2021 Q4 Webcast February 16, 2022 Source Capital (NYSE: SOR)

Performance 2 Performance calculated using Morningstar Direct . Past performance is not indicative of future performance . Source Capital, Inc . (“Fund”) performance changes over time and current performance may be lower or higher than what is stated . Current performance information is updated monthly and is available by calling 1 - 800 - 982 - 4372 . The returns shown for the Fund are calculated at net asset value per share, including reinvestment of all distributions, and are net of all fees and expense . Periods over one year are annualized . Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, which would lower these figures . Since the Fund is a closed - end investment company and its shares are bought and sold on the New York Stock Exchange, your performance may also vary based upon the market price of the common stock . Comparison to an index is for illustrative purposes only . The Fund does not include outperformance of any index or benchmark in their investment objectives . An investor cannot invest directly in an index . * On December 1 , 2015 , the Fund transitioned to a balanced strategy and the current portfolio managers assumed management of the Fund on that date . ** Performance prior to December 1 , 2015 reflects the performance of the prior portfolio manager and investment strategy . Performance prior to December 1 , 2015 is not indicative of performance for any subsequent periods . You should consider the Fund’s investment objectives, risks, and charges and expenses carefully before you invest . You can obtain additional information by visiting the website at www . fpa . com, by email at crm@fpa . com, toll free by calling 1 - 800 - 279 - 1241 (option 1 ), or by contacting the Fund in writing . As of Date: 12/31/2021 Since 12/1/15* 10 Years** 5 Years 3 Years 1 Year QTD Source Capital, Inc. (NAV) 7.78% 10.51% 8.43% 12.51% 11.16% 2.61% 60% MSCI ACWI 40% Bloomberg Agg 9.16% 8.42% 10.24% 14.31% 10.20% 4.02% 60% S&P 500 40% Bloomberg Agg 11.51% 11.14% 12.62% 17.54% 15.86% 6.57%

Executive summary ■ Balanced, opportunistic strategy that seeks maximum total return for shareholders from both capital appreciation and investment income to the extent consistent with protection of invested capital. ■ Fund benefits from closed - end structure which includes its investment in private credit that continued to ramp in 2021 ‒ The Fund’s exposure to private credit (including commitments) increased to 24.7% at year end vs. 11.7% at the end of 2020. ■ Discount to NAV has narrowed ‒ The Fund’s discount to NAV ended the year at 5.47%, down from 11.96% at year - end 2020. ‒ The Fund traded at a discount to NAV as low as 3.8% during 2021, its lowest discount in more than 10 years. ■ The distribution yield remains attractive 1 ‒ 5.14% unlevered distribution rate based on the Fund’s year - end 2021 closing market price. ‒ 2021’s distributions were comprised of only ordinary income and capital gains. We expect the same for 2022. ■ Shareholder commitment: ‒ Goal to increase distribution rate if fund distributable income increases in order to deliver a competitive risk - adjusted distributable yield ‒ Discount management program via share repurchases at discount to NAV 2 and periodic tender offers if necessary ‒ FPA partners and employees and Fund directors increased their investment in the Fund in 2021 and own in excess of $3.9m ■ Seek to narrow the discount to NAV and trade closer to NAV over full market cycle 3 Past performance is no guarantee, nor is it indicative, of future results. Portfolio composition will change due to ongoing management of the Fund. 1 For more information related to the Fund’s distribution rate, please see the press release dated December 2, 2021 ( https://fpa.com/docs/default - source/fpa - news - documents/source - capital - pr - december - 2021.pdf?sfvrsn=1f3919d_2 ). 2 For more information related to the Fund’s share repurchase program, please see the press release dated January 4, 2022 ( https://fpa.com/docs/default - source/fpa - news - documents/2022 - 01 - 04_source - capital - jan - 2022 - final.pdf?sfvrsn=4a01909d_6 ).

Increased exposure to private credit Source: FPA, data is for the period 12/31/2019 through 12/31/2021. Portfolio composition will change due to ongoing management of the Fund. Past performance is no guarantee, nor is it indicative, of future results. 4 0 5 10 15 20 25 30 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Private Loan Net Exposure (%) Committed Funded Net Exposure as of 12/31/2021 Private Credit - Committed 24.7% Private Credit - Funded 14.6%

Narrowing discount to NAV Source: Bloomberg, CEF Connect, data in the chart is for the period 12/31/2011 through 12/31/2021; data in the table is as of 12 /31/2021. There is no guarantee that the Fund will achieve its objectives and goals. Past performance is no guarantee, nor is it indicative, of future results. 5 6 month average -5.7% 1 year average -7.7% Discount to NAV: -18 -16 -14 -12 -10 -8 -6 -4 -2 0 Discount (%)

