false12-31000103102900010310292024-01-052024-01-05

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 5, 2024

STARTEK, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

1-12793

|

84-1370538

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

4610 South Ulster Street,

Suite 150, Denver, Colorado, 80237

(Address of principal executive offices, including zip code)

(303) 262-4500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

SRT

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

As previously disclosed in the Current Report on Form 8-K filed by StarTek, Inc., a Delaware corporation (the “Company”) with the Securities and Exchange

Commission (the “SEC”) on October 10, 2023, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”), dated as of October 10, 2023 with Stockholm Parent, LLC, a Delaware limited liability company (“Parent”), and Stockholm

Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Parent (“Merger Sub”). Parent and Merger Sub are affiliates of CSP Alpha Holdings Parent Pte Ltd, a private company limited by shares incorporated under the laws of Singapore

(“CSP Alpha”), and CSP Victory Limited, an entity governed by the laws of the Cayman Islands (“CSP Victory” and together with CSP Alpha, each, a “Sponsor” and collectively, the “Sponsors”), which provided for Merger Sub to be merged with and into the

Company (the “Merger”), with the Company surviving the Merger as a wholly-owned subsidiary of Parent. On January 5, 2024, the Merger became effective and the Company and Parent took various other actions, as discussed further below.

The foregoing descriptions of the Merger and the Merger Agreement do not purport to be complete and are qualified in their entirety by reference to the full

text of the Merger Agreement which is included as Exhibit 2.1 to the Current Report on Form 8-K filed with the SEC by the Company on October 10, 2023 and is incorporated by reference herein.

Item 1.02. Termination of a Material Definitive Agreement.

The information set forth in the Introductory Note and under Item 2.01 of this Current Report on Form 8-K is incorporated by reference in its entirety into

this Item 1.02.

As previously disclosed, on January 23, 2018, the Company and Amazon.com, Inc. (“Amazon”) entered into a Transaction Agreement and a Warrant to Purchase

Common Stock (the “Warrant”), pursuant to which the Company agreed to issue to Amazon.com NV Investment Holdings LLC, a wholly owned subsidiary of Amazon, a warrant to acquire up to 4,000,000 shares of the Company’s common stock, par value $0.01 per

share (“Common Stock”) subject to certain vesting events set forth therein. In connection with the consummation of the Merger, the Warrant was terminated at the Effective Time (as defined below) by the parties thereto and was of no further force or

effect as of the Effective Time.

Item 2.01. Completion of Acquisition of Disposition of Assets.

The information set forth in the Introductory Note and under Items 5.01, 5.02 and 5.03 of this Current Report on Form 8-K is incorporated by reference in its

entirety into this Item 2.01.

On January 5, 2024, pursuant to the terms of the Merger Agreement, the Merger was effected, with Merger Sub being merged with and into the Company, and the

Company surviving the Merger as a wholly-owned subsidiary of Parent. At the effective time of the Merger (the “Effective Time”), each share of Common Stock issued and outstanding immediately prior to the Effective Time (other than shares held by (i)

the Company, Parent, Merger Sub or any of their respective subsidiaries and (ii) shareholders of the Company who have properly exercised their dissenters’ rights under Delaware law) was converted into the right to receive $4.30 in cash, without

interest (the “Merger Consideration”).

Immediately prior to the Effective Time, each outstanding option to purchase shares granted under a Company Stock Plan (as defined in the Merger Agreement)

(other than any option granted under the Company Stock Purchase Plan (as defined in the Merger Agreement)) (the “Company Options”) was fully vested and cancelled in exchange for the right to receive an amount in cash equal to the product of (i) the

total number of shares of Company Common Stock subject to such cancelled Company Option multiplied by (ii) the excess, if any, of (a) the Merger Consideration over (b) the exercise price per share of Company Common Stock subject to such cancelled

Company Option, without interest and less required tax withholdings. Any Company Option with respect to which the exercise price per share subject thereto was equal or greater than the Merger Consideration was cancelled in exchange for no

consideration.

Immediately prior to the Effective Time, each outstanding restricted stock unit award (including, for the avoidance of doubt, each such restricted stock unit

that is subject to a deferral election) granted under a Company Stock Plan (the “Company RSU Awards”) was fully vested (provided, each Company RSU Award that is subject to performance-based vesting conditions were deemed to be vested at the greater

of (i) actual performance determined as of immediately prior to the Effective Time and (ii) target level of performance) and was cancelled in exchange for the right to receive amount in cash equal to the product obtained by multiplying (a) the

aggregate number of vested restricted stock units subject to such Company RSU Award by (b) the Merger Consideration, without interest and less required tax withholdings.

Immediately prior to the Effective Time, each outstanding deferred stock units (including, for the avoidance of doubt, each such deferred stock units that was

subject to a deferral election) under a Company Stock Plan (the “Company DSU Awards”) was fully vested and were cancelled in exchange for the right to receive an amount in cash equal to the product obtained by multiplying (i) the aggregate number of

vested deferred stock units subject to such Company DSU Award by (ii) the Merger Consideration, without interest and less required tax withholdings.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, which is included as Exhibit 2.1 to the Current Report on Form 8-K filed

with the SEC by the Company on October 10, 2023 and is incorporated by reference herein.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

The information set forth in the Introductory Note and Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.01.

