- Fourth quarter fiscal 2023 results

- Net sales $858 million vs. $912 million in Q4 2022

- Operating margin 15.9% vs. 12.0% in Q4 2022; adjusted

operating margin 15.9% vs. 13.0% in Q4 2022

- Diluted EPS $2.90 vs. $2.11 in Q4 2022; adjusted diluted EPS

$2.76 vs. $2.29 in Q4 2022

- Fiscal year 2023 results

- Net sales $2.9 billion vs. $3.2 billion in 2022

- Operating margin 11.0% vs. 11.8% in 2022; adjusted operating

margin 11.1% vs. 12.1% in 2022

- Diluted EPS $6.24 vs. $6.34 in 2022; adjusted diluted EPS

$6.19 vs. $6.90 in 2022

- Operating cash flow $529 million

- $212 million returned to shareholders through share

repurchases and dividends

- Fiscal year 2024 outlook1:

- Low single-digit growth in net sales to approximately $3.0

billion

- Mid single-digit growth in adjusted operating

income

- Mid single-digit growth in adjusted diluted EPS

- Board of Directors declares 7% increase in quarterly

dividend to $0.80 per share

Carter’s, Inc. (NYSE:CRI), the largest branded marketer of young

children’s apparel in North America, today reported its fourth

quarter and fiscal 2023 results.

“We saw an improving trend in the demand for our brands in the

final weeks of 2023,” said Michael D. Casey, Chairman and Chief

Executive Officer. “Sales improved sequentially each month in the

fourth quarter and drove higher than expected earnings. Our focus

on product innovation, inventory management, pricing discipline,

and cash flow enabled over 20% growth in earnings per share in the

fourth quarter and over $500 million of operating cash flow for the

year.

“In the fourth quarter, we saw higher than planned demand in our

U.S. Wholesale business driven by improved replenishment trends,

on-time deliveries, and earlier demand for our new Spring 2024

product offerings. We saw lower than planned sales in our U.S.

Retail and International segments largely due to sluggish traffic

to our stores and websites earlier in the quarter due, we believe,

to warmer weather and the related impact on demand for our fall and

winter product offerings.

“For the year, our sales and earnings continued to reflect the

lingering effects of inflation weighing on families with young

children. We saw a noteworthy correlation between the improved

consumer sentiment late in the year and the trend in our sales.

That favorable trend in sales continued into the early weeks of

2024. With the continued moderation in inflation, growth in real

wages, and low unemployment, we believe market conditions may

improve in the year ahead.

“Carter’s continues to be the market leader in young children’s

apparel with unparalleled relationships with the largest retailers

in North America. Our brands are sold through over 20,000 points of

sale worldwide. No other company in young children’s apparel has

broader distribution capabilities serving the needs of families

with young children.

“Carter’s has built a resilient multichannel business model

which has historically enabled a double digit operating margin,

strong operating cash flow, low leverage, and the return of excess

capital to our shareholders.

“During the market disruptions in recent years caused by the

global pandemic and historic inflation, we focused on higher margin

sales driven by strengthening our product offerings, the closure of

lower margin stores, leaner inventories, and improved price

realization. We expect that these improvements to our operating

disciplines will enable Carter’s to grow sales and earnings in

2024.

“We enter the new year with a better mix and level of

inventories. Inventories last year were reduced by nearly 30%

driven by the reduction of excess inventories that grew when

inflation surged in 2022 and consumer demand slowed.

“Our growth this year is expected to be driven by our U.S.

Retail and U.S. Wholesale segments. International demand for our

brands is expected to be comparable to last year, with sales

impacted by market disruptions in the Middle East and Europe, and

inflationary pressures weighing on consumers in Canada.

“We believe Carter’s is best in class in young children’s

apparel. As demonstrated in recent years, Carter’s has multiple

levers that have enabled us to manage through historic periods of

market volatility, and we believe we are well positioned to benefit

from the market recovery in the years ahead.”

___________________________ 1 Refer to “Business Outlook”

section of this release for additional information regarding

reconciliations of forward-looking non-GAAP financial measures.

Adjustments to Reported GAAP Results

In addition to the results presented in this earnings release in

accordance with GAAP, the Company has provided adjusted, non-GAAP

financial measurements, as presented below. The Company believes

these adjustments provide a meaningful comparison of the Company’s

results and afford investors a view of what management considers to

be the Company’s underlying performance. These measures are

presented for informational purposes only. See “Reconciliation of

Adjusted Results to GAAP” section of this release for additional

disclosures and reconciliations regarding these non-GAAP financial

measures.

Fourth Fiscal Quarter

2023

2022

(In millions, except earnings per

share)

Operating Income

% Net Sales

Net Income

Diluted EPS

Operating Income

% Net Sales

Net Income

Diluted EPS

As reported (GAAP)

$

136.1

15.9

%

$

106.5

$

2.90

$

109.5

12.0

%

$

80.2

$

2.11

Benefit from credit card settlement

—

(5.3

)

(0.14

)

—

—

—

Intangible asset impairment

—

—

—

9.0

6.9

0.18

As adjusted

$

136.0

15.9

%

$

101.2

$

2.76

$

118.5

13.0

%

$

87.0

$

2.29

Fiscal Year

2023

2022

(In millions, except earnings per

share)

Operating Income

% Net Sales

Net Income

Diluted EPS

Operating Income

% Net Sales

Net Income

Diluted EPS

As reported (GAAP)

$

323.4

11.0

%

$

232.5

$

6.24

$

379.2

11.8

%

$

250.0

$

6.34

Organizational restructuring

4.4

3.4

0.09

—

—

—

Benefit from credit card settlement

—

(5.3

)

(0.14

)

—

—

—

Loss on extinguishment of debt

—

—

—

—

15.2

0.38

Intangible asset impairment

—

—

—

9.0

6.9

0.17

As adjusted

$

327.8

11.1

%

$

230.6

$

6.19

$

388.2

12.1

%

$

272.0

$

6.90

Note: Results may not be additive due to

rounding.

