0000062234FALSE00000622342023-08-022023-08-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

| | | | | | | | | | | |

| Date of Report | | |

| (Date of earliest

event reported): | November 1, 2023 | |

(Exact name of registrant as

specified in its charter)

| | | | | | | | | | | | | | |

| Wisconsin | | 1-12604 | | 39-1139844 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

100 East Wisconsin Avenue, Suite 1900, Milwaukee, Wisconsin 53202-4125

(Address of principal executive offices, including zip code)

(414) 905-1000

(Registrant’s telephone number, including area code)

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17-CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17-CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $1.00 par value | MCS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02.Results of Operations and Financial Condition.

On November 1, 2023, The Marcus Corporation issued a press release announcing its financial results for its third quarter ended September 28, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01.Financial Statements and Exhibits.

(a)Not applicable.

(b)Not applicable.

(c)Not applicable.

(d)Exhibits. The following exhibit is being furnished herewith:

| | | | | |

Exhibit Number | |

| |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| THE MARCUS CORPORATION |

| | |

| | |

| Date: November 1, 2023 | By: | /s/ Chad M. Paris |

| | Chad M. Paris |

| | Chief Financial Officer and Treasurer |

THE MARCUS CORPORATION REPORTS THIRD QUARTER FISCAL 2023 RESULTSBlockbuster Movie Slate at Marcus Theatres and Solid Seasonal Demand at Marcus Hotels & Resorts Drove Strong Results

Milwaukee, November 1, 2023 … The Marcus Corporation (NYSE: MCS) today reported results for the third quarter fiscal 2023 ended September 28, 2023.

“It was another strong quarter for The Marcus Corporation, with growth in revenue, operating income, net earnings and Adjusted EBITDA during the third quarter of fiscal 2023,” said Gregory S. Marcus, chairman, president and chief executive officer of The Marcus Corporation. “Marcus Theatres led the way with the box office phenomenon ‘Barbenheimer,’ along with the surprise hit, Sound of Freedom, delivering strong performances and impressive attendance growth at theatres across our circuit. At Marcus Hotels & Resorts, our peak leisure travel season was bolstered by great weather, while group travel continued to show strong demand. We are pleased by the continued performance of both divisions and remain focused on driving operational and financial excellence in all facets of our business.”

Third Quarter Fiscal 2023 Highlights

•Total revenues for the third quarter of fiscal 2023 were $208.8 million, a 13.7% increase from total revenues of $183.7 million for the third quarter of fiscal 2022.

•Operating income was $20.9 million for the third quarter of fiscal 2023, a 133.9% increase from operating income of $8.9 million for the prior year quarter.

•Net earnings was $12.2 million for the third quarter of fiscal 2023, a 272.0% increase from net earnings of $3.3 million for the same period in fiscal 2022.

•Net earnings per diluted common share was $0.32 for the third quarter of fiscal 2023, a 220.0% increase from net earnings per diluted common share of $0.10 for the third quarter of fiscal 2022.

•Adjusted EBITDA was $42.3 million for the third quarter of fiscal 2023, a 51.9% increase from Adjusted EBITDA of $27.9 million for the prior year quarter.

First Three Quarters Fiscal 2023 Highlights

•Total revenues for the first three quarters of fiscal 2023 were $568.0 million, a 10.4% increase from total revenues of $514.4 million for the first three quarters of fiscal 2022.

•Operating income was $32.8 million for the first three quarters of fiscal 2023, a 196.6% increase from operating income of $11.0 million for the first three quarters of fiscal 2022.

•Net earnings was $16.2 million for the first three quarters of fiscal 2023, compared to net loss of $2.7 million for the same period in fiscal 2022.

•Net earnings per diluted common share was $0.46 for the first three quarters of fiscal 2023, compared to net loss per diluted common share of $0.09 for the first three quarters of fiscal 2022.

•Adjusted EBITDA was $90.5 million for the first three quarters of fiscal 2023, a 32.1% increase from Adjusted EBITDA of $68.5 million for the first three quarters of fiscal 2022.

Marcus Theatres®

Revenue, operating income and Adjusted EBITDA for Marcus Theatres improved significantly in the third quarter and first three quarters of fiscal 2023 compared to the same periods in fiscal 2022.

