UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

November 21, 2024

Innovid Corp.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-40048 |

|

87-3769599 |

(State or other jurisdiction

of incorporation or organization) |

|

(Commission File

Number) |

|

(I.R.S. Employer

Identification No.) |

30 Irving Place, 12th

Floor

New York, NY 10003

(Address of principal executive offices) (Zip

Code)

(212) 966-7555

(Registrant’s telephone number, include

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☒ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.0001 per share |

|

CTV |

|

New York Stock Exchange |

| Warrants to purchase one share of common stock, each at an exercise price of $11.50 per share |

|

CTVWS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry

into a Material Definitive Agreement.

On November 21, 2024, Innovid Corp., a Delaware

corporation (the “Company”), entered into an Agreement and Plan of Merger (the “Merger Agreement”)

with Mediaocean LLC, a Delaware limited liability company (“Parent”), and Ignite Merger Sub, Inc., a Delaware corporation

and wholly owned subsidiary of Parent (“Merger Sub”, and together with Parent, the “Buyer Parties”),

providing for the merger of Merger Sub with and into the Company, with the Company continuing as the surviving corporation (the “Merger”).

Capitalized terms used herein but not otherwise defined have the meaning set forth in the Merger Agreement.

The board of directors of the Company (the “Company

Board”) has unanimously (i) determined that the Merger and the other transactions contemplated by the Merger Agreement are advisable,

fair to and in the best interests of the Company and the holders of shares (the “Company Stockholders”) of the Company’s

common stock, par value $0.0001 per share (“Company Common Stock”); (ii) approved the Merger Agreement and the execution

and delivery of the Merger Agreement by the Company, the performance by the Company of its covenants and other obligations thereunder,

and the consummation of the transactions contemplated by the Merger Agreement upon the terms and subject to the conditions set forth therein;

(iii) resolved to submit the Merger Agreement to the Company Stockholders for consideration at a special meeting of the Company Stockholders;

and (iv) subject to its covenants with respect to its recommendation to the Company Stockholders, resolved to recommend that the Company

Stockholders adopt this Agreement at such special meeting.

At the effective time of the Merger (the “Effective

Time”):

| (i) | each share of Company Common Stock that is outstanding as of

immediately prior to the Effective Time (other than Owned Company Shares or Dissenting Company Shares) will be cancelled and extinguished

and automatically converted into the right to receive cash in an amount equal to $3.15, without interest thereon (the “Per Share

Price”); and |

| (ii) | each share of Company Common Stock that is (a) held by a subsidiary

of the Company, (b) owned by Parent, Merger Sub or any of their direct or indirect wholly owned subsidiaries as of immediately prior

to the Effective Time, or (c) contributed to OceanKey TopCo LP (“TopCo”) pursuant to the Contribution and Exchange

Agreement (as defined below) will automatically be cancelled and extinguished without any conversion thereof or consideration paid therefor. |

In addition, pursuant to the Merger Agreement,

at the Effective Time:

| (i) | a number of unvested restricted stock unit awards granted under any Company Equity Plan (the “Company RSUs”) generally not

to exceed 7,164,386 Company RSUs (as such number may be adjusted in accordance with the terms of the Merger Agreement), shall be accelerated

and fully vest immediately prior to the Effective Time and such Company RSUs (together with any other Company RSUs that have previously

vested but not yet been), will be cancelled, and will convert into the right to receive a lump sum cash payment, without interest and net

of applicable withholdings, equal to the product of (a) the Per Share Price multiplied by (b) the number of shares of Company Common Stock

subject to such award of Company RSUs (the “Company RSU Consideration”), and (ii) all remaining Company RSUs that are outstanding

but unvested as of the Effective Time, including any such Company RSUs that do not become vested as a result of the Merger, will be cancelled

in exchange for restricted stock units (the “TopCo RSUs”) in TopCo with substantially similar terms as those terms applicable

immediately prior to the Effective Time to such Company RSUs (provided that Parent may provide opportunities to the holders of the OceanKey