In connection with the consummation of the Merger, the Company notified representatives of the New York Stock Exchange (“NYSE”) that the Merger had been completed and requested that NYSE delist the Common Stock. As a

result, trading of the Common Stock, which traded under the ticker symbol “SRT” on NYSE, was suspended before the open of trading on January 5, 2024. In addition, the Company requested that NYSE file with the SEC a Notification of Removal from

Listing and/or Registration under Section 12(b) of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”) on Form 25 in order to effect the delisting of the shares of the Common Stock from NYSE and deregistration of such shares

under Section 12(b) of the Exchange Act. The Company also intends to file with the SEC a Form 15 under the Exchange Act requesting the deregistration of the shares of the Common Stock under Section 12(g) of the Exchange Act and suspension of the

Company’s reporting obligations under Section 13 and 15(d) of the Exchange Act.

Item 3.03. Material Modification of Rights of Security Holders.

The information set forth in the Introductory Note and Items 2.01, 3.01, 5.01, 5.02 and 5.03 of this Current Report on Form 8-K is incorporated herein by

reference in its entirety into this Item 3.03.

As a result of the Merger, each share of Common Stock that was issued and outstanding immediately prior to the Effective Time (except as described in Item

2.01 of this Current Report on Form 8-K) was automatically cancelled and exchanged, at the Effective Time, into the right to receive the Merger Consideration. Accordingly, at the Effective Time, each holder of Common Stock immediately prior to the

Effective Time ceased to have any rights as a stockholder of the Company other than the right to receive the Merger Consideration pursuant to the Merger Agreement.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, which is

included as Exhibit 2.1 to the Current Report on Form 8-K filed with the SEC by the Company on October 10, 2023 and is incorporated by reference herein.

Item 5.01. Change of Control of Registrant.

The information set forth in the Introductory Note and under Items 2.01, 3.01, 3.03, 5.02 and 5.03 of this Current Report on Form 8-K is incorporated by

reference in its entirety into this Item 5.01.

In connection with the Merger and at the Effective Time, Merger Sub merged with and into the Company, with the Company continuing as the Surviving

Corporation and a wholly-owned subsidiary of Parent and accordingly, a change of control of the Company occurred. The total amount of consideration payable to the Company’s stockholders in connection with the Merger was approximately $74.4 million.

The funds used by Parent to consummate the Merger and complete the related transactions came from equity contributions from the Sponsors.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

The information set forth in the Introductory Note and under Item 2.01 of this Current Report on Form 8-K is incorporated by reference in its entirety into this Item 5.02.

Pursuant to the Merger Agreement, effective upon the consummation of the Merger, each of Albert Aboody, Sudip Banerjee, Jerry Schafer, Anupam Pahuja and

Nallathur S. Balasubramanian voluntarily resigned from the board of directors of the Company and the committees on which they served, if any.

Additionally, Bharat Rao, Sanjay Chakrabarty and Mukesh Sharda will remain as directors of the Company.

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement which is

included as Exhibit 2.1 to the Current Report on Form 8-K filed with the SEC by the Company on October 10, 2023 and is incorporated by reference herein.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

The information set forth in the Introductory Note and under Item 2.01 of this Current Report on Form 8-K is incorporated by reference in its entirety into

this Item 5.03.

Promptly following the Effective Time, the Restated Certificate of Incorporation of the Company that was in effect immediately before the Effective Time was

amended and restated to be in the form attached hereto as Exhibit 3.1 (the “Amended and Restated Certificate of Incorporation”). In addition, promptly following Effective Time, the Amended and Restated Bylaws of the Company as in effect immediately

prior to the Effective Time were amended and restated in their entirety to be in the form attached hereto as Exhibit 3.2 (the “Amended and Restated Bylaws”).

The foregoing description does not purport to be complete and is qualified in its entirety by reference to the full texts of the Amended and Restated

Certificate of Incorporation and Amended and Restated Bylaws, which are filed as Exhibit 3.1 and Exhibit 3.2 hereto, respectively, and incorporated by reference herein.

Item 7.01. Regulation FD Disclosure.

On January 5, 2024, the Company issued a press release announcing the completion of the Merger, a copy of which is furnished as Exhibit 99.1 hereto and is

incorporated into this Item 7.01 by reference.

Item 9.01. Financial Statements and Exhibits.

|

Exhibit

No.

|

|

Description

|

| |

|

|

|

|

|

Agreement and Plan of Merger, dated October 10, 2023, by and among StarTek, Inc., Stockholm Parent, LLC and Stockholm Merger Sub, Inc. (incorporated by reference to Exhibit 2.1 to the Company’s Form 8-K filed on

October 10, 2023 (File No. 001-12793)).

|

|

|

|

Amended and Restated Certificate of Incorporation of StarTek, Inc., dated January 5, 2024.

|

|

|

|

Amended and Restated Bylaws of StarTek, Inc., dated January 5, 2024.

|

|

|

|

Press Release, dated January 5, 2024.

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

* All schedules and exhibits to this agreement have

been omitted in accordance with Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished supplementally to the SEC upon its request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

STARTEK, INC.

|

| |

|

|

| |

|

|

| |

|

|

|

Date: January 5, 2024

|

By:

|

/s/ Bharat Rao

|

| |

|

Bharat Rao

|

| |

|

Chief Executive Officer

|

Exhibit 3.1

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

STARTEK, INC.

FIRST:

The name of this corporation is StarTek, Inc. (the “Corporation”).

SECOND:

The address of the registered office of the Corporation in the State of Delaware is c/o Corporation Service

Company, 251 Little Falls Drive, in the City of Wilmington, County of New Castle, Delaware 19808. The name of the registered agent of the Corporation in the State of Delaware at such address is Corporation Service Company.

THIRD:

The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized

under the General Corporation Law of the State of Delaware (the “DGCL”), as it now exists or may hereafter be amended and supplemented.

