The Board of Directors of Source Capital, Inc. (NYSE: SOR) (the

“Fund”) today approved increasing the Fund’s regular monthly

distribution rate 12.6% from $0.185 ($2.22 annualized) to $0.2083

($2.50 annualized) for each of the next three months as

follows:

Regular Monthly Distributions:

Month

Rate per Common Share

Record Date

Payable Date

June 2023

$0.2083

June 16, 2023

June 30, 2023

July 2023

$0.2083

July 18, 2023

July 31, 2023

August 2023

$0.2083

August 16, 2023

August 31, 2023

This equates to an approximate 6.7% distribution rate based on

the Fund’s closing market price on Friday May 5, 2023. The

distribution rate may be adjusted in the future based on a variety

of factors including, but not limited to, interest rate levels and

credit spreads, the Fund’s investment allocation to public and

private credit of varying quality and/or to potentially higher

returning (but lower yielding) equities, and the amount of leverage

employed.

The portfolio managers note that as of March 31, 2023,

approximately 29% of the Fund was invested in, or committed to, the

private credit/loan asset class compared to 26% as of March 31,

2022.

About Source Capital, Inc.

Source Capital, Inc. is a closed-end investment company managed

by First Pacific Advisors, LP. Its shares are listed on the New

York Stock Exchange under the symbol “SOR.” The investment

objective of the Fund is to seek maximum total return for

shareholders from both capital appreciation and investment income

to the extent consistent with protection of invested capital. The

Fund may invest in longer duration assets like dividend paying

equities and illiquid assets like private loans in pursuit of its

investment objective and is thus intended only for those investors

with a long-term investment horizon (greater than or equal to ~5

years).

You can obtain additional information by visiting the website

at www.fpa.com, by email at crm@fpa.com,

toll free by calling 1-800-982-4372, or by contacting the Fund

in writing.

Important Disclosures

You should consider the Fund’s investment objectives, risks,

and charges and expenses carefully before you invest.

Distributions may include ordinary income, net capital gains

and/or returns of capital. Generally, a return of capital would

occur when the amount distributed by the Fund includes a portion of

(or is comprised entirely of) your investment in the Fund in

addition to (or rather than) your pro-rata portion of the Fund’s

net income or capital gains. The Fund’s distributions in any period

may be more or less than the net return earned by the Fund on its

investments, and therefore should not be used as a measure of

performance or confused with “yield” or “income.” A return of

capital is not taxable; rather it reduces a shareholder’s tax basis

in his or her shares of the Fund. If the Fund estimates that a

portion of its distribution may be comprised of amounts from

sources other than net investment income, the Fund will notify

shareholders of the estimated composition of such distribution

through a separate written Section 19 notice. Such notices are

provided for informational purposes only and should not be used for

tax reporting purposes. Final tax characteristics of all Fund

distributions will be provided on Form 1099-DIV, which is mailed

after the close of the calendar year.

It is important to note that differences exist between the

Fund’s daily internal accounting records and practices, the Fund’s

financial statements prepared in accordance with U.S. GAAP, and

recordkeeping practices under income tax regulations. Please see

the Fund’s most recent shareholder reports for more detailed tax

information.

The Fund’s distribution rate may be affected by numerous

factors, including changes in realized and projected market

returns, Fund performance, and other factors. There can be no

assurance that a change in market conditions or other factors will

not result in a change in the Fund’s distribution rate at a future

time.

As with any stock, the price of the Fund’s common shares will

fluctuate with market conditions and other factors. Shares of

closed-end management investment companies frequently trade at a

price that is less than (a “discount”) or more than (a “premium”)

their net asset value. If the Fund’s shares trade at a premium to

net asset value, there is no assurance that any such premium will

be sustained for any period of time and will not decrease, or that

the shares will not trade at a discount to net asset value

thereafter.