Consolidated Results

The discussion of results below is presented on an adjusted

(non-GAAP) basis where noted.

Fourth Quarter of Fiscal 2023 compared to Fourth Quarter of

Fiscal 2022

Net sales decreased $54.3 million, or 5.9%, to $857.9 million,

compared to $912.1 million in the fourth quarter of fiscal 2022.

Macroeconomic factors, including inflation, higher interest rates,

higher consumer debt levels, and uncertain probability of recession

negatively affected demand from consumers in the quarter.

Unseasonably warm weather also adversely affected demand for our

fall and holiday product offerings earlier in the quarter. Demand

in our North American retail businesses improved during the

Thanksgiving holiday shopping period and continued through the end

of the year. Our fiscal fourth quarter of 2023 performance

reflected declines in U.S. Retail and U.S. Wholesale segment net

sales, partially offset by growth in International segment net

sales. U.S. Retail and U.S. Wholesale net sales declined 8.9% and

5.1%, respectively, while International net sales grew 4.6%. U.S.

Retail comparable net sales declined 10.8%. Changes in foreign

currency exchange rates used for translation in the fourth quarter

of fiscal 2023, as compared to the fourth quarter of fiscal 2022,

had a favorable effect on consolidated net sales of approximately

$2.2 million, or 0.2%.

Operating income increased $26.5 million, or 24.2%, to $136.1

million, compared to $109.5 million in the fourth quarter of fiscal

2022. Operating margin increased 390 basis points to 15.9%,

reflecting favorable ocean freight rates, lower inventory

provisions, decreased distribution and freight costs, and lower

marketing expense, partially offset by fixed cost deleverage on

lower sales and higher performance-based compensation provisions.

Fourth quarter fiscal 2022 results included a pre-tax charge of

$9.0 million related to the write-down of the Skip Hop tradename

asset recorded at the time of the acquisition of the Skip Hop

business in February 2017. The growth in fourth quarter operating

income of 24.2% reflected an improvement in trend in the business

and compares to a 30.5% decline in operating income in the first

three quarters of fiscal 2023.

Adjusted operating income (a non-GAAP measure) increased $17.5

million, or 14.8%, to $136.0 million, compared to $118.5 million in

the fourth quarter of fiscal 2022. Adjusted operating margin

increased 290 basis points to 15.9%, reflecting favorable ocean

freight rates, lower inventory provisions, decreased distribution

and freight costs, and lower marketing expense, partially offset by

fixed cost deleverage on lower sales and higher performance-based

compensation provisions. The growth in fourth quarter adjusted

operating income of 14.8% reflects an improvement in trend in the

business and compares to a 28.9% decline in adjusted operating

income in the first three quarters of fiscal 2023.

Net income increased $26.3 million, or 32.8%, to $106.5 million,

compared to $80.2 million in the fourth quarter of fiscal 2022.

Diluted earnings per share increased 37.5% to $2.90, compared to

$2.11 in the prior year period. Fourth quarter fiscal 2023 results

included an after-tax benefit of $5.3 million resulting from a

court-approved settlement related to credit card industry

anti-trust litigation. Fourth quarter fiscal 2022 results included

an after-tax charge of $6.9 million related to the write-down of

the Skip Hop tradename.

Adjusted net income (a non-GAAP measure) increased $14.2

million, or 16.3%, to $101.2 million, compared to $87.0 million in

the fourth quarter of fiscal 2022. Adjusted diluted earnings per

share (a non-GAAP measure) increased 20.6% to $2.76, compared to

$2.29 in the fourth quarter of fiscal 2022.

Fiscal Year 2023 compared to Fiscal Year 2022

Consolidated net sales decreased $267.1 million, or 8.3%, to

$2.95 billion. Macroeconomic factors, as noted in the discussion of

fourth quarter results above, negatively affected demand from

consumers and wholesale customers. U.S. Retail, U.S. Wholesale, and

International segment net sales declined 10.6%, 6.1%, and 5.1%,

respectively. U.S. Retail comparable net sales declined 12.2%.

Changes in foreign currency exchange rates used for translation in

fiscal 2023, as compared to fiscal 2022, had an immaterial effect

on consolidated net sales.

Operating income in fiscal 2023 decreased $55.8 million, or

14.7%, to $323.4 million, compared to $379.2 million in fiscal

2022. Operating margin decreased 80 basis points to 11.0%,

reflecting fixed cost deleverage on lower sales, higher

performance-based compensation provisions, and increased

professional fees, partially offset by favorable ocean freight

rates and lower inventory provisions. Fiscal 2023 results included

a pre-tax charge of $4.4 million related to organizational

restructuring. Fiscal 2022 results included a pre-tax charge of

$9.0 million related to the write-down of the Skip Hop

tradename.

Adjusted operating income (a non-GAAP measure) decreased $60.4

million, or 15.5% to $327.8 million, compared to $388.2 million in

fiscal 2022. Adjusted operating margin decreased 100 basis points

to 11.1%, reflecting fixed cost deleverage on lower sales, higher

performance-based compensation provisions, and increased

professional fees, partially offset by favorable ocean freight

rates and lower inventory provisions.

