Endeavour Silver Produces 5,672,703 Oz Silver and 37,858 Oz Gold (8.7 Million Silver Equivalent Oz) in 2023; Improved Fourth Quarter Production Delivers Annual Guidance

09 Enero 2024 - 5:50AM

Endeavour Silver Corp.

(“Endeavour” or the

“Company”) (NYSE: EXK; TSX: EDR)

(“Endeavour” or the “Company”) reports full year 2023 production of

5,672,703 silver ounces (oz) and 37,858 gold oz, for silver

equivalent (1) (“AgEq”) production of 8.7 million oz. Fourth

quarter production was 1,396,315 silver oz and 9,440 gold oz for

2.2 million silver equivalent oz.

“We are extremely pleased with our strong Q4

production results, which have been driven by initiatives our

Operations team implemented to improve both mine and mill

productivity” commented Dan Dickson, Chief Executive Officer. He

further added, “Implementing these initiatives allowed us to

successfully overcome the challenges that affected Q3 production.

Not only did Guanaceví’s production return to historical levels,

which is expected to be continue into 2024, our recovery plan more

than met expectations, allowing us to achieve our annual production

guidance with strong fourth-quarter performance. We have now

delivered three consecutive years of meeting or exceeding our

annual production guidance.”

Q4 Highlights

-

Production In-Line with Guidance: Consolidated

production in-line with guidance, representing the Company’s third

consecutive year of meeting or exceeding production guidance.

-

Guanaceví Improved Performance: Silver grades,

gold grades and plant throughput slightly exceeded plan. The plant

refurbishments and modifications enhance operational flexibility to

exceed the historical throughput of 1,200 tonne per day.

-

Bolañitos Performance Remained Steady: Increased

silver production from higher silver grades with similar throughput

was offset by lower gold production due to lower gold grades. The

variations in grades quarter from quarter is expected, while annual

ore grades were within 2% of annual planned grades.

- Metal

Sales and Inventories: Sold 1,332,648 oz silver and 9,417

oz gold during the quarter. Held 476,015 oz silver and 1,411 oz

gold of bullion inventory and 11,869 oz silver and 300 oz gold in

concentrate inventory at quarter end.

-

Encouraging Brownfields Exploration Results from Guanaceví

and Bolañitos: Drilling continued to intersect high-grade

silver-gold mineralization in the Santa Cruz vein at Guanaceví (see

news release dated October 18, 2023) and intersected multiple

mineralized structures near current workings at Bolañitos (see news

release dated November 27, 2023).

-

Positive Greenfields Exploration Results from the Parral

Project: Drilled over 6,500 metres testing the San

Patricio vein and other regional targets (see news release dated

October 25, 2023).

-

Appointment of Chief Financial Officer: Elizabeth

Senez brings over 20 years’ of experience in accounting, corporate

finance, and corporate treasury (see news release dated

December 5, 2023).

-

At-The-Market Offering for up to US$60 million:

Proceeds to be used for funding development of the Terronera

project and other growth initiatives (see news release dated

December 18, 2023).

Q4 2023 Mine Operations

Consolidated silver production decreased 23% to

1,406,423 ounces in Q4 2023 compared to Q4 2022, primarily driven

by lower silver production at the Guanaceví mine due to a reduction

in silver grade and slightly lower throughput. Although the grades

at El Curso have returned to historic averages during Q4 2023, the

Company was mining in higher grade areas in Q4 2022. Local

third-party ore continued to supplement mine production, totaling

14% of quarterly throughput.

Consolidated gold production decreased by 7% to

9,608 ounces compared to Q4 2022, primarily due to lower gold

grades mined at the Guanaceví mine. The lower gold production from

Guanaceví more than offset the higher gold produced from the

Bolañitos mine.

At Guanaceví, Q4 2023 throughput was 7% lower

than Q4 2022 with silver grades 18% lower and gold grades 17% lower

resulting in lower silver and gold production of 24% and 25%

respectively.

At Bolañitos, Q4 2023 throughput was 4% higher

than Q4 2022 with silver grades 10% lower and gold grades 8%

higher. Silver production decreased by 10% while gold production

increased by 8%. The change in grades was due to typical variations

in the mineralized body.

Production Highlights

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

2023 |

2022 |

% Change |

|

2023 |

2022 |

% Change |

|

220,464 |

224,289 |

(2%) |

Throughput (tonnes) |

874,382 |

834,542 |

5% |

|

1,406,423 |

1,830,835 |

(23%) |

Silver ounces produced |

5,672,703 |

5,963,445 |

(5%) |

|

9,608 |

10,370 |

(7%) |

Gold ounces produced |

37,858 |

37,548 |

1% |

|

1,396,315 |

1,816,813 |

(23%) |

Payable silver ounces produced |

5,627,379 |

5,912,509 |

(5%) |

|

9,440 |

10,196 |

(7%) |

Payable gold ounces produced |

37,189 |

36,901 |

1% |

|

2,175,063 |

2,660,435 |

(18%) |

Silver equivalent ounces produced (1) |

8,701,343 |

8,967,285 |

(3%) |

|

1,332,648 |

2,816,882 |

(53%) |

Silver ounces sold |

5,669,760 |

6,464,869 |

(12%) |

|

9,417 |

11,843 |

(20%) |

Gold ounces sold |

37,186 |

38,868 |

(4%) |

Mine-by-mine production in the fourth quarter and the year ended

December 31, 2023 was:

