FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of October, 2023

Brazilian

Distribution Company

(Translation of Registrant’s Name Into English)

Av. Brigadeiro Luiz Antonio,

3142 São Paulo, SP 01402-901

Brazil

(Address of Principal Executive Offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F)

Form 20-F X Form

40-F

(Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101 (b) (1)):

Yes ___ No X

(Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule

101 (b) (7)):

Yes ___ No X

(Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ___ No X

Earnings release 3Q23

São Paulo, October 30, 2023

GPA [B3: PCAR3; NYSE:

CBD] announces the results for the 3tr quarter of 2023 (3Q23).

As a result of the process

of discontinuing the activities of the Extra hypermarkets and Almacenes Éxito S.A. (“Éxito”), as disclosed in

the material facts and notices to the market, the activities are accounted for as discontinued (IFRS 5 / CPC 31). Accordingly, net sales,

as well as other income and balance sheet lines, were retrospectively adjusted, as defined by CVM Deliberation 598/09 – Non-current

assets held for sale and discontinued operations.

In August 2023 Éxito’s

segregation process was concluded, with a distribution of approximately 83% of GPA’s stake in Éxito to its shareholders.

From there on, GPA still holds a 13.3% of remaining participation, and as a consequence of that, this participation will be considered

as a financial application into current assets.

The following comments refer

to the results of continued operations, including the effects of IFRS 16/CPC 06 (R2), unless otherwise indicated.

New GPA Brazil(1):

Operational consistency with a strong growth in same stores, market share capture and margin growth

| · | Gross revenue from operations

reached R$ 5.1 billion, an increase of 10% vs. 3T22; |

| o | Pão de Açúcar

Banner grew 11.6% and Proximity 21.7% |

| o | E-commerce with a strong growth

of 15% |

| · | Same-store sales increased

by 6.6%, |

| o | Pão de Açúcar

Banner grew 7.2% and Proximity 7.7% |

| · | Market share increased 0.6

p.p. vs. self-service market, reaching four quarters of consecutive growth; |

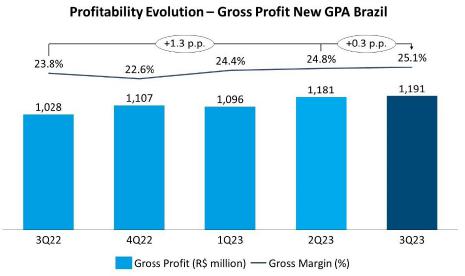

| · | Gross profit reached R$

1.2 billion with margin of 25.1%, 1.3 p.p. higher than 3Q22 and 0.3 p.p. vs. 2Q23; |

| · | Adjusted EBITDA(1)(2)

totaled R$ 333 million, with an EBITDA margin of 7.0%, 1.2 p.p. above 3Q22 and 0.7 p.p. vs. 2Q23; |

| · | GPA Brazil's Operating Cash

Generation(3) improved R$296 million vs. 3Q22. |

| · | Net debt reaches R$3.0

billion, reduction of R$ 0.5 billion, with a deleverage(4) of 0.5x vs. 3Q22. Cash position of R$3 billion,

corresponding to 2.1x short-term debt. |

(1) GPA Brazil excludes impacts of

the international perimeter (Cnova); (2) Operating income before interest, taxes, depreciation, and amortization adjusted by Other Operating

Income and Expenses; (3) Managerial view of the operating cash flow; (4) Net debt by the LTM of GPA’s adjusted EBITDA; (5) it considers

non-current and non-cash effects of R$ 804 million with the reversion of accumulate results of Cnova; (6) it includes the results from

the discontinued operations of hypermarkets and Grupo Éxito (Colombia, Uruguay, and Argentina); (6) it considers continued and

discontinued operations

Grupo Éxito and status

of the segregation transaction

| · | In August 22 th

2023 Éxito’s segregation process was concluded, with the delivery of Brazilian depositary receipts (“BDRs”)

and American depositary receipts (”ADRs”) of Éxito to GPA’s shareholders. After this process, GPA still

holds 13.3% of remaining participation on Éxito; |

| · | In October

13th 2023, GPA’s board of Directors approved the execution of a pre-agreement to sale the remaining participation of

13.3% on Éxito, for US$ 156 million, to Grupo Callejas, owner of the leading grocery retailer group in El Salvador and operates

under the Super Selectos brand. The sale will occur through a tender offer to be launched by Grupo Callejas for the acquisition of 100%

of Éxito’s shares. Access the Material fact in more details through the link. |

Message

from the CEO

| The results we presented in this

third quarter demonstrate the continued positive evolution of our business, in a sequential and consistent way. A year and a half after

the start of the turnaround process, we registered strong growth in sales, with emphasis on Pão de Açúcar and Proximity,

with continuous market share gains in all formats and strong acceleration in e-commerce – with 15% revenue increase compared to

2022.

