United Natural Foods, Inc. (NYSE: UNFI) (the “Company” or

“UNFI”) today reported financial results for the second quarter of

fiscal 2024 (13 weeks) ended January 27, 2024.

Second Quarter Fiscal 2024 Performance

(comparisons to second quarter fiscal 2023)

- Net sales decreased 0.5% to $7.8 billion

- Net loss of $15 million; Loss per diluted share (EPS) of

$(0.25)

- Adjusted EBITDA decreased 29.3% to $128 million

- Adjusted EPS decreased to $0.07

Recent Financial and Operational

Summary

- Revising fiscal 2024 outlook to reduce net sales

expectations, while maintaining the midpoints and narrowing the

ranges for net income, EPS, adjusted EPS, and adjusted

EBITDA

- Continuing to drive improved operational execution and

efficiency

- Management disciplines and operational processes continuing

to drive shrink reduction

- Network automation and optimization progressing

- Expect Centralia, WA automation system to go live this

spring

- Announced Manchester, PA distribution center to be

automated

- Launched northeast distribution center optimization;

expected to be complete in Fiscal 2025

- Streamlined organization more agile and better able to make

quicker decisions closer to the customer

“Our second quarter results reflect our continued focus and

progress on execution and profitability improvement through the

important holiday selling season. Greater than anticipated benefits

from our near-term value creation initiatives and further advances

in managing shrink partially offset the expected reduction in

procurement gains and start-up costs associated with a new

distribution center,” said Sandy Douglas, UNFI’s Chief Executive

Officer.

“We are making steady progress on the multiple work-streams

underlying both our near-term and longer-term transformation into a

more efficient and effective partner to our customers, while we

also enhance profitability and long-term shareholder value

creation.”

Second Quarter Fiscal 2024

Summary

13-Week Period Ended

Percent Change

($ in millions, except for per share

data)

January 27, 2024

January 28, 2023

Net sales

$

7,775

$

7,816

(0.5

)%

Chains

$

3,266

$

3,322

(1.7

)%

Independent retailers

$

1,907

$

1,980

(3.7

)%

Supernatural

$

1,751

$

1,659

5.5

%

Retail

$

631

$

660

(4.4

)%

Other

$

615

$

609

1.0

%

Eliminations

$

(395

)

$

(414

)

(4.6

)%

Net (loss) income

$

(15

)

$

19

(178.9

)%

Adjusted EBITDA (1)

$

128

$

181

(29.3

)%

EPS

$

(0.25

)

$

0.31

(180.6

)%

Adjusted EPS (1)

$

0.07

$

0.78

(91.0

)%

(1)

Please refer to the tables in this press

release for a reconciliation of these non-GAAP financial measures

to the most directly comparable financial measures calculated in

accordance with GAAP.

Net sales decreased 0.5% in the second quarter of fiscal

2024 compared to the same period in the prior year, primarily

driven by a decline in unit volumes, which was partially offset by

inflation and new business with existing customers, primarily in

our Supernatural channel.

Gross profit in the second quarter of fiscal 2024 was

$1.0 billion, a decrease of $34 million, or 3.2%, compared to the

second quarter of fiscal 2023. The gross profit rate in the second

quarter of fiscal 2024 was 13.3% of net sales and included a $6

million LIFO charge. Excluding this non-cash charge, gross profit

rate was 13.4% of net sales. Gross profit rate in the second

quarter of fiscal 2023 was 13.7% of net sales and included a $29

million LIFO charge. Excluding this non-cash charge, gross profit

rate in the second quarter of fiscal 2023 was 14.0% of net sales.

The decrease in gross profit rate, excluding the LIFO charge, was

primarily driven by lower levels of procurement gains resulting

from decelerating inflation.

Operating expenses in the second quarter of fiscal 2024

were $1,010 million compared to $1,002 million in the second

quarter of fiscal 2023. Operating expenses included Business

Transformation Costs of $14 million in the second quarter of fiscal

2024 and $4 million in the second quarter of fiscal 2023. Excluding

these costs, operating expenses in the second quarter of fiscal

2024 were $996 million, or 12.8% of net sales, and $998 million, or

12.8% of net sales, in the second quarter of fiscal 2023.