FOURTH:

The total number of shares of stock which the Corporation shall have authority to issue is 100 shares, having a par

value of $0.01 per share. The Corporation shall be permitted to have fractional shares.

FIFTH:

A director of the Corporation shall not be liable to the Corporation or its stockholders for monetary damages for

breach of fiduciary duty as a director, except to the extent such exemption from liability or limitation thereof is not permitted under the DGCL as the same exists or may hereafter be amended. Any amendment, modification or repeal of the

foregoing sentence shall not adversely affect any right or protection of a director of the Corporation hereunder in respect of any act or omission occurring prior to the time of such amendment, modification or repeal.

SIXTH:

Unless and except to the extent that the by-laws of the Corporation (the “By-Laws”) shall so require, the election of directors of the Corporation need not be by written ballot.

SEVENTH:

To the fullest extent permitted by applicable law, the Corporation is authorized to provide indemnification of (and

advancement of expenses to) the directors, officers, employees and agents of the Corporation through provisions in the By-Laws, agreements with such directors, officers, employees and agents, vote of stockholders or disinterested directors or

otherwise, in excess of the indemnification and advancement otherwise permitted by Section 145 of the DGCL, as it now exists or may hereafter be amended and supplemented. Any amendment, repeal or modification of the foregoing provisions of this

Article Seventh shall not adversely affect any right or protection of a director, officer, employee or agent existing at the time of any acts or omissions of such director, officer, employee or agent occurring prior to such amendment, repeal or

modification.

EIGHTH:

In furtherance and not in limitation of the rights, powers, privileges and discretionary authority granted or

conferred by the DGCL or other statutes or laws of the State of Delaware, the Board of Directors is expressly authorized to make, alter, amend or repeal the By-Laws, without any action on the part of the stockholders, but the stockholders may

make additional By-Laws and may alter, amend or repeal any By-Law whether adopted by them or otherwise. The Corporation may in its By-Laws confer powers upon its Board of Directors in addition to the foregoing and in addition to the powers and

authorities expressly conferred upon the Board of Directors by applicable law.

REMAINDER OF PAGE INTENTIONALLY LEFT BLANK

AMENDED AND RESTATED BY-LAWS

OF

STOCKHOLM MERGER SUB, INC.

As effective on January 5, 2024

AMENDED AND RESTATED

BY-LAWS

OF

STOCKHOLM MERGER SUB, INC.

PREAMBLE

These by-laws (the “By-Laws”), are subject to,

and governed by, the General Corporation Law of the State of Delaware (the “DGCL”) and the certificate of incorporation of Stockholm Merger Sub, Inc. (as amended

or restated from time to time, the “Certificate of Incorporation”), a Delaware corporation (the “Corporation”) then in effect. In the event of a direct conflict between the provisions of these By-Laws and the mandatory provisions of the DGCL or the provisions of the Certificate of Incorporation, such provisions of

the DGCL or the Certificate of Incorporation, as the case may be, will be controlling.

I.

OFFICES

The address of the registered office of the Corporation in the State of Delaware is c/o Corporation Service Company, 251 Little Falls

Drive, in the City of Wilmington, County of New Castle, Delaware 19808. The name of the registered agent of the Corporation in the State of Delaware at such address is Corporation Service Company. The Corporation may also have offices at such other

places both within and without the State of Delaware as the board of directors of the Corporation (the “Board of Directors”), may from time to time determine or

the business of the Corporation may require.

II.

STOCKHOLDERS

Section 2.1. Time and Place of Meetings and Annual Meetings. All meetings of the stockholders for the election of directors or for any other purpose shall be held at such time and place, within or without the

State of Delaware, as shall be designated by the Board of Directors. In the absence of any such designation by the Board of Directors, each such meeting shall be held at the principal office of the Corporation. An annual meeting of stockholders shall

be held for the purpose of electing directors, and transacting such other business as may properly be brought before the meeting. The date of the annual meeting shall be determined by the Board of Directors.

Section 2.2. Special Meetings. Unless otherwise prescribed by law or by the Certificate of Incorporation, special meetings of stockholders, for any purpose or purposes, may be called either by the Board of

Directors or at the request in writing of stockholders holding at least fifty percent (50%) of the Common Stock of the Corporation issued and outstanding, and entitled to vote generally in the election of directors pursuant to the Certificate of

Incorporation. Such request by stockholders shall state the purpose of the proposed meeting. All special meetings of the stockholders shall be held at such place, within or without the State of Delaware, as shall be designated by the Board of

Directors. In the absence of any such designation by the Board of Directors, each such meeting shall be held at the principal office of the Corporation.

Section 2.3. Notice of Meetings. Written notice

of each meeting of the stockholders stating the place, date and time of the meeting shall be given not less than ten (10) nor more than sixty (60) days before the date of the meeting, to each stockholder entitled to vote at such meeting. The notice

of any special meeting of stockholders shall state the purpose or purposes for which the meeting is called.

Section 2.4. Quorum. The holders of a majority of

the Common Stock, issued and outstanding and entitled to vote thereat, present in person or represented by proxy, shall constitute a quorum at all meetings of the stockholders for the transaction of business, except as otherwise provided by law. If a

quorum is not present or represented, the chairman of the meeting or the holders of a majority of the stock present in person or represented by proxy at the meeting and entitled to vote thereat shall have power, by the affirmative vote of the holders

of a majority of such stock, to adjourn the meeting to another time and/or place, without notice other than announcement at the meeting, until a quorum shall be presented or represented. At such adjourned meeting, at which a quorum shall be present

or represented, any business may be transacted which might have been transacted at the original meeting. If the adjournment is for more than thirty days, or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of

the adjourned meeting shall be given to each stockholder of record entitled to vote at the meeting.