The Fund’s daily New York Stock Exchange closing market prices,

net asset values per share, as well as other information, including

updated portfolio statistics and performance are available by

visiting the website at

https://fpa.com/funds/overview/source-capital, by email at

crm@fpa.com, toll free by calling 1-800-279-1241 (option 1), or by

contacting the Fund in writing.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of the

securities in any state in which such offer, solicitation or sale

would be unlawful under the securities laws of any such state. In

the event of a tender offer, there may be tax consequences for a

stockholder. For example, a stockholder may owe capital gains taxes

on any increase in the value of the shares over your original

cost.

Investments, including investments in closed-end funds, carry

risks and investors may lose principal value. Capital markets are

volatile and can decline significantly in response to adverse

issuer, political, regulatory, market, or economic developments. It

is important to remember that there are risks inherent in any

investment and there is no assurance that any investment or asset

class will provide positive performance over time. Value style

investing presents the risk that the holdings or securities may

never reach our estimate of intrinsic value because the market

fails to recognize what the portfolio management team considers the

true business value or because the portfolio management team has

misjudged those values. In addition, value style investing may fall

out of favor and underperform growth or other style investing

during given periods. Non-U.S. investing presents additional risks,

such as the potential for adverse political, currency, economic,

social or regulatory developments in a country, including lack of

liquidity, excessive taxation, and differing legal and accounting

standards. Non-U.S. securities, including American Depository

Receipts (ADRs) and other depository receipts, are also subject to

interest rate and currency exchange rate risks.

Fixed income instruments are subject to interest rate, inflation

and credit risks. Such investments may be secured, partially

secured or unsecured and may be unrated, and whether or not rated,

may have speculative characteristics. The market price of the

Fund’s fixed income investments will change in response to changes

in interest rates and other factors. Generally, when interest rates

rise, the values of fixed income instruments fall, and vice versa.

Certain fixed income instruments are subject to prepayment risk

and/or default risk.

Private placement securities are securities that are not

registered under the federal securities laws and are generally

eligible for sale only to certain eligible investors. Private

placements may be illiquid, and thus more difficult to sell,

because there may be relatively few potential purchasers for such

investments, and the sale of such investments may also be

restricted under securities laws.

The Fund may use leverage. While the use of leverage may help

increase the distribution and return potential of the Fund, it also

increases the volatility of the Fund’s net asset value (NAV), and

potentially increases volatility of its distributions and market

price. There are costs associated with the use of leverage,

including ongoing dividend and/or interest expenses. There also may

be expenses for issuing or administering leverage. Leverage changes

the Fund’s capital structure through the issuance of preferred

shares and/or debt, both of which are senior to the common shares

in priority of claims. If short-term interest rates rise, the cost

of leverage will increase and likely will reduce returns earned by

the Fund’s common stockholders.

The Fund invests in Special Purpose Acquisition Companies

(“SPACS”). SPACS involve risks, including but not limited to: (i)

having no operating history or ongoing business other than seeking

acquisitions; (ii) not being required to undergo the rigorous due

diligence of a traditional initial public offering (“IPO”); (ii)

investors may become exposed to speculative investments; (iv)

providing sponsors certain incentives not found in traditional IPOs

which may cause potential conflicts of interest in the structure of

the SPAC; (v) inability to identify an acquisition target or obtain

approval for a target by shareholders; and/or (vi) shareholders may

not have sufficient voting power to disapprove a SPAC transaction.

As with any investment, an investment in a SPAC may lose value.

SPACS may be considered illiquid, may be subject to restrictions on

resale, or may be diluted by additional offerings.

This material has been distributed for informational purposes

only and should not be considered as investment advice or a

recommendation of any particular security, strategy or investment

product. No part of this material may be reproduced in any form, or

referred to in any other publication, without express written

permission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230508005709/en/

Investors: 800-982-4372, crm@fpa.com, www.fpa.com

Media: Tucker Hewes, Hewes Communications, Inc., 212-207-9451,

tucker@hewescomm.com

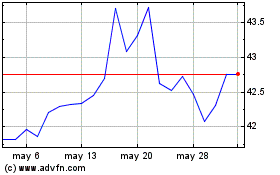

Source Capital (NYSE:SOR)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Source Capital (NYSE:SOR)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024