The Schwab Ultra-Short Income ETF (SCUS) Begins Trading

13 Agosto 2024 - 7:00AM

Business Wire

Today, the Schwab Ultra-Short Income ETF (NYSE Arca: SCUS)

begins trading. The ETF is the first actively managed fixed income

ETF from Schwab Asset Management®, the asset management arm of The

Charles Schwab Corporation. With an expense ratio of 0.14%, the

Schwab Ultra-Short Income ETF is priced below the industry average

of 0.25%1.

The goal of the Schwab Ultra-Short Income ETF is to seek current

income consistent with capital preservation while maintaining

liquidity. The ETF invests in investment grade, short-term, U.S.

dollar denominated debt securities issued by U.S. and foreign

issuers and will maintain a portfolio duration of one year or

less.

About Schwab Asset Management

One of the industry’s largest and most experienced asset

managers, Schwab Asset Management offers a focused lineup of

competitively priced ETFs, mutual funds and separately managed

account strategies designed to serve the central needs of most

investors. By operating through clients’ eyes, and putting them at

the center of our decisions, we aim to deliver exceptional

experiences to investors and the financial professionals who serve

them. As of June 30, 2024, Schwab Asset Management managed

approximately $1.2 trillion on a discretionary basis and $38.3

billion on a non-discretionary basis.

More information is available at www.aboutschwab.com. Follow us

on Twitter/X, Facebook, and LinkedIn.

About Charles Schwab

At Charles Schwab we believe in the power of investing to help

individuals create a better tomorrow. We have a history of

challenging the status quo in our industry, innovating in ways that

benefit investors and the advisors and employers who serve them,

and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us

on Twitter, Facebook, YouTube and LinkedIn.

Disclosures:

Investors should consider carefully information contained in

the prospectus, or if available, the summary prospectus, including

investment objectives, risks, charges and expenses. You can obtain

a prospectus, or if available, a summary prospectus by visiting

https://www.schwabassetmanagement.com/prospectus. Please read it

carefully before investing.

Investment returns will fluctuate and are subject to market

volatility, so that an investor’s shares, when redeemed or sold,

may be worth more or less than their original cost. Unlike mutual

funds, shares of ETFs are not individually redeemable directly with

the ETF. Shares of ETF are bought and sold at market price, which

may be higher or lower than the net asset value (NAV).

Diversification and asset allocation strategies do not ensure a

profit and do not protect against losses in declining markets.

Schwab Ultra-Short Income ETF is an actively managed exchange

traded fund and therefore does not seek to replicate the

performance of any specific index. The fund may have a higher

degree of portfolio turnover than funds that seek to replicate the

performance of an index.

Schwab Ultra-Short Income ETF is not a money market fund and

does not seek to maintain a stable net asset value of $1.00 per

share. The fund is not subject to the strict rules that govern

the diversity, quality, maturity, liquidity and other features of

securities that money market funds may purchase designed to enable

money market funds to maintain a stable share price and to limit

investment risk. Under normal circumstances, the fund’s investments

may be more susceptible than a money market fund is to credit risk,

interest rate risk, valuation risk and other risks relevant to the

fund’s investments. The fund does not seek to maintain a stable net

asset value of $1.00 per share. Therefore, the fund’s net asset

value per share and market value will fluctuate, and these

fluctuations may be significant on certain days. There can be no

guarantee that the fund will generate higher returns than money

market funds. In addition, the fund does not qualify for certain

tax relief afforded to money market funds by the U.S. Treasury.

Fixed income securities are subject to increased loss of

principal during periods of rising interest rates. Fixed-income

investments are subject to various other risks including changes in

credit quality, market valuations, liquidity, prepayments, early

redemption, corporate events, tax ramifications and other

factors.

An actively managed fund is subject to the risk that its

investment adviser and/or subadviser will select investments or

allocate assets in a manner that could cause the fund to

underperform or otherwise not meet its investment objective.

The fund may invest in U.S.-registered, dollar-denominated bonds

of non-U.S. corporations. The fund’s investments in bonds of

non-U.S. issuers may involve certain risks that are greater than

those associated with investments in securities of U.S. issuers.

These include risks of adverse changes in foreign economic,

political, regulatory and other conditions; the imposition of

economic sanctions or other government restrictions; differing

accounting, auditing, financial reporting and legal standards and

practices; differing securities market structures; and higher

transaction costs. These risks may be heightened in connection with

bonds issued by non-U.S. corporations and entities in emerging

markets.

Schwab Asset Management® is the dba name for Charles Schwab

Investment Management, Inc., the investment adviser for Schwab

Funds, Schwab ETFs, and separately managed account strategies.

Schwab Funds are distributed by Charles Schwab & Co, Inc.

(Schwab), Member SIPC. Schwab ETFs are distributed by SEI

Investments Distribution Co. (SIDCO). Schwab Asset Management and

Schwab are separate but affiliated companies and subsidiaries of

The Charles Schwab Corporation, and are not affiliated with

SIDCO.

0824-J3KZ

1 Source: Morningstar data as of June 30, 2024. Data universe is

the actively managed ETFs in the Ultrashort Bond category.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240813339839/en/

Christine Underhill Charles Schwab 415-961-3790

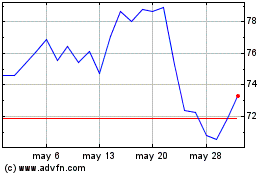

Charles Schwab (NYSE:SCHW)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

Charles Schwab (NYSE:SCHW)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025