Strategy update As of December 31, 2021. There is no guarantee that the Fund will achieve its objectives and goals. Past performance is no guarantee, nor is it indicative, of future results. Portfolio composition will change due to ongoing management of the Fund. Investment options: ■ Private credit: Direct investment and private credit vehicles that seek to deliver a net yield of at least 8%. ■ Public credit: Using FPA’s Flexible Fixed Income strategy as a model. ■ Equity: Global equity strategy that invests in a similar fashion to other FPA global equity strategies. Portfolio considerations: ■ Leverage: Opportunistically increase leverage when opportunity presents itself in private and public credit – a function of yield, spread, and confidence in the expected outcome. Limit leverage when the opposite is true. ■ Risk exposure: Opportunistically manage exposure to equities and higher yielding bonds as function of risk and reward. ■ Share repurchases: Return capital to shareholders and increase total investor level return by repurchasing shares at discount to NAV. 6

Recent actions (last 12 months) As of December 31, 2021 unless otherwise noted. * The Fund’s distribution rate may be affected by numerous factors, including changes in realized and projected market return s, Fund performance, and other factors. There can be no assurance that a change in market conditions or other factors will not result in a change in the Fund’s distribution rate at a f uture time. ** Additional details about the tender offers under the Discount Management Program can be found in the March 8, 2021 press r ele ase which is posted at www.fpa.com and covered calendar years 2021 and 2022. The 2021 measurement period was April 1, 2021 through December 31, 2021. The Discount Managemen t P rogram was extended for calendar year 2023. See press release dated January 4, 2022 at www.fpa.com. Note, in the event of a tender offer, there may be tax conseque nce s for a stockholder. For example, a stockholder may owe capital gains taxes on any increase in value of the shares over their original cost. *** Effective October 14, 2020 . Distributions ■ Monthly $0.185 distribution has remained unchanged since March 2021* Discount management ■ Tender offers: To the extent the discount to NAV is more than 10%, then the Fund will conduct a tender for 10% of the Fund’s outstanding shares at 98% of NAV per share for calendar years 2022 and 2023.** ‒ Announced on January 4, 2022 that no tender offer for calendar year 2021 will take place because fund traded, on average, at less than a 10% discount from April 1, 2021 through December 31, 2021 ■ Share repurchases: May repurchase shares when discount to NAV exceeds 5%.*** 7

Portfolio vs. illustrative index * Invested assets only . Source : FPA, Morningstar, as of December 31 , 2021 . Portfolio composition will change due to ongoing management of the Fund . Portfolio Yield is the weighted average of each category’s yield . The Portfolio Yield shown for Equity is the dividend yield, and for Public Credit, it is yield - to - worst . Yield to Worst (“YTW”) is presented gross of fees and expenses and reflects the lowest possible yield on a callable bond without the issuer defaulting . It does not represent the yield an investor should expect to receive . As of December 31 , 2021 , Source Capital’s (“Fund”) subsidized/unsubsidized 30 - day standardized SEC yield (“SEC Yield”) was 1 . 68 % / 1 . 68 % respectively . The SEC Yield calculation is an annualized measure of the Fund’s dividend and interest payments for the last 30 days, less the Fund expenses . Subsidized yield reflects fee waivers and/or expense reimbursements during the period . Without waivers and/or reimbursements, yields would be reduced . Unsubsidized yield does not adjust for any fee waivers and/or expense reimbursements in effect . The SEC Yield calculation shows investors what they would earn in yield over the course of a 12 - month period if the Fund continued earning the same rate for the rest of the year . Comparison to an index is for illustrative purposes only . The Fund does not include outperformance of any index or benchmark in its investment objectives . An investor cannot invest directly in an index . There is no guarantee that the Fund will achieve its objectives and goals . Past performance is no guarantee, nor is it indicative, of future results . Please see the end of this presentation for Important Disclosures and definitions of key terms . 8 Source Capital has a 1.5% estimated yield advantage versus the Balanced Index. Allocation Portfolio Yield 12/31/2020 12/31/2021 12/31/2020 12/31/2021 Equity 53.9% 62.3% 1.5% 1.7% 60.0% 1.7% Credit Private (Estimated)* 7.7% 13.2% 6.5% 8.0% Public 22.0% 19.9% 4.6% 5.7% Total Credit 29.7% 33.1% 1.5% 6.6% 40.0% 1.8% Cash 16.4% 4.6% 0.1% 0.1% Yield 2.3% 3.3% 1.7% Source Capital Balanced Index: 60% MSCI ACWI / 40% BB US AGG Allocation Estimated Portfolio Yield 12/31/2021

Additional Questions/Comments Please contact: Ryan Leggio Vice President, Strategy for Source Capital rleggio@fpa.com or your FPA relationship representative 9