For the third quarter of fiscal 2023, the division reported total revenues of $126.6 million, a 25.0% increase compared to the same period last year, with comparable same store admission revenues increasing 29.8% compared to the third quarter of fiscal 2022. Operating income of $11.4 million in the third quarter of fiscal 2023 improved from an operating loss of $0.7 million in the third quarter of fiscal 2022 thanks to strong revenue growth and improved labor productivity. The division reported Adjusted EBITDA of $26.7 million in the third quarter of fiscal 2023, an increase of 114.3% compared to the third quarter of fiscal 2022.

Marcus Theatres attendance grew 15.6% at comparable same store theatres during the third quarter of fiscal 2023 compared to the same period last year, on a strong performance from blockbuster films. Average ticket price and average concession revenues continued to be positively impacted by the new Value Tuesday program, with average ticket price up 12.8% and average concession revenues up 6.5% during the third quarter of fiscal 2023 compared to the same period last year.

“Overall attendance in the third quarter grew significantly thanks to the strong performance of a variety of exciting films like Barbie and Oppenheimer,” said Mark A. Gramz, president of Marcus Theatres. “Moviegoers also came to enjoy films that were more under the radar, like Sound of Freedom, which played very well in our markets. The lesson continues to be that when there are great films to be seen – blockbuster, mid-sized or alternative content - moviegoers of all ages want to experience them on the big screen.”

Marcus Theatres’ top five highest-performing films in the third quarter of fiscal 2023 were Barbie, Oppenheimer, Sound of Freedom, Indiana Jones and the Dial of Destiny and Mission: Impossible – Dead Reckoning Part One. The fourth quarter of fiscal 2023 is already off to a strong start with Taylor Swift: The Eras Tour producing the highest box office concert film of all time in North America. Films such as The Exorcist: Believer, PAW Patrol: The Mighty Movie, Saw X, The Creator and Five Nights at Freddy’s are also performing well during the first few weeks of the fourth quarter of fiscal 2023.

While film schedule changes may occur, there are several new films planned to be released during the remainder of fiscal 2023 that have the potential to perform very well, including: The Marvels, The Holdovers, Trolls Band Together, Hunger Games: The Ballad of Songbirds and Snakes, Wish, Napoleon, Renaissance: A Film by Beyoncé, Wonka, Aquaman and the Lost Kingdom, and The Color Purple.

Marcus® Hotels & Resorts

For the third quarter of fiscal 2023, Marcus Hotels & Resorts comparable hotels revenues before cost reimbursements increased 4.1% from the third quarter of fiscal 2022 (which excludes the impact from the sale of The Skirvin Hilton). For the first three quarters of fiscal 2023, comparable hotels revenues before cost reimbursements increased 7.0%.

Revenue per available room, or RevPAR, increased at six of seven comparable company-owned hotels during the third quarter of fiscal 2023 compared to the third quarter of fiscal 2022. As a result, the division outperformed the industry and its competitive sets during the third quarter of fiscal 2023 by 2.3 percentage points and 0.8 percentage points, respectively.

"The third quarter is typically our strongest given the peak summer leisure travel season, and this year was no different," said Michael R. Evans, president of Marcus Hotels & Resorts. "Group demand continues to grow and we are capitalizing on our newly renovated meeting spaces with event bookings. Our strong commitment to

operational excellence and exceptional service, combined with our continued investment in our award-winning properties, ideally positions our hotels and resorts to stand out within the markets where they compete.”

Group booking pace for fiscal 2023 and fiscal 2024 are running ahead of comparable pace during the same period of fiscal 2022. Banquet and catering booking pace for fiscal 2023 and 2024 are also ahead compared to the same period last year.

In October, four Marcus Hotels & Resorts properties earned high honors in Condé Nast Traveler’s Readers’ Choice Awards. The Pfister Hotel and Saint Kate – The Arts Hotel, both in Milwaukee, were named the #2 and #4 in Top Hotels in the Midwest. The Kimpton Hotel Monaco Pittsburgh was recognized as the #9 Top Hotel in the Mid-Atlantic and The Garland in North Hollywood, California was ranked the #16 Top Hotel in Los Angeles. The Condé Nast Traveler Readers’ Choice Awards are the longest-running and most prestigious recognition of excellence in the travel industry and are commonly known as “the best of the best of travel.”

