Buffett Sought $3 Billion Investment in Uber -- WSJ

31 Mayo 2018 - 2:02AM

Noticias Dow Jones

By Greg Bensinger and Nicole Friedman

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (May 31, 2018).

Warren Buffett earlier this year offered to invest $3 billion in

Uber Technologies Inc., but the two sides couldn't agree on the

terms, according to a person familiar with the matter.

The talks between Mr. Buffett's Berkshire Hathaway Inc. and

Uber, reported earlier by Bloomberg News, came on the heels of a

multibillion investment in the ride-hailing firm by SoftBank Group

Inc. In January, the Japanese firm invested $1.25 billion directly

in Uber at around a $70 billion valuation, and bought another $6.5

billion worth of employees and investor shares at a $48 billion

valuation.

Dara Khosrowshahi, who became Uber's CEO last summer, is trying

to prepare the company for a planned initial public offering in

2019. The IPO, if it happens, is expected to be one of the largest

in recent memory. But Mr. Khowsrowshahi is working to pare costs

after the company reported a loss of $4.5 billion last year, while

repairing Uber's relationship with drivers and riders following a

year of scandal.

Uber's revenue is growing quickly -- up 70% in the first quarter

to $2.59 billion -- and has a strong cash position thanks to

previous funding. As of March 31, it held $6.3 billion in cash,

according to the company's recent financial statements reviewed by

The Wall Street Journal.

Berkshire has a history of investing in troubled companies in

exchange for favorable terms. During the financial crisis,

Berkshire threw lifelines to companies including Goldman Sachs

Group Inc. and General Electric Co. The company earned billions on

those investments.

More recently, Mr. Buffett has struggled to find sizable

attractive buys. His company has piled up more than $100 billion in

cash.

Mr. Buffett has typically avoided investing in technology

companies, saying they are outside his area of expertise. But

Berkshire has become one of the largest owners of Apple Inc. in

recent years.

Berkshire's auto-related subsidiaries include car insurer Geico

and dealership chain Berkshire Hathaway Automotive. Berkshire also

held General Motors Co. stock as of March 31.

Write to Greg Bensinger at greg.bensinger@wsj.com and Nicole

Friedman at nicole.friedman@wsj.com

(END) Dow Jones Newswires

May 31, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

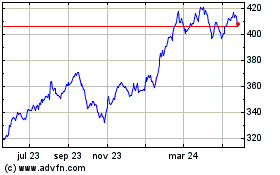

Berkshire Hathaway (NYSE:BRK.B)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

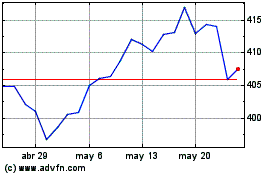

Berkshire Hathaway (NYSE:BRK.B)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024