0001473844FALSE00014738442024-10-252024-10-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________

Form 8-K/A

____________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported): October 25, 2024

Stellar Bancorp, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Texas | 001-38280 | 20-8339782 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) |

9 Greenway Plaza, Suite 110

Houston, Texas 77046

(Address of Principal Executive Offices) (Zip Code)

(713) 210-7600

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| £ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| £ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| £ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| £ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | STEL | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company £

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. £

Explanatory Note

This Amendment No. 1 to the Current Report on Form 8-K amends Item 9.01 of the Current Report on Form 8-K filed on October 25, 2024 (the “Original Form 8-K”) solely to correct the hyperlink provided for Exhibit 99.3 thereto (the “Exhibit”). As previously furnished, the hyperlink did not provide access to the linked document of the Exhibit, which has been corrected on Exhibit 99.3 to this Amendment No. 1. No other changes were made to the Original Form 8-K.

The information in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, or otherwise subject to the liabilities of such section, and is not deemed incorporated by reference into any filings under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 2.02. Results of Operations and Financial Condition.

On October 25, 2024, Stellar Bancorp, Inc. (the “Company”) issued a press release announcing its financial results for the third quarter of 2024. A copy of the press release, as well as a copy of the accompanying earnings presentation, are furnished as Exhibit 99.1 and Exhibit 99.2 hereto, respectively, and incorporated herein by reference.

In accordance with General Instruction B.2 to Form 8-K, the information furnished in this Item 2.02, Exhibit 99.1 and Exhibit 99.2 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, and such information shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, (the ”Securities Act”), except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure

(a) Conference Call.

On Friday, October 25, 2024, at 8:00 a.m., Central Time, the Company will host an investor conference call and webcast to review its third quarter financial results. The webcast will include a presentation that consists of information regarding the Company’s financial results. The presentation materials will be posted on the Company’s website before the open of the market on Friday, October 25, 2024. The presentation materials are attached hereto as Exhibit 99.2 and are incorporated herein by reference.

(b) Redemption of Subordinated Notes.

On October 25, 2025, the Company issued a press release announcing the intention of Stellar Bank, its wholly owned subsidiary (the “Bank”), to redeem all of the Bank’s $40.0 million aggregate principal amount of Fixed-to-Floating Rate Subordinated Notes due December 15, 2027 (‘the Notes”) The redemption price for the Notes will be equal to 100% of principal amount of the Notes redeemed, plus any accrued and unpaid interest to, but excluding, the redemption date.

In accordance with the Notes, the holders of the Notes will receive notice of the redemption, the redemption price and further instructions and details related to the process of such redemption. A copy of the press release is furnished as Exhibit 99.3 and incorporated herein by reference.

In accordance with General Instruction B.2 to Form 8-K, the information furnished in this Item 7.01, including Exhibit 99.2 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, and such information shall not be deemed incorporated by reference in any filing under the Securities Act, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

Exhibits. The following are furnished as exhibits to this Current Report on Form 8-K:

| | | | | |

| Exhibit Number | Description of Exhibit |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements anticipated in such statements. Forward-looking statements speak only as of the date they are made and, except as required by law, the Company does not assume any duty to update forward-looking statements. Such forward-looking statements include, but are not limited to, statements concerning the Company’s plans, objectives, strategies, expectations, intentions and other statements that are not statements of historical fact, and may be identified by words such as “anticipates,” “believes,” “building,” “continue,” “could,” “drive,” “estimates,” “expects,” “extent,” “focus,” “forecasts,” “goal,” “guidance,” “intends,” “may,” “might,” “outlook,” “plan,” “position,” “probable,” “progressing,” “projects,” “prudent,” “seeks,” “should,” “target,” “view,” “will” or “would” or the negative of these words and phrases or similar words or phrases. For a list of factors that could cause actual results to differ materially from those set forth in the forward-looking statements, see the risk factors described in the Company’s most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q and other reports that are filed with the Securities and Exchange Commission. All forward-looking statements are qualified in their entirety by this cautionary statement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| STELLAR BANCORP, INC. |

| | |

| Date: October 25, 2024 | By: | /s/ Paul P. Egge |

| | Paul P. Egge |

| | Chief Financial Officer |

Exhibit 99.1

PRESS RELEASE

STELLAR BANCORP, INC. REPORTS

THIRD QUARTER 2024 RESULTS

HOUSTON, October 25, 2024 - Stellar Bancorp, Inc. (the “Company” or “Stellar”) (NYSE: STEL) today reported net income of $33.9 million, or diluted earnings per share of $0.63, for the third quarter of 2024 compared to net income of $29.8 million, or diluted earnings per share of $0.56, for the second quarter of 2024.

“We are pleased to announce our third quarter 2024 financial results that reflect our work as we mark the second anniversary of our transformational merger completed on October 1, 2022,” said Robert R. Franklin, Jr., Stellar’s Chief Executive Officer. “Since the merger, we have focused on building the foundation of Stellar Bank. Those efforts include constructing the scalable infrastructure to support an institution with more than $10 billion of assets while we have built a strong capital base, significantly increased our liquidity position and maintained a disciplined focus on credit. We have also significantly reduced our exposure to commercial real estate and invested in assets to help us grow a more balanced loan portfolio through additional commercial and industrial lending experience and leadership.”

“Stellar Bank is positioned for success as the economic and political environment becomes clearer. Although we can’t predict timing of interest rate changes, we feel comfortable with our revenue outlook. The election cycle will soon be complete and some of the elevated stress and uncertainty around the process will abate,” Mr. Franklin continued.

“Our markets remain resilient. We have positioned the Bank for quality growth and we look forward to furthering the Stellar brand in our markets,” concluded Mr. Franklin.

Third Quarter 2024 Financial Highlights

•Solid Profitability: Third quarter 2024 net income of $33.9 million, or diluted earnings per share of $0.63, translated into an annualized return on average assets of 1.27%, an annualized return on average equity of 8.49% and an annualized return on average tangible equity of 13.63%(1).

•Strong Net Interest Margin: Tax equivalent net interest margin was 4.19% for the third quarter of 2024 compared to 4.24% for the second quarter of 2024. The tax equivalent net interest margin, excluding purchase accounting accretion (“PAA”), was 3.91%(1) for the third quarter of 2024 compared to 3.82%(1) for the second quarter of 2024.

•Meaningful Capital and Book Value Build: Total risk-based capital ratio increased to 15.91% at September 30, 2024 from 15.34% at June 30, 2024, book value per share increased to $30.43 from $29.23 at June 30, 2024 and tangible book value per share increased to $19.28(1) from $18.00(1) at June 30, 2024.

•Improving Credit Metrics: Nonperforming loans decreased $18.8 million to $32.1 million at September 30, 2024 from $50.9 million at June 30, 2024. Allowance for credit losses on loans to nonperforming loans increased to 262.92% at September 30, 2024 from 186.17% at June 30, 2024.

Third Quarter 2024 Results

Net interest income in the third quarter of 2024 increased $97 thousand, or 0.1%, to $101.5 million from $101.4 million for the second quarter of 2024. The net interest margin on a tax equivalent basis decreased 5 basis points to 4.19% for the third quarter of 2024 from 4.24% for the second quarter of 2024. The decrease in the net interest margin from the prior quarter was primarily due to the impact of decreased interest rates on interest earning assets, partially offset by decreased rates on interest-bearing liabilities. Net interest income for the third quarter of 2024 benefited from $6.8 million of income from purchase accounting accretion compared to $10.1 million in the second quarter of

_____________________

(1) Refer to page 10 of this earnings release for the calculation of this non-GAAP financial measure.

2024. Excluding purchase accounting accretion, net interest income (tax equivalent) for the third quarter of 2024 would have been $94.8 million(1) and the tax equivalent net interest margin would have been 3.91%(1).

Noninterest income for the third quarter of 2024 was $6.3 million, an increase of $886 thousand, or 16.4%, compared to $5.4 million for the second quarter of 2024. Noninterest income increased in the third quarter of 2024 compared to the second quarter of 2024 primarily due to

an increase in gains on sales of assets and Small Business Investment Company income recognized in the third quarter of 2024 compared to the second quarter of 2024.

Noninterest expense for the third quarter of 2024 decreased $150 thousand, or 0.2%, to $71.1 million compared to $71.2 million for the second quarter of 2024. The decrease in noninterest expense in the third quarter of 2024 compared to the second quarter of 2024 was primarily due to a $2.0 million decrease in other noninterest expense and a $520 thousand decrease in regulatory assessments, partially offset by a $2.1 million increase in salaries and employee benefits.

The efficiency ratio was 66.18% for the third quarter of 2024 compared to 66.63% for the second quarter of 2024. Annualized returns on average assets, average equity and average tangible equity were 1.27%, 8.49% and 13.63%(1) for the third quarter of 2024, respectively, compared to 1.13%, 7.78% and 12.82%(1), respectively, for the second quarter of 2024.

Financial Condition

Total assets at September 30, 2024 were $10.63 billion, a decrease of $93.9 million, compared to $10.72 billion at June 30, 2024.

Total loans at September 30, 2024 decreased $162.8 million to $7.55 billion compared to $7.71 billion at June 30, 2024. At September 30, 2024, the remaining balance of the purchase accounting accretion on loans was $81.4 million.

Total deposits at September 30, 2024 increased $17.3 million to $8.74 billion compared to $8.73 billion at June 30, 2024, due to increases in interest-bearing demand deposits and money market and savings deposits, partially offset by decreases in certificates and other time deposits and noninterest-bearing deposits. Shifts in the deposit mix were primarily driven by the current interest rate environment and an intensely competitive market for deposits.

During the third quarter 2024, the Company repurchased 108,984 shares at an average price per share of $26.10 under its share repurchase program.

Asset Quality

Nonperforming assets totaled $35.1 million, or 0.33% of total assets, at September 30, 2024, compared to $53.5 million, or 0.50% of total assets, at June 30, 2024. The allowance for credit losses on loans as a percentage of total loans was 1.12% at September 30, 2024 and 1.23% at June 30, 2024.