Grand Geneva Resort & Spa in Lake Geneva, Wisconsin, recently announced the continuation of its multi-phased renovation at the iconic resort. With newly redesigned guest rooms and suites, updates to the resorts lobby and lobby lounge, and the addition of a new outdoor dining venue complete, the Grand Geneva is now beginning renovations of its 62,000 square foot meeting and event space. These renovations are expected to be complete by spring 2024. In addition, the Timber Ridge Lodge & Waterpark, located on the same resort campus as the Grand Geneva, will be unveiling new experiences in November 2023 at its popular Moose Mountain Falls indoor waterpark ahead of the holiday travel season.

Balance Sheet and Liquidity

At the end of the third quarter of fiscal 2023, the company had $256.7 million in cash and revolving credit availability.

Subsequent to the end of the third quarter, on October 16, 2023, The Marcus Corporation entered into a credit agreement amendment to provide for a new $225 million five-year revolving credit facility that matures in October 2028. This replaces the previous credit facility that was set to mature in January 2025. Commenting on the new credit agreement, Chad M. Paris, chief financial officer and treasurer, said: “The successful closing of this facility demonstrates our continued proactive approach to managing our balance sheet. Maintaining a strong balance sheet has been a hallmark of The Marcus Corporation for 88 years. Our new credit facility ensures we have significant liquidity and financial flexibility to invest in our long-term future growth. The continued support from our long-term relationships within our lending group is greatly appreciated.”

Diluted weighted average shares outstanding and diluted net earnings per common share include the dilutive effect of conversion of the Company’s convertible notes to the extent conversion is dilutive in each period. During the third quarter of fiscal 2023 and 2022, diluted weighted average shares outstanding includes 9.2 million and 9.1 million shares, respectively, from the dilutive effect of the convertible notes. During the first three quarters of fiscal 2023, diluted weighted average shares outstanding includes 9.2 million shares from the dilutive effect of the convertible notes, which were excluded from diluted weighted average shares outstanding during the first three quarters of fiscal 2022 as the convertible notes were antidilutive. Diluted weighted average shares outstanding does not include the benefit from the capped call transactions the Company entered into in connection with the issuance of the convertible notes, which mitigate the dilutive effect of the convertible notes by approximately 2.7 million and 2.6 million shares during the third quarter of fiscal 2023 and 2022, respectively, when settled at the maturity date of the convertible notes. Upon conversion, the convertible notes may be settled, at the Company’s election, in cash, shares of common stock or a combination thereof. To the extent the Company settles the convertible notes in cash, there will be no incremental dilution from the settlement of the convertible notes.

Conference Call and Webcast

The Marcus Corporation management will hold a conference call today, Wednesday, November 1, 2023, at 10:00 a.m. Central/11:00 a.m. Eastern time. Interested parties may listen to the call live on the internet through the investor relations section of the company's website: www.marcuscorp.com, or by dialing 1-646-904-5544 and entering the passcode 589766. Listeners should dial in to the call at least 5-10 minutes prior to the start of

the call or should go to the website at least 15 minutes prior to the call to download and install any necessary audio software.

A telephone replay of the conference call will be available through Wednesday, November 8, 2023, by dialing 1-866-813-9403 and entering passcode 473940. The webcast will be archived on the company’s website until its next earnings release.

For additional information, contact:

Chad Paris

(414) 905-1036

investors@marcuscorp.com

Non-GAAP Financial Measure

Adjusted EBITDA has been presented in this press release as a supplemental measure of financial performance that is not required by, or presented in accordance with, GAAP. The company defines Adjusted EBITDA as net earnings (loss) attributable to The Marcus Corporation before investment income or loss, interest expense, other expense, gain or loss on disposition of property, equipment and other assets, equity earnings or losses from unconsolidated joint ventures, net earnings or losses attributable to noncontrolling interests, income taxes, depreciation and amortization and non-cash share-based compensation expense, adjusted to eliminate the impact of certain items that the company does not consider indicative of its core operating performance. A reconciliation of this measure to the equivalent measure under GAAP, along with reconciliations of this measure for each of our operating segments, are set forth in the attached table.

Adjusted EBITDA is a key measure used by management and the company’s board of directors to assess the company’s financial performance and enterprise value. The company believes that Adjusted EBITDA is a useful measure, as it eliminates certain expenses and gains that are not indicative of the company’s core operating performance and facilitates a comparison of the company’s core operating performance on a consistent basis from period to period. The company also uses Adjusted EBITDA as a basis to determine certain annual cash bonuses and long-term incentive awards, to supplement GAAP measures of performance to evaluate the effectiveness of its business strategies, to make budgeting decisions, and to compare its performance against that of other peer companies using similar measures. Adjusted EBITDA is also used by analysts, investors and other interested parties as a performance measure to evaluate industry competitors.