Focus and commitment to our strategic

plan allowed us to achieve gross revenue growth of 10% in this third quarter. Among the highlights, we recorded the gradual improvement

of the gross margin – the best one since 3Q22 –, and the continuous improvement in expense management, resulting in an adjusted

EBITDA (GPA Brazil) with growth of 32%. The margin evolution was 1.3 p.p. compared to 3Q22, with a material reduction of shrinkage and

an increase in the share of perishables sales across all banners.

|

|

In this quarter, we continued to

advance in the level of customer satisfaction (NPS) in all our banners – improvement of 10 points compared to the same period last

year – and we continued to expand the capture of Premium & Valuable customers, as a consequence of the assertiveness of the

value proposition for Pão de Açúcar banner. Our expansion plan remains underway, with a focus on the premium format

of proximity stores, under the Minuto Pão de Açúcar banner. In 3Q23, there were 20 new stores, 18 Proximity stores,

in addition to two Pão de Açúcar stores with complete services offering, where we offer all the brand's differentiators.

It is also important to note the

successful conclusion of the Grupo Éxito segregation project, with the distribution of shares to GPA shareholders in August and,

more recently, with the announcement of the signing of the agreement for the sale of the entire GPA's remaining stake (13.3%) in Éxito,

announced to the market in October. An important step towards generating value to our shareholders.

Finally, we reached the fourth quarter,

the most important period of the year to food retail, even more motivated and engaged with the strategic plan we outlined and with the

consistent results we have delivered. We focus on the future, working on our assets, activating the right levers, with focus and discipline,

and certain of our differentiated position in the market.

Marcelo Pimentel

GPA CEO

Aviso / Disclaimer: Statements

contained in this release regarding the Company’s business outlook, projections of operating/financial profit and loss, the Company’s

growth potential, and related to market and macroeconomic estimates constitute mere forecasts and were based on the beliefs, intentions,

and expectations of the Management regarding the future of the Company. Those estimates are highly dependent on changes in the market,

the general economic performance of Brazil, the industry, and international markets and, therefore, are subject to change

Sales Performance

New GPA Brazil and Consolidated GPA

Consistent growth of same-store

sales with volume acceleration

(1) Extra Mercado. Compre bem remaining stores

were converted into Extra Mercado between July and August 2023

(2) Revenues mainly from commercial centers

rentals agreements, Stix Fidelidade, Cheftime and James Delivery

(3) To reflect the calendar effect, it was deducted

0.2 p.p. from 3Q23 growth

GPA Brazil sales reached R$ 5.1 billion

in 3Q23 and, excluding gas stations, R$ 4.7 billion, resulting in a 9.5% growth, driven by the 21.7% growth of the Proximity format and

11.6% of the Pão de Açúcar banner.

In Pão de Açúcar

banner, same-store sales growth reached 7.2%, keeping the sequential improvement since 1Q22. The increase in sales was driven by the

strong volume growth, more than offsetting deflation of some food items (meat, milk, oil, beans, between others). Likely 2Q23, the main

highlight was perishables, with growth in fruits & vegetables and butchery. We attribute this result to the measures implemented by

the refresh project, which allowed the banner to offer a better quality of assortment with competitiveness. It is important to

mention the good result in inventory management as well on beverages category, which allowed us to take advantage of increased demand

related to higher temperatures than expected for this season. Finally, it is worth to highlight the growth of 10.6% in our base of Valuable

& Premium clients vs. last year.

In Extra Mercado banner, same-store

sales grew by 2.5%, in line with the past few quarters. It is important to highlight the volume growth, mainly in perishables category,

that mitigated the strong deflation impact on basic items.