Section 2.5. Voting. Unless otherwise required by

law, the Certificate of Incorporation or these By-Laws, any question brought before any meeting of stockholders shall be decided by a majority of the votes cast by holders of the stock represented and entitled to vote thereon, with each such holder

having the number of votes per share and voting as a member of such classes of stockholders as may be provided in the Certificate of Incorporation, unless the question is one upon which, by express provision of law or of the Certificate of

Incorporation, a different vote is required, in which case such express provision shall govern and control the decision of such question. Such votes may be cast in person or by proxy but no proxy shall be voted on or after one year from its date,

unless such proxy provides for a longer period. The Board of Directors, in its discretion, or the officer of the Corporation presiding at a meeting of stockholders, in his discretion, may require that any votes cast at such meeting shall be cast by

written ballot.

Section 2.6. Informal Action by Stockholders. Any

action required to be taken at a meeting of the stockholders, or any other action which may be taken at a meeting of the stockholders, may be taken without a meeting if a consent in writing, setting forth the action so taken, shall be signed by

stockholders having not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all stockholders having a right to vote thereon were present and voted. Prompt notice of the taking of the

corporate action without a meeting by less than unanimous written consent shall be given to those stockholders who have not consented in writing and who, if the action had been taken at a meeting, would have been entitled to notice of the meeting if

the record date for notice of such meeting had been the date that written consents signed by a sufficient number of holders to take the action were duly delivered to the Corporation.

Section 2.7. List of Stockholders Entitled to

Vote. The officer of the Corporation who has charge of the stock ledger of the Corporation shall prepare and make, at least ten (10) days before every meeting of stockholders, a complete list of the stockholders entitled to vote at the

meeting, arranged in alphabetical order, and showing the address of each stockholder and the number of shares registered in the name of each stockholder. Such list shall be open to the examination of any stockholder, for any purpose germane to the

meeting, for a period of at least ten (10) days prior to the meeting: (i) on a reasonably accessible electronic network, provided that the

information required to gain access to such list is provided with the notice of the meeting, or (ii) during ordinary business hours, at the principle place of business of the Corporation. The list shall also be produced and kept at the time and place

of the meeting during the whole time thereof, and may be inspected by any stockholder of the Corporation who is present.

Section 2.8. Stock Ledger. The stock ledger of

the Corporation shall be the only evidence as to who are the stockholders entitled to examine the stock ledger, the list required by Section 2.7 of this Article II or the books of the Corporation, or to vote in person or by proxy at any meeting of

stockholders.

III.

DIRECTORS

Section 3.1. General Powers. The business and

affairs of the Corporation shall be managed and controlled by or under the direction of a Board of Directors, which may exercise all such powers of the Corporation and do all such lawful acts and things as are not by law or by the Certificate of

Incorporation or by these By-Laws directed or required to be exercised or done by the stockholders.

Section 3.2. Number and Election of Directors.

The Board of Directors shall consist of such number of members as is determined by resolution of the Board Directors; provided that the Board of

Directors shall consist of at least one (1) and no more than fifteen (15) members. Except as provided in Section 3.3 of this Article, directors shall be elected by a plurality of the votes cast at annual meetings of stockholders, and each director so

elected shall hold office until the next annual meeting and until his successor is duly elected and qualified, or until his earlier death, resignation or removal. Any director may resign at any time upon notice to the Corporation. Directors need not

be stockholders.

Section 3.3. Vacancies. Except as provided in the

Certificate of Incorporation, or as otherwise may be agreed between or among the stockholders pursuant to any stockholders agreement from time to time in effect, vacancies and newly created directorships resulting from any increase in the number of

directors may be filled by a majority of the votes of the directors then in office though less than a quorum, and each director so chosen shall hold office until his successor is elected and qualified or until his earlier death, resignation or

removal.

Section 3.4. Place of Meetings. The Board of

Directors may hold meetings, both regular and special, either within or without the State of Delaware.

Section 3.5. Regular Meetings. The Board of

Directors shall hold a regular meeting, to be known as the annual meeting, immediately following each annual meeting of the stockholders. Other regular meetings of the Board of Directors shall be held at such time and at such place as shall from time

to time be determined by the Board of Directors.

Section 3.6. Notice of Meetings. Notice of any

regular or special meeting of directors shall be given to each director by the secretary or by the directors calling the meeting. The notices of all meetings shall state the place, date, hour and purpose(s) of the meeting. Notice shall be duly given

to each director (i) by giving notice to such director in person or by telephone or electronic transmission or (ii) by delivering written notice by hand, to his or her last known business or home address in each case at least two (2) days in advance

of a regular meeting and 24 hours in advance of a special meeting.

Section 3.7. Special Meetings. Special meetings

of the Board of Directors may be called by any director or the President.

Section 3.8. Quorum. Except as may be otherwise

specifically provided by law, the Certificate of Incorporation, these By-Laws or as otherwise may be agreed between or among the stockholders pursuant to any stockholders agreement from time to time in effect, at all meetings of the Board of

Directors, a majority of the entire Board of Directors shall constitute a quorum for the transaction of business and, except as otherwise set forth in the Certificate of Incorporation, these Bylaws or as otherwise may be agreed between or among the

stockholders pursuant to any stockholders agreement from time to time in effect, the act of a majority of the votes cast by the directors present at any meeting at which there is a quorum shall be the act of the Board of Directors.