Important disclosures These slides are intended as supplemental material to the February 16 , 2022 Source Capital, Inc . (“Source Capital” or “Fund”) audio presentation and transcript that are posted on First Pacific Advisor, LP’s (“FPA” or “Adviser”) website at www . fpa . com . This presentation is for informational and discussion purposes only and does not constitute, and should not be construed as, an offer or solicitation for the purchase or sale with respect to any securities, products or services discussed, and neither does it provide investment advice . There shall not be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful under the securities laws of any such state . In the event of a tender offer, there may be tax consequences for a stockholder . For example, a stockholder may owe capital gains taxes on any increase in the value of the shares over your original cost . This presentation does not constitute an investment management agreement or offering circular . On December 1 , 2015 , a new portfolio management team assumed management of the Source Capital, Inc . (“Fund”) and the Fund transitioned to a balanced strategy . Performance prior to December 1 , 2015 reflects the performance of the prior portfolio manager and investment strategy and is not indicative of performance for any subsequent periods . Current performance information is updated monthly and is available by calling 1 - 800 - 982 - 4372 or by visiting www . fpa . com . Performance data quoted represents past performance, which is no guarantee of future results . Current performance may vary from the performance quoted . The returns shown for Source Capital are calculated at net asset value per share, including reinvestment of all distributions . Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, which would lower these figures . Since Source Capital is a closed - end investment company and its shares are bought and sold on the New York Stock Exchange, your performance may also vary based upon the market price of the common stock . The Fund is managed according to its investment strategy which may differ significantly in terms of security holdings, industry weightings, and asset allocation from those of the comparative indices . Overall Fund performance, characteristics and volatility may differ from the comparative indices shown . There is no guarantee the Fund’s investment objectives will be achieved . You should consider the Fund’s investment objectives, risks, and charges and expenses carefully before you invest . You can obtain additional information by visiting the website at www . fpa . com, by email at crm@fpa . com, toll free by calling 1 - 800 - 279 - 1241 (option 1 ), or by contacting the Fund in writing . The views expressed herein and any forward - looking statements are as of the date of this publication and are those of the portfolio management team, and are subject to change without notice . These views may differ from other portfolio managers and analysts of the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice . Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments . This information and data has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data . As with any stock, the price of the Fund’s common shares will fluctuate with market conditions and other factors . Shares of closed - end management investment companies frequently trade at a price that is less than (a “discount”) or more than (a “premium”) their net asset value . If the Fund’s shares trade at a premium to net asset value, there is no assurance that any such premium will be sustained for any period of time and will not decrease, or that the shares will not trade at a discount to net asset value thereafter . The Fund’s daily New York Stock Exchange closing market prices, net asset values per share, as well as other information, including updated portfolio statistics and performance are available by visiting the website at https : //fpa . com/funds/overview/source - capital, by email at crm@fpa . com, toll free by calling 1 - 800 - 279 - 1241 (option 1 ), or by contacting the Fund in writing . Distributions may include ordinary income, net capital gains and/or returns of capital . Generally, a return of capital would occur when the amount distributed by the Fund includes a portion of (or is comprised entirely of) your investment in the Fund in addition to (or rather than) your pro - rata portion of the Fund’s net income or capital gains . The Fund’s distributions in any period may be more or less than the net return earned by the Fund on its investments, and therefore should not be used as a measure of performance or confused with “yield” or “income . ” A return of capital is not taxable ; rather it reduces a shareholder’s tax basis in his or her shares of the Fund . It is important to note that differences exist between the Fund’s daily internal accounting records and practices, the Fund’s financial statements prepared in accordance with U . S . GAAP, and recordkeeping practices under income tax regulations . Please see the Fund’s most recent shareholder reports for more detailed tax information . The Fund’s distribution rate may be affected by numerous factors, including changes in realized and projected market returns, Fund performance, and other factors . There can be no assurance that a change in market conditions or other factors will not result in a change in the Fund’s distribution rate at a future time . 10

