Glass Lewis Concludes LL Flooring is in Need of

Swift, Credible Strategic and Financial Review; Finds Little Clear

or Measurable Cause for Shareholders to Endorse Incumbent

Nominees

Notes F9’s Nominees are Industry-Focused and

Offer the Appropriate Operational Skills and Familiarity with LL

Flooring’s Core Business

Doubts the Incumbent Board’s Strategic Plan

Will Drive Growth in Coming Periods

F9 Investments, LLC (“F9”), which together with its affiliates

collectively owns approximately 8.85% of LL Flooring Holdings, Inc.

(“LL Flooring” or the “Company”) (NYSE: LL) common stock and is the

Company’s largest shareholder, today announced that Glass Lewis

& Co. (“Glass Lewis”), a leading independent proxy advisory

firm, has recommended that LL Flooring shareholders vote on F9’s

GOLD proxy card

“FOR” the election of F9’s

three highly qualified director nominees – Thomas D. Sullivan,

Jason Delves, and Jill Witter – and “WITHHOLD” from LL

Flooring’s nominees Douglas T. Moore, Ashish Parmar, and Nancy M.

Taylor in connection with the Company’s 2024 Annual Meeting of

Shareholders to be held on July 10, 2024.

Thomas D. Sullivan said, “LL Flooring’s current ineffectual

leadership has overseen staggering operational losses and clung to

a failing strategy that has placed the Company on the verge of

bankruptcy. We are pleased that Glass Lewis recognizes that our

highly qualified nominees would bring much-needed oversight, rigor,

and relevant flooring industry experience to the Company’s

Board.”

“At this critical juncture when the Company – by its own

admission – is at immediate risk of breaching a financial covenant

and running low on cash as soon as this quarter, LL Flooring needs

new Board members who bring proven leadership ability, shareholder

alignment, and an actionable plan to reverse years of mismanagement

and set LL Flooring on the path to profitability. Our nominees are

committed to acting in the best interest of LL Flooring and its

shareholders, and we urge all shareholders to heed Glass Lewis’

recommendation to vote for change, protect their investment, and

create lasting and meaningful value for all stakeholders.”

In making its recommendation “FOR” F9’s nominees, Glass Lewis

noted the following regarding LL Flooring’s prospects under

incumbent leadership and the need for swift change:

- “It is not clear at this juncture that the board has a clear

vision as to the fair value of the Company or its prospects, nor is

it evident there is firm cognizance of the downward pressure on

LL's shares arising from the Company's substantially poor

performance and significant financial risks.”

- “…we consider election of F9's slate to represent the most

compelling alternative available at what appears to be a fairly

critical juncture for LL.”

With respect to Thomas D. Sullivan, Jason Delves, and Jill

Witter, Glass Lewis wrote:

- “The alternate nominees submitted by [F9] are industry focused,

and, particularly in the case of Messrs. Delves and Sullivan (the

former of which LL already contemplated adding to the board in view

of his ‘relevant industry and operational experience and ...

necessary skills to help the Company’), offer appropriate

operational skills and familiarity with LL and its core flooring

business.”

- “We further consider the Board's effort to denigrate F9's

candidates (Mr. Sullivan, in particular) does not prove

particularly persuasive, and would, in candor, suggest the current

board and management team are in a fairly challenged position to

assert maintenance of the status quo, including directors with 10-

and 18-year tenures, is likely to represent a particularly

compelling outcome at this juncture.”

Regarding LL Flooring’s incumbent nominees, Glass Lewis

noted:

- “We see little clear and measurable cause for shareholders to

endorse the view that perpetuation of the incumbent board's tack is

likely to represent the most attractive route forward at this

time.”

- “We believe the board carves out very little in the way of

credible footing for its operational defense, which largely eschews

recognition of the Company's observably poor performance, valuation

and competitive positioning.”

VOTE ON THE GOLD PROXY CARD TODAY “FOR” F9’S

NOMINEES TOM SULLIVAN, JASON DELVES, AND JILL WITTER AND “WITHHOLD”

ON ALL LL FLOORING NOMINEES AND JERALD HAMMANN

Shareholders must act decisively to safeguard their

investment. YOUR VOTE MATTERS, NO MATTER HOW MANY SHARES YOU OWN.

We urge all shareholders to protect the value of their investment

by voting for F9’s nominees today using the GOLD proxy

card.

You can cast your vote online at www.ProxyVote.com or by

completing, signing and dating the GOLD proxy card or GOLD voting

instruction form and mailing it in the postage paid envelope

provided.

If you have not received the GOLD proxy card from F9 and have

only received a WHITE proxy card sent to you by the Company, you

can still support F9’s nominees using the WHITE proxy card. You can

do so by checking the “WITHHOLD” boxes on all of the Company

nominees and Jerald Hammann and checking the “FOR” boxes for all F9

nominees – Tom Sullivan, Jason Delves, and Jill Witter.

If you have any questions about how to vote your shares, please

contact our proxy solicitor, Campaign Management, by telephone

1-(855) 264-1527 (shareholders) or (212) 632-8422 (banks &

brokerages) or by email at info@campaign-mgmt.com.

