OSI Announces Amended Merger Agreement

22 Mayo 2007 - 7:00AM

PR Newswire (US)

Stockholders to Receive Increased Price of $41.15 per Share in Cash

TAMPA, Fla., May 22 /PRNewswire-FirstCall/ -- OSI Restaurant

Partners, Inc. (NYSE:OSI) today announced that it has entered into

an amendment to its previously announced Agreement and Plan of

Merger with Kangaroo Holdings, Inc. and Kangaroo Acquisition, Inc.

that increases the consideration payable to OSI stockholders to

$41.15 per share in cash, without interest, from $40.00 per share

(the "Revised Merger Consideration"). The Revised Merger

Consideration represents a 27% premium over the closing price of a

share of OSI common stock on November 3, 2006, the last trading day

prior to announcement of the merger. Kangaroo Holdings, Inc. is

controlled by an investor group comprised of investment funds

associated with Bain Capital Partners, LLC and investment funds

affiliated with Catterton Management Company, LLC. OSI's founders

and certain members of its management are expected to exchange

shares of OSI's common stock for shares of Kangaroo Holdings, Inc.

in connection with the merger. OSI's Board of Directors, based in

part upon the unanimous recommendation of its Special Committee of

independent directors, has approved and adopted the amended merger

agreement and recommends that stockholders adopt the amended merger

agreement. Wachovia Securities, LLC served as financial advisor to

the Special Committee, and rendered a fairness opinion to the

Special Committee as to the fairness, from a financial point of

view, of the Revised Merger Consideration to OSI's stockholders

(other than OSI's founders and members of management who are

expected to invest in Kangaroo Holdings, Inc.). Chris T. Sullivan,

Chairman of the Board, Robert D. Basham, Vice Chairman of the

Board, and A. William Allen, III, Chief Executive Officer, each of

whom is expected to exchange shares of OSI common stock for shares

of common stock of Kangaroo Holdings, Inc. in connection with the

merger, abstained from the board vote. The amended merger agreement

requires that the amended merger agreement be adopted by the

affirmative vote of the holders of a majority of the outstanding

shares of OSI common stock, as required by Delaware law, and also

adopted by the affirmative vote of the holders, as of the record

date, of a majority of the number of shares of OSI common stock

held by holders other than OSI's founders and the members of OSI

management expected to exchange shares of OSI common stock for

shares of common stock of Kangaroo Holdings, Inc. in connection

with the merger. The Special Committee and OSI have been advised

that Messrs. Sullivan, Basham and Gannon, OSI's founders, have

agreed with Kangaroo Holdings, Inc. that they will receive only $40

per share for their shares. Pursuant to the merger agreement

amendment, OSI has agreed not to pay its regular quarterly cash

dividend prior to the closing of the merger or termination of the

merger agreement. In addition, the parties have agreed not to

terminate the merger agreement under Section 7.1(b) of the merger

agreement prior to the close of business on June 19, 2007. The

special meeting of OSI stockholders, which was previously scheduled

for May 8, 2007 and was postponed to May 22, 2007, will now be held

on Friday, May 25, 2007, at 11:00 a.m., Eastern Daylight Time, at A

La Carte Event Pavilion, 4050-B Dana Shores Drive, Tampa, Florida

33634. However, in order to provide stockholders with additional

time to consider the changes to the merger effectuated by the

merger agreement amendment, including the Revised Merger

Consideration, and to review updated proxy materials, which OSI

expects to send to stockholders promptly, OSI intends to convene

the special meeting on May 25, 2007 for the sole purpose of

adjourning it to Tuesday, June 5, 2007 at 11:00 a.m. Eastern

Daylight Time at A La Carte Pavilion. Stockholders of record as of

March 28, 2007 remain entitled to vote at the special meeting.