Important disclosures Portfolio composition will change due to ongoing management of the Fund . References to individual financial instruments or sectors are for informational purposes only and should not be construed as recommendations by the Fund or the portfolio managers . It should not be assumed that future investments will be profitable or will equal the performance of the financial instrument or sector examples discussed . The portfolio holdings as of the most recent quarter - end may be obtained atwww . fpa . com . In making any investment decision, you must rely on your own examination of the Fund, including the risks involved in an investment . Investments mentioned herein may not be suitable for all recipients and in each case, potential investors are advised not to make any investment decision unless they have taken independent advice from an appropriately authorized advisor . An investment in any security mentioned herein does not guarantee a positive return as securities are subject to market risks, including the potential loss of principal . You should not construe the contents of this document as legal, tax, investment, accounting or other advice or recommendations . Investing in closed - end funds involves risk, including loss of principal . Closed - end fund shares may frequently trade at a discount or premium to their net asset value . Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments . It is important to remember that there are risks inherent in any investment and there is no assurance that any investment or asset class will provide positive performance over time . The Fund may purchase foreign securities, including American Depository Receipts (ADRs) and other depository receipts, which are subject to interest rate, currency exchange rate, economic and political risks ; these risks may be heightened when investing in emerging markets . Non - U . S . investing presents additional risks, such as the potential for adverse political, currency, economic, social or regulatory developments in a country, including lack of liquidity, excessive taxation, and differing legal and accounting standards . Non - U . S . securities, including American Depository Receipts (ADRs) and other depository receipts, are also subject to interest rate and currency exchange rate risks . The return of principal in a fund that invests in fixed income securities is not guaranteed . The Fund’s investments in fixed income securities have the same issuer, interest rate, inflation and credit risks that are associated with underlying bonds owned by the Fund . Such investments may be secured, partially secured or unsecured and may be unrated, and whether or not rated, may have speculative characteristics . The market price of the Fund’s fixed income investments will change in response to changes in interest rates and other factors . Generally, when interest rates go up, the value of fixed income securities, such as bonds, typically go down (and vice versa) and investors may lose principal value . Credit risk is the risk of loss of principle due to the issuer's failure to repay a loan . Generally, the lower the quality rating of a security, the greater the risk that the issuer will fail to pay interest fully and return principal in a timely manner . If an issuer defaults, the security may lose some or all its value . Lower rated bonds, convertible securities and other types of debt obligations involve greater risks than higher rated bonds . Mortgage securities and collateralized mortgage obligations (CMOs) are subject to prepayment risk and the risk of default on the underlying mortgages or other assets ; such derivatives may increase volatility . Convertible securities are generally not investment grade and are subject to greater credit risk than higher - rated investments . High yield securities can be volatile and subject to much higher instances of default . The Fund may experience increased costs, losses and delays in liquidating underlying securities should the seller of a repurchase agreement declare bankruptcy or default . The ratings agencies that provide ratings are Standard and Poor’s, Moody’s, and Fitch . Credit ratings range from AAA (highest) to D (lowest) . Bonds rated BBB or above are considered investment grade . Credit ratings of BB and below are lower - rated securities (junk bonds) . High - yielding, non - investment grade bonds (junk bonds) involve higher risks than investment grade bonds . Bonds with credit ratings of CCC or below have high default risk . Private placement securities are securities that are not registered under the federal securities laws, and are generally eligible for sale only to certain eligible investors . Private placements may be illiquid, and thus more difficult to sell, because there may be relatively few potential purchasers for such investments, and the sale of such investments may also be restricted under securities laws . While the use of leverage may help increase the distribution and return potential of the Fund, it also increases the volatility of the Fund’s net asset value (NAV), and potentially increases volatility of its distributions and market price . There are costs associated with the use of leverage, including ongoing dividend and/or interest expenses . There also may be expenses for issuing or administering leverage . Leverage changes the Fund’s capital structure through the issuance of preferred shares and/or debt, both of which are senior to the common shares in priority of claims . If short - term interest rates rise, the cost of leverage will increase and likely will reduce returns earned by the Fund’s common stockholders . Value style investing presents the risk that the holdings or securities may never reach their full market value because the market fails to recognize what the portfolio management team considers the true business value or because the portfolio management team has misjudged those values . In addition, value style investing may fall out of favor and underperform growth or other styles of investing during given periods . 11