Finally, at the beginning of August

we concluded all the conversion of stores from Compre Bem to Extra Mercado, in accordance with the plan of unification of mainstream’s

value proposition, and it has already been possible to see a profitability recovery of converted stores in this quarter. The stores were

converted with low investment and with support from our main suppliers, and the converted stores will benefit from the following themes

that make up the value proposition of Extra Mercado:

| · | Expansion of the assortment

with products from the exclusive Qualitá brand, which represents up to 30% of the sales of a group of Mercado Extra stores; |

| · | Extra Card with all its benefits,

including 10% discounts on Qualitá products; |

| · | Clube Extra application that

allows the use of Meu Desconto to activate personalized offers; |

| · | Accumulation and Redemption

of the STIX loyalty program; |

| · | New internal and external visual

communication, and new layout; |

| · | Measurement and daily monitoring

of the NPS; |

In the Proximity format, we

have a strong growth of 21.7% when compared to 3Q22, leveraged by the good performance of the new stores. In the same-store comparison,

we presented an increase of 7.7%, even when compared to the strong comparison that was presented in 3Q22. The proximity banners will also

benefit from the roll out of the complete assortment review, as it was carried out at Pão de Açúcar, what will allow

for a significant improvement in the assertiveness of the product offered to the customer. The proximity format is in an advantage position,

with progress in organic expansion and a differentiated value proposition, to further accelerate its growth with the improvement of market

conditions.

In Gas Stations, after

successive quarters of sales retraction, we can see a strong increase of 18.2%. This improvement may be explained by the combination of

the continued increase of volume (21.2%), impacted, mainly, by the reopening stores of hypermarkets sold to Assaí (in the case

of gas stations that are located into this stores complex).

Consistent market share gains

in all formats

Four consecutive quarters with

increase of market share

Since April 2022, with the kick off

of GPA’s turnaround plan, we have maintained focus and consistency in delivering the objectives of the six strategic pillars: (i)

top line; (ii) NPS; (iii) digital; (iv) expansion; (v) profitability; and (vi) ESG & culture, resulting in growing recognition from

our clients, which may be observed by the relevant gains in market share.

In 3Q23, we grew 0.6 p.p. compared

to 3Q22, according to data from Nielsen consulting.

The Pão de Açúcar

banner, presented an evolution of 0.5 p.p. vs the self-service market and the Mercado Extra banner, increased by 0.1

p.p. comparing with the same base. The evolution of the market share is mainly result of the perishables categories increase, with

the capture of new customers and growth of the Premium & Valuables customer base.

The Proximity format, with

the Minuto Pão de Açúcar and Mini Extra banners, is the biggest highlight in market share gains, with an increase

of 2.2 p.p. when compared to small supermarkets in the metropolitan area of São Paulo.

Expansion: 49 stores opened in

2023, with 20 stores in 3Q23

R$ 557 million of incremental

sales in the quarter generated by opened stores since 2022

The

focus of our expansion project is the proximity format with the Minuto Pão de Açúcar banner, which already has a

mature format and with greater capillarity potential, foreseeing the densification and verticalization of the city of São Paulo

and the metropolitan region. They are high quality spots, with rapid maturation and performance, in addition to being focused on the A/B

public.

In 3Q23, we opened 20 stores with:

(i) 18 in proximity format, 17 in Minuto Pão de Açúcar banner and one in Mini Extra banner; and (ii) two in Pão

de Açúcar banner, one located in Atibaia city/SP, the first store in the region, and other in Sorocaba city/SP. In 9M23,

we accumulate 49 new stores, being: (i) 45 in proximity format, 40 in Minuto Pão de Açúcar banner and five in Mini

Extra Banner; and (ii) four in Pão de Açúcar banner.

|

|

The opened stores under the Pão

de Açúcar banner in the cities of Atibaia and Sorocaba have great potential and already demonstrated, after just few months

of activity, that they should be above the current average sales of the banner. The stores feature the brand's full range of services,

which includes full rotisserie, fresh fishmonger and in-house bakery, as well as a portfolio of regional products in addition to the standard

assortment.

In the 4Q23, we estimate one more

openings in Pão de Açúcar Banner in Itu city/SP. We highlight that the opening of new Pão de Açúcar

stores, after years without expansion, is a relevant movement that has disseminated the brand's value proposition to regions with great

growth potential.