Net income in fiscal 2023 decreased $17.5 million, or 7.0%, to

$232.5 million, compared to $250.0 million in fiscal 2022. Diluted

earnings per share decreased 1.6% to $6.24, compared to $6.34 in

fiscal 2022. Fiscal 2023 results included an after-tax benefit of

$5.3 million resulting from a court-approved settlement related to

credit card industry anti-trust litigation and charge of $3.4

million related to organizational restructuring. Fiscal 2022

results included after-tax charges of $15.2 million related to a

loss on extinguishment of debt and $6.9 million related to the

write-down of the Skip Hop tradename.

Adjusted net income (a non-GAAP measure) decreased $41.4

million, or 15.2%, to $230.6 million compared to $272.0 million in

fiscal 2022. Adjusted earnings per diluted share (a non-GAAP

measure) decreased 10.3% to $6.19, compared to $6.90 in fiscal

2022.

Net cash provided by operations in fiscal 2023 was $529.1

million compared to $88.4 million in fiscal 2022. The improved

operating cash flow principally reflected favorable changes in

working capital, primarily lower inventories, and lower payments of

performance-based compensation.

See the “Business Segment Results” and “Reconciliation of

Adjusted Results to GAAP” sections of this release for additional

disclosures regarding business segment performance and non-GAAP

measures.

Organizational Restructuring and Corporate Office Lease

Amendment

Since the global pandemic, the Company has undertaken several

organizational restructurings which have collectively reduced

corporate offices headcount by approximately 15%. Actions taken in

fiscal 2023 resulted in a pre-tax charges of $6.2 million related

to severance and other termination benefits and are expected to

yield ongoing savings of approximately $18 million on an annualized

basis beginning in 2024.

During the first quarter of fiscal 2023, the Company executed an

amendment to the lease of its corporate headquarters in Atlanta,

Georgia. As a result of the related reduction in leased office

space, the Company recorded a net gain of approximately $1.8

million related to the partial termination of the lease in the

first quarter of fiscal 2023. This action is expected to result in

approximately $1 million in annualized savings beginning in

2024.

The above organizational restructuring and corporate office

lease amendment charges have been included as adjustments to our

fiscal 2023 reported GAAP results.

Liquidity and Financial Position

The Company’s total liquidity at the end of fiscal 2023 was $1.2

billion, comprised of cash and cash equivalents of $351 million and

$846 million in unused borrowing capacity on the Company’s $850

million secured revolving credit facility.

Return of Capital

In the fourth quarter and fiscal 2023, the Company returned to

shareholders a total of $60.0 million and $212.0 million,

respectively, through share repurchases and cash dividends as

described below.

- Share repurchases: During the fourth quarter of fiscal

2023, the Company repurchased and retired approximately 0.5 million

shares of its common stock for $32.5 million at an average price of

$69.10 per share. During fiscal 2023, the Company repurchased and

retired approximately 1.4 million shares for $100.0 million at an

average price of $69.17 per share. Fiscal 2023 share repurchases

represented approximately 3.8% of common shares outstanding as of

the beginning of fiscal year 2023. All shares were repurchased in

open market transactions pursuant to applicable regulations for

such transactions. As of December 30, 2023, the total remaining

capacity under the Company’s previously announced repurchase

authorizations was approximately $649.5 million.

- Dividends: During the fourth quarter of fiscal 2023, the

Company paid a cash dividend of $0.75 per common share totaling

$27.5 million. In fiscal 2023, the Company paid quarterly cash

dividends of $0.75 per common share each quarter totaling $112.0

million.

On February 26, 2024, the Company’s Board of Directors declared

a 7% increase ($0.05 per share) to its quarterly cash dividend, to

$0.80 per share, for payment on March 29, 2024, to shareholders of

record at the close of business on March 11, 2024.

From the inception of our return of capital initiatives in

fiscal 2007 through fiscal 2023, the Company has returned a total

of $3.2 billion to shareholders through share repurchases and

dividends.

The Company’s Board of Directors will evaluate future

distributions of capital, including dividends and share

repurchases, based on a number of factors, including business

conditions, the Company’s financial performance, and other

considerations.

Business Outlook

We do not reconcile forward-looking adjusted operating income or

adjusted diluted earnings per share to their most directly

comparable GAAP measures because we cannot predict with reasonable

certainty the ultimate outcome of certain components of such

reconciliations that are not within our control due to factors

described above, or others that may arise, without unreasonable

effort. For these reasons, we are unable to assess the probable

significance of the unavailable information, which could materially

impact the amount of future operating income or diluted EPS, the

most directly comparable GAAP metrics to adjusted operating income

and adjusted diluted earnings per share, respectively.

For fiscal year 2024, the Company expects:

- Low single-digit growth in net sales to approximately $3.0

billion ($2.95 billion in fiscal 2023);

- Mid single-digit growth in adjusted operating income ($328

million in fiscal 2023);

- Mid single-digit growth in adjusted diluted earnings per share

($6.19 in fiscal 2023);

- Operating cash flow in excess of $250 million; and

- Capital expenditures of $80 million.

Our forecast for fiscal year 2024 assumes:

- Improved macroeconomic environment and consumer demand as the

year progresses;

- Sales and earnings growth weighted to the second half;

- Continued conservative inventory commitments by wholesale

customers;

- Gross margin expansion, driven by lower ocean freight rates,

lower product costs, and growth in higher margin retail sales;

- Increased SG&A, reflecting higher growth-related

investments and inflation, partially offset by productivity

initiatives;

- Higher interest expense and effective tax rate; and

- Lower average number of shares outstanding.