Improvements in transportation costs as well as operating leverage

led to a sequential decrease in operating expenses as a percentage

of net sales compared to the first quarter of fiscal 2024.

Interest expense, net for the second quarter of fiscal

2024 was $40 million compared to $39 million for the second quarter

of fiscal 2023. The increase in interest expense, net was primarily

driven by higher average interest rates. The second quarter of

fiscal 2023 included approximately $3 million in non-cash charges

primarily related to the acceleration of unamortized debt issuance

costs and original issue discounts resulting from debt

prepayments.

Effective tax rate for the second quarter of fiscal 2024

was a benefit of 26.3% on pre-tax loss compared to an expense rate

of 29.0% on pre-tax income for the second quarter of fiscal 2023.

The change from the second quarter of fiscal 2023 is primarily

driven by the reduction in pre-tax income during the second quarter

of fiscal 2023.

Net loss for the second quarter of fiscal 2024 was $15

million. Net income for the second quarter of fiscal 2023 was $19

million.

Net loss per diluted share (EPS) was $(0.25) for the

second quarter of fiscal 2024 compared to net income per diluted

share of $0.31 for the second quarter of fiscal 2023. Adjusted EPS

was $0.07 for the second quarter of fiscal 2024 compared to $0.78

in the second quarter of fiscal 2023.

Adjusted EBITDA for the second quarter of fiscal 2024 was

$128 million compared to $181 million for the second quarter of

fiscal 2023.

Capital Allocation and Financing Overview

- Free Cash Flow – During the second quarter of fiscal

2024, free cash flow was $116 million compared to $448 million in

the second quarter of fiscal 2023. The results for the second

quarter of fiscal 2024 reflect net cash provided by operating

activities of $183 million, primarily driven by an expected decline

in seasonal working capital levels, and payments for capital

expenditures of $67 million. Cash provided by operating activities

in the second quarter of fiscal 2023 included approximately $282

million from the monetization of certain qualified accounts

receivables.

- Leverage – Total outstanding debt, net of cash, was

$2.16 billion at the end of the second quarter of fiscal 2024,

reflecting a decrease of $124 million compared to the end of the

first quarter of fiscal 2024. The net debt to Adjusted EBITDA

leverage ratio was 4.3x as of January 27, 2024.

- Liquidity – As of January 27, 2024, total liquidity was

approximately $1.43 billion, consisting of approximately $34

million in cash, plus the unused capacity of approximately $1.40

billion under the Company’s asset-based lending facility.

Fiscal 2024 Outlook (1)

The Company is updating its full-year outlook to the

following:

Fiscal Year Ending August 3, 2024 (53

weeks)

Previous Full Year

Outlook

Updated Full Year

Outlook

Net sales ($ in billions)

$30.9 - $31.5

$30.5 - $31.0

Net loss ($ in millions)

$(120) - $(46)

$(101) - $(65)

EPS (2)

$(2.02) - $(0.76)

$(1.70) - $(1.08)

Adjusted EPS (2)(3)(4)

$(0.88) - $0.38

$(0.56) - $0.06

Adjusted EBITDA (4) ($ in millions)

$450 - $550

$475 - $525

Capital and cloud implementation

expenditures (4)(5) ($ in millions)

~ $400

~ $400

(1)

The outlook provided above is for fiscal

2024 only. The outlook is forward-looking, is based on management's

current estimates and expectations and is subject to a number of

risks, including many that are outside of management's control. See

cautionary Safe Harbor Statement below. The 53rd week is expected

to add approximately $600 million to Net sales and $9 million to

Adjusted EBITDA in the ranges provided.

(2)

(Loss) earnings per share amounts as

presented include rounding.

(3)

The Company uses an adjusted effective tax

rate in calculating Adjusted EPS. The adjusted effective tax rate

is calculated based on adjusted net (loss) income before tax. It

also excludes the potential impact of changes to uncertain tax

positions, valuation allowances, tax impacts related to the vesting

of share-based compensation awards and discrete GAAP tax items

which could impact the comparability of the operational effective

tax rate. The Company believes using this adjusted effective tax

rate provides better consistency across the interim reporting

periods since each of these discrete items can cause volatility in

the GAAP tax rate that is not indicative of the underlying ongoing

operations of the Company. By providing this non-GAAP measure,

management intends to provide investors with a meaningful,

consistent comparison of the Company’s effective tax rate on

ongoing operations.