The third quarter of 2024 included a reversal of provision for credit losses of $6.0 million compared to a reversal of provision for credit losses of $1.9 million recorded during the second quarter of 2024. Net charge-offs for the third quarter of 2024 were $3.9 million, or 0.21% (annualized) of average loans, compared to net recoveries of $1 thousand, or 0.00% (annualized) of average loans, for the second quarter of 2024.

GAAP Reconciliation of Non-GAAP Financial Measures

Stellar’s management uses certain non-GAAP financial measures to evaluate its performance. Please refer to the GAAP Reconciliation and Management’s Explanation of Non-GAAP Financial Measures on page 10 of this earnings release for a reconciliation of these non-GAAP financial measures.

Conference Call

Stellar’s management team will host a conference call and webcast on Friday, October 25, 2024 at 8:00 a.m. Central Time (9:00 a.m. Eastern Time) to discuss its results for the second quarter of 2024. Participants may register for the conference call at https://registrations.events/direct/Q4I635867 to receive the dial-in numbers and unique PIN to access the call. If you need assistance in obtaining a dial-in number, please contact IR@stellar.bank. A simultaneous audio-only webcast may be accessed at https://events.q4inc.com/attendee/992487934. If you are unable to participate during the live webcast, the webcast will be accessible via the Investor Relations section of the Company’s website at ir.stellar.bank.

About Stellar Bancorp, Inc.

Stellar Bancorp, Inc. is a bank holding company headquartered in Houston, Texas. Stellar’s principal banking subsidiary, Stellar Bank, provides a diversified range of commercial banking services primarily to small- to medium-sized businesses and individual customers across the Houston, Dallas, Beaumont and surrounding communities in Texas.

Investor Relations

IR@stellar.bank

Forward-Looking Statements

Certain statements in this press release which are not historical in nature are intended to be, and are hereby identified as, “forward-looking statements” for purposes of the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements about the benefits of the Company’s merger with Allegiance Bancshares, Inc. (the “Merger”), including future financial performance and operating results, the Company’s plans, business and growth strategies, objectives, expectations and intentions, and other statements that are not historical facts, including projections of macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact economic trends, and any such variations may be material. Forward-looking statements may be identified by terminology such as “may,” “will,” “should,” “could,” “scheduled,” “plans,” “intends,” “projects,” “anticipates,” “expects,” “believes,” “estimates,” “potential,” “would,” or “continue” or negatives of such terms or other comparable terminology.

All forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors that may cause the actual results, performance or achievements of Stellar to differ materially from any results expressed or implied by such forward-looking statements. Such factors include, among others: the risk that the cost savings and any revenue synergies from the Merger may not be fully realized or may take longer than anticipated to be realized; disruption to our business as a result of the Merger; the risk that the integration of operations will be materially delayed or will be more costly or difficult than we expected or that we are otherwise unable to successfully integrate our legacy businesses; the amount of the costs, fees, expenses and charges related to the Merger; reputational risk and the reaction of our customers, suppliers, employees or other business partners to the Merger; changes in the interest rate environment, the value of Stellar’s assets and obligations and the availability of capital and liquidity; general competitive, economic, political and market conditions; and other factors that may affect future results of Stellar including changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; disruptions to the economy and the U.S. banking system caused by recent bank failures, risks associated with uninsured deposits and responsive measures by federal or state governments or banking regulators, including increases in the cost of our deposit insurance assessments and other actions of the Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation and Texas Department of Banking and legislative and regulatory actions and reforms.

Additional factors which could affect the Company’s future results can be found in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, in each case filed with the SEC and available on the SEC’s website at https://www.sec.gov. We disclaim any obligation and do not intend to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events or otherwise, except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements.

Stellar Bancorp, Inc.

Financial Highlights

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 2024 | | 2023 |

| September 30 | | June 30 | | March 31 | | December 31 | | September 30 |

| (Dollars in thousands) |

| ASSETS | | | | | | | | | |

| Cash and due from banks | $ | 103,735 | | | $ | 110,341 | | | $ | 74,663 | | | $ | 121,004 | | | $ | 94,970 | |

| Interest-bearing deposits at other financial institutions | 412,482 | | | 379,909 | | | 325,079 | | | 278,233 | | | 207,302 | |

| Total cash and cash equivalents | 516,217 | | | 490,250 | | | 399,742 | | | 399,237 | | | 302,272 | |

| | | | | | | | | |

| Available for sale securities, at fair value | 1,691,752 | | | 1,630,971 | | | 1,523,100 | | | 1,395,680 | | | 1,414,952 | |

| | | | | | | | | |

| Loans held for investment | 7,551,124 | | | 7,713,897 | | | 7,908,111 | | | 7,925,133 | | | 8,004,528 | |

| Less: allowance for credit losses on loans | (84,501) | | | (94,772) | | | (96,285) | | | (91,684) | | | (93,575) | |

| Loans, net | 7,466,623 | | | 7,619,125 | | | 7,811,826 | | | 7,833,449 | | | 7,910,953 | |

| | | | | | | | | |

| Accrued interest receivable | 39,473 | | | 43,348 | | | 45,466 | | | 44,244 | | | 43,536 | |

| Premises and equipment, net | 113,742 | | | 113,984 | | | 115,698 | | | 118,683 | | | 119,332 | |

| Federal Home Loan Bank stock | 20,123 | | | 15,089 | | | 16,050 | | | 25,051 | | | 29,022 | |

| Bank-owned life insurance | 106,876 | | | 106,262 | | | 105,671 | | | 105,084 | | | 104,699 | |

| Goodwill | 497,318 | | | 497,318 | | | 497,318 | | | 497,318 | | | 497,318 | |

| Core deposit intangibles, net | 98,116 | | | 104,315 | | | 110,513 | | | 116,712 | | | 122,944 | |

| Other assets | 79,537 | | | 103,001 | | | 103,838 | | | 111,681 | | | 120,432 | |

| Total assets | $ | 10,629,777 | | | $ | 10,723,663 | | | $ | 10,729,222 | | | $ | 10,647,139 | | | $ | 10,665,460 | |

| | | | | | | | | |

| | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | | |

| Deposits: | | | | | | | | | |

| Noninterest-bearing | $ | 3,303,048 | | | $ | 3,308,441 | | | $ | 3,323,149 | | | $ | 3,546,815 | | | $ | 3,656,288 | |

| Interest-bearing | | | | | | | | | |

| Demand | 1,571,504 | | | 1,564,405 | | | 1,576,261 | | | 1,659,999 | | | 1,397,492 | |

| Money market and savings | 2,280,651 | | | 2,213,031 | | | 2,203,767 | | | 2,136,777 | | | 2,128,950 | |

| Certificates and other time | 1,587,398 | | | 1,639,426 | | | 1,691,539 | | | 1,529,876 | | | 1,503,891 | |

| Total interest-bearing deposits | 5,439,553 | | | 5,416,862 | | | 5,471,567 | | | 5,326,652 | | | 5,030,333 | |

| Total deposits | 8,742,601 | | | 8,725,303 | | | 8,794,716 | | | 8,873,467 | | | 8,686,621 | |

| | | | | | | | | |

| Accrued interest payable | 16,915 | | | 12,327 | | | 12,227 | | | 11,288 | | | 7,612 | |

| Borrowed funds | 60,000 | | | 240,000 | | | 215,000 | | | 50,000 | | | 323,981 | |

| Subordinated debt | 110,064 | | | 109,964 | | | 109,864 | | | 109,765 | | | 109,665 | |

| Other liabilities | 74,074 | | | 70,274 | | | 66,717 | | | 81,601 | | | 76,735 | |

| Total liabilities | 9,003,654 | | | 9,157,868 | | | 9,198,524 | | | 9,126,121 | | | 9,204,614 | |

| | | | | | | | | |

| SHAREHOLDERS’ EQUITY: | | | | | | | | | |

| Common stock | 535 | | | 536 | | | 536 | | | 533 | | | 533 | |

| Capital surplus | 1,238,619 | | | 1,238,477 | | | 1,235,221 | | | 1,232,627 | | | 1,231,686 | |

| Retained earnings | 474,905 | | | 447,948 | | | 425,130 | | | 405,945 | | | 385,600 | |

| Accumulated other comprehensive loss | (87,936) | | | (121,166) | | | (130,189) | | | (118,087) | | | (156,973) | |

| Total shareholders’ equity | 1,626,123 | | | 1,565,795 | | | 1,530,698 | | | 1,521,018 | | | 1,460,846 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 10,629,777 | | | $ | 10,723,663 | | | $ | 10,729,222 | | | $ | 10,647,139 | | | $ | 10,665,460 | |

Stellar Bancorp, Inc.

