Marsh McLennan Announces Pricing of $7.25 Billion Senior Notes Offering

30 Octubre 2024 - 4:30PM

Business Wire

Marsh McLennan (NYSE: MMC) (the “Company”) announced today that

it has priced $950 million aggregate principal amount of its 4.550%

Senior Notes due 2027, $1,000 million aggregate principal amount of

its 4.650% Senior Notes due 2030, $1,000 million aggregate

principal amount of its 4.850% Senior Notes due 2031, $2,000

million aggregate principal amount of its 5.000% Senior Notes due

2035, $500 million aggregate principal amount of its 5.350% Senior

Notes due 2044, $1,500 million aggregate principal amount of its

5.400% Senior Notes due 2055 and $300 million aggregate principal

amount of its Floating Rate Senior Notes due 2027 (collectively,

the “Notes”). The Company intends to use the net proceeds from the

Notes offering to fund, in part, the pending acquisition (the

“Transaction”) of the parent company of McGriff Insurance Services,

LLC, an affiliate of TIH Insurance Holdings, including the payment

of related fees and expenses, as well as for general corporate

purposes. The Transaction is targeted to close by year-end, subject

to regulatory approval and other standard closing conditions. The

closing of the Notes offering is not conditioned upon the closing

of the Transaction and is expected to occur on November 8, 2024,

subject to the satisfaction of certain customary closing

conditions.

All series of Notes (other than the 5.400% Senior Notes due 2055

(the “2055 Notes”)) are subject to a special mandatory redemption,

at a redemption price equal to 101% of the aggregate principal

amount thereof plus accrued and unpaid interest to, but excluding,

the special mandatory redemption date, under certain circumstances

if the Transaction is terminated or does not close by an agreed

upon date. If the Transaction is not completed, the Company intends

to use the net proceeds of the 2055 Notes for general corporate

purposes.

Citigroup Global Markets Inc., BofA Securities, Inc., Deutsche

Bank Securities Inc., HSBC Securities (USA) Inc., J.P. Morgan

Securities LLC, Wells Fargo Securities, LLC, Barclays Capital Inc.,

Goldman Sachs & Co. LLC, Morgan Stanley & Co. LLC, RBC

Capital Markets, LLC, Scotia Capital (USA) Inc., TD Securities

(USA) LLC and U.S. Bancorp Investments, Inc. are acting as joint

book-running managers for the Notes offering. Academy Securities,

Inc., ANZ Securities, Inc., BNP Paribas Securities Corp., BNY

Mellon Capital Markets, LLC, CIBC World Markets, Corp., ING

Financial Markets LLC, MUFG Securities Americas Inc., PNC Capital

Markets LLC, Siebert Williams Shank & Co., LLC and Standard

Chartered Bank are acting as co-managers for the Notes

offering.

An effective shelf registration statement related to the Notes

has previously been filed with the Securities and Exchange

Commission (the “SEC”). The offering and sale of the Notes are

being made by means of a prospectus supplement and an accompanying

base prospectus related to the offering. Before you invest, you

should read the prospectus supplement and the base prospectus for

more complete information about the issuer and this offering.

You may obtain these documents for free by visiting the SEC

website at www.sec.gov. Alternatively, copies may be obtained from

any of the underwriters at (i) Citigroup Global Markets Inc., c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717 or by telephone at 1-800-831-9146, (ii) BofA Securities,

Inc., North Tryon Street, Charlotte, NC 28255 or Attn: Prospectus

Department Email: dg.prospectus_requests@bofa.com or by telephone

at 1-800-294-1322, (iii) Deutsche Bank Securities Inc., Attn.:

Prospectus Group 1 Columbus Circle, New York, NY 10019 or Email:

Prospectus.Ops@db.com or Tel: 1-800-503-4611, (iv) HSBC Securities

(USA) Inc., Attn: Transaction Management Group, 66 Hudson

Boulevard, New York, NY 10001 or email: tmg.americas@us.hsbc.com,

(v) J.P. Morgan Securities LLC, 383 Madison Avenue, New York, NY

10179, Attn: Investment Grade Syndicate Desk or by calling collect

at 1-212-834-4533 and (vi) Wells Fargo Securities, LLC, 608 2nd

Avenue South, Suite 1000, Minneapolis, MN 55402 Attn: WFS Customer

Service, Telephone: 1-800-645-3751, Email:

wfscustomerservice@wellsfargo.com.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy any securities, nor does it

constitute an offer, solicitation or sale in any jurisdiction in

which such offer, solicitation or sale is unlawful.

About Marsh McLennan

Marsh McLennan (NYSE: MMC) is a global leader in risk, strategy

and people, advising clients in 130 countries across four

businesses: Marsh, Guy Carpenter, Mercer and Oliver Wyman. With

annual revenue of $23 billion and more than 85,000 colleagues,

Marsh McLennan helps build the confidence to thrive through the

power of perspective.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030621892/en/

Media: Erick Gustafson Marsh McLennan +1 202 263 7788

erick.gustafson@mmc.com

Investor: Jay Gelb Marsh McLennan +1 212 345 1569

mmc.investor.relations@mmc.com

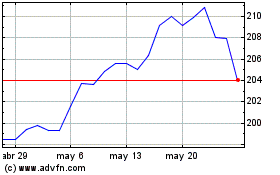

Marsh and McLennan Compa... (NYSE:MMC)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Marsh and McLennan Compa... (NYSE:MMC)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024