Important disclosures Investing in Special Purpose Acquisition Companies (“SPACS”) involves risks. Because SPACs and similar entities have no opera tin g history or ongoing business other than seeking acquisitions, the value of their securities is particularly dependent on the ability of the entity’s management to identify a nd complete a profitable acquisition. SPACs are not required to provide the depth of disclosures or undergo the rigorous due diligence of a traditional initial public offering (IPO). Invest ors in SPACs may become exposed to speculative investments, foreign or domestic, in higher risk sectors/industries. SPAC investors generally pay certain fees and give the sponsor certai n i ncentives (e.g., discounted ownership stakes) not found in traditional IPOs. Due to this, an investment in a SPAC may include potential conflicts and the potential for misalignment of incentives in the structure of the SPAC. For more information relating to the risks of investing in SPACs please refer to the Fund’s offering documents or FPA’s Form ADV Part 2A. You can obtain additional information by visiting the website at www.fpa.com, by email at crm@fpa.com, toll free by calling 1 - 800 - 279 - 1241 (option 1), or by contacting the Fund in writing. Index / Benchmark / Category Definitions Indices are unmanaged and index returns do not reflect transactions costs (e . g . , commissions), investment management fees or other fees and expenses that would reduce performance for an investor . It is not possible to invest directly in an index . Indices have limitations when used for comparative purposes because they may have volatility, credit, or other material characteristics that are different from the referenced fund . For example, the referenced fund may hold underlying securities that are not included in any index used for comparative purposes and FPA makes no representation that the referenced fund is comparable to any such index in composition or element of risk involved . Any comparisons herein of the investment performance of a referenced fund to an index are qualified as follows : ( i ) the volatility of such index may be materially different from that of the referenced fund ; (ii) such index may employ different investment guidelines and criteria than the referenced fund and, therefore, holdings in such fund may differ significantly from holdings of the securities that comprise such index ; and (iii) the performance of such index may not necessarily have been selected to represent an appropriate index to compare to the performance of the referenced fund, but rather, is disclosed to allow for comparison of the referenced fund’s performance (or the performance of the assets held by such fund) to that of a well - known index . Indexes should not be relied upon as a fully accurate measure of comparison . No representation is made as to the risk profile of any index relative to the risk profile of the referenced fund . MSCI ACWI Index is a free float - adjusted market capitalization weighted index that is designed to represent performance of the full opportunity set of large - and mid - cap stocks across 23 developed and 26 emerging markets . S&P 500 Index includes a representative sample of 500 hundred companies in leading industries of the U . S . economy . The index focuses on the large - cap segment of the market, with over 80 % coverage of U . S . equities, but is also considered a proxy for the total market . Bloomberg Barclays U . S . Aggregate Bond Index provides a measure of the performance of the US investment grade bonds market, which includes investment grade US Government bonds, investment grade corporate bonds, mortgage pass - through securities and asset - backed securities that are publicly offered for sale in the United States . The securities in the Index must have at least 1 - year remaining in maturity . In addition, the securities must be denominated in US dollars and must be fixed rate, nonconvertible, and taxable . 60 % S&P 500 / 40 % Bloomberg Barclays U . S . Aggregate Bond Index is a hypothetical combination of unmanaged indices and comprises 60 % S&P 500 Index and 40 % Bloomberg Barclays U . S . Aggregate Bond Index . 60 % MSCI ACWI/ 40 % Bloomberg Barclays U . S . Aggregate Bond Index is a hypothetical combination of unmanaged indices and comprises 60 % MSCI ACWI Index and 40 % Bloomberg Barclays U . S . Aggregate Bond Index . Consumer Price Index (CPI) is an unmanaged index representing the rate of the inflation of U . S . consumer prices as determined by the U . S . Department of Labor Statistics . There can be no guarantee that the CPI will reflect the exact level of inflation at any given time . This index reflects non - seasonally adjusted returns . CPI + 200 bps is created by adding 2 % to the annual percentage change in the CPI . This index reflects non - seasonally adjusted returns . 12

Important disclosures Other Definitions Basis Point (bps) is equal to one hundredth of one percent, or 0 . 01 % . 100 basis points = 1 % . Dividend Yield is a financial ratio (dividend/price) that shows how much a company pays out in dividends each year relative to its stock price . Yield Advantage is the advantage gained by purchasing convertible securities instead of common stock, which equals the difference between the rates of return of the convertible security and the common shares . Yield to Worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting . It is a type of yield that is referenced when a bond has provisions that would allow the issuer to close it out before it matures . © 2021 Morningstar, Inc . All Rights Reserved . The information contained herein : ( 1 ) is proprietary to Morningstar and/or its content providers ; ( 2 ) may not be copied or distributed ; and ( 3 ) is not warranted by Morningstar to be accurate, complete or timely . Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information . Past performance is no guarantee, nor is it indicative, of future results . 13

Q4 2020 Source Capital, Inc. (SOR) Webcast

February 16,

2022

This transcript must be read in conjunction

with the corresponding webcast slides, posted on fpa.com. The webcast slide page numbers are referenced below. Please also reference

the Important Disclosures at the end of this transcript and throughout and at the end of the webcast presentation.

You should consider Source Capital, Inc.’s

(“Fund” or “Source”) investment objectives, risks, and charges and expenses carefully before you invest. You can

obtain additional information by visiting the website at fpa.com, by email at crm@fpa.com, toll-free by calling 1-800-279-1241 (Option

1), or by contacting the Fund in writing.

Note: Items in brackets [ ] are meant to be

clarifying statements but are not part of the actual audio recording of the webcast.

(00:00:04)

| Moderator: | Hello, and welcome to today’s webcast. My name is Sarah and I will be your event specialist today. All lines have been placed

on mute to prevent any background noise. Please note that today’s webcast is being recorded. |

If you need technical assistance, as a

best practice we suggest you refresh your browser.