Financial Highlights

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| 2024 | | 2023 | | 2024 | | 2023 |

| September 30 | | June 30 | | March 31 | | December 31 | | September 30 | | September 30 | | September 30 |

| |

| INTEREST INCOME: | | | | | | | | | | | | | |

| Loans, including fees | $ | 132,372 | | | $ | 135,885 | | | $ | 134,685 | | | $ | 139,114 | | | $ | 138,948 | | | $ | 402,942 | | | $ | 398,608 | |

| Securities: | | | | | | | | | | | | | |

| Taxable | 13,898 | | | 11,923 | | | 9,293 | | | 9,622 | | | 9,493 | | | 35,114 | | | 28,872 | |

| Tax-exempt | 814 | | | 816 | | | 818 | | | 418 | | | 437 | | | 2,448 | | | 2,135 | |

| Deposits in other financial institutions | 4,692 | | | 3,555 | | | 3,627 | | | 3,021 | | | 2,391 | | | 11,874 | | | 9,027 | |

| Total interest income | 151,776 | | | 152,179 | | | 148,423 | | | 152,175 | | | 151,269 | | | 452,378 | | | 438,642 | |

| | | | | | | | | | | | | |

| INTEREST EXPENSE: | | | | | | | | | | | | | |

| Demand, money market and savings deposits | 29,440 | | | 28,399 | | | 27,530 | | | 25,033 | | | 23,557 | | | 85,369 | | | 62,302 | |

| Certificates and other time deposits | 18,073 | | | 18,758 | | | 15,084 | | | 15,075 | | | 13,282 | | | 51,915 | | | 26,211 | |

| Borrowed funds | 840 | | | 1,700 | | | 1,774 | | | 4,154 | | | 5,801 | | | 4,314 | | | 13,653 | |

| Subordinated debt | 1,916 | | | 1,912 | | | 1,917 | | | 1,983 | | | 1,908 | | | 5,745 | | | 5,647 | |

| Total interest expense | 50,269 | | | 50,769 | | | 46,305 | | | 46,245 | | | 44,548 | | | 147,343 | | | 107,813 | |

| NET INTEREST INCOME | 101,507 | | | 101,410 | | | 102,118 | | | 105,930 | | | 106,721 | | | 305,035 | | | 330,829 | |

| (Reversal of) provision for credit losses | (5,985) | | | (1,935) | | | 4,098 | | | 1,047 | | | 2,315 | | | (3,822) | | | 7,896 | |

| Net interest income after provision for credit losses | 107,492 | | | 103,345 | | | 98,020 | | | 104,883 | | | 104,406 | | | 308,857 | | | 322,933 | |

| | | | | | | | | | | | | |

| NONINTEREST INCOME: | | | | | | | | | | | | | |

| Service charges on deposit accounts | 1,594 | | | 1,648 | | | 1,598 | | | 1,520 | | | 1,620 | | | 4,840 | | | 4,544 | |

| Gain (loss) on sale of assets | 432 | | | (64) | | | 513 | | | 198 | | | — | | | 881 | | | 192 | |

| Bank-owned life insurance | 614 | | | 591 | | | 587 | | | 573 | | | 551 | | | 1,792 | | | 1,605 | |

| Debit card and ATM income | 551 | | | 543 | | | 527 | | | 542 | | | 935 | | | 1,621 | | | 4,454 | |

| Other | 3,111 | | | 2,698 | | | 3,071 | | | 4,053 | | | 1,589 | | | 8,880 | | | 6,881 | |

| Total noninterest income | 6,302 | | | 5,416 | | | 6,296 | | | 6,886 | | | 4,695 | | | 18,014 | | | 17,676 | |

| | | | | | | | | | | | | |

| NONINTEREST EXPENSE: | | | | | | | | | | | | | |

| Salaries and employee benefits | 41,123 | | | 39,061 | | | 41,376 | | | 40,464 | | | 39,495 | | | 121,560 | | | 116,570 | |

| Net occupancy and equipment | 4,570 | | | 4,503 | | | 4,390 | | | 4,572 | | | 4,455 | | | 13,463 | | | 12,360 | |

| Depreciation | 1,911 | | | 1,948 | | | 1,964 | | | 1,955 | | | 1,952 | | | 5,823 | | | 5,629 | |

| Data processing and software amortization | 5,706 | | | 5,501 | | | 4,894 | | | 5,000 | | | 4,798 | | | 16,101 | | | 14,526 | |

| Professional fees | 1,714 | | | 1,620 | | | 2,662 | | | 3,867 | | | 997 | | | 5,996 | | | 4,088 | |

| Regulatory assessments and FDIC insurance | 1,779 | | | 2,299 | | | 1,854 | | | 5,169 | | | 1,814 | | | 5,932 | | | 5,863 | |

| Amortization of intangibles | 6,212 | | | 6,215 | | | 6,212 | | | 6,247 | | | 6,876 | | | 18,639 | | | 20,636 | |

| Communications | 827 | | | 847 | | | 937 | | | 743 | | | 663 | | | 2,611 | | | 2,053 | |

| Advertising | 878 | | | 891 | | | 765 | | | 1,004 | | | 877 | | | 2,534 | | | 2,623 | |

| Acquisition and merger-related expenses | — | | | — | | | — | | | 3,072 | | | 3,421 | | | — | | | 12,483 | |

| Other | 6,346 | | | 8,331 | | | 6,356 | | | 5,848 | | | 5,400 | | | 21,033 | | | 15,722 | |

| Total noninterest expense | 71,066 | | | 71,216 | | | 71,410 | | | 77,941 | | | 70,748 | | | 213,692 | | | 212,553 | |

| INCOME BEFORE INCOME TAXES | 42,728 | | | 37,545 | | | 32,906 | | | 33,828 | | | 38,353 | | | 113,179 | | | 128,056 | |

| Provision for income taxes | 8,837 | | | 7,792 | | | 6,759 | | | 6,562 | | | 7,445 | | | 23,388 | | | 24,825 | |

| NET INCOME | $ | 33,891 | | | $ | 29,753 | | | $ | 26,147 | | | $ | 27,266 | | | $ | 30,908 | | | $ | 89,791 | | | $ | 103,231 | |

| | | | | | | | | | | | | |

| EARNINGS PER SHARE | | | | | | | | | | | | | |

| Basic | $ | 0.63 | | | $ | 0.56 | | | $ | 0.49 | | | $ | 0.51 | | | $ | 0.58 | | | $ | 1.68 | | | $ | 1.94 | |

| Diluted | $ | 0.63 | | | $ | 0.56 | | | $ | 0.49 | | | $ | 0.51 | | | $ | 0.58 | | | $ | 1.68 | | | $ | 1.94 | |

Stellar Bancorp, Inc.

Financial Highlights

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| 2024 | | 2023 | | 2024 | | 2023 |

| September 30 | | June 30 | | March 31 | | December 31 | | September 30 | | September 30 | | September 30 |

| (Dollars and share amounts in thousands, except per share data) |

| Net income | $ | 33,891 | | $ | 29,753 | | $ | 26,147 | | $ | 27,266 | | $ | 30,908 | | $ | 89,791 | | $ | 103,231 |

| | | | | | | | | | | | | |

| Earnings per share, basic | $ | 0.63 | | $ | 0.56 | | $ | 0.49 | | $ | 0.51 | | $ | 0.58 | | $ | 1.68 | | $ | 1.94 |

| Earnings per share, diluted | $ | 0.63 | | $ | 0.56 | | $ | 0.49 | | $ | 0.51 | | $ | 0.58 | | $ | 1.68 | | $ | 1.94 |

| Dividends per share | $ | 0.13 | | $ | 0.13 | | $ | 0.13 | | $ | 0.13 | | $ | 0.13 | | $ | 0.39 | | $ | 0.39 |

| | | | | | | | | | | | | |

Return on average assets(A) | 1.27 | % | | 1.13 | % | | 0.98 | % | | 1.02 | % | | 1.14 | % | | 1.13 | % | | 1.28 | % |

Return on average equity(A) | 8.49 | % | | 7.78 | % | | 6.88 | % | | 7.33 | % | | 8.34 | % | | 7.73 | % | | 9.52 | % |

Return on average tangible equity(A)(B) | 13.63 | % | | 12.82 | % | | 11.47 | % | | 12.61 | % | | 14.47 | % | | 12.67 | % | | 16.86 | % |

Net interest margin (tax equivalent)(A)(C) | 4.19 | % | | 4.24 | % | | 4.26 | % | | 4.40 | % | | 4.37 | % | | 4.23 | % | | 4.55 | % |

Net interest margin (tax equivalent) excluding PAA(A)(B)(C) | 3.91 | % | | 3.82 | % | | 3.91 | % | | 3.91 | % | | 3.87 | % | | 3.88 | % | | 4.07 | % |

Efficiency ratio(D) | 66.18 | % | | 66.63 | % | | 66.18 | % | | 69.21 | % | | 63.50 | % | | 66.33 | % | | 61.02 | % |

| | | | | | | | | | | | | |

| Capital Ratios | | | | | | | | | | | | | |

| Stellar Bancorp, Inc. (Consolidated) | | | | | | | | | | | | | |

| Equity to assets | 15.30 | % | | 14.60 | % | | 14.27 | % | | 14.29 | % | | 13.70 | % | | 15.30 | % | | 13.70 | % |

Tangible equity to tangible assets(B) | 10.27 | % | | 9.53 | % | | 9.12 | % | | 9.04 | % | | 8.37 | % | | 10.27 | % | | 8.37 | % |

| Estimated Total capital ratio (to risk-weighted assets) | 15.91 | % | | 15.34 | % | | 14.62 | % | | 14.02 | % | | 13.61 | % | | 15.91 | % | | 13.61 | % |

Estimated Common equity Tier 1 capital (to risk weighted assets) | 13.62 | % | | 12.98 | % | | 12.29 | % | | 11.77 | % | | 11.30 | % | | 13.62 | % | | 11.30 | % |

Estimated Tier 1 capital (to risk-weighted assets) | 13.74 | % | | 13.10 | % | | 12.41 | % | | 11.89 | % | | 11.41 | % | | 13.74 | % | | 11.41 | % |

Estimated Tier 1 leverage (to average tangible assets) | 11.25 | % | | 10.93 | % | | 10.55 | % | | 10.18 | % | | 9.82 | % | | 11.25 | % | | 9.82 | % |

| Stellar Bank | | | | | | | | | | | | | |

| Estimated Total capital ratio (to risk-weighted assets) | 15.07 | % | | 14.65 | % | | 14.13 | % | | 13.65 | % | | 13.32 | % | | 15.07 | % | | 13.32 | % |

Estimated Common equity Tier 1 capital (to risk-weighted assets) | 13.63 | % | | 13.12 | % | | 12.61 | % | | 12.20 | % | | 11.80 | % | | 13.63 | % | | 11.80 | % |

Estimated Tier 1 capital (to risk-weighted assets) | 13.63 | % | | 13.12 | % | | 12.61 | % | | 12.20 | % | | 11.80 | % | | 13.63 | % | | 11.80 | % |

Estimated Tier 1 leverage (to average tangible assets) | 11.16 | % | | 10.94 | % | | 10.72 | % | | 10.44 | % | | 10.15 | % | | 11.16 | % | | 10.15 | % |

| | | | | | | | | | | | | |

| Other Data | | | | | | | | | | | | | |

| Weighted average shares: | | | | | | | | | | | | | |

| Basic | 53,541 | | 53,572 | | 53,343 | | 53,282 | | 53,313 | | 53,485 | | 53,211 |

| Diluted | 53,580 | | 53,608 | | 53,406 | | 53,350 | | 53,380 | | 53,531 | | 53,300 |

| Period end shares outstanding | 53,446 | | 53,564 | | 53,551 | | 53,291 | | 53,322 | | 53,446 | | 53,322 |

| Book value per share | $ | 30.43 | | $ | 29.23 | | $ | 28.58 | | $ | 28.54 | | $ | 27.40 | | $ | 30.43 | | $ | 27.40 |

Tangible book value per share(B) | $ | 19.28 | | $ | 18.00 | | $ | 17.23 | | $ | 17.02 | | $ | 15.76 | | $ | 19.28 | | $ | 15.76 |

| Employees - full-time equivalents | 1,040 | | 1,045 | | 1,007 | | 998 | | 1,008 | | 1,040 | | 1,008 |

(A)Interim periods annualized.