Adjusted EBITDA is a non-GAAP measure of the company’s financial performance and should not be considered as an alternative to net earnings (loss) as a measure of financial performance, or any other performance measure derived in accordance with GAAP and it should not be construed as an inference that the company’s future results will be unaffected by unusual or non-recurring items. Additionally, Adjusted EBITDA is not intended to be a measure of liquidity or free cash flow for management’s discretionary use. In addition, this non-GAAP measure excludes certain non-recurring and other charges and has its limitations as an analytical tool. You should not consider Adjusted EBITDA in isolation or as a substitute for analysis of the company’s results as reported under GAAP. In evaluating Adjusted EBITDA, you should be aware that in the future the company will incur expenses that are the same as or similar to some of the items eliminated in the adjustments made to determine Adjusted EBITDA, such as acquisition expenses, preopening expenses, accelerated depreciation, impairment charges and other adjustments. The company’s presentation of Adjusted EBITDA should not be construed to imply that the company’s future results will be unaffected by any such adjustments. Definitions and calculations of Adjusted EBITDA differ among companies in our industries, and therefore Adjusted EBITDA disclosed by the company may not be comparable to the measures disclosed by other companies.

About The Marcus Corporation

Headquartered in Milwaukee, The Marcus Corporation is a leader in the lodging and entertainment industries, with significant company-owned real estate assets. The Marcus Corporation’s theatre division, Marcus Theatres®, is the fourth largest theatre circuit in the U.S. and currently owns or operates 993 screens at 79 locations in 17 states under the Marcus Theatres, Movie Tavern® by Marcus and BistroPlex® brands. The company’s lodging division, Marcus® Hotels & Resorts, owns and/or manages 15 hotels, resorts and other properties in eight states. For more information, please visit the company’s website at www.marcuscorp.com.

Certain matters discussed in this press release are “forward-looking statements” intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements may generally be identified as such because the context of such statements include words such as we “believe,” “anticipate,” “expect” or words of similar import. Similarly, statements that describe our future plans, objectives or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties which may cause results to differ materially from those expected, including, but not limited to, the following: (1) the adverse effects the COVID-19 pandemic, or future pandemics, may have on our theatre and hotels and resorts businesses, results of operations, liquidity, cash flows, financial condition, access to credit markets and ability to service our existing and future indebtedness; (2) the availability, in terms of both quantity and audience appeal, of motion pictures for our theatre division (including disruptions in the production of films due to events such as a strike by actors, writers or directors); (3) the effects of theatre industry dynamics such as the maintenance of a suitable window between the date such motion pictures are released in theatres and the date they are released to other distribution channels; (4) the effects of adverse economic conditions in our markets; (5) the effects of adverse economic conditions on our ability to obtain financing on reasonable and acceptable terms, if at all; (6) the effects on our occupancy and room rates caused by the relative industry supply of available rooms at comparable lodging facilities in our markets; (7) the effects of competitive conditions in our markets; (8) our ability to achieve expected benefits and performance from our strategic initiatives and acquisitions; (9) the effects of increasing depreciation expenses, reduced operating profits during major property renovations, impairment losses, and preopening and start-up costs due to the capital intensive nature of our business; (10) the effects of changes in the availability of and cost of labor and other supplies essential to the operation of our business; (11) the effects of weather conditions, particularly during the winter in the Midwest and in our other markets; (12) our ability to identify properties to acquire, develop and/or manage and the continuing availability of funds for such development; (13) the adverse impact on business and consumer spending on travel, leisure and entertainment resulting from terrorist attacks in the United States, other incidents of violence in public venues such as hotels and movie theatres or epidemics; and (14) a disruption in our business and reputational and economic risks associated with civil securities claims brought by shareholders. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. Our forward-looking statements are based upon our assumptions, which are based upon currently available information. Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are made only as of the date of this press release and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

THE MARCUS CORPORATION

Consolidated Statements of Earnings (Loss)

(Unaudited)