For the first quarter of fiscal 2024, the Company expects

approximately:

- $620 million to $645 million in net sales ($696 million in Q1

fiscal 2023);

- $35 million to $40 million in adjusted operating income ($58

million in Q1 fiscal 2023); and

- $0.60 to $0.70 in adjusted diluted earnings per share ($0.98 Q1

fiscal 2023).

Our forecast for the first quarter of fiscal 2024 assumes:

- A mid single-digit to high single-digit decline in U.S. Retail

sales, a mid-teens decline in U.S. Wholesale sales (reflecting

earlier demand for our spring product offerings and lower off-price

channel sales), and a low single-digit to mid single-digit decline

in International sales;

- Gross margin expansion, reflecting lower inbound freight rates,

lower product costs, and favorable channel mix;

- Increased SG&A, driven by new store openings and higher

performance-based compensation provisions;

- Lower interest expense and effective tax rate; and

- Lower average number of shares outstanding.

Conference Call

The Company will hold a conference call with investors to

discuss fourth quarter and fiscal 2023 results and its business

outlook on February 27, 2024 at 8:30 a.m. Eastern Standard Time. To

listen to a live webcast and view the accompanying presentation

materials, please visit ir.carters.com and select links for “News

& Events” followed by “Webcasts & Presentations.” To access

the call by phone, please preregister on

https://register.vevent.com/register/BIaee6e086e7574b0db4355d2c2a89c065

to receive your dial-in number and unique passcode.

A webcast replay will be available shortly after the conclusion

of the call at ir.carters.com.

About Carter’s, Inc.

Carter’s, Inc. is the largest branded marketer in North America

of apparel exclusively for babies and young children. The Company

owns the Carter’s and OshKosh B’gosh brands, two of the most

recognized brands in the marketplace. These brands are sold through

over 1,000 Company-operated stores in the United States, Canada,

and Mexico and online at www.carters.com, www.oshkosh.com,

www.cartersoshkosh.ca, and www.carters.com.mx. Carter’s is the

largest supplier of young children’s apparel to the largest

retailers in North America. Its brands are sold in leading

department stores, national chains, and specialty retailers

domestically and internationally. The Company’s Child of Mine brand

is available at Walmart, its Just One You brand is available at

Target, and its Simple Joys brand is available on Amazon.com. The

Company also owns Little Planet, a brand focused on organic fabrics

and sustainable materials, and Skip Hop, a global lifestyle brand

for families with young children. Carter’s is headquartered in

Atlanta, Georgia. Additional information may be found at

www.carters.com.

Forward Looking Statements

Statements contained in this press release that are not

historical fact and use predictive words such as “estimates”,

“outlook”, “guidance”, “expect”, “believe”, “intend”, “designed”,

“target”, “plans”, “may”, “will”, “are confident” and similar words

are forward-looking statements (as such term is defined in the

Private Securities Litigation Reform Act of 1995). These

forward-looking statements and related assumptions involve risks

and uncertainties that could cause actual results and outcomes to

differ materially from any forward-looking statements or views

expressed in this press release. These risks and uncertainties

include, but are not limited to, the factors disclosed in Part I,

Item 1A. “Risk Factors” of the Company’s most recently filed Annual

Report on Form 10-K, and otherwise in our reports and filings with

the Securities and Exchange Commission, as well as the following

factors: the continuing effects of the novel coronavirus (COVID-19)

pandemic; changes in global economic and financial conditions, and

the resulting impact on consumer confidence and consumer spending,

as well as other changes in consumer discretionary spending habits;

continued inflationary pressures with respect to labor and raw

materials and global supply chain constraints that have, and could

continue, to affect freight, transit, and other costs; risks

related to geopolitical conflict, including ongoing geopolitical

challenges between the United States and China, the ongoing

hostilities in Ukraine and Israel, acts of terrorism, mass casualty

events, social unrest, civil disturbance or disobedience; risks

related to a shutdown of the U.S. government; financial

difficulties for one or more of our major customers; an overall

decrease in consumer spending, including, but not limited to,

decreases in birth rates; our products not being accepted in the

marketplace and our failure to manage our inventory; increased

competition in the market place; diminished value of our brands;

the failure to protect our intellectual property; the failure to

comply with applicable quality standards or regulations;

unseasonable or extreme weather conditions; pending and threatened

lawsuits; a breach of our information technology systems and the

loss of personal data; increased margin pressures, including

increased cost of materials and labor and our inability to

successfully increase prices to offset these increased costs; our

foreign sourcing arrangements; disruptions in our supply chain,

including increased transportation and freight costs; the

management and expansion of our business domestically and

internationally; the acquisition and integration of other brands

and businesses; changes in our tax obligations, including

additional customs, duties or tariffs; fluctuations in foreign

currency exchange rates; risks associated with corporate

responsibility issues; our ability to achieve our forecasted

financial results for the fiscal year; our continued ability to

declare and pay a dividend and conduct share repurchases in future

periods; our planned opening and closing of stores during the

fiscal year; and other risks detailed in the Company’s periodic

reports as filed in accordance with the Securities Exchange Act of

1934, as amended. The Company does not undertake any obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events, or otherwise.