Section 3.9. Organization. The Chairman of the

Board of Directors, if elected, shall act as Chairman at all meetings of the Board of Directors. If a Chairman of the Board of Directors is not elected or, if elected, is not present, the President, or if the President is not present, a director

chosen by a majority of the votes of the directors present, shall act as Chairman at meetings of the Board of Directors.

Section 3.10. Action without Meeting. Unless

otherwise restricted by the Certificate of Incorporation or these By-Laws, any action required or permitted to be taken at any meeting of the Board of Directors or of any committee thereof may be taken without a meeting, if a consent in writing or by

electronic transmission, setting forth the action so taken, shall be signed by all of the directors of the Board or committee having a right to vote thereon.

Section 3.11. Attendance by Telephone. Unless

otherwise restricted by the Certificate of Incorporation or these By-Laws, members of the Board of Directors, or of any committee designated by the Board of Directors, may participate in a meeting of the Board of Directors, or any committee, by means

of conference telephone or other communications equipment by means of which all persons participating in the meeting can hear each other, and such participation in a meeting shall constitute presence in person at the meeting.

Section 3.12. Removal. Except as otherwise

provided in the Certificate of Incorporation, or as otherwise may be agreed between or among the stockholders pursuant to any stockholders agreement from time to time in effect, any one or more or all of the directors may be removed, with or without

cause, by the holders of a majority of the shares then entitled to vote at an election of directors.

Section 3.13. Compensation of Directors.

Directors may be paid such compensation for their services and such reimbursement for expenses of attendance at meetings as the Board of Directors may from time to time determine; provided, however, that all directors shall be provided the same compensation and reimbursement rights from

time to time in effect. No such payment shall preclude any director from serving the Corporation or any of its parent or subsidiary corporations or any of its stockholders in any other capacity and receiving compensation for such service.

Section 3.14. Committees. The Board of Directors

may, by resolution of the Board, designate one or more committees, each committee to consist of one or more directors of the Corporation, which, to the extent provided in the resolution or in these By-laws, shall have and may exercise such powers of

the Board of Directors in the management of the business and affairs of the Corporation, as the Board of Directors may by resolution determine and specify in the respective resolutions appointing them, subject to such restrictions as may be contained

in the Certificate of Incorporation or the laws of the State of Delaware. Such committee or committees shall have such name or names as may be determined from time to time by resolutions adopted by the Board of Directors. The committees shall keep

regular minutes of their proceedings and report the same to the Board of Directors when required. A majority of all the members of any such committee may fix its rules of procedure, determine its action and fix the time and place, whether within or

without the State of Delaware, of its meetings and specify what notice thereof, if any, shall be given, unless the Board of Directors shall otherwise by resolution provide. The Board of Directors shall have the power to change the membership of any

such committee at any time, to fill vacancies thereon and to discharge any such committee, either with or without cause, at any time. Each member of any such committee shall be paid such fee, if any, as shall be fixed by the Board of Directors for

each meeting of such committee which he or she shall attend and for his or her expenses, if any, of attendance at each regular or special meeting of such committee as shall be determined by the Board of Directors.

IV.

OFFICERS

Section 4.1. Enumeration. The officers of the

Corporation shall be chosen by the Board of Directors and may include a Chairman of the Board of Directors, President, a Secretary, a Treasurer and such other officers and agents, with such titles, as the Board of Directors shall deem appropriate.

The duties and responsibilities of such other officers and agents shall be determined by a resolution of the Board of Directors or, in the event the Board of Directors does not specify such duties and responsibilities, such other officers and agents

shall have such duties and responsibilities that are customarily associated with such titles. Any number of offices may be held by the same person. The officers of the Corporation need not be stockholders of the Corporation nor, except in the case of

the Chairman of the Board of Directors, need such officers be Directors of the Corporation.

Section 4.2. Term of Office. The officers of the

Corporation shall be elected at the annual meeting of the Board of Directors and shall hold office until their successors are elected and qualified. Any officer elected or appointed by the Board of Directors may be removed at any time by the Board of

Directors, subject to any terms or restrictions set forth in a written employment agreement with such officer, or as otherwise may be agreed between or among the stockholders pursuant to any stockholders agreement from time to time in effect. Any

vacancy occurring in any office of the Corporation required by this Article shall be filled by the Board of Directors, and any vacancy in any other office may be filled by the Board of Directors. Each successor shall hold office for the unexpired

term of his predecessor and until his successor is elected and qualified, or until his earlier death, resignation or removal.

Section 4.3. Chairman of the Board. The

Chairman of the Board if any, when elected, shall have general supervision, direction and control of the business and affairs of the Corporation, subject to the control of the Board of Directors, shall preside at meetings of stockholders and shall

have such other functions, authority and duties as customarily appertain to the Chairman of the Board of a business corporation or as may be prescribed by the Board of Directors. During the absence or disability of the President, the Chairman of the

Board of Directors shall exercise all the powers and discharge all the duties of the President. The Chairman of the Board of Directors shall also perform such other duties and may exercise such other powers as from time to time may be assigned to him

by these By-Laws.

Section 4.4. President; Chief Executive

Officer. Unless a separate Chief Executive Officer is appointed, the President shall serve as the Chief Executive Officer of the Corporation. The President shall, subject to the control of the Board of Directors and, if there be one,

the Chairman of the Board of Directors, have general supervision of the business of the Corporation and shall see that all orders and resolutions of the Board of Directors are carried into effect. In the absence or disability of the Chairman of the

Board of Directors, or if there be none, the President shall preside at all meetings of the stockholders and the Board of Directors. If there be no Chairman of the Board of Directors, the President shall be the chief executive officer of the

Corporation. The President shall also perform such other duties and may exercise such other powers as from time to time may be assigned to him by these By-Laws or by the Board of Directors.