(B)Refer to the calculation of these non-GAAP financial measures and a reconciliation to their most directly comparable GAAP financial measures on page 10 of this Earnings Release.

(C)Net interest margin represents net interest income divided by average interest-earning assets.

(D)Represents total noninterest expense divided by the sum of net interest income plus noninterest income, excluding net gains and losses on the sale of loans, securities and assets. Additionally, taxes and provision for credit losses are not part of this calculation.

Stellar Bancorp, Inc.

Financial Highlights

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30, 2024 | | June 30, 2024 | | September 30, 2023 |

| Average Balance | | Interest Earned/

Interest Paid | | Average Yield/Rate | | Average Balance | | Interest Earned/

Interest Paid | | Average Yield/Rate | | Average Balance | | Interest Earned/

Interest Paid | | Average Yield/Rate |

| (Dollars in thousands) |

| Assets | | | | | | | | | | | | | | | | | |

| Interest-Earning Assets: | | | | | | | | | | | | | | | | | |

| Loans | $ | 7,627,522 | | | $ | 132,372 | | | 6.90 | % | | $ | 7,808,320 | | | $ | 135,885 | | | 7.00 | % | | $ | 8,043,706 | | | $ | 138,948 | | | 6.85 | % |

| Securities | 1,676,614 | | | 14,712 | | | 3.49 | % | | 1,549,638 | | | 12,739 | | | 3.31 | % | | 1,471,916 | | | 9,930 | | | 2.68 | % |

| Deposits in other financial institutions | 339,493 | | | 4,692 | | | 5.50 | % | | 258,916 | | | 3,555 | | | 5.52 | % | | 181,931 | | | 2,391 | | | 5.21 | % |

| Total interest-earning assets | 9,643,629 | | | $ | 151,776 | | | 6.26 | % | | 9,616,874 | | | $ | 152,179 | | | 6.36 | % | | 9,697,553 | | | $ | 151,269 | | | 6.19 | % |

| Allowance for credit losses on loans | (94,785) | | | | | | | (96,306) | | | | | | | (99,892) | | | | | |

| Noninterest-earning assets | 1,077,422 | | | | | | | 1,103,297 | | | | | | | 1,143,634 | | | | | |

| Total assets | $ | 10,626,266 | | | | | | | $ | 10,623,865 | | | | | | | $ | 10,741,295 | | | | | |

| | | | | | | | | | | | | | | | | |

| Liabilities and Shareholders' Equity | | | | | | | | | | | | | | | | | |

| Interest-Bearing Liabilities: | | | | | | | | | | | | | | | | | |

| Interest-bearing demand deposits | $ | 1,606,736 | | | $ | 12,458 | | | 3.08 | % | | $ | 1,545,096 | | | $ | 12,213 | | | 3.18 | % | | $ | 1,400,508 | | | $ | 10,415 | | | 2.95 | % |

| Money market and savings deposits | 2,254,767 | | | 16,982 | | | 3.00 | % | | 2,227,393 | | | 16,186 | | | 2.92 | % | | 2,166,610 | | | 13,142 | | | 2.41 | % |

| Certificates and other time deposits | 1,620,908 | | | 18,073 | | | 4.44 | % | | 1,694,536 | | | 18,758 | | | 4.45 | % | | 1,400,367 | | | 13,282 | | | 3.76 | % |

| Borrowed funds | 49,077 | | | 840 | | | 6.81 | % | | 112,187 | | | 1,700 | | | 6.09 | % | | 411,212 | | | 5,801 | | | 5.60 | % |

| Subordinated debt | 110,007 | | | 1,916 | | | 6.93 | % | | 109,910 | | | 1,912 | | | 7.00 | % | | 109,608 | | | 1,908 | | | 6.91 | % |

| Total interest-bearing liabilities | 5,641,495 | | | $ | 50,269 | | | 3.54 | % | | 5,689,122 | | | $ | 50,769 | | | 3.59 | % | | 5,488,305 | | | $ | 44,548 | | | 3.22 | % |

| | | | | | | | | | | | | | | | | |

| Noninterest-Bearing Liabilities: | | | | | | | | | | | | | | | | | |

| Noninterest-bearing demand deposits | 3,303,726 | | | | | | | 3,308,633 | | | | | | | 3,695,592 | | | | | |

| Other liabilities | 93,127 | | | | | | | 87,986 | | | | | | | 86,389 | | | | | |

| Total liabilities | 9,038,348 | | | | | | | 9,085,741 | | | | | | | 9,270,286 | | | | | |

| Shareholders’ equity | 1,587,918 | | | | | | | 1,538,124 | | | | | | | 1,471,009 | | | | | |

| Total liabilities and shareholders’ equity | $ | 10,626,266 | | | | | | | $ | 10,623,865 | | | | | | | $ | 10,741,295 | | | | | |

| | | | | | | | | | | | | | | | | |

| Net interest rate spread | | | | | 2.72 | % | | | | | | 2.77 | % | | | | | | 2.97 | % |

| | | | | | | | | | | | | | | | | |

| Net interest income and margin | | | $ | 101,507 | | | 4.19 | % | | | | $ | 101,410 | | | 4.24 | % | | | | $ | 106,721 | | | 4.37 | % |

| | | | | | | | | | | | | | | | | |

| Net interest income and net interest margin (tax equivalent) | | | $ | 101,578 | | | 4.19 | % | | | | $ | 101,482 | | | 4.24 | % | | | | $ | 106,919 | | | 4.37 | % |

| | | | | | | | | | | | | | | | | |

| Cost of funds | | | | | 2.24 | % | | | | | | 2.27 | % | | | | | | 1.92 | % |

| Cost of deposits | | | | | 2.15 | % | | | | | | 2.16 | % | | | | | | 1.69 | % |

Stellar Bancorp, Inc.

Financial Highlights

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| Average Balance | | Interest Earned/

Interest Paid | | Average Yield/Rate | | Average Balance | | Interest Earned/

Interest Paid | | Average Yield/Rate |

| (Dollars in thousands) |

| Assets | | | | | | | | | | | |

| Interest-Earning Assets: | | | | | | | | | | | |

| Loans | $ | 7,790,957 | | | $ | 402,942 | | | 6.91 | % | | $ | 7,957,911 | | | $ | 398,608 | | | 6.70 | % |

| Securities | 1,556,462 | | | 37,562 | | | 3.22 | % | | 1,525,808 | | | 31,007 | | | 2.72 | % |

| Deposits in other financial institutions | 287,960 | | | 11,874 | | | 5.51 | % | | 251,475 | | | 9,027 | | | 4.80 | % |

| Total interest-earning assets | 9,635,379 | | | $ | 452,378 | | | 6.27 | % | | 9,735,194 | | | $ | 438,642 | | | 6.02 | % |

| Allowance for credit losses on loans | (94,236) | | | | | | | (96,570) | | | | | |

| Noninterest-earning assets | 1,104,426 | | | | | | | 1,148,847 | | | | | |

| Total assets | $ | 10,645,569 | | | | | | | $ | 10,787,471 | | | | | |

| | | | | | | | | | | |

| Liabilities and Shareholders' Equity | | | | | | | | | | | |

| Interest-Bearing Liabilities: | | | | | | | | | | | |

| Interest-bearing demand deposits | $ | 1,616,313 | | | $ | 36,949 | | | 3.05 | % | | $ | 1,478,547 | | | $ | 28,141 | | | 2.54 | % |

| Money market and savings deposits | 2,211,148 | | | 48,420 | | | 2.93 | % | | 2,291,588 | | | 34,161 | | | 1.99 | % |

| Certificates and other time deposits | 1,586,623 | | | 51,915 | | | 4.37 | % | | 1,164,572 | | | 26,211 | | | 3.01 | % |

| Borrowed funds | 98,374 | | | 4,314 | | | 5.86 | % | | 333,220 | | | 13,653 | | | 5.48 | % |

| Subordinated debt | 109,909 | | | 5,745 | | | 6.98 | % | | 109,508 | | | 5,647 | | | 6.89 | % |

| Total interest-bearing liabilities | 5,622,367 | | | $ | 147,343 | | | 3.50 | % | | 5,377,435 | | | $ | 107,813 | | | 2.68 | % |

| | | | | | | | | | | |

| Noninterest-Bearing Liabilities: | | | | | | | | | | | |

| Noninterest-bearing demand deposits | 3,379,096 | | | | | | | 3,878,760 | | | | | |

| Other liabilities | 92,527 | | | | | | | 81,894 | | | | | |

| Total liabilities | 9,093,990 | | | | | | | 9,338,089 | | | | | |

| Shareholders’ equity | 1,551,579 | | | | | | | 1,449,382 | | | | | |

| Total liabilities and shareholders' equity | $ | 10,645,569 | | | | | | | $ | 10,787,471 | | | | | |

| | | | | | | | | | | |

| Net interest rate spread | | | | | 2.77 | % | | | | | | 3.34 | % |

| | | | | | | | | | | |

| Net interest income and margin | | | $ | 305,035 | | | 4.23 | % | | | | $ | 330,829 | | | 4.54 | % |

| | | | | | | | | | | |

| Net interest income and net interest margin (tax equivalent) | | | $ | 305,266 | | | 4.23 | % | | | | $ | 331,549 | | | 4.55 | % |

| | | | | | | | | | | |

| Cost of funds | | | | | 2.19 | % | | | | | | 1.56 | % |

| Cost of deposits | | | | | 2.09 | % | | | | | | 1.34 | % |

Stellar Bancorp, Inc.