E-commerce with strong growth

acceleration

Revenue increase of 15%, best

growth rate in the last 4 quarters

In 3Q23, we reached an increase of

15% in e-commerce revenue, an acceleration when compared to the last quarters, with penetration increase of 0.5 p.p. in relation to the

total food sales. This quarter, we had a strong sales increase in both formats, 1P and 3P.

In 1P format, we observed a 7% in

number of visit in our APP, supported by new features that have been implemented in last quarters, with a better experience and client

conversion. Other highlight point is the increase of perishables’ participation, a fundamental pillar of digital’s value proposition

as well, which reached 33%, presenting a growth of 5.4 p.p. In 3P Format, we maintained the leadership in the partners platforms.

|

|

The e-commerce pass through a relevant

process of efficiency gains in the last quarters, which allowed expenses reduction with no impact on sales growth, resulting in an increase

of our contribution margin. Among the initiatives, we highlight: (i) closure of the James marketplace operation (4Q22), (ii) reduction

of unprofitable marketplace sellers (1Q23); (iii) migration of 100% of sales from the Distribution Center to the stores (2Q23). This

last initiative allowed a complete integration between e-commerce and in-stores operations, with incremental sales to stores and a significant

reduction in the expenses structure.

Customers & NPS: Noticeable

improvement in customer satisfaction

Greater customer satisfaction

translates into greater flow

The consistency of focusing on the

customer at the center of our decisions continues to produce important advances in NPS across all banners. In 3Q23, NPS grew 10 points

compared to the same period in 2022 and 6 points vs. 2Q23, with highlights for: (i) Improvement of service level in stores, supported

by personnel training at all banners; (ii) reduction of time in checkout lines with the implementation of self-checkouts; (iii) improvement

in price perception.

In Pão de Açúcar

Banner, after the relaunch of Programa mais in 2Q23, we observed an increase in Gold and Black costumers, a classification

with a higher level of loyalty. This increase led to a 10.6% growth in number of Premium & Valuable costumers, group with a higher

purchase frequency and monthly expenses, what demonstrates the effectiveness of the new program in generating value for the costumer.

We continue to advance in our communication with customers, in 3Q23 we invested in the CDP – Customer Data Platform tool, which

allow us to further personalize the customer experience on a larger scale, leveraging our Premium & Valuable customer base and e-commerce

sales.

In September, we received the Advantage

ABRAS Award, in “Retailer that better evolved in supermarket channel in 2023” category, with over 450 companies research

led by Advantage Group in partnership with ABRAS (Brazilian association of supermarkets), evaluating our collaboration with the industry

in all dimensions. In the same month we received the CONAREC Award in Retail category (Supermarkets, hyper and Cash&Carry),

which evaluated GPA as the company that provided the best customer experience. These recognitions further reinforce our efforts to raise

experience standards in all our stores.

Financial Performance

New GPA Brazil(1)

(1) Result of the New GPA Brazil does

not include impacts from the international perimeter (Cnova)

(2) Operating

income before interest, taxes, depreciation and amortization adjusted by Other Operating Income and Expenses and excludes impacts from

the international perimeter (Cnova)

Gross Profit of the New GPA

Brazil totaled R$ 1.2 billion in 3Q23, with a margin of 25.1%, showing an improvement of 1.3 p.p. and 0.3 p.p. compared to 3Q22 and 2Q23,

respectively. The continuous evolution of Gross Profit is mainly the result of advances in the strategic pillars with: (i) increase of

0.7 p.p. in the share of sales under the Pão de Açúcar banner in the company’s total sales; (ii) improved commercial

negotiations; and (iii) shrinkage reduction.

Selling, General and Administrative

Expenses totaled R$ 900 million in the quarter, showing a dilution of 0.5 p.p. in relation to net revenue when compared to 2Q23 and

a 0.1 p.p. increase vs. 3Q22. This dilution is concentrated in the sales expenses, which presented a reduction of 5.9% in the comparison

with the previous quarter, after the Zero Base Budget implementation.

The Equity Income of New GPA

Brazil totaled R$ 12 million in 3Q23, a reduction of R$ 4 million, reflecting the changes in the card points program and more rigor in

granting and credit limits.

As a result of the effects mentioned

above, Adjusted EBITDA for New GPA Brazil was R$ 333 million, growth of 32% vs. 3Q22, and adjusted EBITDA margin was 7.0%, an improvement

of 0.7 p.p. vs. 2Q23. Compared to 3Q22, the adjusted EBITDA margin increased 1.3 p.p. in line with the company’s turnaround plan.

