Spirit Realty Capital Shareholders Approve Realty Income Merger

19 Enero 2024 - 3:05PM

Business Wire

Realty Income Corporation (NYSE: O) ("Realty Income"), The

Monthly Dividend Company®, and Spirit Realty Capital, Inc. (NYSE:

SRC) (“Spirit”), today announced that Spirit stockholders approved

all of the proposals necessary for the closing of the previously

announced merger pursuant to which Realty Income will acquire

Spirit. No approval of Realty Income shareholders is required in

connection with the merger.

At the special meeting of Spirit stockholders held today,

approximately 99.8% of the votes cast were voted in favor of the

merger, which represented approximately 86.4% of the outstanding

shares of Spirit common stock.

The final voting results on the proposals voted on at the

special meeting will be set forth in Spirit’s Form 8-K filed with

the U.S. Securities and Exchange Commission (“SEC”) after

certification by its inspector of election.

The merger is subject to customary closing conditions and is

expected to close on January 23, 2024. Under the terms of the

merger agreement, at the closing of the merger, Spirit common

shareholders will receive 0.762 newly-issued Realty Income common

shares for each Spirit common share they own immediately prior to

the effective time of the merger. In addition, at the closing of

the merger, all of Spirit’s outstanding shares of Series A

Cumulative Redeemable Preferred Stock will be exchanged for shares

of Realty Income Series A Cumulative Redeemable Preferred Stock,

which are expected trade under the symbol “O PR” on the New York

Stock Exchange.

About Realty Income

Realty Income, The Monthly Dividend Company®, is an S&P 500

company and member of the S&P 500 Dividend Aristocrats® index.

We invest in people and places to deliver dependable monthly

dividends that increase over time. The company is structured as a

real estate investment trust (“REIT”), and its monthly dividends

are supported by the cash flow from over 13,250 real estate

properties primarily owned under long-term lease agreements with

commercial clients. To date, the company has declared 643

consecutive common stock monthly dividends throughout its 55-year

operating history and increased the dividend 123 times since Realty

Income’s public listing in 1994 (NYSE: O). Additional information

about the company can be obtained from the corporate website at

www.realtyincome.com.

About Spirit Realty

Spirit Realty Capital, Inc. (NYSE: SRC) is a premier net-lease

REIT that primarily invests in single-tenant, operationally

essential real estate assets subject to long-term leases. As of

September 30, 2023, Spirit’s diverse portfolio consisted of 2,037

retail, industrial and other properties across 49 states, which

were leased to 338 tenants operating in 37 industries. As of

September 30, 2023, Spirit’s properties were approximately 99.6%

occupied.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Exchange Act of 1934, as amended. When used in

this press release, the words “estimated,” “anticipated,” “expect,”

“believe,” “intend,” “continue,” “should,” “may,” “likely,”

“plans,” and similar expressions are intended to identify

forward-looking statements. Forward-looking statements include

discussions of Realty Income’s business and portfolio; strategy,

plans, and the intentions of management; and statements regarding

the merger including the anticipated closing date. Forward-looking

statements are subject to risks, uncertainties, and assumptions

about Realty Income which may cause its actual future results to

differ materially from expected results. Some of the factors that

could cause actual results to differ materially are, among others,

its continued qualification as a REIT; general domestic and foreign

business, economic, or financial conditions; competition;

fluctuating interest and currency rates; inflation and its impact

on its clients and us; access to debt and equity capital markets

and other sources of funding; continued volatility and uncertainty

in the credit markets and broader financial markets; other risks

inherent in the real estate business including its clients’

defaults under leases, increased client bankruptcies, potential

liability relating to environmental matters, illiquidity of real

estate investments, and potential damages from natural disasters;

impairments in the value of its real estate assets; changes in

domestic and foreign income tax laws and rates; its clients’

solvency; property ownership through joint ventures and

partnerships which may limit control of the underlying investments;

current or future epidemics or pandemics, measures taken to limit

their spread, the impacts on Realty Income, its business, its

clients (including those in the theater and fitness industries),

and the economy generally; the loss of key personnel; the outcome

of any legal proceedings to which Realty Income is a party or which

may occur in the future; acts of terrorism and war; the structure,

timing and completion of the merger and any effects of the

announcement, pendency or completion of the merger, including the

anticipated benefits therefrom; and those additional risks and

factors discussed in its reports filed with the SEC. Readers are

cautioned not to place undue reliance on forward-looking

statements. Forward-looking statements are not guarantees of future

plans and performance and speak only as of the date of this press

release. Actual plans and operating results may differ materially

from what is expressed or forecasted in this press release. Realty

Income does not undertake any obligation to update forward-looking

statements or publicly release the results of any forward-looking

statements that may be made to reflect events or circumstances

after the date these statements were made.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240119881439/en/

Steve Bakke, CFA Senior Vice President, Corporate Finance (858)

284-5425 sbakke@realtyincome.com

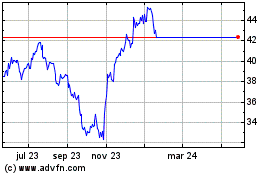

Spirit Realty Capital (NYSE:SRC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Spirit Realty Capital (NYSE:SRC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024