PFD, PFO, FFC, FLC and DFP Announce Increased May, June and July Dividends

24 Abril 2020 - 10:30AM

Business Wire

The Boards of Directors of Flaherty & Crumrine Preferred and

Income Fund Incorporated (NYSE: PFD), Flaherty &

Crumrine Preferred and Income Opportunity Fund Incorporated

(NYSE: PFO), Flaherty & Crumrine Preferred and Income

Securities Fund Incorporated (NYSE: FFC), Flaherty &

Crumrine Total Return Fund Incorporated (NYSE: FLC) and

Flaherty & Crumrine Dynamic Preferred and Income Fund

Incorporated (NYSE: DFP) today announced that they have

declared per share dividends for May, June and July, 2020 as

follows:

May

June

July

PFD

$0.078

$0.078

$0.078

PFO

$0.0635

$0.0635

$0.0635

FFC

$0.118

$0.118

$0.118

FLC

$0.121

$0.121

$0.121

DFP

$0.1505

$0.1505

$0.1505

Payment Date

May 29, 2020

June 30, 2020

July 31, 2020

Record Date

May 22, 2020

June 23, 2020

July 24, 2020

Ex-Dividend Date

May 21, 2020

June 22, 2020

July 23, 2020

Each of these new dividends represents an increase from April’s

dividend of +4.0% for PFD, +1.6% for PFO, +5.4% for FFC, +5.2% for

FLC and +5.2% for DFP.

R. Eric Chadwick, Chairman of the Board of each fund, said “In

response to COVID-19, and a sudden halt in economic activity

brought on by measures to flatten its spread, prices of preferred

and contingent capital securities in the first three weeks of March

moved lower rapidly and relentlessly. COVID-19 will prove to be a

terrible event in both human and economic terms. Although markets

have calmed considerably from their drastic initial moves, no one

knows the full magnitude of this crisis just yet. We still face

another several weeks to several months of mandated safer-at-home

orders and social-distancing, followed by a cautious, staggered

approach to re-open our economy thereafter. And, there remains much

uncertainty on timing. In the meantime, we continue to monitor

credits and security valuations closely and work to position the

funds to meet their objectives – and for the best chance of

recovery in asset values as the pandemic recedes.”

Mr. Chadwick continued, “In response to this crisis, the Federal

Reserve has taken unprecedented steps to improve financial

conditions, and the fed funds target rate is back to its

financial-crisis low of 0-0.25%. This move lower in all short-term

rates has caused leverage expense to decline from an average of

about 3.1% in 2019 to about 1.5% most recently, while leverage

balances have remained unchanged. Consequently, we have increased

dividends modestly to better reflect projected annual net income

available for distribution to common shareholders. We remain

cautiously optimistic on the preferred and contingent capital

securities markets, especially from the viewpoint of long-term

income investors. However, we acknowledge that there is limited

modern historical precedent for this pandemic and its global

economic impact, making our ‘crystal ball’ unusually cloudy.”

The tax breakdown of all 2020 distributions will be available

early in 2021, but at this point the funds anticipate that the

dividends detailed above will consist of net investment income and

not capital gains or return of capital.

Website: www.preferredincome.com

Past performance is not indicative of future performance. An

investor should consider the fund’s investment objective, risks,

charges and expenses carefully before investing.

To the extent any portion of the distribution is estimated to be

sourced from something other than income, such as return of

capital, the source would be disclosed on a Section 19(a)-1 letter

located under the “SEC Filings and News” section of the funds’

website, www.preferredincome.com. The actual amounts and sources of

the amounts for tax reporting purposes will depend upon a fund’s

investment performance during the remainder of its fiscal year and

may be subject to change based on tax regulations. A distribution

rate that is largely comprised of sources other than income may not

be reflective of a fund’s performance.

PFD, PFO and FFC invest primarily in preferred and other-income

producing securities with an investment objective of high current

income consistent with preservation of capital. FLC invests

primarily in preferred and other income-producing securities with a

primary investment objective of high current income and a secondary

objective of capital appreciation. DFP invests primarily in

preferred and other income-producing securities with an investment

objective of total return, with an emphasis on high current income.

PFD, PFO, FFC, FLC and DFP are managed by Flaherty & Crumrine

Incorporated, an independent investment adviser which was founded

in 1983 to specialize in the management of portfolios of preferred

and related income-producing securities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200424005042/en/

Flaherty & Crumrine Incorporated Chad Conwell,

626-795-7300

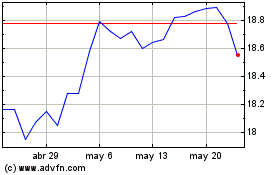

Flaherty and Crumrine Dy... (NYSE:DFP)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Flaherty and Crumrine Dy... (NYSE:DFP)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024