RSUs to defer taxation of vested OceanKey RSUs beyond the applicable vesting dates to the extent practicable and subject to compliance

with all applicable local Laws and provided further that certain TopCo RSUs may be fully vested upon issuance at the Effective Time) in

accordance with the terms of the Merger Agreement; and |

| (ii) | each outstanding option to purchase shares of Company Common Stock (each, a “Company Option”),

whether vested or unvested, that is outstanding immediately prior to the Effective Time will be fully vested and cancelled in exchange

for the Per Share Price (over the applicable exercise price per share of Company common stock subject to such Company Option) in respect

of the number of shares of Company Common Stock subject to such Company Option. |

Holders of Dissenting Company Shares will be entitled

to receive payment of the appraised value of such Dissenting Company Shares in accordance with the provisions of Section 262 of the DGCL.

Any Company Warrants that are issued and outstanding

as of immediately prior to the Effective Time will be treated in accordance with its terms.

At the Effective Time, the Innovid Corp. 2021

Employee Stock Purchase Plan will be terminated.

If the Merger is consummated, the Company Common

Stock and the Company’s warrants which trade on The New York Stock Exchange will be de-listed from The New York Stock Exchange as

promptly as practicable following the Effective Time and de-registered under the Securities Exchange Act of 1934, as amended, as promptly

as practicable after such delisting.

Conditions to the Merger

Consummation of the Merger is subject to certain

conditions set forth in the Merger Agreement, including, but not limited to: (i) the affirmative vote of the holders of a majority of

the outstanding shares of Company Common Stock entitled to vote in accordance with the DGCL to adopt the Merger Agreement (the “Requisite

Stockholder Approval”); (ii) the expiration or termination of any waiting periods applicable to the consummation of the Merger

under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), in the case of the conditions

to the obligations of Parent and Merger Sub, without the imposition of a Burdensome Condition (as defined below); (iii) the accuracy of

the Company’s and Parent’s representations and warranties contained in the Merger Agreement, subject to specified materiality

qualifications; (iv) the Company’s and Parent’s compliance with their respective covenants; (v) the absence of (a) any injunction

or order preventing the consummation of the Merger and (b) any law that prohibits the consummation of the Merger; and (vi) the absence

of a Company Material Adverse Effect.

Efforts Covenants

The parties to the Merger Agreement have agreed

to use their respective reasonable best efforts to take all actions, do all things and assist and cooperate with each other to consummate

and make effective, as promptly as practicable, the transactions contemplated by the Merger Agreement, including by using reasonable best

efforts to cause the conditions to the Merger to be satisfied. The parties have further agreed to use their respective reasonable best

efforts to take all actions necessary to avoid or eliminate impediments, obtain all consents and make all filings under applicable antitrust

laws that may be required to enable the parties to the Merger Agreement to consummate the transactions contemplated by the Merger Agreement

as promptly as practicable. However, in no event are Parent, Merger Sub or their affiliates required to take, and the Company shall not

take without the prior written consent of Parent, any actions required by any Governmental Authority in connection with obtaining approval

for the Merger under antitrust laws that would be material to the business, operations or financial condition of the combined business

of Parent, the Company and their respective subsidiaries, taken as a whole after giving effect to the transactions contemplated by the

Merger Agreement (collectively, a “Burdensome Condition”).

No-Shop Period

From the date of execution of the Merger Agreement

(the “No-Shop Period Start Date”) until the earlier to occur of the termination of the Merger Agreement and the Effective

Time, the Company will be subject to customary “no-shop” restrictions on its ability to solicit alternative Acquisition Proposals

from third parties and to provide information to, and participate and engage in discussions or negotiations with, third parties regarding

any alternative Acquisition Proposals, subject to a customary “fiduciary out” provision that allows the Company, under certain

specified circumstances, to provide information to, and participate or engage in discussions or negotiations with and afford access to,

third parties with respect to an Acquisition Proposal if the Company Board determines in good faith (after consultation with its financial

advisor and outside legal counsel) that such alternative Acquisition Proposal either constitutes a Superior Proposal or is reasonably

likely to lead to a Superior Proposal, and the failure to take such actions would be inconsistent with its fiduciary duties pursuant to

applicable law.

