PGP Statement on SEC Settlement

16 Junio 2023 - 4:14PM

Pacific Investment Management Company LLC (“PIMCO”), the investment

manager of PIMCO Global StocksPLUS® & Income Fund (NYSE: PGP),

a closed-end fund (“PGP” or the “Fund”), has entered into a

settlement with the U.S. Securities and Exchange Commission (“SEC”)

that relates to PGP.

The settlement, which contains SEC findings that

PIMCO neither admits nor denies, does not affect in any way PIMCO’s

ability to manage PGP or any other client fund or account. The

settlement relates to disclosures concerning paired interest rate

swaps used by PGP, which the SEC alleges became a more significant

source of the Fund’s current distributable income from September 1,

2014 through August 26, 2016. The disclosures in question

subsequently were updated in PGP’s fiscal year-end 2016 annual

shareholder report. PIMCO has agreed to pay the SEC $6.5 million in

monetary penalties to settle the matter. The settlement contains no

findings that PIMCO intended to mislead investors or breach any

law.

Additional Information

The common shares of the Fund trade on the New

York Stock Exchange. As with any stock, the price of the Fund’s

common shares will fluctuate with market conditions and other

factors. If you sell your common shares of the Fund, the price

received may be more or less than your original investment. Shares

of closed-end investment management companies, such as the Fund,

frequently trade at a discount from their net asset value and may

trade at a price that is less than the initial offering price

and/or the net asset value of such shares. Further, if the Fund’s

shares trade at a price that is more than the initial offering

price and/or the net asset value of such shares, including at a

substantial premium and/or for an extended period of time, there is

no assurance that any such premium will be sustained for any period

of time and will not decrease, or that the shares will not trade at

a discount to net asset value thereafter.

The Fund’s daily New York Stock Exchange closing

market prices, net asset values per share, as well as other

information, including updated portfolio statistics and performance

are available at pimco.com/closedendfunds or by calling the Fund’s

shareholder servicing agent at (844) 33-PIMCO. Updated portfolio

holdings information about the Fund will be available approximately

15 calendar days after the Fund’s most recent fiscal quarter end,

and will remain accessible until the Fund files a shareholder

report or a publicly-available Form N-PORT for the period that

includes the date of the information.

The Fund’s shares do not represent a deposit or

obligation of, and are not guaranteed or endorsed by, any bank or

other insured depository institution, and are not insured by the

FDIC, the Federal Reserve Board or any other government agency. You

may lose money by investing in the Fund.

An investor should consider, among other

things, the Fund’s investment objectives, risks, charges and

expenses carefully before investing. The Fund’s annual report

contains (or will contain) this and other information about the

Fund.

About PIMCO

PIMCO was founded in 1971 in Newport Beach, California and is

one of the world’s premier fixed income investment managers. Today

we have offices across the globe and 3,000+ professionals united by

a single purpose: creating opportunities for investors in every

environment. PIMCO is owned by Allianz S.E., a leading global

diversified financial services provider.

Except for the historical information and discussions contained

herein, statements contained in this news release constitute

forward-looking statements. These statements may involve a number

of risks, uncertainties and other factors that could cause actual

results to differ materially, including the performance of

financial markets, the investment performance of PIMCO’s sponsored

investment products and separately managed accounts, general

economic conditions, future acquisitions, competitive conditions

and government regulations, including changes in tax laws. Readers

should carefully consider such factors. Further, such

forward-looking statements speak only on the date at which such

statements are made. PIMCO undertakes no obligation to update any

forward-looking statements to reflect events or circumstances after

the date of such statement.

This material has been distributed for informational purposes

only and should not be considered as investment advice or a

recommendation of any particular security, strategy or investment

product. No part of this material may be reproduced in any form, or

referred to in any other publication, without express written

permission. PIMCO is a trademark of Allianz Asset Management of

America L.P. in the United States and throughout the world. PIMCO

Investments LLC, 1633 Broadway, New York, NY 10019, is a company of

PIMCO. ©2023, PIMCO.

For information on the PIMCO Closed-End Funds:Financial

Advisors: (800) 628-1237Shareholders: (844) 337-4626 or (844)

33-PIMCOPIMCO Media Relations: (212) 597-1054

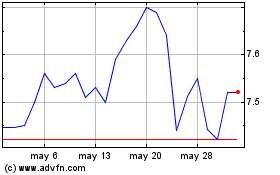

Pimco Global Stocksplus ... (NYSE:PGP)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Pimco Global Stocksplus ... (NYSE:PGP)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024