For the coming quarters, we will

continue to make progress: (i) negotiating commercial aspects with our suppliers; (ii) the completion of projects that will impact the

rebalancing of categories in light of GPA's new value proposition; (iii) the capture of project-based cost savings with implementation

of the Zero Base Budget methodology; and (iv) in the improvement of promotional balance with the growing perception of the new value proposition

of the banners by customers.

OTHER CONSOLIDATED OPERATING INCOME AND EXPENSES

In the quarter, Other Income and Expenses reached R$ 48

million, practically in line with the same period of the previous year. This result is mainly due to labor contingencies in the continued

perimeter and provision for stores closures.

CONSOLIDATED NET FINANCIAL RESULT

In the end

of 3Q23 GPA's net financial result totaled R$ (56) million, representing -1.2% of net revenue. Considering the interest on the leasing

liability, the amount reached R$ (170) million, equivalent to -3.6% of net revenue.

The main

highlights of the financial result for the quarter were:

| · | Financial income reached R$

226 million, a positive variation of R$ 8 million vs. 3Q22. This variation is mainly due to the higher profitability of cash related to

the increase in interest rates in the period and the higher level of average cash in the period. |

| · | Financial expenses including

prepayment of receivables amounted to R$ (282) million vs. R$ (303), an improvement of R$ 21 million, mainly due to the reduction in the

cost of debt. |

CONSOLIDATED NET INCOME OF CONTINUED AND DESCONTINUED

OPERATIONS

The Net Income from Continued

Operations reached R$ 809 million in 3Q23, vs. a loss of R$ (229) million in the same period of last year. The continued result was

impacted by a non-cash effect, due the reversal of the provisioning of R$ 804 million in Cnova’s accumulated losses. Excluding this

effects, the net income would be of R$ 5 million

In September 2023, the

Casino Group made a proposal to GPA’s board of Directors to initiate negotiations for the sale of GPA’s participation in Cnova

(link). The Casino’s proposal, allied to GPA’s absence of current or future financial

obligations towards Cnova and the intention to sell this asset, led to the reversal of accumulated non-cash losses.

The Net Loss from Discontinued

Operations reached R$ (2,104) million, substantially impacted by non-current and non-cash effects, due the conclusion of Éxito’s

segregation process with the delivery of Éxito’s shares to GPA’s shareholders, totaling R$ (2,082) million, being:

(i) R$ (1,360) million due to exchange rate devaluation from the time of acquisition until the segregation; (ii) R$ (746) remeasurement

of the remaining portion in the net amount of the investment write-off; and (iii) R$ 23 million in other items of comprehensive income.

Adjusting by these effects, the Net

Loss from discontinued operations would be R$ (22) million, being R$ (66) million due to the demobilization of stores and labor contingencies

at Extra Hiper and R$ 44 million resulting from Éxito’s discontinued net profit before the conclusion of the segregation

process (July/2023).

CONSOLIDATED CASH FLOW CONTINUED OPERATIONS

GPA presented a Free Cash Flow of

R$ 169 million in 3Q23, an increase of R$ 794 million when compared to 3Q22, being: (i) R$ 296 million from an improvement in operating

cash flow; and (ii) R$ 498 million from investments cash flow, impacted by the sale of non-core assets.

In operating cash flow, the main

contributions came from EBITDA, working capital of goods, and variation of other assets and liabilities improvements. In EBITDA, the improvement

was due to sales growth and better profitability. In working capital of goods, we had a gain of two days of COGS in inventory, result

of the review of assortment in stores, and a gain of six days of COGS in suppliers.

In the investments flow, most of

the result occurred with the sale of non-core assets according to the net debt deleverage plan, highlighting the second installment of

the sale and lease back operation of 11 stores, done in 2Q23, with impact of R$ 190 million, and the sale land in Rio de Janeiro city,

which totaled R$ 247 million.

Finally, in financing activities

and projects, it showed a cash consumption of R$ (250) million, mainly due to interest on debt. In 3Q22, we highlight a cash inflow of

approximately R$ 1.8 billion from the sale of Extra Hiper stores.