Recommendation Change

Prior to obtaining the Requisite Stockholder Approval,

the Company Board may, in certain circumstances, effect a Recommendation Change (as defined in the Merger Agreement) in response to an

Intervening Event (as defined in the Merger Agreement) or with respect to a Superior Proposal, subject to complying with specified notice

requirements to Parent and other conditions set forth in the Merger Agreement.

Termination and Fees

The Merger Agreement contains customary termination

rights for each of the Company and Parent, including: (i) subject to certain limitations, if the consummation of the Merger has not occurred

by 11:59 p.m., Eastern time, on the date that is six months from the date of the Merger Agreement (such date, as may be extended, the

“Termination Date”), subject to an automatic extension to the date that is nine months from the date of the Merger

Agreement if on such date all of the conditions to closing have been satisfied or waived, except those relating to regulatory approvals,

and subject to further automatic extension to the date that is twelve months from the date of the Merger Agreement if on such date all

of the conditions to closing have been satisfied or waived, except those relating to regulatory approvals and a Second Request (as defined

in the Merger Agreement) has been received with respect to the Merger; (ii) in the event any legal restraint on the consummation of the

Merger has become final and non-appealable or any law has been enacted that prohibits the consummation of the Merger (such final legal

restraint or law, a “Legal Restraint”); (iii) if the Company fails to obtain the Requisite Stockholder Approval at

the special meeting (or any adjournment or postponement thereof) at which a vote is taken on the adoption of the Merger Agreement (such

failure, a “Stockholder Vote Failure”); or (iv) by the mutual written agreement of Parent and the Company.

The Company may terminate the Merger Agreement,

(i) subject to certain requirements, in order to enter into a definitive agreement to consummate a transaction that the Company Board

has determined is a Superior Proposal; (ii) if Parent breaches or fails to perform or if there is any inaccuracy of any of Parent’s

or Merger Sub’s respective representations, warranties, covenants or other agreements contained in the Merger Agreement, which breach,

failure to perform or inaccuracy would result in a failure of a condition to the Company’s obligations to consummate the Merger,

subject to certain cure periods and limitations (such breach, failure to perform or inaccuracy, a “Parent Material Breach”);

or (iii) if all the conditions to Parent’s obligations to consummate the Merger are satisfied and Parent fails to timely consummate

the Closing after certain notice has been provided to Parent (such failure, a “Parent Financing Failure”).

Parent may terminate the Merger Agreement if (i)

the Company Board has effected a Recommendation Change or (ii) if the Company breaches or fails to perform or if there is any inaccuracy

of any of the Company’s representations, warranties, covenants or other agreements contained in the Merger Agreement, which breach,

failure to perform or inaccuracy would result in a failure of a condition to Parent’s and Merger Sub’s obligations to consummate

the Merger, subject to certain cure periods and limitations (such breach, failure to perform or inaccuracy, a “Company Material

Breach”).

The Company is required to pay Parent a termination

fee of $17,000,000 in cash upon termination of the Merger Agreement under specified circumstances, including, among others, if the Merger

Agreement is validly terminated:

| ● | (i)

(x) due to a Stockholder Vote Failure or (y) due to the failure of the Closing to have occurred

prior to the Termination Date or a Company Material Breach, in the case of clause (y) at

a time when the Requisite Stockholder Approval has not been obtained, (ii) following the

execution and delivery of the Merger Agreement, an acquisition proposal was made to the Company

or publicly and such acquisition proposal is not withdrawn prior to the termination of the

Merger Agreement, and (iii) the Company enters into a definitive agreement for, or consummates,

an acquisition transaction within 12 months following the termination of the Merger Agreement; |

| ● | by

Parent or the Company due to a Stockholder Vote Failure at any time when the Company’s

material breach of its non-solicitation covenants would have resulted in Company Material

Breach; |

| ● | by Parent following a Recommendation Change; or |

| ● | by the Company to enter into a definitive agreement with respect to a Superior Proposal. |