(4)

Please refer to the tables in this press

release for a reconciliation of these non-GAAP financial measures

to the most directly comparable financial measures calculated in

accordance with GAAP.

(5)

Reflects the sum of payments for capital

expenditures and cloud technology implementation expenditures. The

Company believes that providing this non-GAAP measure provides

investors with better visibility to the Company’s total investment

spend. The increase compared to fiscal 2023 is primarily driven by

investments in the Company’s transformation program. The components

of fiscal 2024 will be primarily dependent on the nature of certain

contracts to be executed.

Conference Call and Webcast

The Company’s second quarter fiscal 2024 conference call and

audio webcast will be held today, Wednesday, March 6, 2024 at 8:30

a.m. ET. A webcast of the conference call (and supplemental

materials) will be available to the public, on a listen only basis,

via the internet at the Investors section of the Company’s website

www.unfi.com. The call can also be

accessed at (888) 660 - 6768 (conference ID 1099581). An online

archive of the webcast (and supplemental materials) will be

available for 120 days.

About United Natural Foods

UNFI is North America’s premier grocery wholesaler delivering

the widest variety of fresh, branded, and owned brand products to

more than 30,000 locations throughout North America, including

natural product superstores, independent retailers, conventional

supermarket chains, eCommerce providers, and foodservice customers.

UNFI also provides a broad range of value-added services and

segmented marketing expertise, including proprietary technology,

data, market insights, and shelf management to help customers and

suppliers build their businesses and brands. As the largest

full-service grocery partner in North America, UNFI is committed to

building a food system that is better for all and is uniquely

positioned to deliver great food, more choices, and fresh thinking

to customers. To learn more about how UNFI is delivering value for

its stakeholders, visit www.unfi.com.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995: Statements in this press release regarding the

Company’s business that are not historical facts are

“forward-looking statements” that involve risks and uncertainties

and are based on current expectations and management estimates;

actual results may differ materially. The risks and uncertainties

which could impact these statements are described in the Company’s

filings under the Securities Exchange Act of 1934, as amended,

including its annual report on Form 10-K for the year ended July

29, 2023 filed with the Securities and Exchange Commission (the

“SEC”) on September 26, 2023 and other filings the Company makes

with the SEC, and include, but are not limited to, our dependence

on principal customers; the relatively low margins of our business,

which are sensitive to inflationary and deflationary pressures and

intense competition, including as a result of the continuing

consolidation of retailers and the growth of consumer choices for

grocery and consumable purchases; our ability to realize the

anticipated benefits of our transformation initiatives; changes in

relationships with our suppliers; our ability to operate, and rely

on third parties to operate, reliable and secure technology

systems; labor and other workforce shortages and challenges; the

addition or loss of significant customers or material changes to

our relationships with these customers; our ability to realize

anticipated benefits of our acquisitions; our ability to continue

to grow sales, including of our higher margin natural and organic

foods and non-food products, and to manage that growth; our ability

to maintain sufficient volume in our wholesale segment to support

our operating infrastructure; the impact and duration of any

pandemics or disease outbreaks; our ability to access additional

capital; increases in healthcare, pension and other costs under our

and multiemployer benefit plans; the potential for additional asset

impairment charges; our sensitivity to general economic conditions

including inflation, changes in disposable income levels and

consumer purchasing habits; our ability to timely and successfully

deploy our warehouse management system throughout our distribution

centers and our transportation management system across the Company

and to achieve efficiencies and cost savings from these efforts;

the potential for disruptions in our supply chain or our

distribution capabilities from circumstances beyond our control,

including due to lack of long-term contracts, severe weather, labor

shortages or work stoppages or otherwise; moderated supplier

promotional activity, including decreased forward buying

opportunities; union-organizing activities that could cause labor

relations difficulties and increased costs; our ability to maintain

food quality and safety; and volatility in fuel costs. Any

forward-looking statements are made pursuant to the Private

Securities Litigation Reform Act of 1995 and, as such, speak only

as of the date made. The Company is not undertaking to update any

information in the foregoing reports until the effective date of

its future reports required by applicable laws. Any estimates of

future results of operations are based on a number of assumptions,

many of which are outside the Company’s control and should not be

construed in any manner as a guarantee that such results will in

fact occur. These estimates are subject to change and could differ

materially from final reported results. The Company may from time

to time update these publicly announced estimates, but it is not

obligated to do so.

