By Heather Haddon

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 27, 2019).

Kraft Heinz Co.'s yearslong quest for cost cuts and profit

undermined a key element for success in the packaged-food business:

good relationships with supermarkets.

When the food giant said last week it was slashing the value of

its Kraft and Oscar Mayer brands by $15.4 billion, it became clear

its strategy had failed to address a broad consumer shift away from

processed meats and other packaged items toward healthier, more

natural options.

Another problem for Kraft Heinz was its decision to scale back

in-store promotions and discounts that could have buoyed sales of

Kraft cheese slices, Capri Sun drinks and other signature products,

according to people familiar with the industry and food-sector

analysts.

"We may have made a mistake in terms of trying to push hard

against certain...retailers and finding out that we weren't as

strong as we thought," said Warren Buffett, in discussing the

company's troubles on CNBC on Monday. Mr. Buffett's investment

firm, Berkshire Hathaway Inc., owns more than a quarter of Kraft

Heinz. "You've got the weaker bargaining hand than you had ten

years ago," he said.

After Kraft and Heinz merged in 2015, and as retailers faced

growing pressure from deep-discount chains and online sales, the

food company moved to raise prices on some items, including a 25%

hike on Capri Sun drinks. Executives at grocer Kroger Co. balked at

the move, arguing that price-sensitive shoppers drawn to the

low-cost fruit drink would stop buying it, people briefed on the

discussions said.

"We lost a lot of business for eight months," one of the people

said of the increases. "It didn't achieve the sales that Kroger

wanted. It achieved the profit Kraft wanted."

Kraft Heinz officials acknowledged at the time that Capri Sun

sales dropped due to the higher price, but said the increase was

necessary to pay for a reformulation of the product in response to

consumer trends. A drop in promotions of boxed dinners also had

hurt its overall sales.

Investment firm 3G Capital LLC, which engineered the megamerger

that made Kraft Heinz the world's fifth largest food company, was

aggressive about saving costs across the business.

"You had a change in personnel and mind-set," said Don

Fitzgerald, a food-sector consultant who was chief marketing

officer at Kroger for its Mariano's chain until this month. "There

was a clear shift in focus from really working with retailers and

being consumer-focused."

The salespeople hired by Kraft Heinz and third-party contractors

came with less leverage and ability to promote and discount Oscar

Mayer wieners, Kraft slices and other key brands, Mr. Fitzgerald

and former Kraft Heinz officials said.

Meanwhile, competition from nonbranded store products grew,

particularly in commodities such as cheese that retailers heavily

discounted, Kraft Heinz officials have told investors. Kraft

natural-cheese sales declined 2% last year by volume, while

private-label versions grew by nearly 9%, according to data from

market-research firm IRI.

"House brands, private label, is getting stronger," Mr. Buffett

said in the television interview. "And it's gonna keep getting

bigger."

Total dollar sales for Kraft Heinz in the U.S. have fallen for

three straight years, according to IRI data.

Supermarkets have greater options for their shelves today, and

power has shifted their way in recent years as grocers gain more

market data to determine what sells best.

Packaged-food makers have to be more creative in pitching their

products to retailers, and that is particularly the case for

center-store aisles as more shoppers buy fresh food. That has made

the relationship between grocers and suppliers even more critical

for driving sales of goods that consumers increasingly snub.

Kraft Heinz officials say they have made improvements recently,

including wider distribution and offering retailers more discounts.

Kraft Heinz spokesman Michael Mullen pointed to a retailer survey

by the Kantar research firm showing that the company ranked fourth

among packaged-goods companies on strategy, supply chain and other

factors last year, up from fifth in 2017.

"It was part of our commitment to have improving relationships

with all our customers as we went through the merger. That has

proven out," Mr. Mullen said.

The company said its U.S. pricing, factoring out commodity cost

fluctuations, was down 1.4% in the latter half of its fourth

quarter, compared with the same period a year earlier.

Those efforts are leading to gains in sales volume, market data

show. Its processed cheese products -- which includes Kraft slices,

Cheez Whiz and Velveeta -- showed a 6% increase for January after

heavy promotions and price drops, while coffee and frozen-entrée

sales also improved, according to food-industry analysts at

AllianceBernstein.

The company has expanded its own sales force to distribute and

merchandise its products at supermarkets. Kraft Heinz said in May

that its in-store sales team for the U.S. was 80% larger than in

the prior year, which it said is boosting its presence with key

retailers.

"Our volume improvement was also supported with a much better

service level," said Paulo Basilio, U.S. president for Kraft Heinz,

in discussing the price increases last week.

Business relationships, however, take time to repair.

Kraft Heinz laid off roughly 5% of its total workforce after the

merger, and job cuts have continued. Veteran Kraft employees who

drove some important relationships with retailers over the years

left, and were replaced by less-experienced people, the former

Kraft Heinz officials said.

"Our sales team really struggled," one of the people said.

Late deliveries to stores also hampered the company. The delays

of shipments of products such as Ore-Ida potatoes lessened their

prominence on shelves, Mr. Fitzgerald said.

Kraft Heinz's Mr. Mullen said that like other companies, Kraft

Heinz has had periodic supply-chain issues.

Last year, Kraft Heinz stepped up investment in its supply-chain

and warehouse network, and executives said Thursday it had achieved

industry-leading metrics for orders delivered on time and complete.

New production lines for frozen potato, meat and other products

eliminated supply disruptions, company executives said. That work

was expensive, denting the company's profit.

Those in the food industry said Kraft Heinz's merchandising

missteps should serve as a warning to other brands.

"The maniacal focus on cost cutting will not ultimately serve

the interest of company stakeholders," Bob Goldin, co-founder of

the Pentallect Inc. consulting firm, said in a recent note to

clients. "We urge all companies to recommit themselves to growing

the old fashioned way."

Annie Gasparro contributed to this article.

Write to Heather Haddon at heather.haddon@wsj.com

(END) Dow Jones Newswires

February 27, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

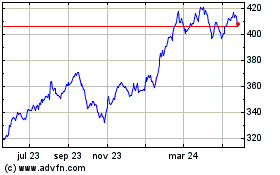

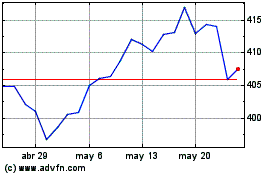

Berkshire Hathaway (NYSE:BRK.B)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

Berkshire Hathaway (NYSE:BRK.B)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024