Delek Logistics Partners, LP Announces Pricing of Public Offering of Common Units

08 Octubre 2024 - 9:00PM

Business Wire

Delek Logistics Partners, LP (NYSE: DKL) (“Delek Logistics”)

announced today the pricing of its underwritten public offering of

3,846,153 common units representing limited partner interests in

Delek Logistics at $39.00 per unit. The offering is being made

pursuant to an effective shelf registration statement previously

filed with the Securities and Exchange Commission (the “SEC”). A

preliminary prospectus supplement relating to the offering has also

been filed with the SEC. Delek Logistics has granted the

underwriters a 30-day option to purchase up to 576,922 additional

common units. Delek Logistics intends to use the net proceeds from

the offering (including any net proceeds from the underwriters’

exercise of their option to purchase additional common units) to

redeem its outstanding convertible preferred units and to repay

outstanding borrowings under its revolving credit agreement.

None of the common units offered in the offering will be

purchased by Delek US Holdings, Inc. (“Delek Holdings”). As a

result, Delek Holdings’ ownership of the outstanding Delek

Logistics common units will decline from 70.4% prior to the

offering (on an as-converted basis) to approximately 65.2% after

the offering.

Avigal Soreq, our President and Chief Executive Officer, and

certain other of our executives (collectively, the “Executives”),

have indicated an interest in purchasing up to $300,000 of the

common units offered in the offering at the price offered to the

public. Because this indication is not a binding agreement or

commitment to purchase, the Executives may elect not to purchase

any units in the offering, or the underwriters may elect not to

sell any units in the offering to the Executives.

The offering is expected to settle and close on October 10,

2024, subject to the satisfaction of customary closing

conditions.

BofA Securities, Barclays, and RBC Capital Markets are acting as

joint book-running managers for the offering. A copy of the

preliminary prospectus supplement and accompanying base prospectus

relating to this offering may be obtained from any of the

underwriters, including BofA Securities at NC1-022-02-25 at 201

North Tryon Street, Charlotte, North Carolina 28255, Attention:

Prospectus Department or by email at

dg.prospectus_requests@bofa.com; Barclays Capital Inc. at c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, Barclaysprospectus@broadridge.com, (888)-603-5847; and

RBC Capital Markets, LLC, Attention: Equity Capital Markets, 200

Vesey Street, New York, NY 10281, by telephone at 877-822-4089 or

by email at equityprospectus@rbccm.com; You may also obtain these

documents for free when they are available by visiting the SEC’s

website at www.sec.gov.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction. The offering may be made only by means of a

prospectus and related prospectus supplement meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended (the “Securities Act”).

About Delek Logistics Partners, LP

Delek Logistics is a midstream energy master limited partnership

headquartered in Brentwood, Tennessee. Through its owned assets and

joint ventures located primarily in and around the Permian Basin,

the Delaware Basin and other select areas in the Gulf Coast region,

Delek Logistics provides gathering, pipeline, transportation, and

other services for its customers in crude oil, intermediates,

refined products, natural gas, storage, wholesale marketing,

terminalling, water disposal and recycling.

Delek Holdings (NYSE: DK) owns the general partner interest as

well as a majority limited partner interest in Delek Logistics and

is also a significant customer.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act, Section 21E of

the Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995, including statements

regarding the closing of the offering and the anticipated use of

the net proceeds therefrom. These statements may contain words such

as “possible,” “believe,” “should,” “could,” “would,” “predict,”

“plan,” “estimate,” “intend,” “may,” “anticipate,” “will,” “if,”

“expect” or similar expressions, as well as statements in the

future tense, are made as of the date they were first issued and

are based on current expectations, estimates, forecasts and

projections as well as the beliefs and assumptions of management.

Forward-looking statements are subject to a number of risks and

uncertainties, many of which involve factors or circumstances that

are beyond Delek Logistics’ control. Delek Logistics’ actual

results could differ materially from those stated or implied in

forward-looking statements due to a number of factors, including,

but not limited to, market risks and uncertainties, including those

which might affect the offering, and the impact of any natural

disasters or public health emergencies. These and other potential

risks and uncertainties that could cause actual results to differ

from the results predicted are more fully detailed in Delek

Logistics’ filings and reports with the SEC, including the Annual

Report on Form 10-K for the year ended December 31, 2023 and other

reports and filings with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241008649268/en/

Investor Relations and Media/Public Affairs Contact:

investor.relations@delekus.com

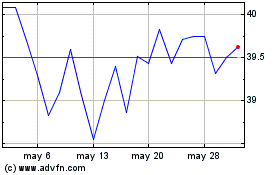

Delek Logistics Partners (NYSE:DKL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Delek Logistics Partners (NYSE:DKL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024