Financial Highlights

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| 2024 | | 2023 |

| September 30 | | June 30 | | March 31 | | December 31 | | September 30 |

| (Dollars in thousands) |

| Period-end Loan Portfolio: | | | | | | | | | |

| Commercial and industrial | $ | 1,347,876 | | $ | 1,392,435 | | $ | 1,451,462 | | $ | 1,409,002 | | $ | 1,474,600 |

| Paycheck Protection Program (PPP) | 2,877 | | 3,629 | | 4,293 | | 5,100 | | 5,968 |

| Real estate: | | | | | | | | | |

| Commercial real estate (including multi-family residential) | 3,976,296 | | 4,029,671 | | 4,049,885 | | 4,071,807 | | 4,076,606 |

| Commercial real estate construction and land development | 890,316 | | 922,805 | | 1,039,443 | | 1,060,406 | | 1,078,265 |

| 1-4 family residential (including home equity) | 1,112,235 | | 1,098,681 | | 1,049,316 | | 1,047,174 | | 1,024,945 |

| Residential construction | 161,494 | | 200,134 | | 252,573 | | 267,357 | | 289,553 |

| Consumer and other | 60,030 | | 66,542 | | 61,139 | | 64,287 | | 54,591 |

| Total loans held for investment | $ | 7,551,124 | | $ | 7,713,897 | | $ | 7,908,111 | | $ | 7,925,133 | | $ | 8,004,528 |

| | | | | | | | | |

| Deposits: | | | | | | | | | |

| Noninterest-bearing | $ | 3,303,048 | | $ | 3,308,441 | | $ | 3,323,149 | | $ | 3,546,815 | | $ | 3,656,288 |

| Interest-bearing | | | | | | | | | |

| Demand | 1,571,504 | | 1,564,405 | | 1,576,261 | | 1,659,999 | | 1,397,492 |

| Money market and savings | 2,280,651 | | 2,213,031 | | 2,203,767 | | 2,136,777 | | 2,128,950 |

| Certificates and other time | 1,587,398 | | 1,639,426 | | 1,691,539 | | 1,529,876 | | 1,503,891 |

| Total interest-bearing deposits | 5,439,553 | | 5,416,862 | | 5,471,567 | | 5,326,652 | | 5,030,333 |

| Total deposits | $ | 8,742,601 | | $ | 8,725,303 | | $ | 8,794,716 | | $ | 8,873,467 | | $ | 8,686,621 |

| | | | | | | | | |

| Asset Quality: | | | | | | | | | |

| Nonaccrual loans | $ | 32,140 | | $ | 50,906 | | $ | 57,129 | | $ | 39,191 | | $ | 38,291 |

| Accruing loans 90 or more days past due | — | | — | | — | | — | | — |

| Total nonperforming loans | 32,140 | | 50,906 | | 57,129 | | 39,191 | | 38,291 |

| Other real estate | 2,984 | | 2,548 | | — | | — | | — |

| Total nonperforming assets | $ | 35,124 | | $ | 53,454 | | $ | 57,129 | | $ | 39,191 | | $ | 38,291 |

| | | | | | | | | |

| Net charge-offs (recoveries) | $ | 3,933 | | $ | (1) | | $ | 714 | | $ | 2,577 | | $ | 8,116 |

| | | | | | | | | |

| Nonaccrual loans: | | | | | | | | | |

| Commercial and industrial | $ | 9,718 | | $ | 18,451 | | $ | 15,465 | | $ | 5,048 | | $ | 14,991 |

| Real estate: | | | | | | | | | |

| Commercial real estate (including multi-family residential) | 10,695 | | 18,094 | | 21,268 | | 16,699 | | 13,563 |

| Commercial real estate construction and land development | 4,183 | | 1,641 | | 8,406 | | 5,043 | | 170 |

| 1-4 family residential (including home equity) | 7,259 | | 12,454 | | 10,368 | | 8,874 | | 8,442 |

| Residential construction | 121 | | 155 | | 1,410 | | 3,288 | | 635 |

| Consumer and other | 164 | | 111 | | 212 | | 239 | | 490 |

| Total nonaccrual loans | $ | 32,140 | | $ | 50,906 | | $ | 57,129 | | $ | 39,191 | | $ | 38,291 |

| | | | | | | | | |

| Asset Quality Ratios: | | | | | | | | | |

| Nonperforming assets to total assets | 0.33 | % | | 0.50 | % | | 0.53 | % | | 0.37 | % | | 0.36 | % |

| Nonperforming loans to total loans | 0.43 | % | | 0.66 | % | | 0.72 | % | | 0.49 | % | | 0.48 | % |

| Allowance for credit losses on loans to nonperforming loans | 262.92 | % | | 186.17 | % | | 168.54 | % | | 233.94 | % | | 244.38 | % |

| Allowance for credit losses on loans to total loans | 1.12 | % | | 1.23 | % | | 1.22 | % | | 1.16 | % | | 1.17 | % |

| Net charge-offs to average loans (annualized) | 0.21 | % | | 0.00 | % | | 0.04 | % | | 0.13 | % | | 0.40 | % |

Stellar Bancorp, Inc.

GAAP Reconciliation and Management’s Explanation of Non-GAAP Financial Measures

(Unaudited)

Stellar’s management uses certain non-GAAP (generally accepted accounting principles) financial measures to evaluate its performance. Stellar believes that these non-GAAP financial measures provide meaningful supplemental information regarding its performance and that management and investors benefit from referring to these non-GAAP financial measures in assessing Stellar’s performance and when planning, forecasting, analyzing and comparing past, present and future periods. Specifically, Stellar reviews pre-tax, pre-provision income, pre-tax pre-provision ROAA, tangible book value per share, return on average tangible equity, tangible equity to tangible assets and net interest margin (tax equivalent) excluding PAA for internal planning and forecasting purposes. Stellar has included in this earnings release information relating to these non-GAAP financial measures for the applicable periods presented. These non-GAAP measures should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which Stellar calculates the non-GAAP financial measures may differ from that of other companies reporting measures with similar names.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| 2024 | | 2023 | | 2024 | | 2023 |

| September 30 | | June 30 | | March 31 | | December 31 | | September 30 | | September 30 | | September 30 |

| (Dollars and share amounts in thousands, except per share data) |

| Net income | $ | 33,891 | | $ | 29,753 | | $ | 26,147 | | $ | 27,266 | | $ | 30,908 | | $ | 89,791 | | $ | 103,231 |

| Add: Provision for credit losses | (5,985) | | (1,935) | | 4,098 | | 1,047 | | 2,315 | | (3,822) | | 7,896 |

| Add: Provision for income taxes | 8,837 | | 7,792 | | 6,759 | | 6,562 | | 7,445 | | 23,388 | | 24,825 |

| Pre-tax, pre-provision income | $ | 36,743 | | $ | 35,610 | | $ | 37,004 | | $ | 34,875 | | $ | 40,668 | | $ | 109,357 | | $ | 135,952 |

| | | | | | | | | | | | | |

| Total average assets | $ | 10,626,266 | | $ | 10,623,865 | | $ | 10,686,789 | | $ | 10,626,373 | | $ | 10,741,295 | | $ | 10,645,569 | | $ | 10,787,471 |

| | | | | | | | | | | | | |

Pre-tax, pre-provision return on average assets(B) | 1.38 | % | | 1.35 | % | | 1.39 | % | | 1.30 | % | | 1.50 | % | | 1.37 | % | | 1.68 | % |

| | | | | | | | | | | | | |

| Total shareholders’ equity | $ | 1,626,123 | | $ | 1,565,795 | | $ | 1,530,698 | | $ | 1,521,018 | | $ | 1,460,846 | | $ | 1,626,123 | | $ | 1,460,846 |

| Less: Goodwill and core deposit intangibles, net | 595,434 | | 601,633 | | 607,831 | | 614,030 | | 620,262 | | 595,434 | | 620,262 |

| Tangible shareholders’ equity | $ | 1,030,689 | | $ | 964,162 | | $ | 922,867 | | $ | 906,988 | | $ | 840,584 | | $ | 1,030,689 | | $ | 840,584 |

| | | | | | | | | | | | | |

| Shares outstanding at end of period | 53,446 | | 53,564 | | 53,551 | | 53,291 | | 53,322 | | 53,446 | | 53,322 |

| | | | | | | | | | | | | |

| Tangible book value per share | $ | 19.28 | | $ | 18.00 | | $ | 17.23 | | $ | 17.02 | | $ | 15.76 | | $ | 19.28 | | $ | 15.76 |

| | | | | | | | | | | | | |

| Average shareholders’ equity | $ | 1,587,918 | | $ | 1,538,124 | | $ | 1,528,298 | | $ | 1,475,377 | | $ | 1,471,009 | | $ | 1,551,579 | | $ | 1,449,382 |

| Less: Average goodwill and core deposit intangibles, net | 598,866 | | 604,722 | | 611,149 | | 617,236 | | 623,864 | | 604,890 | | 630,890 |

| Average tangible shareholders’ equity | $ | 989,052 | | $ | 933,402 | | $ | 917,149 | | $ | 858,141 | | $ | 847,145 | | $ | 946,689 | | $ | 818,492 |

| | | | | | | | | | | | | |

Return on average tangible equity(B) | 13.63 | % | | 12.82 | % | | 11.47 | % | | 12.61 | % | | 14.47 | % | | 12.67 | % | | 16.86 | % |