Section 4.5. Secretary. The Secretary shall keep

a record of all proceedings of the stockholders of the Corporation and of the Board of Directors, and shall perform like duties for the standing committees when required. The Secretary shall give, or cause to be given, notice, if any, of all meetings

of the stockholders and shall perform such other duties as may be prescribed by the Board of Directors, the Chairman of the Board or the President. The Secretary shall also keep a register of the post office address of each stockholder which shall be

furnished to the Secretary by such stockholder, and have general charge of the stock transfer books of the Corporation.

Section 4.6. Treasurer. The Treasurer shall have

the custody of the corporate funds and securities and shall keep full and accurate accounts of receipts and disbursements in books belonging to the Corporation and shall deposit all moneys and other valuable effects in the name and to the credit of

the Corporation in such depositories as may be designated by the Board of Directors. The Treasurer shall disburse the funds of the Corporation as may be ordered by the Board of Directors, taking proper vouchers for such disbursements, and shall

render to the Chairman of the Board, the President and the Board of Directors, at its regular meetings or when the Board of Directors so requires, an account of all transactions as Treasurer and of the financial condition of the Corporation. The

Treasurer shall perform such other duties as may from time to time be prescribed by the Board of Directors, the Chairman of the Board or the President.

Section 4.7. Other Officers. The President or

Board of Directors may appoint other officers and agents for any Group, Division or Department into which this Corporation may be divided by the Board of Directors, with titles as the President or Board of Directors may from time to time deem

appropriate. All such officers and agents shall receive such compensation, have such tenure and exercise such authority as the President or Board of Directors may specify. All appointments made by the President hereunder and all the terms and

conditions thereof must be reported to the Board of Directors.

In no case shall an officer or agent of any one Group, Division or Department have authority to bind another Group, Division or Department

of the Company or to bind the Corporation except as to the business and affairs of the Group, Division or Department of which he or she is an officer or agent.

Section 4.8. Salaries. The salaries of the

elected officers shall be fixed from time to time by the Board of Directors and no officer shall be prevented from receiving such salary by reason of the fact that he is also a director of the Corporation.

Section 4.9. Voting Securities Held by the

Corporation. Unless otherwise provided by the Board of Directors, powers of attorney, proxies, waivers of notice of meeting, consents and other instruments relating to securities owned by the Corporation may be executed in the name of

and on behalf of the Corporation by the President or any Vice President and any such officer may, in the name of and on behalf of the Corporation, take all such action as any such officer may deem advisable to vote in person or by proxy at any

meeting of security holders of any corporation in which the Corporation may own securities and at any such meeting shall possess and may exercise any and all rights and powers incidental to the ownership of such securities and which, as the owner

thereof, the Corporation might have exercised and possessed if present. The Board of Directors, may, by resolution, from time to time confer like powers upon any other person or persons.

V.

CERTIFICATES OF STOCK

Section 5.1. Form. The shares of the Corporation

need not be represented by certificates; provided that the Board of Directors may provide by resolution or resolutions that some or all of any or

all classes or series of its stock shall be certificated shares. Certificates of stock in the Corporation, if any, shall be signed by or in the name of the Corporation by any two (2) authorized officers of the Corporation (or, if there shall only be

one (1) officer of the Corporation, by such officer). Any or all the signatures on the certificate may be an electronic signature. In case any officer, transfer agent or registrar who has signed or whose electronic signature has been placed upon a

certificate shall have ceased to be such officer, transfer agent or registrar before such certificate is issued, the certificate may be issued by the Corporation with the same effect as if such officer, transfer agent or registrar were such officer,

transfer agent or registrar at the date of its issue.

Section 5.2. Record Date. (a) In order that the

Corporation may determine the stockholders entitled to notice of any meeting of stockholders or any adjournment thereof, the Board of Directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the

record date is adopted by the Board of Directors, and which record date shall not be more than 60 nor less than 10 days before the date of such meeting. If the Board of Directors so fixes a date, such date shall also be the record date for

determining the stockholders entitled to vote at such meeting unless the Board of Directors determines, at the time it fixes such record date, that a later date on or before the date of the meeting shall be the date for making such determination. If

no record date is fixed by the Board of Directors, the record date for determining stockholders entitled to notice of and to vote at a meeting of stockholders shall be at the close of business on the day next preceding the day on which notice is

given, or, if notice is waived, at the close of business on the day next preceding the day on which the meeting is held. A determination of stockholders of record entitled to notice of or to vote at a meeting of stockholders shall apply to any

adjournment of the meeting; provided, however,

that the Board of Directors may fix a new record date for determination of stockholders entitled to vote at the adjourned meeting, and in such case shall also fix as the record date for stockholders entitled to notice of such adjourned meeting the

same or an earlier date as that fixed for determination of stockholders entitled to vote in accordance with the foregoing provisions of this Section 5.2(a) at

the adjourned meeting.

(b) In order that the Corporation may determine the stockholders entitled to consent to corporate action in writing without a meeting, the

Board of Directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted by the Board of Directors, and which date shall not be more than 10 days after the date upon which the

resolution fixing the record date is adopted by the Board of Directors. If no record date has been fixed by the Board of Directors, the record date for determining stockholders entitled to consent to corporate action in writing without a meeting, when

no prior action by the Board of Directors is required by this chapter, shall be the first date on which a signed written consent setting forth the action taken or proposed to be taken is delivered to the Corporation by delivery to its registered office

in this State, its principal place of business or an officer or agent of the Corporation having custody of the book in which proceedings of meetings of stockholders are recorded. Delivery made to a Corporation’s registered office shall be by hand or by

certified or registered mail, return receipt requested. If no record date has been fixed by the Board of Directors and prior action by the Board of Directors is required by this chapter, the record date for determining stockholders entitled to consent

to corporate action in writing without a meeting shall be at the close of business on the day on which the Board of Directors adopts the resolution taking such prior action.