CARTER’S, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(dollars in thousands, except for

share data)

(unaudited)

For the fiscal quarter

ended

For the fiscal year

ended

December 30,

2023

December 31,

2022

December 30,

2023

December 31,

2022

Net sales

$

857,864

$

912,129

$

2,945,594

$

3,212,733

Cost of goods sold

439,689

496,580

1,549,659

1,740,375

Gross profit

418,175

415,549

1,395,935

1,472,358

Royalty income, net

4,837

5,471

21,410

25,820

Selling, general, and administrative

expenses

286,952

302,473

1,093,940

1,110,007

Intangible asset impairment

—

9,000

—

9,000

Operating income

136,060

109,547

323,405

379,171

Interest expense

7,631

9,285

33,973

42,781

Interest income

(2,007

)

(394

)

(4,776

)

(1,261

)

Other (income) expense, net

(7,516

)

200

(8,034

)

975

Loss on extinguishment of debt

—

—

—

19,940

Income before income taxes

137,952

100,456

302,242

316,736

Income tax provision

31,441

20,277

69,742

66,698

Net income

$

106,511

$

80,179

$

232,500

$

250,038

Basic net income per common share

$

2.90

$

2.11

$

6.24

$

6.34

Diluted net income per common share

$

2.90

$

2.11

$

6.24

$

6.34

Dividend declared and paid per common

share

$

0.75

$

0.75

$

3.00

$

3.00

CARTER’S, INC.

CONDENSED BUSINESS SEGMENT

RESULTS

(dollars in thousands)

(unaudited)

For the fiscal quarter

ended

For the fiscal year

ended

December 30,

2023

% of total

sales

December 31,

2022

% of total

sales

December 30, 2023

% of total

sales

December 31,

2022

% of total

sales

Net sales:

U.S. Retail

$

479,798

56.0

%

$

526,495

57.7

%

$

1,501,780

51.0

%

$

1,680,159

52.3

%

U.S. Wholesale

247,389

28.8

%

260,699

28.6

%

1,014,584

34.4

%

1,080,471

33.6

%

International

130,677

15.2

%

124,935

13.7

%

429,230

14.6

%

452,103

14.1

%

Total consolidated net sales

$

857,864

100.0

%

$

912,129

100.0

%

$

2,945,594

100.0

%

$

3,212,733

100.0

%

Operating income:

Operating margin

Operating margin

Operating margin

Operating margin

U.S. Retail

$

87,487

18.2

%

$

89,240

16.9

%

$

190,620

12.7

%

$

252,497

15.0

%

U.S. Wholesale

51,846

21.0

%

27,571

10.6

%

198,849

19.6

%

161,659

15.0

%

International

21,746

16.6

%

16,953

13.6

%

44,940

10.5

%

56,617

12.5

%

Corporate expenses (*)

(25,019

)

n/a

(24,217

)

n/a

(111,004

)

n/a

(91,602

)

n/a

Total operating income

$

136,060

15.9

%

$

109,547

12.0

%

$

323,405

11.0

%

$

379,171

11.8

%

(*)

Unallocated corporate expenses include

corporate overhead expenses that are not directly attributable to

one of our business segments and include unallocated accounting,

finance, legal, human resources, and information technology

expenses, occupancy costs for our corporate headquarters, and other

benefit and compensation programs, including performance-based

compensation.

(dollars in millions)

Fiscal quarter ended December

30, 2023

Fiscal year ended December 30,

2023

Charges:

U.S. Retail

U.S. Wholesale

International

U.S. Retail

U.S. Wholesale

International

Organizational restructuring (*)

$

—

$

—

$

—

$

—

$

0.1

$

0.2

(*)

The fiscal year ended December 30, 2023

includes a charge of $4.1 million recorded in Corporate expenses

related to organizational restructuring and related corporate

office lease amendment actions.

(dollars in millions)

Fiscal quarter ended December

31, 2022

Fiscal year ended December 31,

2022

Charges:

U.S. Retail

U.S. Wholesale

International

U.S. Retail

U.S. Wholesale

International

Skip Hop tradename impairment charge

$

0.4

$

5.6

$

3.0

$

0.4

$

5.6

$

3.0

Note: Results may not be additive due to

rounding.

CARTER’S, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(dollars in thousands, except for

share data)

(unaudited)

December 30, 2023

December 31, 2022

ASSETS

Current assets:

Cash and cash equivalents

$

351,213

$

211,748

Accounts receivable, net of allowance for

credit losses of $4,754 and $7,189, respectively

183,774

198,587

Finished goods inventories

537,125

744,573

Prepaid expenses and other current

assets

29,131

33,812

Total current assets

1,101,243

1,188,720

Property, plant, and equipment, net

183,111

189,822

Operating lease assets

528,407

492,335

Tradenames, net

298,186

298,393

Goodwill

210,537

209,333

Customer relationships, net

27,238

30,564

Other assets

29,891

30,548

Total assets

$

2,378,613

$

2,439,715

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

242,149

$

264,078

Current operating lease liabilities

135,369

142,432

Other current liabilities

134,344

122,439

Total current liabilities

511,862

528,949

Long-term debt, net

497,354

616,624

Deferred income taxes

41,470

41,235

Long-term operating lease liabilities

448,810

421,741

Other long-term liabilities

33,867

34,757

Total liabilities

$

1,533,363

$

1,643,306

Shareholders’ equity:

Preferred stock; par value $0.01 per

share; 100,000 shares authorized; none issued or outstanding

$

—

$

—

Common stock, voting; par value $0.01 per

share; 150,000,000 shares authorized; 36,551,221 and 37,692,132

shares issued and outstanding, respectively

366

377

Additional paid-in capital

—

—

Accumulated other comprehensive loss

(23,915

)