Non-GAAP Financial Measures: To supplement the financial

information presented on a U.S. generally accepted accounting

principles (“GAAP”) basis, the Company has included in this press

release the non-GAAP financial measures Adjusted EBITDA, adjusted

earnings per diluted common share (“Adjusted EPS”), adjusted

effective tax rate, free cash flow, net debt to Adjusted EBITDA

leverage ratio and capital and cloud implementation expenditures.

Adjusted EPS is a consolidated measure, which the Company

reconciles by adding Net income attributable to UNFI plus the LIFO

charge or benefit, Goodwill impairment benefits and charges,

Restructuring, acquisition, and integration related expenses, gains

and losses on sales of assets, certain legal charges and gains,

surplus property depreciation and interest expense, losses on debt

extinguishment, the impact of diluted shares when GAAP earnings is

presented as a loss and non-GAAP earnings represent income, and the

tax impact of adjustments and the adjusted effective tax rate,

which tax impact is calculated using the adjusted effective tax

rate, and certain other non-cash charges or items, as determined by

management. The non-GAAP adjusted effective tax rate excludes the

potential impact of changes to various uncertain tax positions and

valuation allowances, as well as tax impacts related to the vesting

of share-based compensation awards. The non-GAAP Adjusted EBITDA

measure is a consolidated measure which the Company reconciles by

adding Net (loss) income including noncontrolling interests, less

Net income attributable to noncontrolling interests, plus

Non-operating income and expenses, including Net periodic benefit

income, excluding service cost, Interest expense, net and Other

(income) expense, net, plus (Benefit) provision for income taxes

and Depreciation and amortization all calculated in accordance with

GAAP, plus adjustments for Share-based compensation, non-cash LIFO

charge or benefit, Restructuring, acquisition and integration

related expenses, Goodwill impairment charges, Loss (gain) on sale

of assets and other asset charges, certain legal charges and gains,

and certain other non-cash charges or other items, as determined by

management. The changes to the definition of Adjusted EBITDA in the

fourth quarter of fiscal 2023 from prior periods reflect changes to

line item references in our Consolidated Financial Statements,

which do not impact the calculation of Adjusted EBITDA. The

non-GAAP free cash flow measure is defined as net cash (used in)

provided by operating activities less payments for capital

expenditures. The non-GAAP net debt to Adjusted EBITDA leverage

ratio is defined as the total carrying value of the Company’s

outstanding short- and long-term debt and finance lease liabilities

less net cash and cash equivalents, the sum of which is divided by

the trailing four quarters Adjusted EBITDA. The non-GAAP capital

and cloud implementation expenditures measure is defined as the sum

of payments for capital expenditures and cloud technology

implementation expenditures.

The reconciliation of these non-GAAP financial measures to their

comparable GAAP financial measures and the calculation of net debt

to Adjusted EBITDA leverage are presented in the tables appearing

below. The presentation of non-GAAP financial measures is not

intended to be considered in isolation or as a substitute for any

measure prepared in accordance with GAAP. The Company believes that

presenting the non-GAAP financial measures Adjusted EBITDA and

Adjusted EPS aids in making period-to-period comparisons, assessing

the performance of the Company’s business and understanding the

underlying operating performance and core business trends by

excluding certain adjustments not expected to recur in the normal

course of business or that are not meaningful indicators of actual

and estimated operating performance. The inclusion of free cash

flow assists investors in understanding the cash generating ability

of the Company separate from cash generated by the sale of assets.

Net debt to Adjusted EBITDA leverage ratio is a commonly used

metric that assists investors in understanding and evaluating the

Company’s capital structure and changes to its capital structure

over time. The Company believes that providing non-GAAP capital and

cloud implementation expenditures provides investors with better

visibility into the Company's total investment expenditures. The

components of capital and cloud implementation expenditures for

fiscal 2024 will be primarily dependent on the nature of certain

contracts to be executed. The Company currently expects to continue

to exclude the items listed above from non-GAAP financial measures.