(c) In order that the Corporation may determine the stockholders entitled to receive payment of any dividend or other distribution or

allotment of any rights or the stockholders entitled to exercise any rights in respect of any change, conversion or exchange of stock, or for the purpose of any other lawful action, the Board of Directors may fix a record date, which record date shall

not precede the date upon which the resolution fixing the record date is adopted, and which record date shall be not more than 60 days prior to such action. If no record date is fixed, the record date for determining stockholders for any such purpose

shall be at the close of business on the day on which the Board of Directors adopts the resolution relating thereto.

Section 5.3. Beneficial Owners.

The Corporation shall be entitled to recognize the exclusive right of a person registered on its books as the owner of shares to receive dividends, and to vote as such owner, and to hold liable for calls and assessments a person registered on its

books as the owner of shares, and shall not be bound to recognize any equitable or other claim to or interest in such share or shares on the part of any other person, whether or not it shall have express or other notice thereof, except as otherwise

provided by law. The Corporation shall not be required to register any transfer of shares made in violation of any agreement among a stockholder or investor in the Corporation and the Corporation, or recognize as a holder of any such shares any

transferee in such a violative transaction.

VI.

INDEMNIFICATION

Section 6.1. The Corporation shall indemnify every person who was or is a party or is or was threatened to be made a party to any

action, suit, or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that he is or was a director or officer of the Corporation or, while a director or officer of the Corporation, is or was serving at the

request of the Corporation as a director, officer, trustee, employee or agent of another corporation, partnership, joint venture, trust, enterprise or nonprofit entity, including service with respect to employee benefit plans (a “Covered

Person”), against expenses (including counsel fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with such action, suit or proceeding, to the full extent permitted by

applicable law as it presently exists or may hereafter be amended. Except as otherwise provided in Section 3 of this Article VI, the Corporation shall be required to indemnify a Covered Person in connection with a proceeding (or part thereof)

initiated by such Covered Person only if the proceeding (or part thereof) was authorized by the Board.

Section 6.2. Prepayment of Expenses. The Corporation shall, to the fullest extent not prohibited by applicable law, pay the expenses (including counsel fees) incurred by a

Covered Person in defending any proceeding in advance of its final disposition; provided, however, that, to the extent required by law, such payment of expenses in advance of the final disposition of the proceeding shall be made only upon receipt

of an undertaking by the Covered Person to repay all amounts advanced if it should be ultimately determined that the Covered Person is not entitled to be indemnified under this Article VI or otherwise.

Section 6.3. Claims. If a claim for indemnification (following the final disposition of such action, suit or proceeding) or advancement of expenses under this Article VI is not paid in full within 30 days after a written claim therefor by the Covered Person has been received by the Corporation, the Covered Person may

file suit to recover the unpaid amount of such claim and, if successful in whole or in part, shall be entitled to be paid the expense of prosecuting such claim. In any such action, the Corporation shall have the burden of proving that the Covered

Person is not entitled to the requested indemnification or advancement of expenses under applicable law.

Section 6.4. Nonexclusivity of Rights. The rights conferred on any Covered Person by this Article

VI shall not be exclusive of any other rights that such Covered Person may have or hereafter acquire under any statute, provision of the Certificate of Incorporation, these By-laws, agreement, vote of stockholders or disinterested

directors or otherwise.

Section 6.5. Other Sources. The Corporation’s obligation, if any, to indemnify or to advance expenses to any Covered Person who was or is serving at its request as a

director, officer, trustee, employee or agent of another corporation, partnership, joint venture, trust, enterprise, nonprofit entity or employee benefit plan shall be reduced by any amount such Covered Person may collect as indemnification or

advancement of expenses from such other corporation, partnership, joint venture, trust, enterprise, nonprofit entity or employee benefit plan.

Section 6.6. Primacy. Any Covered Person entitled to indemnification, advancement of expenses and/or insurance, in each case pursuant to this Article VI, may have certain rights to indemnification, advancement of expenses and/or insurance provided by or on behalf of other third parties (each, an “Indemnitor”). Notwithstanding anything to the contrary in these By-Laws or otherwise the Corporation is the Indemnitor of first resort (i.e., for the avoidance of doubt, the Corporation’s obligations to

each Indemnitee are primary, any obligations of any Indemnitor to advance expenses or to provide indemnification for the same expenses or liabilities incurred by each Indemnitee are secondary), (ii) the Corporation will be required to advance the

full amount of expenses incurred by each Indemnitee and will be liable for the full amount of all liabilities, expenses, judgments, penalties, fines and amounts paid in settlement to the extent legally permitted and as required by this Article VI, without regard to any rights each Indemnitee may have against any Indemnitors, and (iii) the Corporation irrevocably waives, relinquishes and releases

the Indemnitors from any and all claims against the Indemnitors for contribution, subrogation or any other recovery of any kind in respect thereof. Notwithstanding anything to the contrary in these By-Laws or otherwise, no advancement or payment by

the Indemnitors on behalf of an Indemnitee with respect to any claim for which such Indemnitee has sought indemnification or advancement of expenses from the Corporation will affect the foregoing and the Indemnitors will have a right of contribution

and/or be subrogated to the extent of such advancement or payment to all of the rights of recovery of such Indemnitee against the Corporation. The Indemnitors are express third party beneficiaries of the terms of this Article VI.