(34,338

)

Retained earnings

868,799

830,370

Total shareholders’ equity

845,250

796,409

Total liabilities and shareholders’

equity

$

2,378,613

$

2,439,715

CARTER’S, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOW

(dollars in thousand)

(unaudited)

For the fiscal year

ended

December 30, 2023

December 31, 2022

Cash flows from operating activities:

Net income

$

232,500

$

250,038

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation of property, plant, and

equipment

60,407

61,543

Amortization of intangible assets

3,732

3,733

(Recoveries of) provisions for excess and

obsolete inventory, net

(10,439

)

5,039

Intangible asset impairments

—

9,000

Gain on partial termination of corporate

lease

(4,366

)

—

Other asset impairments and loss on

disposal of property, plant and equipment, net of recoveries

3,078

372

Amortization of debt issuance costs

1,586

1,950

Stock-based compensation expense

19,463

21,879

Unrealized foreign currency exchange gain,

net

(207

)

(78

)

Provisions for doubtful accounts

receivable from customers

471

75

Loss on extinguishment of debt

—

19,940

Unrealized (gain) loss on investments

(2,237

)

2,475

Deferred income tax benefit

(600

)

(740

)

Other

—

919

Effect of changes in operating assets and

liabilities:

Accounts receivable

15,453

32,683

Finished goods inventories

222,920

(106,763

)

Prepaid expenses and other assets

4,317

14,897

Accounts payable and other liabilities

(16,946

)

(228,601

)

Net cash provided by operating

activities

$

529,132

$

88,361

Cash flows from investing activities:

Capital expenditures

$

(59,860

)

$

(40,364

)

Net cash used in investing activities

$

(59,860

)

$

(40,364

)

Cash flows from financing activities:

Payment of senior notes due 2025

$

—

$

(500,000

)

Premiums paid to extinguish debt

—

(15,678

)

Payments of debt issuance costs

—

(2,420

)

Borrowings under secured revolving credit

facility

70,000

240,000

Payments on secured revolving credit

facility

(190,000

)

(120,000

)

Repurchase of common stock

(100,034

)

(299,667

)

Dividends paid

(112,005

)

(118,113

)

Withholdings from vesting of restricted

stock

(5,024

)

(6,930

)

Proceeds from exercise of stock

options

4,418

4,457

Other

—

(919

)

Net cash used in financing activities

$

(332,645

)

$

(819,270

)

Net effect of exchange rate changes on

cash

2,838

(1,273

)

Net increase (decrease) in cash and cash

equivalents

$

139,465

$

(772,546

)

Cash and cash equivalents, beginning of

fiscal year

211,748

984,294

Cash and cash equivalents, end of fiscal

year

$

351,213

$

211,748

CARTER’S, INC.

RECONCILIATION OF ADJUSTED

RESULTS TO GAAP

(dollars in millions, except

earnings per share)

(unaudited)

Fiscal quarter ended December

30, 2023

Gross Profit

% Net Sales

SG&A

% Net Sales

Operating Income

% Net Sales

Income Taxes

Net Income

Diluted EPS

As reported (GAAP)

$

418.2

48.7

%

$

287.0

33.4

%

$

136.1

15.9

%

$

31.4

$

106.5

$

2.90

Benefit from credit card settlement

(b)

—

—

—

(1.7

)

(5.3

)

(0.14

)

As adjusted (a)

$

418.2

48.7

%

$

287.0

33.5

%

$

136.0

15.9

%

$

29.8

$

101.2

$

2.76

Three Fiscal Quarters Ended

September 30, 2023

Gross Profit

% Net Sales

SG&A

% Net Sales

Operating Income

% Net Sales

Income Taxes

Net Income

Diluted EPS

As reported (GAAP)

$

977.8

46.8

%

$

807.0

38.7

%

$

187.3

9.0

%

$

38.3

$

126.0

$

3.36

Organizational restructuring (c)

—

(4.4

)

4.4

1.0

3.4

0.09

As adjusted (a)

$

977.8

46.8

%

$

802.6

38.4

%

$

191.8

9.2

%

$

39.3

$

129.4

$

3.45

Fiscal year ended December 30,

2023

Gross Profit

% Net Sales

SG&A

% Net Sales

Operating Income

% Net Sales

Income Taxes

Net Income

Diluted EPS

As reported (GAAP)

$

1,395.9

47.4

%

$

1,093.9

37.1

%

$

323.4

11.0

%

$

69.7

$

232.5

$

6.24

Organizational restructuring (c)

—

(4.4

)

4.4

1.0

3.4

0.09

Benefit from credit card settlement

(b)

—

—

—

(1.7

)

(5.3

)

(0.14

)

As adjusted (a)

$

1,395.9

47.4

%

$

1,089.5

37.0

%

$

327.8

11.1

%

$

69.1

$

230.6

$

6.19

Fiscal quarter ended December

31, 2022

Gross Profit

% Net Sales

SG&A

% Net Sales

Operating Income

% Net Sales

Income Taxes

Net Income

Diluted EPS

As reported (GAAP)

$

415.5

45.6

%

$

302.5

33.2

%

$

109.5

12.0

%

$

20.3

$

80.2

$

2.11

Intangible asset impairment (d)

—

—

9.0

2.1

6.9

0.18

As adjusted (a)

