually."

-- Ben Eisen

Write to Ben Eisen at ben.eisen@wsj.com

(END) Dow Jones Newswires

May 05, 2018 17:01 ET (21:01 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

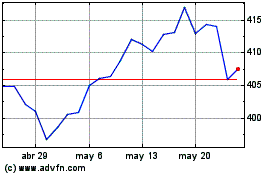

Berkshire Hathaway (NYSE:BRK.B)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

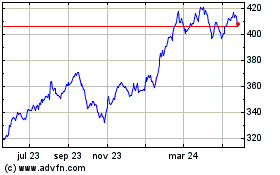

Berkshire Hathaway (NYSE:BRK.B)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024