| | | | | | | | | | | | | |

| Total assets | $ | 10,629,777 | | $ | 10,723,663 | | $ | 10,729,222 | | $ | 10,647,139 | | $ | 10,665,460 | | $ | 10,629,777 | | $ | 10,665,460 |

| Less: Goodwill and core deposit intangibles, net | 595,434 | | 601,633 | | 607,831 | | 614,030 | | 620,262 | | 595,434 | | 620,262 |

| Tangible assets | $ | 10,034,343 | | $ | 10,122,030 | | $ | 10,121,391 | | $ | 10,033,109 | | $ | 10,045,198 | | $ | 10,034,343 | | $ | 10,045,198 |

| | | | | | | | | | | | | |

| Tangible equity to tangible assets | 10.27 | % | | 9.53 | % | | 9.12 | % | | 9.04 | % | | 8.37 | % | | 10.27 | % | | 8.37 | % |

| | | | | | | | | | | | | |

| Net interest income (tax equivalent) | $ | 101,578 | | $ | 101,482 | | $ | 102,207 | | $ | 106,121 | | $ | 106,919 | | $ | 305,266 | | $ | 331,549 |

| Less: Purchase accounting accretion | 6,795 | | 10,098 | | 8,551 | | 11,726 | | 12,400 | | 25,444 | | 35,076 |

| Adjusted net interest income (tax equivalent) | $ | 94,783 | | $ | 91,384 | | $ | 93,656 | | $ | 94,395 | | $ | 94,519 | | $ | 279,822 | | $ | 296,473 |

| | | | | | | | | | | | | |

| Average earning assets | $ | 9,643,629 | | $ | 9,616,874 | | $ | 9,645,544 | | $ | 9,576,927 | | $ | 9,697,553 | | $ | 9,635,379 | | $ | 9,735,194 |

| Net interest margin (tax equivalent) excluding PAA | 3.91 | % | | 3.82 | % | | 3.91 | % | | 3.91 | % | | 3.87 | % | | 3.88 | % | | 4.07 | % |

(A)Represents total noninterest expense, excluding acquisition and merger-related expenses, core deposit intangibles amortization and write-downs on assets moved to held for sale, divided by the sum of net interest income, excluding purchase accounting adjustments plus noninterest income, excluding gains and losses on the sale of assets. Additionally, taxes and provision for credit losses are not part of this calculation.

(B)Interim periods annualized.

Third Quarter 2024 Earnings Presentation Exhibit 99.2

Forward-Looking Statements and Non-GAAP Financial Measures 2 Certain statements in this press release which are not historical in nature are intended to be, and are hereby identified as, “forward-looking statements” for purposes of the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements about the benefits of the merger of Allegiance Bancshares, Inc. with and into and CBTX, Inc. (the “Merger”) which became effective on October 1, 2022, including the future financial performance of Stellar Bancorp, Inc. (the “Company”), operating results, plans, business and growth strategies, objectives, expectations and intentions, and other statements that are not historical facts, including projections of macroeconomic and industry trends, which are inherently unreliable due to the multiple factors that impact economic trends, and any such variations may be material. Forward-looking statements may be identified by terminology such as “may,” “will,” “should,” “could,” “scheduled,” “plans,” “intends,” “projects,” “anticipates,” “expects,” “believes,” “estimates,” “potential,” “would,” or “continue” or negatives of such terms or other comparable terminology. All forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company. Such factors include, among others: the risk that the cost savings and any revenue synergies from the Merger may not be fully realized or may take longer than anticipated to be realized; disruption to our business as a result of the Merger; the risk that the integration of operations will be materially delayed or will be more costly or difficult than we expected or that we are otherwise unable to successfully integrate our legacy businesses; the amount of the costs, fees, expenses and charges related to the Merger; reputational risk and the reaction of our customers, suppliers, employees or other business partners to the Merger; changes in the interest rate environment, the value of Stellar’s assets and obligations and the availability of capital and liquidity; general competitive, economic, political and market conditions; and other factors that may affect future results of Stellar including changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer borrowing, repayment, investment and deposit practices; the impact, extent and timing of technological changes; capital management activities; disruptions to the economy and the U.S. banking system caused by recent bank failures, risks associated with uninsured deposits and responsive measures by federal or state governments or banking regulators, including increases in the cost of our deposit insurance assessments and other actions of the Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation and Texas Department of Banking and legislative and regulatory actions and reforms. Additional factors which could affect the Company’s future results can be found in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, in each case filed with the SEC and available on the SEC’s website at https://www.sec.gov. We disclaim any obligation and do not intend to update or revise any forward-looking statements contained in this communication, which speak only as of the date hereof, whether as a result of new information, future events or otherwise, except as required by federal securities laws. As forward-looking statements involve significant risks and uncertainties, caution should be exercised against placing undue reliance on such statements. GAAP Reconciliation of Non-GAAP Financial Measures The Company’s management uses certain non-GAAP (generally accepted accounting principles) financial measures to evaluate its performance. The Company believes that these non- GAAP financial measures provide meaningful supplemental information regarding its performance and that management and investors benefit from referring to these non-GAAP financial measures in assessing the Company’s performance and when planning, forecasting, analyzing and comparing past, present and future periods. Specifically, the Company reviews pre-tax, pre-provision income; pre-tax pre-provision ROAA, the ratio of tangible equity to tangible assets; net interest margin (tax equivalent) excluding purchase accounting adjustments; and loan yield excluding accretion for internal planning and forecasting purposes. The Company has included in this presentation information relating to these non-GAAP financial measures for the applicable periods presented. These non-GAAP measures should not be considered in isolation or as a substitute for the most directly comparable or other financial measures calculated in accordance with GAAP. Moreover, the manner in which Stellar calculates the non-GAAP financial measures may differ from that of other companies reporting measures with similar names.

3 (1) Deposit market share based on FDIC data as of June 30, 2024. (2) Houston Region defined as the Houston-Pasadena-The Woodlands and Beaumont-Port Arthur MSAs; Excludes non-retail branches (3) Refer to the calculation of this non-GAAP financial measure and a reconciliation to its most directly comparable GAAP financial measure in the appendix. Houston’s Largest Regionally Focused Bank Valuable franchise in one of the best markets in the U.S. • 6th in deposit market share for Houston region(1)(2) • 1st in deposit market share for Texas-based banks in the Houston region(1)(2) • Noninterest-bearing deposits to total deposits of 37.8% Strong core earnings power and capital position at third quarter 2024 • Net interest margin (tax equivalent) of 4.19% • Net interest margin (tax equivalent) excluding purchase accounting adjustments of 3.91%(3) • Total capital ratio (to risk weighted-assets) of 15.91% Banking Centers Banking Centers Free-standing ATM 9/30/2024 6/30/2024 Total assets 10,629,777$ 10,723,663$ Total loans 7,551,124 7,713,897 Total deposits 8,742,601 8,725,303 Total loans to total deposits 86.37% 88.41% Net interest margin (tax equivalent) 4.19% 4.24% Net interest margin (tax equivalent) excluding PPA (3) 3.91% 3.82% Noninterest-bearing deposits to total deposits 37.78% 37.92% (Dollars in thousands)

$30.1 $25.3 $13.2 $9.0 $8.6 $7.8 $5.7 $5.7 $5.7 $5.3 $3.4 $3.0 $2.6 $2.4 $2.3 $2.1 $1.9 JPMorgan Wells Fargo BofA Zions PNC Frost Prosperity Cadence Woodforest Capital One Third Coast Comerica Truist BOK Regions Texas Capital Texas Independent Focused on Serving the Houston Region 4 Note: Deposit market share based on FDIC data as of June 30, 2024. 1) Houston Region defined as the Houston-Pasadena-The Woodlands and Beaumont-Port Arthur MSAs; Excludes non-retail branches. Source: S&P Capital IQ Pro Stellar Houston Region Market Share(1) Deposits (dollars in billions) $150.8 Houston Percent of Houston Total Assets Region(1) Company Region Market Name ($B) Deposits ($B) Deposits (%) Share (%) JPMorgan 4,143 150.8 7.5 47.4 Wells Fargo 1,940 30.1 2.1 9.5 BofA 3,258 25.3 1.3 7.9 Zions 88 13.2 17.8 4.1 PNC 557 9.0 2.1 2.8 Stellar 11 8.6 97.6 2.7 Frost 49 7.8 19.1 2.4 Prosperity 40 5.7 20.5 1.8 Cadence 48 5.7 15.1 1.8 Woodforest 10 5.7 70.9 1.8 Capital One 480 5.3 1.4 1.7 Third Coast 4 3.4 87.4 1.1 Comerica 80 3.0 4.8 1.0 Truist 520 2.6 0.7 0.8 BOK 50 2.4 6.5 0.8 Regions 154 2.3 1.8 0.7 Texas Capital 30 2.1 8.7 0.7 Texas Independent 2 1.9 100 0.6

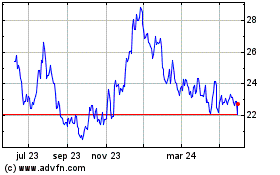

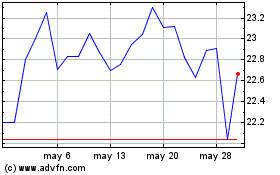

5 Third Quarter 2024 Highlights (1) Refer to the calculation of these non-GAAP financial measures and a reconciliation to their most directly comparable GAAP financial measures in the appendix. Solid Profitability: Third quarter 2024 net income of $33.9 million, or diluted earnings per share of $0.63, translated into an annualized return on average assets of 1.27%, an annualized return on average equity of 8.49% and an annualized return on average tangible equity of 13.63%(1). Strong Net Interest Margin: Tax equivalent net interest margin was 4.19% for the third quarter of 2024 compared to 4.24% for the second quarter of 2024. The tax equivalent net interest margin, excluding purchase accounting accretion (“PAA”), was 3.91%(1) for the third quarter of 2024 compared to 3.82%(1) for the second quarter of 2024. Meaningful Capital and Book Value Build: Total risk-based capital ratio increased to 15.91% at September 30, 2024 from 15.34% at June 30, 2024, book value per share increased to $30.43 from $29.23 at June 30, 2024 and tangible book value per share increased to $19.28(1) from $18.00(1) at June 30, 2024. Improving Credit Metrics: Nonperforming loans decreased $18.8 million to $32.1 million at September 30, 2024 from $50.9 million at June 30, 2024. Allowance for credit losses on loans to nonperforming loans increased to 262.92% at September 30, 2024 from 186.17% at June 30, 2024. Tangible Book Value Per Share (1) Total Capital Ratio $14.02 $17.02 $19.28 12/31/2022 12/31/2023 9/30/2024 12.39% 14.02% 15.91% 12/31/2022 12/31/2023 9/30/2024

