FIS Leverages Scale and NYCE Debit Network to Enable Streamlined Peer-to-Peer Payment Capabilities within Digital Banking Platforms

15 Agosto 2024 - 7:00AM

Business Wire

Key Facts

- FIS is teaming with Neural Payments to leverage its NYCE debit

rails and scale to simplify the peer-to-peer (P2P) payment

experience.

- FIS has enabled the Neural Payments solution to be embedded

within an institution’s mobile banking app, eliminating the need to

access a separate application to send or receive P2P payments.

- Neural Payments allows recipients to accept funds even if their

financial institution doesn’t utilize it, instead prompting them to

collect funds through their provider of choice.

FIS® (NYSE: FIS), a global leader in financial technology, today

announced that it is unlocking the Neural Payments solution to its

clients, expanding the availability of peer-to-peer (P2P) payments

by leveraging the company’s global scale and NYCE debit rails to

bring this capability to a wider range of institutions.

Neural Payments’ innovative platform enables bank customers to

transfer money from their account to anyone, regardless of whether

the recipient’s institution utilizes Neural Payments and without

the need to download a third-party app or register a new card.

Payments can be settled via popular mobile wallets and debit card;

with FedNow, and The Clearing House RTP available now. Recipients

can claim their payment within seconds after funds are sent.

“A recent FIS UK surveyi shows that mobile banking capabilities

are the top reason for every generation’s loyalty to their primary

bank,” said Chris Como, Head of Cards and Money Movement at FIS.

“This combination of our industry reach and our NYCE debit rails

with Neural Payments’ innovative technology will greatly help

streamline money movement for today’s economy and the increasingly

digital consumer. It illustrates our commitment to unlocking

financial technology for the world, and I’m excited to begin

introducing these capabilities to our client institutions.”

Why P2P Payments Matter

P2P applications are widely used and continue to experience

robust growth, bridging gaps across generations and digital

accessibility. According to Neural Payments, over 80% of consumers

report having utilized a P2P service, with frequent use on a weekly

basis. The worldwide market for P2P payments was estimated to be

worth $2.21 trillion in 2022 and is anticipated to reach

approximately $11.62 trillion by 2032 based on a report by

Precedence Research.

How FIS Enables the Neural Payments Solution

FIS will enable its financial institution clients to integrate

Neural Payments’ white-label solution within the institution’s

mobile banking app, so users will not need to visit a third party

to send money. For conventional closed loop payments, linked debit

accounts are settled in real-time within FIS clients’ existing

products.

“Aligning with FIS to bring our white-label P2P offering to

financial institutions is a natural next step in the evolution of

our long-standing relationship,” said Mick Oppy, Co-Founder and CEO

at Neural Payments. “This solution is already reshaping the P2P

landscape with its open-loop system that transcends traditional

banking boundaries. As a global leader in financial technology, FIS

will help us extend that reach to provide a payment service that

finally delivers on the promise of P2P, allowing money to be moved

safely, inexpensively, and through the broadest possible number of

networks.”

Neural Payments is an FIS Fintech Accelerator alumni and winner

of the 2022 Demo Day Award.

Learn More

FIS’ offering of Neural Payments is available for immediate use

by financial institutions, including banks of all sizes and credit

unions. Interested institutions can learn more by emailing

digitalsales@fisglobal.com.

About FIS

FIS is a financial technology company providing solutions to

financial institutions, businesses, and developers. We unlock

financial technology to the world across the money lifecycle

underpinning the world’s financial system. Our people are dedicated

to advancing the way the world pays, banks and invests, by helping

our clients to confidently run, grow, and protect their businesses.

Our expertise comes from decades of experience helping financial

institutions and businesses of all sizes adapt to meet the needs of

their customers by harnessing where reliability meets innovation in

financial technology. Headquartered in Jacksonville, Florida, FIS

is a member of the Fortune 500® and the Standard & Poor’s 500®

Index. To learn more, visit FISglobal.com. Follow FIS on LinkedIn,

Facebook and X.

_____________________________ i The UK data is based on a

representative sample of 2,008 adult consumers across the UK,

spanning Generation Z (18-27), Millennials (28-42), Generation X

(43-58) and Baby Boomers (59+).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240815618435/en/

Kim Snider, 904.438.6278 Senior Vice President FIS Global

Marketing and Communications kim.snider@fisglobal.com

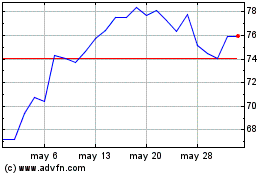

Fidelity National Inform... (NYSE:FIS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

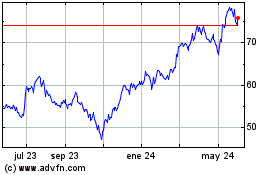

Fidelity National Inform... (NYSE:FIS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024