$

415.5

45.6

%

$

302.5

33.2

%

$

118.5

13.0

%

$

22.4

$

87.0

$

2.29

Fiscal year ended December 31,

2022

Gross Profit

% Net Sales

SG&A

% Net Sales

Operating Income

% Net Sales

Income Taxes

Net Income

Diluted EPS

As reported (GAAP)

$

1,472.4

45.8

%

$

1,110.0

34.6

%

$

379.2

11.8

%

$

66.7

$

250.0

$

6.34

Intangible asset impairment (d)

—

—

9.0

2.1

6.9

0.17

Loss on extinguishment of debt (e)

—

—

—

4.8

15.2

0.38

As adjusted (a)

$

1,472.4

45.8

%

$

1,110.0

34.6

%

$

388.2

12.1

%

$

73.6

$

272.0

$

6.90

Fiscal Quarter Ended April 1,

2023

Gross Profit

% Net Sales

SG&A

% Net Sales

Operating Income

% Net Sales

Income Taxes

Net Income

Diluted EPS

As reported (GAAP)

$

309.5

44.5

%

$

259.6

37.3

%

$

56.4

8.1

%

$

11.7

$

36.0

$

0.95

Organizational restructuring (c)

—

(1.2

)

1.2

0.3

0.9

0.03

As adjusted (a)

$

309.5

44.5

%

$

258.5

37.1

%

$

57.5

8.3

%

$

12.0

$

36.9

$

0.98

(a)

In addition to the results provided in

this earnings release in accordance with GAAP, the Company has

provided adjusted, non-GAAP financial measurements that present

gross profit, SG&A, operating income, income taxes, net income,

and net income on a diluted share basis excluding the adjustments

discussed above. The Company believes these adjustments provide a

meaningful comparison of the Company’s results and afford investors

a view of what management considers to be the Company's core

performance. These measures are used by the Company's executive

management to assess the Company's performance. The adjusted,

non-GAAP financial measurements included in this earnings release

should not be considered as an alternative to net income or as any

other measurement of performance derived in accordance with GAAP.

The adjusted, non-GAAP financial measurements are presented for

informational purposes only and are not necessarily indicative of

the Company’s future condition or results of operations.

(b)

Gain resulting from a court-approved

settlement related to payment card interchange fees.

(c)

Net expenses related to organizational

restructuring and related corporate office lease amendment

actions.

(d)

Related to the write-down of the Skip Hop

tradename asset.

(e)

Related to the redemption of the $500

million aggregate principal amount of senior notes due 2025 in

April 2022 that were previously issued by a wholly-owned subsidiary

of the Company.

Note: Results may not be additive due to rounding.

CARTER’S, INC.

RECONCILIATION OF NET INCOME

ALLOCABLE TO COMMON SHAREHOLDERS

(unaudited)

For the fiscal quarter

ended

For the fiscal year

ended

December 30,

2023

December 31,

2022

December 30,

2023

December 31,

2022

Weighted-average number of common and

common equivalent shares outstanding:

Basic number of common shares

outstanding

35,992,362

37,453,066

36,589,922

38,822,737

Dilutive effect of equity awards

3,172

11,001

3,344

27,908

Diluted number of common and common

equivalent shares outstanding

35,995,534

37,464,067

36,593,266

38,850,645

As reported on a GAAP Basis:

(dollars in thousands, except per share

data)

Basic net income per common share:

Net income

$

106,511

$

80,179

$

232,500

$

250,038

Income allocated to participating

securities

(2,076

)

(1,251

)

(4,285

)

(3,714

)

Net income available to common

shareholders

$

104,435

$

78,928

$

228,215

$

246,324

Basic net income per common share

$

2.90

$

2.11

$

6.24

$

6.34

Diluted net income per common share:

Net income

$

106,511

$

80,179

$

232,500

$

250,038

Income allocated to participating

securities

(2,076

)

(1,251

)

(4,285

)

(3,712

)

Net income available to common

shareholders

$

104,435

$

78,928

$

228,215

$

246,326

Diluted net income per common share

$

2.90

$

2.11

$

6.24

$

6.34

As adjusted (a):

(dollars in thousands, except per share

data)

Basic net income per common share:

Net income

$

101,199

$

87,039

$

230,605

$

272,049

Income allocated to participating

securities

(1,969

)

(1,362

)

(4,249

)

(4,056

)

Net income available to common

shareholders

$

99,230

$

85,677

$

226,356

$

267,993

Basic net income per common share

$

2.76

$

2.29

$

6.19

$

6.90

Diluted net income per common share:

Net income

$

101,199

$

87,039

$

230,605

$

272,049

Income allocated to participating

securities

(1,969

)

(1,362

)

(4,248

)

(4,055

)

Net income available to common

shareholders

$

99,230

$

85,677

$

226,357

$

267,994

Diluted net income per common share

$

2.76

$

2.29

$

6.19

$

6.90

(a)

In addition to the results provided in

this earnings release in accordance with GAAP, the Company has

provided adjusted, non-GAAP financial measurements that present per

share data excluding the adjustments presented above. The Company

excluded approximately $5.3 million and $1.9 million in after-tax

benefits from these results for the quarter and fiscal year ended

December 30, 2023, respectively. The Company excluded approximately

$6.9 million and $22.0 million in after-tax expenses from these

results for the quarter and fiscal year ended December 31, 2022,

respectively.