Parent is required to pay the Company a termination

fee of $42,000,000 in cash upon termination of the Merger Agreement if the Merger Agreement is validly terminated:

| ● | due

to a Parent Financing Failure; |

| ● | due to (i) the failure of the Closing to have occurred prior to the Termination Date or (ii) the imposition

of a Legal Restraint arising under antitrust laws, in each case, at a time when all conditions to closing are capable of being satisfied,

other than the receipt of required regulatory approvals (and the Company has not willfully and materially breached its regulatory approval

covenants); or |

| ● | due to a Parent Material Breach with respect to Parent’s regulatory approval covenants at a time

when all conditions to closing are otherwise capable of being satisfied, other than the receipt of required regulatory approvals. |

Other Terms of the Merger Agreement

The Company also made customary representations

and warranties in the Merger Agreement and agreed to customary covenants regarding the operation of the business of the Company and its

subsidiaries prior to the consummation of the Merger. The Merger Agreement also provides that the Company, on the one hand, or the Buyer

Parties, on the other hand, may specifically enforce the obligations under the Merger Agreement, including the obligation to consummate

the Merger if the conditions set forth in the Merger Agreement are satisfied and subject to certain other conditions.

The foregoing description of the Merger Agreement

and the transactions contemplated thereby does not purport to be complete, and is subject to, and qualified in its entirety by reference

to, the full text of the Merger Agreement. The Merger Agreement has been included to provide investors with information regarding its

terms. It is not intended to provide any other factual information about the Company, Parent, Merger Sub or their respective subsidiaries

or affiliates. The representations, warranties and covenants contained in the Merger Agreement were made only for purposes of the Merger

Agreement as of the specific dates therein, were solely for the benefit of the parties to the Merger Agreement, may be subject to limitations

agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual

risk among the parties to the Merger Agreement instead of establishing these matters as facts, and may be subject to standards of materiality

applicable to the contracting parties that differ from those applicable to investors. Investors should not rely on the representations,

warranties and covenants or any descriptions thereof as characterizations of the actual state of facts or condition of the parties thereto

or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of representations and warranties

may change after the date of the Merger Agreement, which subsequent information may or may not be reflected in the Company’s public

disclosures. The Merger Agreement should not be read alone, but should instead be read in conjunction with the other information regarding

the Company, Parent and Merger Sub and the transactions contemplated by the Merger Agreement that will be contained in or attached as

an annex to the proxy statement that the Company will file in connection with the transactions contemplated by the Merger Agreement, as

well as in the other filings that the Company will make with the U.S. Securities and Exchange Commission (the “SEC”).

Financing

Parent has obtained equity and debt financing

commitments for the purpose of financing the transactions contemplated by the Merger Agreement and paying related fees and expenses.

Concurrently with the execution of the Merger

Agreement, affiliates of funds managed by affiliates of CVC Capital Partners and Charlesbank Capital Partners entered into an equity commitment

letter with Parent pursuant to which they have severally committed to provide equity financing to Parent in an aggregate amount equal

to $47,000,000, on the terms and subject to the conditions set forth in the signed equity commitment letter.

Certain financial institutions have severally

committed to provide an affiliate of Parent (“Borrower”) with a $350.0 million senior secured first lien term loan

facility and a $50.0 million increase to the existing revolving facility commitments under Borrower’s existing credit agreement,

on the terms set forth in the related debt commitment letter. The obligations of such financial institutions to provide debt financing

under the debt commitment letter are subject to a number of customary conditions.

Support Agreements

Concurrently with the execution of the Merger

Agreement, Parent entered into support agreements (each, a “Support Agreement” and collectively, the “Support

Agreements”) with each member of the Company Board in their capacities as stockholders of the Company, pursuant to which, among

other things and on the terms and subject to the conditions therein, each such stockholder agrees to vote all shares of Company Common

that it beneficially owns (representing approximately 7.22% in the aggregate of the total current outstanding voting power of the Company),

in favor of, among other things, granting the Requisite Stockholder Approval, approving the Merger and adopting the Merger Agreement.

The Support Agreements include certain restrictions on transfer of Company Common Shares by the members of the Company Board. The Support

Agreements will terminate, among other circumstances, upon (i) the Company Board effecting a Recommendation Change, (ii) the valid termination

of the Merger Agreement, (iii) the completion of the stockholder meeting at which a vote upon the Merger Agreement and the Merger is taken

or (iv) the Effective Time.