VII.

GENERAL PROVISIONS

Section 7.1. Fiscal Year. The fiscal year of the

Corporation shall end on December 31 of each year or as fixed by resolution of the Board of Directors.

Section 7.2. Notices. Whenever written notice is

required by law, the Certificate of Incorporation or these By-Laws, to be given to any director, member of a committee or stockholder, such notice may be given by mail, addressed to such director, member of a committee or stockholder, at his address

as it appears on the records of the Corporation, with postage thereon prepaid, and such notice shall be deemed to be given at the time when the same shall be deposited in the United States mail. Written notice may also be given personally or, subject

to applicable law, by telegram, telex, cable, facsimile or other electronic transmission.

Section 7.3. Waiver of Notice. Whenever any

notice is required to be given under law or the provisions of the Certificate of Incorporation or these By-Laws, a waiver thereof in writing or by electronic transmission, signed or given by the person or persons entitled to said notice, whether

before or after the time stated therein, shall be deemed equivalent to notice.

Section 7.4. Resignations and Removals. Any

director or any officer, whenever elected or appointed, may resign at any time either in a writing served upon, or by an electronic transmission sent to, the President or the Secretary, and such resignation shall be deemed to be effective as of the

close of business on the date said writing or transmission is received by the President or Secretary. No formal action shall be required of the Board of Directors or the stockholders to make any such resignation effective. Except as the Board of

Directors may otherwise determine, no officer who resigns or is removed shall have any right to any compensation as an officer for any period following his resignation or removal, or any right to damages on account of such removal, whether his

compensation be by the month or by the year or otherwise, unless such compensation is expressly provided in a duly authorized written agreement with the Corporation.

Section 7.5. Disbursements. All checks or demands

for money and notes of the Corporation shall be signed by such officer or officers or such other person or persons as the Board of Directors may from time to time designate.

VIII.

AMENDMENTS

These By-Laws may be altered, amended or repealed or new By-Laws may be adopted by the Board of Directors. The fact that the power to

amend, alter, repeal or adopt the By-Laws has been conferred upon the Board of Directors shall not divest the stockholders of the same powers.

IX.

SUBJECT TO CERTIFICATE OF INCORPORATION

These By-Laws and the provisions hereof are subject to the terms and conditions of the Certificate of Incorporation of the Corporation

(including any certificates of designations filed thereunder), and in the event of any conflict between these By-Laws and the Certificate of Incorporation, the Certificate of Incorporation shall control.

11

Exhibit 99.1

Startek Announces Completion of Take-Private Acquisition by Funds Managed by CSP Management Limited

DENVER — January 5, 2024 — Startek, Inc. (NYSE: SRT) (“Startek” or the “Company”), a global

customer experience (CX) solutions provider, today announced the successful completion of its take-private acquisition by funds managed by Capital Square Partners (“CSP”), effective today, January 5, 2024.

Under the terms of the definitive agreement for the transaction that was previously announced on October 10, 2023, CSP will acquire all shares of Startek common stock not already owned by CSP for $4.30 per share in cash.

With the completion of the take-private acquisition, Startek’s common stock ceased trading before market open on January 5, 2024 and will no longer be listed on the New York Stock Exchange.

Advisors

Houlihan Lokey Capital, Inc. served as financial advisor to the Special Committee of the Board of Directors of Startek, and Gibson, Dunn & Crutcher LLP served as its legal counsel. Latham & Watkins LLP served as legal counsel to CSP.

About Startek®

For more than 35 years, Startek has delivered customer experience (CX) excellence for the world’s leading brands. Spread across 12 countries, our 38,000 associates create memorable, personalized experiences in both voice and non-voice channels. Our

clients span from fortune 500s to fast-growing startups in a diverse range of industries including cable, media and telecom; travel and hospitality; retail and e-commerce and banking and financial services.

By creating closer connections, Startek delivers value for our clients, opportunity for our people and sustainable growth for our shareholders.

To learn more visit www.startek.com and follow us on LinkedIn.

About Capital Square Partners

Founded in 2014 in Singapore, Capital Square Partners is a private equity firm investing in cross-border technology and business services across Southeast Asia and India. As a sector focused fund manager with $1.5 billion under management, CSP is one of

the largest dedicated technology and technology enabled business services private equity fund manager in Asia. Over the past decade, the team has invested, created and exited a number of leading companies in technology services sector, including Minacs,

Indecomm, GAVS Technologies and Accion Labs. Capital Square Partners holds a Capital Markets Services (CMS) License from the Monetary Authority of Singapore. For more information click here.

Startek Contacts

Investor Relations

Cody Cree

Gateway Group, Inc.

(949) 574-3860

SRT@gateway-grp.com

Media Relations

Neha Iyer

Startek

neha.iyer@startek.com

v3.23.4

Document and Entity Information

|

Jan. 05, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 05, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

1-12793

|

| Entity Registrant Name |

STARTEK, INC.

|

| Entity Central Index Key |

0001031029

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

84-1370538

|

| Entity Address, Address Line One |

4610 South Ulster Street

|

| Entity Address, Address Line Two |

Suite 150

|

| Entity Address, City or Town |

Denver

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80237

|

| City Area Code |

303

|

| Local Phone Number |

262-4500

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

SRT

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

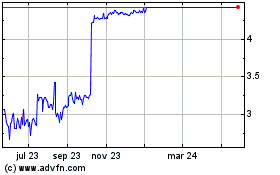

StarTek (NYSE:SRT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

StarTek (NYSE:SRT)

Gráfica de Acción Histórica

De May 2023 a May 2024