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| 13 Weeks Ended | | 39 Weeks Ended |

| September 28,

2023 | | September 29,

2022 | | September 28,

2023 | | September 29,

2022 |

| Revenues: | | | | | | | |

| Theatre admissions | $ | 63,652 | | | $ | 49,424 | | | $ | 180,274 | | | $ | 150,928 | |

| Rooms | 36,456 | | | 36,924 | | | 82,959 | | | 83,219 | |

| Theatre concessions | 54,551 | | | 44,715 | | | 156,633 | | | 138,326 | |

| Food and beverage | 20,214 | | | 21,444 | | | 53,980 | | | 54,969 | |

| Other revenues | 23,908 | | | 22,174 | | | 65,024 | | | 62,173 | |

| 198,781 | | | 174,681 | | | 538,870 | | | 489,615 | |

| Cost reimbursements | 9,985 | | | 8,969 | | | 29,179 | | | 24,832 | |

| Total revenues | 208,766 | | | 183,650 | | | 568,049 | | | 514,447 | |

| | | | | | | |

| Costs and expenses: | | | | | | | |

| Theatre operations | 62,742 | | | 54,756 | | | 180,716 | | | 160,921 | |

| Rooms | 11,594 | | | 11,856 | | | 31,232 | | | 30,530 | |

| Theatre concessions | 20,738 | | | 17,868 | | | 59,069 | | | 56,054 | |

| Food and beverage | 15,266 | | | 16,150 | | | 43,285 | | | 43,325 | |

| Advertising and marketing | 6,025 | | | 6,544 | | | 16,703 | | | 17,003 | |

| Administrative | 19,854 | | | 19,995 | | | 59,171 | | | 56,703 | |

| Depreciation and amortization | 19,158 | | | 16,452 | | | 51,028 | | | 50,435 | |

| Rent | 6,592 | | | 6,672 | | | 19,679 | | | 19,500 | |

| Property taxes | 4,663 | | | 4,911 | | | 13,952 | | | 14,636 | |

| Other operating expenses | 10,532 | | | 10,528 | | | 30,596 | | | 29,463 | |

| Impairment charges | 684 | | | — | | | 684 | | | — | |

| Reimbursed costs | 9,985 | | | 8,969 | | | 29,179 | | | 24,832 | |

| Total costs and expenses | 187,833 | | | 174,701 | | | 535,294 | | | 503,402 | |

| | | | | | | |

| Operating income | 20,933 | | | 8,949 | | | 32,755 | | | 11,045 | |

| | | | | | | |

| Other income (expense): | | | | | | | |

| Investment income (loss) | 445 | | | (35) | | | 1,064 | | | (762) | |

| Interest expense | (2,869) | | | (3,688) | | | (8,970) | | | (11,843) | |

| Other income (expense) | (477) | | | (472) | | | (1,355) | | | (1,278) | |

| Equity earnings (losses) from unconsolidated joint ventures | 75 | | | 30 | | | (127) | | | (104) | |

| (2,826) | | | (4,165) | | | (9,388) | | | (13,987) | |

| | | | | | | |

| Earnings (loss) before income taxes | 18,107 | | | 4,784 | | | 23,367 | | | (2,942) | |

| Income tax expense (benefit) | 5,873 | | | 1,495 | | | 7,133 | | | (289) | |

| Net earnings (loss) | 12,234 | | | 3,289 | | | 16,234 | | | (2,653) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net earnings (loss) per common share - diluted | $ | 0.32 | | | $ | 0.10 | | | $ | 0.46 | | | $ | (0.09) | |

| | | | | | | |

| | | | | | | |

| Weighted average shares outstanding - diluted | 40,974 | | | 40,702 | | | 40,935 | | | 31,481 | |

THE MARCUS CORPORATION

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands)