Q4 2023 Production by Mine

|

Production |

Tonnes |

Tonnes |

Grade |

Grade |

Recovery |

Recovery |

Silver |

Gold |

|

by mine |

Processed |

per day |

Ag gpt* |

Au gpt* |

Ag % |

Au % |

Oz |

Oz |

|

Guanaceví |

110,781 |

1,204 |

419 |

1.20 |

85.2% |

87.0% |

1,271,679 |

3,721 |

|

Bolañitos |

109,683 |

1,192 |

45 |

1.86 |

84.8% |

89.9% |

134,744 |

5,887 |

|

Consolidated |

220,464 |

2,396 |

233 |

1.53 |

85.1% |

88.8% |

1,406,423 |

9,608 |

*gpt = grams per tonneTotals may not add due to rounding

2023 Production by Mine

|

Production |

Tonnes |

Tonnes |

Grade |

Grade |

Recovery |

Recovery |

Silver |

Gold |

|

by mine |

Processed |

per day |

Ag gpt* |

Au gpt* |

Ag % |

Au % |

Oz |

Oz |

|

Guanaceví |

433,409 |

1,187 |

417 |

1.19 |

88.0% |

90.5% |

5,105,237 |

14,955 |

|

Bolañitos |

440,973 |

1,208 |

47 |

1.82 |

85.1% |

88.6% |

567,466 |

22,903 |

|

Consolidated |

874,382 |

2,396 |

230 |

1.51 |

87.7% |

89.3% |

5,672,703 |

37,858 |

*gpt = grams per tonneTotals may not add due to

rounding

Qualified Person

Dale Mah, Vice President Corporate Development,

a qualified person under NI 43-101, has approved the scientific and

technical information related to operations matters contained in

this news release.

2023 Financial Results and Conference Call

The Company’s annual 2023 financial results will

be released before markets open on Monday, March 11, 2024, and a

telephone conference call will be held the same day at 9:00 a.m. PT

/ 12:00 p.m. ET. To participate in the conference call, please dial

the numbers below.

|

Date & Time: |

|

Monday, March

11, 2024, at 9:00 a.m. PT / 12:00 p.m. ET |

| |

|

|

| Telephone: |

|

Toll-free in Canada and the US +1-800-319-4610Local or

International +1-604-638-5340Please allow up to 10 minutes to be

connected to the conference call. |

| |

|

|

| Replay: |

|

A replay of the conference call will be available by dialing

(toll-free) +1-800-319-6413 in Canada and the US (toll-free)

or +1-604-638-9010 outside of Canada and the US. The replay

passcode is 0627#. The replay will also be available on the

Company’s website at www.edrsilver.com. |

About Endeavour Silver –

Endeavour is a mid-tier precious metals mining company that

operates two high-grade underground silver-gold mines in Mexico.

Endeavour is advancing construction of the Terronera Project and

exploring its portfolio of exploration projects in Mexico, Chile

and the United States to facilitate its goal to become a premier

senior silver producer. Our philosophy of corporate social

integrity creates value for all stakeholders.

Contact Information:Galina Meleger, VP,

Investor RelationsEmail: gmeleger@edrsilver.comWebsite:

www.edrsilver.com

Follow Endeavour Silver on Facebook, Twitter,

Instagram and LinkedIn.

Cautionary Note Regarding Forward-Looking

Statements

This news release contains “forward-looking

statements” within the meaning of the United States private

securities litigation reform act of 1995 and “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Such forward-looking statements and information herein

include but are not limited to statements regarding the development

and financing of the Terronera Project, Endeavour’s anticipated

performance in 2024 including changes in mining operations and

forecasts of production levels, anticipated production costs and

all-in sustaining costs and the timing and results of various

activities. The Company does not intend to and does not assume any

obligation to update such forward-looking statements or

information, other than as required by applicable law.

Forward-looking statements or information

involve known and unknown risks, uncertainties and other factors

that may cause the actual results, level of activity, production

levels, performance or achievements of Endeavour and its operations

to be materially different from those expressed or implied by such

statements. Such factors include but are not limited changes in

production and costs guidance; the ongoing effects of inflation and

supply chain issues on mine economics; national and local

governments, legislation, taxation, controls, regulations and

political or economic developments in Canada and Mexico; financial

risks due to precious metals prices; operating or technical

difficulties in mineral exploration, development and mining

activities; risks and hazards of mineral exploration, development

and mining; the speculative nature of mineral exploration and

development; risks in obtaining necessary licenses and permits; and

challenges to the Company’s title to properties; as well as those

factors described in the section “risk factors” contained in the

Company’s most recent form 40F/Annual Information Form filed with

the S.E.C. and Canadian securities regulatory authorities.

Forward-looking statements are based on

assumptions management believes to be reasonable, including but not

limited to: the continued operation of the Company’s mining

operations, no material adverse change in the market price of

commodities, forecasted mine economics as of 2024, mining

operations will operate and the mining products will be completed

in accordance with management’s expectations and achieve their

stated production outcomes, and such other assumptions and factors

as set out herein. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking statements or

information, there may be other factors that cause results to be

materially different from those anticipated, described, estimated,

assessed or intended. There can be no assurance that any

forward-looking statements or information will prove to be accurate

as actual results and future events could differ materially from

those anticipated in such statements or information. Accordingly,

readers should not place undue reliance on forward-looking

statements or information.

End Note: (1) Silver equivalent calculated using

an 80:1 silver: gold ratio

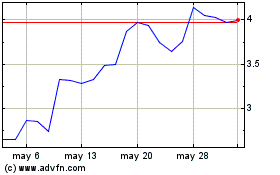

Endeavour Silver (NYSE:EXK)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Endeavour Silver (NYSE:EXK)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024