Deposit Summary 6 Deposit Portfolio Composition Deposits (in millions) Maintaining Discipline Navigating Competitive Deposit Market As of September 30, 2024: • Noninterest-bearing deposits to total deposits: 37.8% • Cost of deposits: 2.15% • Cost of funds: 2.24% • Loan to deposit ratio: 86.37% • Brokered deposits: $649.4 million at September 30, 2024 from $741.3 million at June 30, 2024 . (1) NIB 37.8% IB Demand 18.0% MMDA & Sav. 26.1% CD's 18.1% Q3 2024 Q2 2024 Noninterest-bearing ("NIB") 3,303,048$ 3,308,441$ Interest-bearing demand ("IB Demand") 1,571,504 1,564,405 Money market and savings ("MMDA & Sav.") 2,280,651 2,213,031 Certificates and other time ("CD's") 1,587,398 1,639,426 Total deposits 8,742,601$ 8,725,303$ (Dollars in thousands)

Loan Summary 7 (1) Refer to the calculation of these non-GAAP financial measures and a reconciliation to their most directly comparable GAAP financial measures in the appendix. . Loan Portfolio Composition (1) (1) Q3 2024 Q2 2024 Commercial and Industrial (“C&I”) 1,350,753$ 1,396,064$ Nonowner-occupied Commercial Real Estate (“NOO CRE”) 1,689,530 1,694,022 Owner-occupied CRE (“OO CRE”) 1,871,742 1,912,387 Multifamily Real Estate (“MF”) 415,024 423,262 Total Commercial Real Estate 3,976,296 4,029,671 CRE Construction & Development (“CRE C&D”) 890,316 922,805 1-4 Family Residential (“1-4 Family”) 1,112,235 1,098,681 Residential Construction (“Resi. C&D”) 161,494 200,134 Consumer and other ("Other") 60,030 66,542 Total 7,551,124$ 7,713,897$ (In thousands) 1-4 Family 14.7% MF 5.5% Resi. C&D 2.1% Other 0.8% CRE C&D 11.8% NOO CRE 22.4% OO CRE 24.8% C&I 17.9% Average Yield Excl. PAA(1) Average Yield Excl. PAA(1) Interest-earning Assets: Loans 7,627,522$ 132,372$ 6.90% 6.55% 7,808,320$ 135,885$ 7.00% 6.48% Securities 1,676,614 14,712 3.49% 1,549,638 12,739 3.31% Deposits in other financial institutions 339,493 4,692 5.50% 258,916 3,555 5.52% Total interest-earning assets 9,643,629$ 151,776$ 6.26% 5.98% 9,616,874$ 152,179$ 6.36% 5.94% (Dollars in thousands) Q3 2024 Q2 2024 Average Outstanding Balance Interest Earned Average Outstanding Balance Interest Earned

Asset Quality Summary 8 Nonperforming Loans by Type (1) Combined represents the simple addition of legacy balances for 2022; estimated. Nonperforming loans to total loans: • 0.43% at September 30, 2024 compared to 0.66% as of June 30, 2024 Allowance for credit losses on loans to nonperforming loans: • 262.92% at September 30, 2024 compared to 186.17% as of June 30, 2024 Allowance for credit losses on loans: • $84.5 million, or 1.12% of total loans, at September 30, 2024, compared to $94.8 million, or 1.23% of total loans, as of June 30, 2024 C&I 30.2% Other 0.9% CRE 33.3% CRE C&D 13.0% 1-4 Family 22.6% Nonaccrual Loans with No Related Allowance Nonaccrual Loans with Related Allowance Total Nonaccrual Loans Commercial and industrial 4,832$ 4,886$ 9,718$ Commercial real estate (including multi-family residential) 8,773 1,922 10,695 Commercial real estate construction and land development 79 4,104 4,183 1-4 family residential (including equity) 5,509 1,750 7,259 Residential construction — 121 121 Consumer and other 86 78 164 19,279$ 12,861$ 32,140$ (In thousands) Q3 2024 Q2 2024 Total nonperforming loans 32,140$ 50,906$ Nonperforming loans to total loans 0.43% 0.66% Total nonperforming assets 35,124$ 53,454$ Nonperforming assets to total assets 0.33% 0.50% Net charge-offs (recoveries) 3,933$ (1)$ Net charge-offs to average loans (annualized) 0.21% 0.00% YTD net charge-offs 4,646$ 713$ YTD net charge-offs to average loans (annualized) 0.08% 0.02% (Dollars in thousands)

CRE and Office Detail: Q3 2024 9 (1) (1) CRE (incl. multifamily) by Property Type CRE - Office Retail 673,140$ 1,320$ 16.9% Warehouse 557,764 762 14.1% Convenience Store (C-Store) 441,031 1,345 11.1% Multi-family 427,736 1,910 10.8% Office 421,990 826 10.6% Industrial 171,845 1,606 4.3% Hotel / Motel 168,205 4,005 4.2% Restaurant / Bar 167,316 1,046 4.2% Auto Sales / Repair 159,532 728 4.0% Church 130,958 949 3.3% Healthcare 113,855 1,116 2.9% Other 542,924 1,188 13.6% Total 3,976,296$ 1,126 100.0% Property Type Balance Average Loan Size % of Total (Dollars In thousands) Retail 16.9% Office 10.6% Warehouse 14.1% C-Store 11.1% Multi-family 10.8% Industrial 4.3% Hotel / Motel 4.2% Restaurant / Bar 4.2% Auto Sales / Repair 4.0% Church 3.3% Healthcare 2.9% Other 13.6% Owner- occupied 40.2% Non-owner occupied 59.8% Multi-Story Office Building 128 235,572$ 55.8% 1,840$ Single Story Office Building 312 134,020 31.8% 430 Flex Office Space 71 52,398 12.4% 738 Total 511 421,990$ 100.0% 826 0 - 12 months 81 61,518$ 14.6% 759$ 13 - 24 months 77 48,130 11.4% 625 25 - 36 months 84 99,227 23.5% 1,181 37 - 48 months 38 22,467 5.3% 591 49 + months 231 190,648 45.2% 825 511 421,990$ 100.0% 826 Average Loan Size (Dollars in thousands) (Dollars in thousands) Maturity Number BalanceCollateral Type Number Balance % of Total % of Total Average Loan Size

CRE Construction and Development: Q3 2024 10 (1) (1) • Total committed exposure for CRE construction loans was $1.23 billion at September 30, 2024 and June 30, 2024. • The largest category of CRE construction loans was Land – Commercial at $354.6 million outstanding, or 39.8%, of CRE construction loans at September 30, 2024. • Owner-occupied CRE construction loans were 13.3% of CRE construction loans at September 30, 2024. (1) Includes loans that are secured by commercial properties that are in some stage of construction, land with improvements but valued as and only with intent to remove and construct new structures in the future, and raw land. (2) Multi-family community development loans (“CD”). Land - Commercial 39.8% Warehouse 13.9% Multi-family - CD 15.4% Multi-family - Market Rate 5.7% Land - Residential Lot 6.4% Retail 3.2% C-Store 2.1% Residential Subdivision 3.3% Other 10.2% CRE Construction Lending Highlights Number Balance Number Balance Land - Commercial (1) 439 354,616$ 808 464 365,110$ 787$ Multi-family - CD(2) 14 137,102 9,793 14 127,298 9,093 Warehouse 30 123,545 4,118 29 118,566 4,088 Other 84 91,599 1,090 79 91,982 1,164 Land - Residential Lot 246 56,931 231 265 68,751 259 Multi-family - Market Rate 6 50,275 8,379 8 43,615 5,452 Residential Subdivision 8 29,067 3,633 8 48,178 6,022 Retail 19 28,616 1,506 26 37,072 1,426 Convenience Store (C-Store) 10 18,565 1,857 12 22,233 1,853 Total 856 890,316$ 1,040 905 922,805$ 1,020 (Dollars in thousands) (Dollars in thousands) Loan Type Q3 2024 Q2 2024 Average Loan Size Average Loan Size

Regulatory Capital Ratios 11 (1) Refer to the calculation of this non-GAAP financial measure and a reconciliation to its most directly comparable GAAP financial measure in the appendix. Minimum Required Plus Capital Conservation Buffer Consolidated Capital Ratios Estimated Total Capital Ratio (to risk-weighted assets) 15.91% 15.34% 10.50% Estimated Common Equity Tier 1 Capital Ratio (to risk-weighted assets) 13.62% 12.98% 7.00% Estimated Tier 1 Capital Ratio (to risk-weighted assets) 13.74% 13.10% 8.50% Estimated Tier 1 Leverage Ratio (to average tangible assets) 11.25% 10.93% 4.00% Estimated Tangible Equity to Tangible Assets (1) 10.27% 9.53% N/A Bank Capital Ratios Estimated Total Capital Ratio (to risk-weighted assets) 15.07% 14.65% 10.50% Estimated Common Equity Tier 1 Capital Ratio (to risk-weighted assets) 13.63% 13.12% 7.00% Estimated Tier 1 Capital Ratio (to risk-weighted assets) 13.63% 13.12% 8.50% Estimated Tier 1 Leverage Ratio (to average tangible assets) 11.16% 10.94% 4.00% September 30, 2024 June 30, 2024 Stellar’s capital build continued during the third quarter of 2024 • Stellar repurchased 108,984 shares at an average price per share of $26.10