For more information about F9 and detailed voting instructions,

visit our website at www.LLGroove.com.

Solomon Partners Securities, LLC is serving as F9’s financial

advisor and Dentons US LLP is serving as its legal advisor.

DISCLAIMER

Except as otherwise set forth in this press release, the views

expressed in this press release reflect the opinions of F9

Investments, LLC and its affiliates (“F9”) and are based on

publicly available information with respect to LL Flooring

Holdings, Inc. (“LL” or the “Company”). F9 recognizes that there

may be confidential information in the possession of the Company

that could lead it or others to disagree with F9’s conclusions. F9

reserves the right to change any of its opinions expressed herein

at any time as it deems appropriate and disclaims any obligation to

notify the market or any other party of any such change, except as

required by law. F9 disclaims any obligation to update the

information or opinions contained in this press release, except as

required by law. For the avoidance of doubt, this press release is

not affiliated with or endorsed by LL.

This press release is provided merely as information and is not

intended to be, nor should it be construed as, an offer to sell or

a solicitation of an offer to buy any security nor as a

recommendation to purchase or sell any security. Certain of the

Participants (as defined below) currently beneficially own shares

of the Company. The Participants and their affiliates may from time

to time sell all or a portion of their holdings of the Company in

open market transactions or otherwise, buy additional shares (in

open market or privately negotiated transactions or otherwise), or

trade in options, puts, calls, swaps or other derivative

instruments relating to such shares.

Some of the materials in this press release contain

forward-looking statements. All statements contained herein that

are not clearly historical in nature or that necessarily depend on

future events are forward-looking, and the words “anticipate,”

“believe,” “expect,” “potential,” “could,” “opportunity,”

“estimate,” “plan,” “once again,” “achieve,” and similar

expressions are generally intended to identify forward-looking

statements. The projected results and statements contained herein

that are not historical facts are based on current expectations,

speak only as of the date of these materials and involve risks,

uncertainties and other factors that may cause actual results,

performances or achievements to be materially different from any

future results, performances or achievements expressed or implied

by such projected results and statements. Assumptions relating to

the foregoing involve judgments with respect to, among other

things, future economic competitive and market conditions and

future business decisions, all of which are difficult or impossible

to predict accurately and many of which are beyond the control of

F9.

The estimates, projections and potential impact of the

opportunities identified by F9 herein are based on assumptions that

F9 believes to be reasonable as of the date of this press release,

but there can be no assurance or guarantee (i) that any of the

proposed actions set forth in this press release will be completed,

(ii) that the actual results or performance of the Company will not

differ, and such differences may be material, or (iii) that any of

the assumptions provided in this press release are accurate.

F9 has neither sought nor obtained the consent from any third

party to use any statements or information contained herein that

have been obtained or derived from statements made or published by

such third parties, nor has it paid for any such statements. Any

such statements or information should not be viewed as indicating

the support of such third parties for the views expressed herein.

F9 does not endorse third-party estimates or research which are

used herein solely for illustrative purposes.

Important Information

F9 Investments, LLC, Thomas D. Sullivan, John Jason Delves and

Jill Witter (collectively, the “Participants”) filed a definitive

proxy statement and accompanying form of gold proxy card (as

supplemented and amended, the “Definitive Proxy Statement”) with

the Securities and Exchange Commission (the "SEC”) on May 31, 2024

to be used in connection with the 2024 annual meeting of

stockholders of the Company.

THE PARTICIPANTS STRONGLY ADVISE ALL STOCKHOLDERS OF THE COMPANY

TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER PROXY MATERIALS

BECAUSE THEY CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS

ARE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV AND

F9’S WEBSITE AT WWW.LLGROOVE.COM. THE DEFINITIVE PROXY STATEMENT

AND ACCOMPANYING PROXY CARD WILL BE FURNISHED TO SOME OR ALL OF THE

COMPANY’S STOCKHOLDERS. STOCKHOLDERS MAY ALSO DIRECT A REQUEST TO

F9’S PROXY SOLICITOR, CAMPAIGN MANAGEMENT, 15 WEST 38TH STREET,

SUITE #747, NEW YORK, NY 10018 (STOCKHOLDERS CAN E-MAIL

INFO@CAMPAIGNMANAGEMENT.COM OR CALL TOLL-FREE: (855) 264-1527.

Information about the Participants and a description of their

direct or indirect interests by security holdings or otherwise can

be found in the Definitive Proxy Statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240630079304/en/

INVESTOR AND MEDIA CONTACTS

Investors: Michael Fein Campaign Management (212) 632-8422

michael.fein@campaign-mgmt.com

Media: Jonathan Gasthalter/Nathaniel Garnick Gasthalter &

Co. (212) 257-4170 F9Investments@gasthalter.com

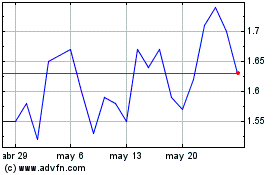

LL Flooring (NYSE:LL)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

LL Flooring (NYSE:LL)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024