The foregoing description of the Support Agreements

and the transactions contemplated thereby does not purport to be complete, and is subject to, and qualified in its entirety by reference

to, the full text of each Support Agreement.

Contribution and Exchange Agreement

Concurrently with the execution of the Merger

Agreement, Parent entered into a contribution and exchange agreement (the “Contribution and Exchange Agreement”) with

Mr. Zvika Netter, the Company’s Chief Executive Officer (the “Rollover Holder”), pursuant to which, upon the

terms and subject to the conditions thereof, the Rollover Holder will, immediately prior to the Effective Time, contribute to OceanKey

a number of shares of Company Common Stock in exchange for, or otherwise subscribe and purchase, newly issued equity interests of OceanKey.

The foregoing description of the Contribution

and Exchange Agreement and the transactions contemplated thereby does not purport to be complete, and is subject to, and qualified in

its entirety by reference to, the full text of the Contribution and Exchange Agreement.

Item 8.01. Other

Events.

The Company has terminated its previously announced

stock repurchase program, in response to its entry into the Merger Agreement.

On November 21, 2024, the Company issued a press

release announcing its entry into the Merger Agreement. A copy of the press release is attached as Exhibit 99.1 to this Current Report

on Form 8-K (the “8-K”) and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| * | The schedules and exhibits have been omitted pursuant to Item

601(b)(2) of Regulation S-K. The Company agrees to furnish supplementally a copy of such schedules and exhibits, or any section thereof,

to the SEC upon request. |

Cautionary Statement Regarding Forward-Looking Statements

This 8-K contains forward-looking statements These forward-looking

statements include, without limitation, statements relating to the Merger. These statements are based on the beliefs and assumptions of

the Company’s management. Although the Company believes that its plans, intentions and expectations reflected in or suggested by

these forward-looking statements are reasonable, it cannot assure you that it will achieve or realize these plans, intentions or expectations.

These statements constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. Such statements

can be identified by the fact that they do not relate strictly to historical or current facts. When used in this 8-K, words such as “anticipate,”

“believe,” “can,” “continue,” “could,” “estimate,” “expect,” “forecast,”

“intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,”

“project,” “seek,” “should,” “strive,” “target,” “will,” “would”

and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not

forward-looking. Should one or more of a number of known and unknown risks and uncertainties materialize, or should any of our assumptions

prove incorrect, our actual results or performance may be materially different from those expressed or implied by these forward-looking

statements. Some factors that could cause actual results to differ include, but are not limited to: (i) the completion of the Merger on

anticipated terms and timing, including obtaining required stockholder and regulatory approvals, and the satisfaction of other conditions

to the completion of the Merger; (ii) potential litigation relating to the Merger that could be instituted against the Company, Parent

or their respective directors, managers or officers, including the effects of any outcomes related thereto; (iii) the risk that disruptions

from the Merger will harm the Company’s business, including current plans and operations; (iv) the ability of the Company to retain

and hire key personnel; (v) potential adverse reactions or changes to business relationships resulting from the announcement or completion

of the Merger; (vi) continued availability of capital and financing and rating agency actions; (vii) legislative, regulatory and economic

developments affecting the Company’s business; (viii) general economic and market developments and conditions; (ix) potential business

uncertainty, including changes to existing business relationships, during the pendency of the Merger that could affect the Company’s

financial performance; (x) certain restrictions during the pendency of the Merger that may impact the Company’s ability to pursue

certain business opportunities or strategic transactions; (xi) unpredictability and severity of catastrophic events, including but not

limited to acts of terrorism, pandemics, outbreaks of war or hostilities, as well as the Company’s response to any of the aforementioned

factors; (xii) significant transaction costs associated with the Merger; (xiii) the possibility that the Merger may be more expensive

to complete than anticipated, including as a result of unexpected factors or events; (xiv) the occurrence of any event, change or other

circumstance that could give rise to the termination of the Merger Agreement, including in circumstances requiring the Company to pay

a termination fee; (xv) competitive responses to the Merger; (xvi) other risks and uncertainties indicated in this 8-K, including those

set forth under the section titled “Risk Factors” and those incorporated by reference to our Annual Report on Form 10-K for

the fiscal year ended December 31, 2023, which was filed with the SEC on February 29, 2024; and (xvii) the risks and uncertainties that

will be described in the Proxy Statement (as defined herein) available from the sources indicated below. These risks, as well as other

risks associated with the Merger, will be more fully discussed in the Proxy Statement. While the list of factors presented here is, and

the list of factors to be presented in the Proxy Statement will be, considered representative, no such list should be considered a complete

statement of all potential risks and uncertainties.