12 Liquidity Profile Stellar is well-positioned to manage through the current environment. Sources of Liquidity at September 30, 2024 Sources of Liquidity Estimated Uninsured Deposits at September 30, 2024 (1) Brokered deposit capacity is governed by internal policy limits. (Dollars in millions) Total deposits 8,743$ Estimated uninsured deposits 4,923 (976) Estimated uninsured, net of collateralized deposits 3,947$ Percent of total deposits 45.1% Less: collateralized deposits (Dollars in millions) Cash 516$ Unpledged securities 1,191 Total on-balance sheet 1,707 FHLB available capacity 1,862 Discount window available capacity 768 Total immediate available liquidity 4,337 Available brokered deposit capacity(1) 1,551 Total available liquidity 5,888$ 109.9% 149.2% Immediate available liquidity coverage of estimated uninsured deposits, net of collateralized deposits Total available liquidity coverage of estimated uninsured deposits, net of collateralized deposits

13 Key Takeaways Excellent core funding profile Strong earnings power and franchise value in one of the best markets in the U.S. Key success factors: Credit performance and risk management Significant financial flexibility Positioned for rapid capital-build to continue

$30.1 $25.3 $13.2 $9.0 $8.6 $7.8 $5.7 $5.7 $5.7 JPMorgan Wells Fargo BofA Zions PNC Frost Prosperity Cadence Woodforest Diverse and Strong Markets of Operation 14 Houston is Diverse, with Significant Economic Tailwinds Greater Houston Market Top 10 Bank by Deposits in Houston Region(1) ($B) Note: Deposit market share based on FDIC data as of June 30, 2024. 1) Houston Region defined as the Houston-Pasadena-The Woodlands and Beaumont-Port Arthur MSAs; Excludes non-retail branches. Source: S&P Capital IQ Pro, Houston.org, Texas Medical Center, and Wallet Hub. $150.8 Est. Population Growth ’24-’29 Est. Number of Households Growth ’24-’29 Population Change (’19-’24) Median Household Income (’24) Significant Deposit Share Houston MSA: 6.0% Texas: 5.9% / U.S: 2.1% Houston MSA: $75,557 Texas: $73,203 / U.S: $75,874 Stellar has over $8.6 billion in deposits in the Houston region(1) Houston HQ Bank Houston is the #4 most diverse city in the U.S. based on socioeconomic factors, according to Wallet Hub Houston added nearly 140,000 residents in ’23, 2nd among U.S. metros in population growth. The increase equates to a new resident every 3.8 minutes 25th largest economy in the world – if ranked as a country, 14th largest population in the U.S – if ranked as a state Port Houston is the busiest Gulf Coast container port, the Houston Ship Channel is #1 ranked U.S. port in total foreign and domestic waterborne tonnage Houston is home to the Texas Medical Center, the world's largest medical complex, which has 10 million annual patient encounters Business friendly: #3 among U.S. metro areas in Fortune 500 headquarters (26) Major business clusters in Beaumont-Port Arthur area include chemical and petroleum manufacturing, materials manufacturing and transportation 4.9% 4.7% 2.4% Houston MSA Texas USA 5.1% 5.1% 2.7% Houston MSA Texas USA Stellar

Diversified and Growing Economy 15 1) Data is preliminary as of February 2024, from the U.S. Bureau of Labor Statistics Source: U.S. Bureau of Labor Statistics Houston vs. U.S. Job Change by Industry (Feb ‘23 – Feb. ‘24)(1) Diversified Economy by Job Sector(1) Commentary Houston’s economy has become much more diversified over the years, while remaining the energy capital of the United States Most of Houston's job sectors are growing at a faster rate than U.S. Transportation, warehousing, and utility services showed a large gain over the last year versus the United States United States Houston MSA Professional and Business Services 16% Education and Health Services 14% Government 13% Leisure and Hospitality 10% Retail Trade 9% Manufacturing 7% Construction 7% Transportation, Warehousing, and Utilities 6% Financial Activities 5% Wholesale Trade 5% Other Services 4% Mining and Logging 2% Information 1% (0.7)% 5.3% 0.1% 1.9% 1.6% (2.4)% 1.9% 2.5% 4.4% 2.4% 3.3% 0.5% 0.0% 4.8% Mining and Logging Private Education and Health Services Financial Activities Leisure and Hospitality Professional and Business Services Information Wholesale Trade Transportation, Warehousing, and Utilities Government Total Nonfarm Manufacturing Construction Retail Trade Other Services

2.0 3.0 4.0 5.0 6.0 7.0 2.0 2.5 3.0 3.5 2007 2009 2011 2013 2015 2017 2019 2021 2023 Houston is a Strong and Resilient Market 16 Since the Great Recession, Houston has proven its resiliency, weathering economic cycles and natural disasters − Houston welcomed 2.1 million new residents and created over 965 thousand jobs since 2007 P o p u la tio n (M ) O il P ri c e D e c lin e G re a t R e c e s s io n Ik e H a rv e y C O V ID -1 9 E m p lo y m e n t (M ) Employment Population1) Data is preliminary as of February 2024, from the U.S. Bureau of Labor Statistics Source: U.S. Bureau of Labor Statistics, Texas Workforce Commission

92,198 (150,000) (100,000) (50,000) 0 50,000 100,000 150,000 D a lla s H o u s to n T a m p a A tl a n ta P h o e n ix M ia m i D e n v e r W a s h in g to n B o s to n M in n e a p o lis R iv e rs id e S e a tt le B a lt im o re P h ila d e lp h ia D e tr o it S a n D ie g o S a n F ra n c is c o C h ic a g o L o s A n g e le s N e w Y o rk Houston’s Growth Projected to Continue 17 Source: S&P Capital IQ Pro; U.S. Census Bureau. 2010-2024 Population Change (%) Houston had the second highest net migration in 2023 20 most populated metros 3.93% 0.31% -0.48% 27.64% 27.00% 21.95% 8.88% New York MSA Los Angeles MSA Chicago MSA Dallas MSA Houston MSA Texas U.S. • Houston has seen tremendous growth over the past ten years, aided by the relocation of multiple Fortune 500 companies • The continued growth of the Houston metro will strengthen and diversify the greater economy, benefiting the businesses and constituents Houston added over 90,000 people by net migration in 2023, second only to Dallas

$92,406 $89,429 $85,119 $82,998 $75,557 $73,203 $75,874 New York MSA Los Angeles MSA Chicago MSA Dallas MSA Houston MSA Texas U.S. $800,000 $982,500 $363,500 $450,000 $339,000 $344,800 $420,357 New York Los Angeles Chicago Dallas Houston Texas U.S. 8.7x 11.0x 4.3x 5.4x 4.5x 4.7x 5.5x New York MSA Los Angeles MSA Chicago MSA Dallas MSA Houston MSA Texas U.S. Housing Market and Cost of Living 18 • Cost of living in Houston is 5.9% less than that of the U.S. market average while the median household income is in line with U.S. median • Houston is #1 in U.S. annual new home construction 2 0 2 4 M e d ia n H o u s e h o ld I n c o m e 2 0 2 4 M e d ia n H o m e P ri c e (1 ) M e d ia n H o m e P ri c e t o H H I R a ti o (1) Home price shown for each respective city Source: S&P Capital IQ Pro; Redfin (March 2024); Houston.org

Appendix: Non-GAAP Reconciliation(1) 19 (1) See the disclosure under the heading “GAAP Reconciliation of Non-GAAP Financial Measures” on slide 2 regarding the use of non-GAAP financial measures. (2) Interim periods annualized. Total shareholders’ equity $ 1,626,123 $ 1,565,795 Less: Goodw ill and core deposit intangibles, net 595,434 601,633 Tangible shareholders’ equity $ 1,030,689 $ 964,162 Shares outstanding at end of period 53,446 53,564 Tangible book value per share $ 19.28 $ 18.00 Total assets $ 10,629,777 $ 10,723,663 Less: Goodw ill and core deposit intangibles, net 595,434 601,633 Tangible assets $ 10,034,343 $ 10,122,030 Tangible equity to tangible assets 10.27% 9.53% Net interest income (tax equivalent) $ 101,578 $ 101,482 Less: Purchase accounting accretion 6,795 10,098 Adjusted net interest income (tax equivalent) $ 94,783 $ 91,384 Average earning assets $ 9,643,629 $ 9,616,874 Net interest margin (tax equivalent)(2) 4.19% 4.24% Net interest margin (tax equivalent) excluding PAA (2) 3.91% 3.82% Interest on loans, as reported $ 132,372 $ 135,885 Less: Purchase accounting accretion 6,795 10,098 Interest on loans w ithout loan accretion $ 125,577 $ 125,787 Average loans $ 7,627,522 $ 7,808,320 Loan yield, as reported 6.90% 7.00% Loan yield, w ithout loan accretion 6.55% 6.48% Interest on interest-earning assets, as reported $ 151,776 $ 152,179 Less: Purchase accounting accretion 6,795 10,098 Interest on interest-earnings assets w ithout loan accretion $ 144,981 $ 142,081 Average interest-earnings assets $ 9,643,629 $ 9,616,874 Yield on interest-earnings assets, as reported 6.26% 6.36% Yield on interest-earnings assets, w ithout loan accretion 5.98% 5.94% (Dollars in thousands) Q3 2024 Q2 2024

20 NYSE: STEL

Exhibit 99.3

PRESS RELEASE

Stellar Bancorp, Inc.

Announces Redemption of Subordinated Notes

HOUSTON, October 25, 2024 - Stellar Bancorp, Inc. (the “Company”) (NYSE: STEL) today announced the intention of Stellar Bank, its wholly-owned subsidiary (“the Bank”), to redeem all of the Bank’s $40.0 million aggregate principal amount of Fixed-to-Floating Rate Subordinated Notes due December 15, 2027 (“the Notes”). The redemption price for the Notes will be equal to 100% of principal amount of the Notes redeemed, plus any accrued and unpaid interest to, but excluding, the redemption date.