RECONCILIATION OF ADJUSTED

RESULTS TO GAAP

(unaudited)

The following table provides a

reconciliation of EBITDA and Adjusted EBITDA for the periods

indicated to net income, which is the most directly comparable

financial measure presented in accordance with GAAP:

Fiscal quarter ended

Fiscal year ended

(dollars in millions)

December 30,

2023

December 31,

2022

December 30,

2023

December 31,

2022

Net income

$

106.5

$

80.2

$

232.5

$

250.0

Interest expense

7.6

9.3

34.0

42.8

Interest income

(2.0

)

(0.4

)

(4.8

)

(1.3

)

Tax expense

31.4

20.3

69.7

66.7

Depreciation and amortization

15.6

16.5

64.1

65.3

EBITDA

$

159.1

$

125.8

$

395.6

$

423.5

Adjustments to EBITDA

Benefit from credit card settlement

(a)

$

(6.9

)

$

—

$

(6.9

)

$

—

Organizational restructuring (b)

—

—

4.4

—

Intangible asset impairment (c)

—

9.0

—

9.0

Loss on extinguishment of debt (d)

—

—

—

19.9

Total adjustments

(6.9

)

9.0

(2.5

)

28.9

Adjusted EBITDA

$

152.2

$

134.8

$

393.0

$

452.5

(a)

Gain resulting from a court-approved

settlement related to payment card interchange fees.

(b)

Net expenses related to organizational

restructuring and related corporate office lease amendment

actions.

(c)

Related to the write-down of the Skip Hop

tradename asset.

(d)

Related to the redemption of the $500

million aggregate principal amount of senior notes due 2025 in

April 2022 that were previously issued by a wholly-owned subsidiary

of the Company.

Note: Results may not be additive due to rounding.

EBITDA and Adjusted EBITDA are supplemental financial measures

that are not defined or prepared in accordance with GAAP. We define

EBITDA as net income before interest, income taxes and depreciation

and amortization. Adjusted EBITDA is EBITDA adjusted for the items

described in the footnotes (a) - (d) to the table above.

We present EBITDA and Adjusted EBITDA because we consider them

to be important supplemental measures of our performance and

believe they are frequently used by securities analysts, investors

and other interested parties in the evaluation of companies in our

industry. These measures are used by the Company's executive

management to assess the Company's performance.

The use of EBITDA and Adjusted EBITDA instead of net income or

cash flows from operations has limitations as an analytical tool,

and you should not consider them in isolation, or as a substitute

for analysis of our results as reported under GAAP. EBITDA and

Adjusted EBITDA do not represent net income or cash flow from

operations as those terms are defined by GAAP and do not

necessarily indicate whether cash flows will be sufficient to fund

cash needs. While EBITDA, Adjusted EBITDA and similar measures are

frequently used as measures of operations and the ability to meet

debt service requirements, these terms are not necessarily

comparable to other similarly titled captions of other companies

due to the potential inconsistencies in the method of calculation.

EBITDA and Adjusted EBITDA do not reflect the impact of earnings or

charges resulting from matters that we consider not to be

indicative of our ongoing operations. Because of these limitations,

EBITDA and Adjusted EBITDA should not be considered as

discretionary cash available to us for working capital, debt

service and other purposes.

RECONCILIATION OF U.S. GAAP

AND NON-GAAP INFORMATION

(dollars in millions)

(unaudited)

The tables below reflect the calculation

of constant currency for total net sales of the International

segment and consolidated net sales for the fiscal quarter and

fiscal year ended December 30, 2023:

Fiscal quarter ended

Reported Net Sales December

30, 2023

Impact of Foreign Currency

Translation

Constant- Currency Net Sales

December 30, 2023

Reported Net Sales December

31, 2022

Reported Net Sales %

Change

Constant- Currency Net Sales %

Change

Consolidated net sales

$

857.9

$

2.2

$

855.6

$

912.1

(5.9

)%

(6.2

)%

International segment net sales

$

130.7

$

2.2

$

128.5

$

124.9

4.6

%

2.8

%

Fiscal year ended

Reported Net Sales December

30, 2023

Impact of Foreign Currency

Translation

Constant- Currency Net Sales

December 30, 2023

Reported Net Sales December

31, 2022

Reported Net Sales %

Change

Constant- Currency Net Sales %

Change

Consolidated net sales

$

2,945.6

$

0.1

$

2,945.5

$

3,212.7

(8.3

) %

(8.3

) %

International segment net sales

$

429.2

$

0.1

$

429.2

$

452.1

(5.1

) %

(5.1

) %

The Company evaluates its net sales on

both an “as reported” and a “constant currency” basis. The constant

currency presentation, which is a non-GAAP measure, excludes the

impact of fluctuations in foreign currency exchange rates that

occurred between the comparative periods. Constant currency net

sales results are calculated by translating current period net

sales in local currency to the U.S. dollar amount by using the

currency conversion rate for the prior comparative period. The

Company consistently applies this approach to net sales for all

countries where the functional currency is not the U.S. dollar. The

Company believes that the presentation of net sales on a constant

currency basis provides useful supplemental information regarding

changes in our net sales that were not due to fluctuations in

currency exchange rates and such information is consistent with how

the Company assesses changes in its net sales between comparative

periods.

Note: Results may not be additive due to rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240226809729/en/

Sean McHugh Vice President & Treasurer (678) 791-7615

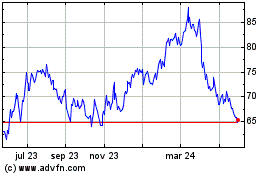

Carters (NYSE:CRI)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

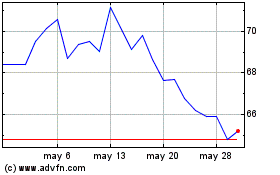

Carters (NYSE:CRI)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024