Stockholders who have previously submitted their proxy or otherwise

voted, and who do not want to change their vote, need not take any

action. Stockholders with questions about the merger or how to vote

their shares (or how to change a prior vote of their shares) should

call the Company's proxy solicitor, MacKenzie Partners, Inc. at

(800) 322-2885 (toll free) or (212) 929-5500 (collect). About OSI

Restaurant Partners OSI Restaurant Partners, Inc. portfolio of

brands consists of Outback Steakhouse, Carrabba's Italian Grill,

Bonefish Grill, Fleming's Prime Steakhouse & Wine Bar, Roy's,

Lee Roy Selmon's, Blue Coral Seafood & Spirits and Cheeseburger

in Paradise. It has operations in 50 states and 20 countries

internationally. About Bain Capital Bain Capital Partners, LLC

(http://www.baincapital.com/) is a global private investment firm

that manages several pools of capital including private equity,

venture capital, public equity and leveraged debt assets with

approximately $40 billion in assets under management. Since its

inception in 1984, Bain Capital has made private equity investments

and add-on acquisitions in over 230 companies around the world,

including such restaurant and retail concepts as Domino's Pizza,

Dunkin' Donuts and Burger King, and retailers including Toys "R"

Us, AMC Entertainment, Staples and Burlington Coat Factory.

Headquartered in Boston, Bain Capital has offices in New York,

London, Munich, Tokyo, Hong Kong and Shanghai. About Catterton

Management With more than $2 billion under management, Catterton

Management is a leading private equity firm in the U.S. focused

exclusively on the consumer industry. Since its founding in 1990,

Catterton has leveraged its investment capital, strategic and

operating skills, and network of industry contacts to establish one

of the strongest investment track records in the consumer industry.

Catterton invests in all major consumer segments, including Food

and Beverage, Retail and Restaurants, Consumer Products and

Services, and Media and Marketing Services. Catterton has led

investments in companies such as Build-A-Bear Workshop, Cheddar's

Restaurant Holdings Inc., P.F. Chang's China Bistro, Baja Fresh

Mexican Grill, First Watch Restaurants, Frederic Fekkai, Kettle

Foods, Farley's and Sathers Candy Co., and Odwalla, Inc. More

information about the firm can be found at

http://www.cpequity.com/. Additional Information and Where to Find

It In connection with the proposed transaction, OSI has filed a

definitive proxy statement and other materials with the Securities

and Exchange Commission (the "SEC") and expects to file

supplementary proxy materials with the SEC. WE URGE INVESTORS TO

READ THE PROXY STATEMENT, THESE OTHER MATERIALS AND THE

SUPPLEMENTARY MATERIALS CAREFULLY BECAUSE THEY CONTAIN IMPORTANT

INFORMATION ABOUT OSI AND THE PROPOSED TRANSACTION. Investors can

obtain free copies of the definitive proxy statement as well as

other filed documents containing information about OSI at

http://www.sec.gov/, the SEC's free internet site. The

supplementary materials also will be available on the SEC's

internet site when filed. Free copies of OSI's SEC filings are also

available on OSI's internet site at

http://www.osirestaurantpartners.com/. Participants in the

Solicitation OSI and its executive officers and directors may be

deemed, under SEC rules, to be participants in the solicitation of

proxies from OSI's stockholders with respect to the proposed

transaction. Information regarding the identity of potential

participants, and their direct or indirect interests, by

securities, holdings or otherwise, is set forth in the definitive

proxy statement and other materials previously filed with the SEC

in connection with the proposed transaction and also will be

contained in the supplementary materials. DATASOURCE: OSI

Restaurant Partners, Inc. CONTACT: Dirk Montgomery, Chief Financial

Officer, OSI Restaurant Partners, Inc., +1-813-282-1225 Web site:

http://www.osirestaurantpartners.com/ http://www.baincapital.com/

http://www.cpequity.com/

Copyright

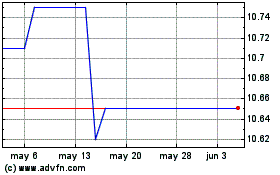

Osiris Acquisition (NYSE:OSI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Osiris Acquisition (NYSE:OSI)

Gráfica de Acción Histórica

De May 2023 a May 2024