It is now my pleasure to turn today’s

program over to Ryan Leggio. Ryan, the floor is yours.

| Ryan: | Thanks so much, and we apologize for the brief delay, everyone. Thank you for taking the time to join today’s call as we provide

a fund and portfolio update, and address the pre-submitted questions. I want to give a special welcome to the many newer shareholders

who are joining us on the call today. |

In just a moment, you will hear from Steven

Romick. Steven joined FPA in 1996 as a Managing Partner, and has been a portfolio manager of the Fund since December 2015.

I want to mention that we continue to be

excited about Source’s long-term prospects, and hope you share that sentiment after today’s webcast. We made significant progress

on the goals we laid out on our last webcast a little less than a year ago, and believe we are well-positioned to make further progress

this year.

Q4 2020 Source Capital, Inc. (SOR) Webcast

February 16,

2022

As a reminder, we will not be taking live

questions during the webcast but are more than happy to connect with any current or potential shareholders in the coming days should you

have follow-up questions or comments.

[Please refer to Slide 2] As a disclosure

requirement, we show this slide of the trailing performance as of December 31, 2021. Additional details on the Fund, including performance,

holdings, and commentaries can be found in the Source Capital section of FPA’s website FPA.com.

I would like to point out that as of January 31,

2022, the Fund is four star-rated by Morningstar overall and over the past three years, due to the Fund’s risk-adjusted performance

versus its Morningstar allocation peers.1 We believe this strategy is well-positioned to continue to deliver attractive risk-adjusted

results over the long term.2

It is my pleasure at this time to turn

over the call to Steven Romick. Steven, over to you.

1

Morningstar Category: Allocation--50% to 70% Equity as of Feb 22, 2022 (“peers”). As of January 31, 2022. Morningstar

RatingTM: For each fund with at least a three-year history, Morningstar calculates a Morningstar RatingTM based

on a Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects

of sales charges, loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The

top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive

2 stars and the bottom 10% receive 1 star. (Each share class is counted as a fraction of one fund within this scale and rated separately,

which may cause slight variations in the distribution percentages.) The Overall Morningstar RatingTM for a fund is derived

from a weighted average of the performance figures associated with its three-, five- and 10-year (if applicable) Morningstar Rating metrics.

The Morningstar ratings metrics for Source Capital, Inc. for the three-, five-, and ten-year periods are 4 Stars, 3 Stars and 4 Stars

respectively as of January 31, 2022. More information on Morningstar’s methodology can be found here: https://s21.q4cdn.com/198919461/files/doc_downloads/othe_disclosure_materials/MorningstarRatingforFunds.pdf.

The Morningstar star rating should not be used

as the sole basis in evaluating a fund. See additional important disclosures at the end of this transcript.

2

FPA typically measures risk-adjusted results using the Sharpe Ratio. The Sharpe Ratio is a measure that indicates the average

return minus the risk-free return divided by the standard deviation of return on an investment. The ratio is the average return earned

in excess of the risk-free rate per unit of volatility or total risk.

Q4 2020 Source Capital, Inc. (SOR) Webcast

February 16,

2022

(00:02:18)

| Steven: | [Please refer to Slide 3] Thank you so much, Ryan, and thank you for taking the time to listen to this brief update on FPA’s

Source Capital closed-end fund. Source’s portfolio management team is working to achieve a balance with capital appreciation and

income while being mindful of the downside, that is, a permanent impairment of capital. The distribution yield remains attractive, with a 6.42% [correction:

5.14% distribution yield as of 12/31/2021] unlevered distribution rate based on the Fund’s year end 2021 closing market price.3

Our goal is to continue to manage distributable income to a level that delivers a competitive risk-adjusted distributable yield. As a

statement of our commitment to Source Capital, FPA partners and employees increased their investment in the Fund last year, and now own

shares valued at approximately $4 million. |

[Please refer to Slide 4] The Fund’s

closed-end structure, with its more stable capital base, allows us to take a longer-term view and invest in certain less liquid opportunities

in the service of [the Fund’s] goals. Private credit is an example of that, and the Fund’s exposure to private loans continues

to increase, ending 2021 with almost 25% exposure if we were to include the capital commitments to Fund investments. That’s more

than double the 11.7% at year-end 2020. The funded exposure ended 2021 at 14.6%, up from 7.5% at the end of the previous year.

3 Note: During the audio presentation, it was incorrectly

stated that the distribution yield was 6.42% as of 12/31/2021. The corrected number is shown in brackets above and on page 5 in this

transcript.

Q4 2020 Source Capital, Inc. (SOR) Webcast

February 16,

2022

We have underwritten the Fund’s private

credit exposure to a targeted yield of at least 8%, allocated to a mix of private partnerships and individual loans.4 The

distributable yield should benefit as the private partnerships get more invested, and would be further enhanced should we successfully

find additional private loan opportunities, but we haven’t recently found the risk/reward in the recent deals we evaluated to be

attractive.