| | | | | | | | | | | |

| September 28,

2023 | | December 29,

2022 |

| | | |

| Assets: | | | |

| | | |

| Cash and cash equivalents | $ | 36,036 | | | $ | 21,704 | |

| Restricted cash | 4,046 | | | 2,802 | |

| Accounts receivable | 21,426 | | | 21,455 | |

| Assets held for sale | 1,831 | | | 460 | |

| Other current assets | 22,793 | | | 17,474 | |

| Property and equipment, net | 687,384 | | | 715,765 | |

| Operating lease right-of-use assets | 183,674 | | | 194,965 | |

| Other assets | 96,743 | | | 89,973 | |

| | | |

| Total Assets | $ | 1,053,933 | | | $ | 1,064,598 | |

| | | |

| Liabilities and Shareholders' Equity: | | | |

| | | |

| Accounts payable | $ | 29,360 | | | $ | 32,187 | |

| Taxes other than income taxes | 19,009 | | | 17,948 | |

| Other current liabilities | 70,346 | | | 78,787 | |

| Current portion of finance lease obligations | 2,561 | | | 2,488 | |

| Current portion of operating lease obligations | 15,054 | | | 14,553 | |

| Current maturities of long-term debt | 10,411 | | | 10,432 | |

| Finance lease obligations | 13,354 | | | 15,014 | |

| Operating lease obligations | 182,826 | | | 195,281 | |

| Long-term debt | 159,681 | | | 170,005 | |

| Deferred income taxes | 33,093 | | | 26,567 | |

| Other long-term obligations | 45,340 | | | 44,415 | |

| Equity | 472,898 | | | 456,921 | |

| | | |

| Total Liabilities and Shareholders' Equity | $ | 1,053,933 | | | $ | 1,064,598 | |

THE MARCUS CORPORATION

Business Segment Information

(Unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Theatres | | Hotels/

Resorts | | Corporate

Items | | Total |

| 13 Weeks Ended September 28, 2023 | | | | | | | |

| Revenues | $ | 126,585 | | | $ | 82,098 | | | $ | 83 | | | $ | 208,766 | |

| Operating income (loss) | 11,377 | | | 14,377 | | | (4,821) | | | 20,933 | |

| Depreciation and amortization | 14,258 | | | 4,817 | | | 83 | | | 19,158 | |

| Adjusted EBITDA | 26,694 | | | 19,447 | | | (3,811) | | | 42,330 | |

| | | | | | | |

| 13 Weeks Ended September 29, 2022 | | | | | | | |

| Revenues | $ | 101,258 | | | $ | 82,300 | | | $ | 92 | | | $ | 183,650 | |

| Operating income (loss) | (723) | | | 14,120 | | | (4,448) | | | 8,949 | |

| Depreciation and amortization | 11,632 | | | 4,733 | | | 87 | | | 16,452 | |

| Adjusted EBITDA | 12,454 | | | 19,065 | | | (3,654) | | | 27,865 | |

| | | | | | | |

| 39 Weeks Ended September 28, 2023 | | | | | | | |

| Revenues | $ | 359,811 | | | $ | 207,975 | | | $ | 263 | | | $ | 568,049 | |

| Operating income (loss) | 32,707 | | | 15,450 | | | (15,402) | | | 32,755 | |

| Depreciation and amortization | 37,063 | | | 13,706 | | | 259 | | | 51,028 | |

| Adjusted EBITDA | 71,749 | | | 30,372 | | | (11,635) | | | 90,486 | |

| | | | | | | |

| 39 Weeks Ended September 29, 2022 | | | | | | | |

| Revenues | $ | 310,186 | | | $ | 203,958 | | | $ | 303 | | | $ | 514,447 | |

| Operating income (loss) | 7,687 | | | 17,963 | | | (14,605) | | | 11,045 | |

| Depreciation and amortization | 35,686 | | | 14,484 | | | 265 | | | 50,435 | |

| Adjusted EBITDA | 45,986 | | | 33,282 | | | (10,752) | | | 68,516 | |

Corporate items include amounts not allocable to the business segments. Corporate revenues consist principally of rent and the corporate operating loss includes general corporate expenses. Corporate information technology costs and accounting shared services costs are allocated to the business segments based upon several factors, including actual usage and segment revenues.

Supplemental Data

(Unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 13 Weeks Ended | | 39 Weeks Ended |

| Consolidated | | September 28,

2023 | | September 29,

2022 | | September 28,

2023 | | September 29,

2022 |

| Net cash flow provided by (used in) operating activities | | $ | 21,316 | | | $ | 5,134 | | | $ | 68,642 | | | $ | 60,362 | |

| Net cash flow provided by (used in) investing activities | | (10,240) | | | (11,388) | | | (26,882) | | | (22,863) | |

| Net cash flow provided by (used in) financing activities | | (19,848) | | | (40,369) | | | (26,184) | | | (44,758) | |

| Capital expenditures | | (9,940) | | | (11,142) | | | (25,836) | | | (27,483) | |

