QIAGEN N.V. (NYSE: QGEN; Frankfurt Prime Standard: QIA) today

announced results for the second quarter and first half of 2024.

Net sales were stable at $496 million in Q2 2024

compared to Q2 2023, while results at constant exchanges rates

(CER) of $502 million rose 1% and were above the outlook for at

least $495 million CER. The adjusted operating income margin rose

about one percentage point to 28.4% from Q2 2023 on efficiency

gains while supporting targeted investments. Adjusted diluted

earnings per share (EPS) were $0.55, and results at CER of $0.55

were above the outlook for at least $0.52 CER.

QIAGEN has updated its FY 2024 outlook based on

the solid core business performance in the first half of the year,

which was about $15 million CER above guidance, as well as the

decision to phase out the NeuMoDx clinical PCR system. As a result,

total net sales are expected to be at least $1.985 billion CER and

includes a $30 million CER adjustment in expected NeuMoDx sales for

2024.

The outlook for adjusted diluted EPS has been

increased to at least $2.16 CER, while the adjusted operating

income margin target is for at least 28.5% compared to 26.9% in

2023.

“Our teams executed well in the second quarter,

showing sequential growth from the first quarter as well as over

the year-ago period as we accelerate our performance during 2024.

We are on track to achieve our updated outlook that reflects the

strong trends in our core business along with the decision on the

NeuMoDx system,” said Thierry Bernard, CEO of QIAGEN.

“We are strengthening our portfolio with new

product launches, particularly for QIAstat-Dx with the FDA 510(k)

clearances of the new gastrointestinal panel and the updated

respiratory panel. As we head into the second half of 2024, we

continue to expect solid growth trends in our core business and are

well-positioned to deliver on our commitments for 2024,” Bernard

said.

“QIAGEN again delivered growth ahead of our

outlook for the second quarter of 2024 that gives us renewed

confidence in achieving the updated outlook for sales and adjusted

earnings for 2024,” said Roland Sackers, Chief Financial Officer of

QIAGEN. “We are seeing the benefits of our initiatives to improve

profitability, as we confirm our full-year target for an adjusted

operating income margin of at least 28.5%, combined with higher

free cash flow. These improvements put us on a trajectory to

achieve the targets we have set for 2028 as part of our commitment

to solid profitable growth.”

Please find a PDF of the full press release

incl. tables here.

Investor presentation and conference

call

A conference call is planned for Thursday,

August 1, 2024 at 15:00 Frankfurt Time / 14:00 London Time / 9:00

New York Time. A live audio webcast will be made available in

the investor relations section of the QIAGEN website, and a

recording will also be made available after the event. A

presentation will be available before the conference call at

https://corporate.qiagen.com/investor-relations/events-and-presentations/default.aspx.

Use of adjusted results

QIAGEN reports adjusted results, as well as

results on a constant exchange rate (CER) basis, and other non-U.S.

GAAP figures (generally accepted accounting principles), to provide

additional insight into its performance. These results include

adjusted net sales, adjusted gross income, adjusted gross profit,

adjusted operating income, adjusted operating expenses, adjusted

operating income margin, adjusted net income, adjusted net income

before taxes, adjusted diluted EPS, adjusted EBITDA, adjusted EPS,

adjusted income taxes, adjusted tax rate, and free cash flow. Free

cash flow is calculated by deducting capital expenditures for

Property, Plant & Equipment from cash flow from operating

activities. Adjusted results are non-GAAP financial measures that

QIAGEN believes should be considered in addition to reported

results prepared in accordance with GAAP but should not be

considered as a substitute. QIAGEN believes certain items should be

excluded from adjusted results when they are outside of ongoing

core operations, vary significantly from period to period, or

affect the comparability of results with competitors and its own

prior periods. Furthermore, QIAGEN uses non-GAAP and constant

currency financial measures internally in planning, forecasting and

reporting, as well as to measure and compensate employees. QIAGEN

also uses adjusted results when comparing current performance to

historical operating results, which have consistently been

presented on an adjusted basis.

About QIAGEN

QIAGEN N.V., a Netherlands-based holding

company, is the leading global provider of Sample to Insight

solutions that enable customers to gain valuable molecular insights

from samples containing the building blocks of life. Our sample

technologies isolate and process DNA, RNA and proteins from blood,

tissue and other materials. Assay technologies make these

biomolecules visible and ready for analysis. Bioinformatics

software and knowledge bases interpret data to report relevant,

actionable insights. Automation solutions tie these together in

seamless and cost-effective workflows. QIAGEN provides solutions to

more than 500,000 customers around the world in Molecular

Diagnostics (human healthcare) and Life Sciences (academia, pharma

R&D and industrial applications, primarily forensics). As of

June 30, 2024, QIAGEN employed more than 5,900 people in over 35

locations worldwide. Further information can be found at

https://www.qiagen.com.

Forward-Looking Statement

Certain statements contained in this press

release may be considered forward-looking statements within the

meaning of Section 27A of the U.S. Securities Act of 1933, as

amended, and Section 21E of the U.S. Securities Exchange Act of

1934, as amended. To the extent that any of the statements

contained herein relating to QIAGEN's products, timing for launch

and development, marketing and/or regulatory approvals, financial

and operational outlook, growth and expansion, collaborations,

markets, strategy or operating results, including without

limitation its expected adjusted net sales and adjusted diluted

earnings results, are forward-looking, such statements are based on

current expectations and assumptions that involve a number of

uncertainties and risks. Such uncertainties and risks include, but

are not limited to, risks associated with management of growth and

international operations (including the effects of currency

fluctuations, regulatory processes and dependence on logistics),

variability of operating results and allocations between customer

classes, the commercial development of markets for our products to

customers in academia, pharma, applied testing and molecular

diagnostics; changing relationships with customers, suppliers and

strategic partners; competition; rapid or unexpected changes in

technologies; fluctuations in demand for QIAGEN's products

(including fluctuations due to general economic conditions, the

level and timing of customers' funding, budgets and other factors);

our ability to obtain regulatory approval of our products;

difficulties in successfully adapting QIAGEN's products to

integrated solutions and producing such products; the ability of

QIAGEN to identify and develop new products and to differentiate

and protect our products from competitors' products; market

acceptance of QIAGEN's new products and the integration of acquired

technologies and businesses; actions of governments, global or

regional economic developments, weather or transportation delays,

natural disasters, political or public health crises, and its

impact on the demand for our products and other aspects of our

business, or other force majeure events; as well as the possibility

that expected benefits related to recent or pending acquisitions

may not materialize as expected; and the other factors discussed

under the heading “Risk Factors” in most recent Annual Report on

Form 20-F. For further information, please refer to the discussions

in reports that QIAGEN has filed with, or furnished to, the U.S.

Securities and Exchange Commission.

Source: QIAGEN N.V.Category: Financial

John Gilardi

QIAGEN N.V.

+49 152 018 11711

ir@qiagen.com

Domenica Martorana

QIAGEN N.V.

+49 152 018 11244

ir@qiagen.com

Thomas Theuringer

QIAGEN N.V.

+49 2103 29 11826

pr@qiagen.com

Lisa Mannagottera

QIAGEN N.V.

+49 2103 29 14181

pr@qiagen.com

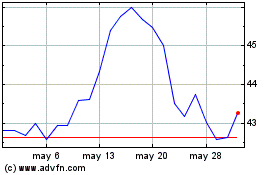

Qiagen NV (NYSE:QGEN)

Gráfica de Acción Histórica

De Jul 2024 a Jul 2024

Qiagen NV (NYSE:QGEN)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024