Mercer Wise 401(k) and Mercer Wise Pooled Employer Plan Surpass $3.5 Billion in US Plan Assets

22 Agosto 2024 - 11:10AM

Business Wire

Mercer, a business of Marsh McLennan (NYSE: MMC) and a global

leader in helping clients realize their investment objectives,

shape the future of work, and enhance health and retirement

outcomes for their people, today announced that its Mercer Wise

401(k) and Mercer Wise Pooled Employer Plan (PEP) have reached a

combined USD $3.6 billion in US plan assets under management

(AUM).1

Mercer Wise 401(k) and Mercer Wise PEP, launched in 2017 and

2021 respectively, are outsourced retirement plan solutions that

seek to improve participant outcomes while reducing plan sponsors’

administrative duties and fiduciary risk.

The Mercer Wise platform has 80 US-based employers1, spanning a

range of industries from technology and manufacturing to healthcare

and hospitality, with employee bases of 350 to over 5,000.

Together, the plans provide 401(k) benefits to more than 70,000

employees in the US.1

Mercer’s research highlights that long-term financial security,

focused on the ability to retire, remains one of American

employees’ top concerns, and retirement benefits are among the top

three reasons employees stay with their organization.

“Pooled employer plans provide a real opportunity to build

retirement security for millions of Americans that have

historically not had access to an employer-sponsored plan,” said

Holly Verdeyen, Mercer’s US Defined Contribution Leader.

“Through the Mercer Wise platform, we are helping employers

offer competitive financial wellness benefits and improve

retirement plan coverage for their employees, all while potentially

reducing plan costs and participant fees that allow employees to

save more over time,” Ms. Verdeyen said.

The Employee Benefits Research Institute’s Retirement Security

Projection Model estimates that the retirement savings shortfall

for US households is $3.27 trillion in 2022 dollars. As people live

longer than prior generations, interventions are needed to help

Americans bridge the retirement savings gap. Employers can play an

important role in helping Americans plan for retirement by

providing access to quality financial savings and insurance

vehicles.

Empower, which serves as the recordkeeper for the Mercer Wise

401(k) and Mercer Wise PEP plans, recently conducted a study, “Time

is Money,” which found that half of Americans think they are

running out of time to save for retirement. Additionally, only 22%

of Americans are keeping track of their ability to retire and

nearly half (48%) worry about how they’ll pay for expenses once

they are no longer working.

“People who have access to workplace plans tend to start

investing for retirement earlier and save more. This puts them in a

better position to replace their pre-retirement income,” said

Joseph Smolen, Empower’s Executive Vice President for Core and

Institutional Markets. “With Americans living longer than ever

before, employer-sponsored retirement plans are a critical

component of helping millions of Americans prepare for

retirement.”

For more information on the Mercer Wise offerings, click

here.

About Mercer

Mercer, a business of Marsh McLennan (NYSE: MMC), is a global

leader in helping clients realize their investment objectives,

shape the future of work, and enhance health and retirement

outcomes for their people. Marsh McLennan is a global leader in

risk, strategy, and people, advising clients in 130 countries

across four businesses: Marsh, Guy Carpenter, Mercer and Oliver

Wyman. With annual revenue of $23 billion and more than 85,000

colleagues, Marsh McLennan helps build the confidence to thrive

through the power of perspective. For more information, visit

mercer.com, or follow on LinkedIn and X.

__________________________ 1 As of June 30, 2024

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240822502077/en/

Media contact: Salina Pellios Mercer +1 332 284 4154

Salina.pellios@mmc.com

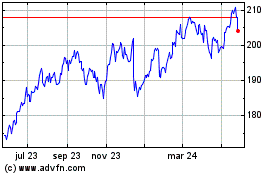

Marsh and McLennan Compa... (NYSE:MMC)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

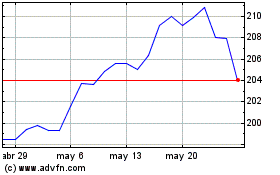

Marsh and McLennan Compa... (NYSE:MMC)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024