Management utilizes and plans to utilize these non-GAAP financial

measures to compare the Company’s operating performance during the

2024 fiscal year to the comparable periods in the 2023 fiscal year

and to internally prepared projections. These non-GAAP financial

measures may differ from similarly titled measures of other

companies.

UNITED NATURAL FOODS,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited)

(in millions, except for per

share data)

13-Week Period Ended

26-Week Period Ended

January 27,

2024

January 28,

2023

January 27,

2024

January 28,

2023

Net sales

$

7,775

$

7,816

$

15,327

$

15,348

Cost of sales

6,740

6,747

13,262

13,183

Gross profit

1,035

1,069

2,065

2,165

Operating expenses

1,010

1,002

2,033

2,002

Restructuring, acquisition and integration

related expenses

4

3

8

5

Loss (gain) on sale of assets and other

asset charges

5

1

24

(4

)

Operating income

16

63

—

162

Net periodic benefit income, excluding

service cost

(4

)

(7

)

(7

)

(14

)

Interest expense, net

40

39

75

74

Other income, net

(1

)

—

(1

)

(1

)

(Loss) income before income taxes

(19

)

31

(67

)

103

(Benefit) provision for income taxes

(5

)

9

(14

)

14

Net (loss) income including noncontrolling

interests

(14

)

22

(53

)

89

Less net income attributable to

noncontrolling interests

(1

)

(3

)

(1

)

(4

)

Net (loss) income attributable to United

Natural Foods, Inc.

$

(15

)

$

19

$

(54

)

$

85

Basic (loss) earnings per share

$

(0.25

)

$

0.32

$

(0.92

)

$

1.43

Diluted (loss) earnings per share

$

(0.25

)

$

0.31

$

(0.92

)

$

1.38

Weighted average shares outstanding:

Basic

59.4

59.8

59.0

59.3

Diluted

59.4

61.0

59.0

61.3

UNITED NATURAL FOODS,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS (unaudited)

(in millions, except for par

values)

January 27,

2024

July 29, 2023

ASSETS

Cash and cash equivalents

$

34

$

37

Accounts receivable, net

990

889

Inventories, net

2,311

2,292

Prepaid expenses and other current

assets

246

245

Total current assets

3,581

3,463

Property and equipment, net

1,766

1,767

Operating lease assets

1,430

1,228

Goodwill

20

20

Intangible assets, net

685

722

Deferred income taxes

34

32

Other long-term assets

155

162

Total assets

$

7,671

$

7,394

LIABILITIES AND STOCKHOLDERS’

EQUITY

Accounts payable

$

1,722

$

1,781

Accrued expenses and other current

liabilities

247

283

Accrued compensation and benefits

168

143

Current portion of operating lease

liabilities

187

180

Current portion of long-term debt and

finance lease liabilities

12

18

Total current liabilities

2,336

2,405

Long-term debt

2,176

1,956

Long-term operating lease liabilities

1,298

1,099

Long-term finance lease liabilities

7

12

Pension and other postretirement benefit

obligations

15

16

Other long-term liabilities

147

162

Total liabilities

5,979

5,650

Stockholders’ equity:

Preferred stock, $0.01 par value,

authorized 5.0 shares; none issued or outstanding

—

—

Common stock, $0.01 par value, authorized

100.0 shares; 61.9 shares issued and 59.4 shares outstanding at

January 27, 2024; 61.0 shares issued and 58.5 shares outstanding at

July 29, 2023

1

1

Additional paid-in capital

616

606

Treasury stock at cost

(86

)

(86

)

Accumulated other comprehensive loss

(35

)

(28

)

Retained earnings

1,196

1,250

Total United Natural Foods, Inc.

stockholders’ equity

1,692

1,743

Noncontrolling interests

—

1

Total stockholders’ equity

1,692

1,744

Total liabilities and stockholders’

equity

$

7,671

$

7,394

UNITED NATURAL FOODS,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (unaudited)

26-Week Period Ended

(in millions)

January 27,

2024

January 28,

2023

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net (loss) income including noncontrolling

interests

$

(53

)

$

89

Adjustments to reconcile net (loss) income

to net cash (used in) provided by operating activities:

Depreciation and amortization

152

147

Share-based compensation

16

23

Gain on sale of assets

(7

)

(9

)

Long-lived asset impairment charges

21

—

Net pension and other postretirement

benefit income

(7

)

(14

)