(00:04:10)

[Please refer to Slide 5] The actions taken

to date have allowed Source Capital’s discount to narrow. After trading as low as 3.8% discount during 2021, its lowest discount

in over a decade, it ended the year at a 5.47% discount, down from 11.96% at year-end 2020. To the extent that discount widens significantly

in the future, we intend to opportunistically repurchase the Fund’s own shares. Hopefully these actions, among others, coupled with

successful execution of [the Fund’s] strategy over time, will continue to allow the Fund’s discount to trade closer to NAV

over full market cycles.

[Please refer to Slide 6] The ability to

invest in both public and private credit as well as equities provides the Fund an unusually wide range of securities from which to choose

that can help us to achieve our objective. That has been aided by opportunistic share repurchases and will hopefully be further enhanced

by the addition of leverage as the Fund gets more invested in credit.

FPA’s Fixed Income team continues

to migrate the yield of its public credit book higher, and we hope for that to continue, market permitting. Tom Atteberry, the co-head

of the Fixed Income team, will be transitioning to a senior advisor role mid-year, but the product is in excellent hands with Abhi Patwardhan

continuing at the helm. Not much else has changed.

4 There is no guarantee that this targeted yield will be

achieved. Investments involve risks including risk of loss.

Q4 2020 Source Capital, Inc. (SOR) Webcast

February 16,

2022

[Please refer to Slide 7] The Board of

Source Capital has approved maintaining the monthly fund distributions as the current rate of 18.5 cents per share through May 2022.5

This equates to an annualized 6.42% [correction: 5.14% distribution yield as of 12/31/2021] unlevered distribution rate, as previously

stated.

As previously reported but worth repeating,

if the Fund’s discount to NAV--net asset value--exceeds 10%, then the Fund will conduct a tender for 10% of its shares outstanding

at 98% of NAV. This commitment stands for 2022 and 2023. Periodic share repurchases and the eventual use of the Fund’s credit line

as a function of opportunity should also benefit shareholders.

(00:06:16)

[Please refer

to Slide 8] Here is a snapshot of the portfolio at year end, as compared to a global balanced [index].6

Source Capital ended 2021 with 62% in equities, 33% in credit, and the balance of about 5% in cash. Thanks to the Fund’s exposure

to higher-yielding private and public credit, we estimate that its gross yield run rate is approximately 3.25%, higher by about [1.00%]

from the end of 2020, and almost two times the [weighted average gross] yield of the Global Balanced Index exhibited here.7

We hope to continue to increase the Fund’s yield as we further increase the yield of the Fund’s credit book, draw down cash,

and ultimately add leverage via the credit line that was established last year.

5

For more information, please see press release dated February 14, 2022 on fpa.com: https://fpa.com/docs/default-source/fpa-news-documents/source-capital-pr-february-2022.pdf?sfvrsn=fc1f909d_2.

6

The global balanced index referenced is the 60% MSCW ACWI/40% Bloomberg US Bond Aggregate index. Source: Morningstar.

7

Note: In the audio presentation, the Portfolio Manager misspoke and stated the gross yield run rate for 2021 was about 1.25%

higher than from the end of 2020. The actual difference is about 1.0%. “Gross yield” is the overall return on an investment

before taxes and expenses are deducted.

Q4 2020 Source Capital, Inc. (SOR) Webcast

February 16,

2022

That’s

the end of the very brief prepared remarks. We are always available here to answer your questions. We've asked in advance for people to

submit questions, and there's really only one that come over the transom, you know, in advance.

So

this question--there's actually a couple of them tied to the same subject, which regards [to] the Fund’s SPAC exposure. It says:

Please address the SPAC [special purpose acquisition company] investment strategy8 in more detail, and how successful this

has been so far for the portfolio. Many SPACs are selling at fractions of the original market prices so we are interested in how the investment

team has navigated the capital destruction up till now.

Well,

it’s important to note that those SPACs that are trading at fractions of prices happened after the announced deals, for the most

part. So that hasn’t been really--that has not been part of our strategy.

(00:07:50)

For those unfamiliar with our investment

in these, what's known as special--SPACs, but are special purpose acquisition companies--we assembled a basket that was around 7% of the

Fund at year end. We bought these SPACs roughly at or below their trust value--before a deal’s been announced--which provides us

with a free option in the event that other investors take a favorable view if and when the SPAC announces its targeted acquisition. If

the market takes a dim view of the proposed transaction, we can simply exercise our redemption rights to receive the trust value of the

shares in cash.

8 Please review the Important Disclosures in the webcast

for additional information regarding the risks of investing in SPACS.