These forward-looking statements are based on information available

as of the date of this 8-K and current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties.

Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date, and we do not undertake

any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result

of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties,

our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. You

should not place undue reliance on these forward-looking statements.

Important Additional Information and Where to Find It

In connection with the Merger, the Company will file with the SEC a

Proxy Statement on Schedule 14A (the “Proxy Statement”), the definitive version of which will be sent or provided to

the Company Stockholders. The Company may also file other documents with the SEC regarding the Merger. This 8-K is not a substitute for

the Proxy Statement or any other document which the Company may file with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE

PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS

TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER AND RELATED

MATTERS. Investors and security holders may obtain free copies of the Proxy Statement and other documents (when they become available)

that are filed or will be filed with the SEC by the Company through the website maintained by the SEC at www.sec.gov, the Company’s

website maintained by the SEC at www.sec.gov, the Company’s website at https://investors.innovid.com/ or by contacting the Company’s

Investor Relations Team at ir@innovid.com.

The Merger will be implemented pursuant to the Merger Agreement, which

contains the full terms and conditions of the Merger.

Participants in the Solicitation

The Company, Parent and their respective directors and officers may

be deemed to be participants in the solicitation of proxies from the Company Stockholders in connection with the Merger. Information about

the Company’s directors and executive officers and their ownership of Company’s securities is set forth in Company’s

filings with the SEC. To the extent that holdings of the Company’s securities have changed since the amounts printed in the Company’s

proxy statement, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional

information regarding the interests of those persons and other persons who may be deemed participants in the Merger may be obtained by

reading the Proxy Statement when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

INNOVID CORP. |

| |

|

|

| Date: November 21, 2024 |

By: |

/s/ Anthony Callini |

| |

Name: |

Anthony Callini |

| |

Title: |

Chief Financial Officer |

7

Exhibit 99.1

Mediaocean to Acquire

Innovid (NYSE:CTV)

Innovid will Merge

with Flashtalking by Mediaocean to Create a Premier Independent, Omnichannel Ad Tech Platform

NEW YORK, Nov. 21, 2024 – Mediaocean, a foundational

partner for omnichannel advertising, and Innovid (NYSE:CTV), an independent software platform

for the creation, delivery, measurement, and optimization of advertising, today announced they have entered into a definitive agreement

in which Mediaocean will acquire Innovid. As part of the deal, Innovid will merge with Flashtalking to create a premier global,

independent, omnichannel ad tech platform.

Mediaocean will acquire Innovid

at a price of $3.15 per share of common stock in a transaction with an enterprise value of approximately $500 million, and an equity value

of ~$525 million. The acquisition is expected to close in early 2025.

Together, the combined organization

will provide a broad array of complementary offerings, including ad delivery, creative personalization, measurement, and optimization

across channels, including digital, social, CTV, and linear TV.

Brands today often rely on technology owned

by media sellers, resulting in walled off access to inventory and data, less control over where their ads appear, and media spend being

optimized for publisher yield. Combining two trusted and innovative platforms – Innovid and Flashtalking – will empower advertisers

with increased control over data and decisions, more choice in where ad spend can go, and the right tools and workflows to make media

investments more effective and efficient.

Zvika Netter, CEO & Founder of Innovid,

will lead the combined ad tech organization as CEO reporting to Bill Wise, Co-Founder & CEO of Mediaocean. Grant Parker, who currently

runs Flashtalking, will be President of the combined ad tech organization reporting to Netter. Netter will also join the board of Mediaocean.