THE MARCUS CORPORATION

Reconciliation of Net earnings (loss) to Adjusted EBITDA

(Unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| 13 Weeks Ended | | 39 Weeks Ended |

| September 28,

2023 | | September 29,

2022 | | September 28,

2023 | | September 29,

2022 |

| Net earnings (loss) | $ | 12,234 | | | $ | 3,289 | | | $ | 16,234 | | | $ | (2,653) | |

| Add (deduct): | | | | | | | |

| Investment (income) loss | (445) | | | 35 | | | (1,064) | | | 762 | |

| Interest expense | 2,869 | | | 3,688 | | | 8,970 | | | 11,843 | |

| Other expense (income) | 477 | | | 384 | | | 1,355 | | | 1,545 | |

| (Gain) loss on disposition of property, equipment and other assets | 242 | | | 88 | | | 1,019 | | | (267) | |

| Equity (earnings) losses from unconsolidated joint ventures | (75) | | | (30) | | | 127 | | | 104 | |

| | | | | | | |

| Income tax expense (benefit) | 5,873 | | | 1,495 | | | 7,133 | | | (289) | |

| Depreciation and amortization | 19,158 | | | 16,452 | | | 51,028 | | | 50,435 | |

| Share-based compensation (a) | 1,313 | | | 2,464 | | | 5,000 | | | 7,036 | |

| Impairment charges (b) | 684 | | | — | | | 684 | | | — | |

| | | | | | | |

| Adjusted EBITDA | $ | 42,330 | | | $ | 27,865 | | | $ | 90,486 | | | $ | 68,516 | |

Reconciliation of Operating income (loss) to Adjusted EBITDA by Reportable Segment

(Unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 13 Weeks Ended September 28, 2023 | | 39 Weeks Ended September 28, 2023 |

| Theatres | | Hotels & Resorts | | Corp. Items | | Total | | Theatres | | Hotels & Resorts | | Corp. Items | | Total |

| Operating income (loss) | $ | 11,377 | | | $ | 14,377 | | | $ | (4,821) | | | $ | 20,933 | | | $ | 32,707 | | | $ | 15,450 | | | $ | (15,402) | | | $ | 32,755 | |

| Depreciation and amortization | 14,258 | | | 4,817 | | | 83 | | | 19,158 | | | 37,063 | | | 13,706 | | | 259 | | | 51,028 | |

| Loss (gain) on disposition of property, equipment and other assets | 233 | | | 9 | | | — | | | 242 | | | 537 | | | 482 | | | — | | | 1,019 | |

| Share-based compensation (a) | 142 | | | 244 | | | 927 | | | 1,313 | | | 758 | | | 734 | | | 3,508 | | | 5,000 | |

| Impairment charges (b) | 684 | | | — | | | — | | | 684 | | | 684 | | | — | | | — | | | 684 | |

| Adjusted EBITDA | $ | 26,694 | | | $ | 19,447 | | | $ | (3,811) | | | $ | 42,330 | | | $ | 71,749 | | | $ | 30,372 | | | $ | (11,635) | | | $ | 90,486 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 13 Weeks Ended September 29, 2022 | | 39 Weeks Ended September 29, 2022 |

| Theatres | | Hotels & Resorts | | Corp. Items | | Total | | Theatres | | Hotels & Resorts | | Corp. Items | | Total |

| Operating income (loss) | $ | (723) | | | $ | 14,120 | | | $ | (4,448) | | | $ | 8,949 | | | $ | 7,687 | | | $ | 17,963 | | | $ | (14,605) | | | $ | 11,045 | |

| Depreciation and amortization | 11,632 | | | 4,733 | | | 87 | | | 16,452 | | | 35,686 | | | 14,484 | | | 265 | | | 50,435 | |

| Share-based compensation (a) | 1,545 | | | 212 | | | 707 | | | 2,464 | | | 2,613 | | | 835 | | | 3,588 | | | 7,036 | |

| Adjusted EBITDA | $ | 12,454 | | | $ | 19,065 | | | $ | (3,654) | | | $ | 27,865 | | | $ | 45,986 | | | $ | 33,282 | | | $ | (10,752) | | | $ | 68,516 | |

(a)Non-cash expense related to share-based compensation programs.

(b)Non-cash impairment charges related to one permanently closed theatre in fiscal 2023.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

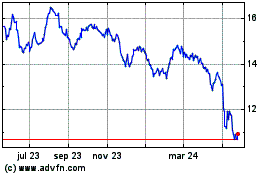

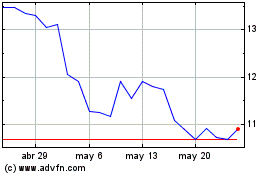

Marcus (NYSE:MCS)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Marcus (NYSE:MCS)

Gráfica de Acción Histórica

De May 2023 a May 2024