Q4 2020 Source Capital, Inc. (SOR) Webcast

February 16,

2022

Quite often, we are also buying a share

in a SPAC with a unit for warrants attached. In this instance, we have the opportunity to retain the warrants and participate in the future

upside of the SPAC even if we choose to sell or redeem the shares prior to the closing of the actual acquisition. It’s a great setup.

Heads we win, and tails we don’t lose.9

We look at SPACs as a high yield substitute,

but with a higher expected yield and less downside risk--particularly given that high yield bonds today in the U.S. are in the low 4s

before any level of default, and in Europe they're just in the low 2s.10

This trade has worked within expectations

thus far. In 2021, Source’s SPAC bucket contributed 0.6% to the Fund’s gross return.11 A back-of-the-envelope

calculation, given the average 6.8% weight during the year, suggests around 8.8% return for the SPACs in the aggregate [during 2021],

although it’s not something we've specifically calculated.12

Ryan, I’m going to turn the

call back to you.

| Ryan: | Thanks, Steven, and again thank you, everyone, for joining the call. I just want to emphasize one point that Steven made, which is

if you have any additional questions or if we missed your question, please reach out to your FPA relationship representative, or you can

reach out to me directly, and my contact information is both on the screen in front of you and on our website. |

9

Past performance is no guarantee, nor is it indicative, of future results. There is no guarantee that the Fund’s

investments in SPACs will not result in an investment loss.

10

Bloomberg. As of December 31, 2021.

11

Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if

included, would reduce the returns presented. Based on weighted contribution to the Fund’s trailing twelve month (TTM) performance

as of December 31, 2021. It should not be assumed that recommendations made in the future will be profitable or will equal the performance

of the securities listed. Past performance is no guarantee, nor is it indicative, of future results. Portfolio composition will

change due to ongoing management of the Fund.

12

Estimated and subject to change. An investment in any financial instrument mentioned herein does not guarantee a positive

return as securities are subject to market risks, including the potential loss of principal. There is no guarantee the Fund’s investment

objectives will be achieved.

Q4 2020 Source Capital, Inc. (SOR) Webcast

February 16,

2022

With that, we thank everyone for joining

our brief Source webcast today, and turn the call back over to the moderator for closing disclosures. Thank you.

(00:09:58)

| Moderator: | [Please reference Important Disclosure Section, slides 10-13] Thank you for your participation in today’s webcast. We invite

you, your colleagues, and shareholders to listen to the playback of this recording and view the presentation slides that will be available

on our website within a few days at FPA.com. We urge you to visit the website for additional information about the Fund, such as complete

portfolio holdings, historical returns, and after-tax returns. |

Following today’s webcast, you will

have the opportunity to provide your feedback and submit any comments or suggestions. We encourage you to complete this portion of the

webcast. We know your time is valuable, and we do appreciate and review all of your comments.

Please visit FPA.com for future webcast

information, including replays. We post the date and time of upcoming webcasts towards the end of each current quarter, and webcasts are

typically held three to four weeks following each quarter at crm@fpa.com.

We hope that our quarterly commentaries,

webcasts, and special commentaries will continue to keep you appropriately informed on the strategies discussed today.

We do want to make sure you understand

that the views expressed on this call are as of today, and are subject to change without notice, based on market and other conditions.

These views may differ from other portfolio managers and analysts at the firm as a whole and are not intended to be a forecast of future

events, a guarantee of future results, or investment advice.

Q4 2020 Source Capital, Inc. (SOR) Webcast

February 16,

2022

Past performance is no guarantee nor

is it indicative of future results. Any mention of individual securities or sectors should not be construed as a recommendation to purchase

or sell such securities, or invest in such sectors, and any information provided is not a sufficient basis upon which to make an investment

decision. It should not be assumed that future investments will be profitable or will equal the performance of the security or sector

examples discussed.

(00:11:56)

Investing in the Fund involves risk, including

the risk that you may receive little or no return on your investment or that you may lose part or all of your investment.

Any statistics or market data mentioned

during this webcast have been obtained from sources believed to be reliable, but the accuracy and completeness cannot be guaranteed.

You should consider the Fund’s

investment objectives, risks, charges, and expenses carefully before you invest. You can obtain additional information by visiting the

website at FPA.com, by email at crm@fpa.com, tollfree by calling 1-800-279-1241 option 1, or by contacting the Fund in writing.

©2022 Morningstar, Inc. All

Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not

be copied or distributed; and (3) is not warranted by Morningstar to be accurate, complete or timely. Neither Morningstar nor its

content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee

of future results.

This concludes today’s call. Thank

you and enjoy the rest of your day.

(00:12:47)

[END FILE]

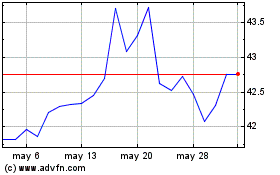

Source Capital (NYSE:SOR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Source Capital (NYSE:SOR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024