“Today’s advertising landscape needs

independent technology companies who can provide a neutral alternative to Google and interoperate effectively across Big Tech platforms,”

said Bill Wise, Co-Founder & CEO of Mediaocean. “Our Prisma business provides robust ad infrastructure to the world’s

largest brands and agencies. Now Flashtalking plus Innovid will establish a premier independent ad tech business with a keen focus on

creative and CTV.”

“From the start, when we

founded Innovid 17 years ago, we have been driven by the belief that advertising can be made better for all – and this merger represents

a key milestone on that journey, and the people, teams, and passion behind it,” said Zvika Netter, CEO & Founder, Innovid. “We

believe Innovid, Mediaocean, and Flashtalking represent decades of innovation and integrations of some of the world’s best technologies.

Together, we will be a partner that brands, agencies, and publishers can rely on to innovate, drive growth, and build their future.”

“Innovid and Flashtalking

are two of the most trusted ad tech platforms providing business-critical value to advertisers around the world,” said Grant Parker,

President, Flashtalking. “We believe our solutions engage consumers in the moment and deliver highly-relevant messages. Combined,

we will provide omnichannel orchestration for brands and agencies – from creative personalization to media delivery to transparent

and trusted measurement and optimization.”

For Mediaocean, Deutsche Bank Securities Inc.

is serving as financial advisor and White & Case is serving as legal advisor with Bain & Company and 3C Ventures providing strategic

consulting. For Innovid, Evercore is acting as financial advisor and Latham & Watkins as legal

advisor.

Cautionary

Statement Regarding Forward-Looking Statements

This

communication contains forward-looking statements. These forward-looking statements include, without limitation, statements relating

to the proposed merger of Innovid with Mediaocean (the “Transaction”). These statements are based on the beliefs and assumptions

of the management of Innovid. Although Innovid believes that its plans, intentions and expectations reflected in or suggested by these

forward-looking statements are reasonable, it cannot assure you that it will achieve or realize these plans, intentions or expectations.

These statements constitute projections, forecasts and forward-looking statements, and are not guarantees of performance. Such statements

can be identified by the fact that they do not relate strictly to historical or current facts. When used in this communication, words

such as “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,”

“expect,” “forecast,” “intend,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “seek,” “should,” “strive,”

“target,” “will,” “would” and similar expressions may identify forward-looking statements, but the

absence of these words does not mean that a statement is not forward-looking. Should one or more of a number of known and unknown risks

and uncertainties materialize, or should any of our assumptions prove incorrect, our actual results or performance may be materially

different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ

include, but are not limited to: (i) the completion of the Transaction on anticipated terms and timing, including obtaining required

stockholder and regulatory approvals, and the satisfaction of other conditions to the completion of the Transaction; (ii) potential litigation

relating to the Transaction that could be instituted against Mediaocean, Innovid or their respective directors, managers or officers,

including the effects of any outcomes related thereto; (iii) the risk that disruptions from the Transaction will harm Innovid’s

business, including current plans and operations; (iv) the ability of Innovid to retain and hire key personnel; (v) potential adverse

reactions or changes to business relationships resulting from the announcement or completion of the Transaction; (vi) continued availability

of capital and financing and rating agency actions; (vii) legislative, regulatory and economic developments affecting Innovid’s

business; (vii) general economic and market developments and conditions; (ix) potential business uncertainty, including changes to existing

business relationships, during the pendency of the Transaction that could affect Innovid’s financial performance; (x) certain restrictions

during the pendency of the Transaction that may impact Innovid’s ability to pursue certain business opportunities or strategic

transactions; (xi) unpredictability and severity of catastrophic events, including but not limited to acts of terrorism, pandemics, outbreaks

of war or hostilities, as well as Innovid’s response to any of the aforementioned factors; (xii) significant transaction costs

associated with the Transaction; (xiii) the possibility that the Transaction may be more expensive to complete than anticipated, including

as a result of unexpected factors or events; (xiv) the occurrence of any event, change or other circumstance that could give rise to

the termination of the Transaction, including in circumstances requiring Innovid to pay a termination fee or other expenses; (xv) competitive

responses to the Transaction; (xvi) other risks and uncertainties indicated in this communication, including those set forth under the

section titled “Risk Factors” and those incorporated by reference to our Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, which was filed with the Securities and Exchange Commission (“SEC”) on February 29, 2024; and (xvii) the

risks and uncertainties that will be described in the Proxy Statement (as defined herein) available from the sources indicated below.