(1) it Includes leasing expenses;

(2) Cash flow after EBITDA (including leasing expenses), paid income tax, working capital of goods variation and other asset and liabilities

expenses; (3) it Includes revenues and costs of strategic projects such as sale of Extra Hiper stores and the sale of participation in

Éxito

NET DEBT CONSOLIDATED CONTINUED OPERATIONS

The numbers presented below consider

GPA Brazil only. Grupo Éxito was excluded, because it was treated as a discontinued operation.

Net debt, including non-discounted

receivables, reached R$(3.0) billion, down by R$ 507 million vs. the same period of the previous year. The company’s financial leverage,

calculated by net debt divided by GPA’s Brazil Adjusted EBITDA, decreased by 0.5x compared to 3Q22, reaching -2.5x.

At the end of 3Q23, GPA had a strong

cash position of R$3 billion, equivalent to 2.1x the Company's short-term debt.

INVESTMENTS

In 3Q23, Capex totaled R$ 331 million,

a R$ 47 million reduction vs. 3Q22, with most of the reduction in Renovations, Conversions and Maintenance. This is because in 2022 there

was a concentration of investments in Pão de Açúcar stores renovations for the implementation of G7 concept, as well

as the investments for conversions of hypermarkets into supermarkets. Among the main capex lines, we only see growth vs. 2022 in the store

openings, due to the acceleration of the expansion plan.

ESG AT GPA

Agenda with and for society and the environment

Based on our sustainability strategy and GPA's pillars

of action, the main highlights of 3Q23 are as follows:

| 1. | Women in leadership positions:

We continued to advance and reached 41% of women in leadership positions (management and above), compared to 40% and 38% in 2Q23 and

3Q22, respectively, a reflection of the development actions being performed.

Since the beginning of the year, 43 women were hired for leadership positions and 48 promotions of women who participated in development

programs, confirming positive results. |

| 2. | Combating climate change:

We presented an accumulated reduction of 11% in scope 1 and 2 emissions compared to the same period of the previous year, as a result

of “gas replacement” and “engine room retrofit” projects. Furthermore, we were recognized with the Gold Seal by

Programa Brasileiro GHG Protocol - responsible for developing calculation tools for estimating greenhouse gas emissions - which corresponds

to the highest level of qualification granted to companies that demonstrate compliance with transparency criteria in publishing its greenhouse

gas inventory. |

| 3. | Animal welfare in the value

chain: We continue to advance our commitment to animal welfare in the “cage-free egg chain”, in line with our goal of

reaching 100% by 2028 for all brands. The Pão de Açúcar banner achieved more than 65% of total egg sales being cage-free. |

| 4. | Social Impact: Through

GPA Institute, we launched the “Impulsiona+” Program, in partnership with Phomenta, that aim to support the development

of social organizations, partners of GPA Institute. |

Furthermore, our

banner Extra Mercado is a sponsor of the project “XEPA: Favela, comida, e Sustentabilidade”, focusing in promote a conscious

consumption of healthy food and full use of food into the periphery communities in Brazil.

BREAKDOWN OF STORE CHANGES BY

BANNERS

In 3Q23, we opened 20 new stores:

| · | 18 in Proximity Format (17

Minuto Pão de Açúcar and 1 Mini Extra) |

| · | 2 in Pão de Açúcar

Banner, in cities of Atibaia (first store of the banner in the city) and Sorocaba |

Furthermore, in the mainstream format

we had the conversion of 22 Compre Bem store to Extra Mercado, completing the conversion plan for the format.

CONSOLIDATED FINANCIAL STATEMENTS

Balance Sheet

CONSOLIDATED FINANCIAL STATEMENTS

Balance Sheet

INCOME STATEMENT – 3RD QUARTER OF 2023

(1) Adjusted EBITDA excludes Other Operating Income and

Expenses

SIGNATURES

Pursuant

to the requirement of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

|

|

| |

|

COMPANHIA BRASILEIRA DE DISTRIBUIÇÃO

|

| Date: October

30, 2023 |

By: /s/ Marcelo Pimentel

|

| |

|

Name: |

Marcelo Pimentel |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

| |

|

By: /s/

Rafael Sirotsky Russowsky |

| |

|

Name: |

Rafael Sirotsky Russowsky |

| |

|

Title: |

Investor Relations Officer |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

Companhia Brasileira de ... (NYSE:CBD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Companhia Brasileira de ... (NYSE:CBD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024