These risks, as well as other risks associated with the Transaction, will be more fully discussed in the Proxy Statement. While the list

of factors presented here is, and the list of factors to be presented in the Proxy Statement will be, considered representative, no such

list should be considered a complete statement of all potential risks and uncertainties.

These

forward-looking statements are based on information available as of the date of this communication and current expectations, forecasts

and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied

upon as representing our views as of any subsequent date, and we do not undertake any obligation to update forward-looking statements

to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise,

except as may be required under applicable securities laws.

As

a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from

those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements.

Important

Additional Information and Where to Find It

In connection with the Transaction,

Innovid will file with the SEC a Proxy Statement on Schedule 14A (the “Proxy Statement”), the definitive version of which

will be sent or provided to Innovid stockholders. Innovid may also file other documents with the SEC regarding the Transaction. This

communication is not a substitute for the Proxy Statement or any other document which Innovid may file with the SEC. INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL

AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the Proxy Statement and other documents

(when they become available) that are filed or will be filed with the SEC by Innovid through the website maintained by the SEC at www.sec.gov,

Innovid’s website at https://investors.innovid.com/ or by contacting Innovid’s Investor Relations Team at ir@innovid.com.

Participants

in Solicitation

Mediaocean and Innovid and their

respective directors and officers may be deemed to be participants in the solicitation of proxies from Innovid’s stockholders in

connection with the proposed transaction. Information about Innovid’s directors and executive officers and their ownership of Innovid’s

securities is set forth in Innovid’s filings with the SEC. To the extent that holdings of Innovid’s securities have changed

since the amounts printed in Innovid’s proxy statement, such changes have been or will be reflected on Statements of Change in Ownership

on Form 4 filed with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants

in the proposed transaction may be obtained by reading the proxy statement/ prospectus regarding the proposed transaction when it becomes

available. You may obtain free copies of these documents as described in the preceding paragraph.

About

Mediaocean

Mediaocean

is powering the future of the advertising ecosystem with technology that empowers brands and agencies to deliver impactful omnichannel

marketing experiences. With hundreds of billions in annualized ad spend running through its software products, Mediaocean deploys AI

and automation to optimize investments and outcomes, with its advertising infrastructure and ad tech tools used by more than 100,000

people across the globe. Mediaocean owns and operates Prisma, the industry’s trusted

system of record for media management and finance, Flashtalking, an innovative ad server and

creative personalization platform, as well as Protected by Mediaocean, an MRC-accredited ad

verification solution. Visit www.mediaocean.com for more information.

About Innovid

Innovid (NYSE:CTV) is an independent

software platform for the creation, delivery, measurement, and optimization of advertising across connected TV (CTV), linear, and digital.

Through a global infrastructure that enables cross-platform ad serving, data-driven creative, and measurement, Innovid offers its clients

always-on intelligence to optimize advertising investment across channels, platforms, screens, and devices. Innovid is an independent

platform steering innovation in converged TV innovation, through proprietary technology and partnerships designed to reimagine TV advertising.

Headquartered in New York City, Innovid serves a global client base through offices across the Americas, Europe, and Asia Pacific. To

learn more, visit https://www.innovid.com/ or follow us on LinkedIn or X.

# # #

Media Contacts

| Innovid |

Mediaocean |

|

Megan Coyle

megan@innovid.com |

Aaron

Goldman

press@mediaocean.com |

4

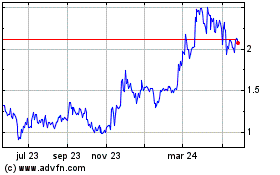

Innovid (NYSE:CTV)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

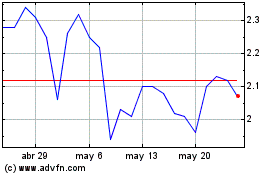

Innovid (NYSE:CTV)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025