Deferred income tax expense

—

1

LIFO charge

13

50

Provision (recoveries) for losses on

receivables

2

(3

)

Non-cash interest expense and other

adjustments

5

8

Changes in operating assets and

liabilities

(213

)

(22

)

Net cash (used in) provided by operating

activities

(71

)

270

CASH FLOWS FROM INVESTING

ACTIVITIES:

Payments for capital expenditures

(141

)

(151

)

Proceeds from dispositions of assets

11

12

Payments for investments

(12

)

(4

)

Net cash used in investing activities

(142

)

(143

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Proceeds from borrowings under revolving

credit line

1,422

1,944

Proceeds from issuance of other loans

14

—

Repayments of borrowings under revolving

credit line

(1,180

)

(1,861

)

Repayments of long-term debt and finance

leases

(37

)

(143

)

Repurchases of common stock

—

(29

)

Payments of employee restricted stock tax

withholdings

(6

)

(39

)

Distributions to noncontrolling

interests

(2

)

(2

)

Repayments of other loans

—

(1

)

Other

(1

)

—

Net cash provided by (used in) financing

activities

210

(131

)

EFFECT OF EXCHANGE RATE ON CASH

—

—

NET DECREASE IN CASH AND CASH

EQUIVALENTS

(3

)

(4

)

Cash and cash equivalents, at beginning of

period

37

44

Cash and cash equivalents, at end of

period

$

34

$

40

Supplemental disclosures of cash flow

information:

Cash paid for interest

$

74

$

65

Cash (refunds) payments for federal,

state, and foreign income taxes, net

$

(13

)

$

3

Leased assets obtained in exchange for new

operating lease liabilities

$

298

$

133

Additions of property and equipment

included in Accounts payable

$

31

$

31

SUPPLEMENTAL NON-GAAP

FINANCIAL INFORMATION (unaudited)

UNITED NATURAL FOODS, INC.

Reconciliation of Net (loss) income including noncontrolling

interests to Adjusted EBITDA (unaudited)

13-Week Period Ended

26-Week Period Ended

(in millions)

January 27, 2024

January 28, 2023

January 27, 2024

January 28, 2023

Net (loss) income including noncontrolling

interests

$

(14

)

$

22

$

(53

)

$

89

Adjustments to net (loss) income including

noncontrolling interests:

Less net income attributable to

noncontrolling interests

(1

)

(3

)

(1

)

(4

)

Net periodic benefit income, excluding

service cost

(4

)

(7

)

(7

)

(14

)

Interest expense, net

40

39

75

74

Other income, net

(1

)

—

(1

)

(1

)

(Benefit) provision for income taxes

(5

)

9

(14

)

14

Depreciation and amortization

74

73

152

147

Share-based compensation

10

11

16

23

LIFO charge

6

29

13

50

Restructuring, acquisition and integration

related expenses

4

3

8

5

Loss (gain) on sale of assets and other

asset charges (1)

5

1

24

(4

)

Business transformation costs (2)

14

4

29

9

Other adjustments (3)

—

—

4

—

Adjusted EBITDA

$

128

$

181

$

245

$

388

(1)

Fiscal 2024 includes a $21 million

non-cash asset impairment charge related to one of our

corporate-owned office locations in the first quarter of fiscal

2024.

(2)

Reflects costs associated with business

transformation initiatives, primarily including third-party

consulting costs and licensing costs, which are included within

Operating expenses in the Condensed Consolidated Statements of

Operations.

(3)

Primarily reflects third-party

professional service fees related to shareholder negotiations.

Reconciliation of Net (loss)

income attributable to United Natural Foods, Inc. to Adjusted net

(loss) income and Adjusted EPS (unaudited)

13-Week Period Ended

26-Week Period Ended

(in millions, except per share

amounts)

January 27, 2024

January 28, 2023

January 27, 2024

January 28, 2023

Net (loss) income attributable to United

Natural Foods, Inc.

$

(15

)

$

19

$

(54

)

$

85

Restructuring, acquisition and integration

related expenses

4

3

8

5

(Gain) loss on sale of assets and other

asset charges other than losses on sales of receivables (1)

—

(4

)

14

(9

)

LIFO charge

6

29

13

50

Surplus property depreciation and interest

expense (2)

1

—

2

1

Loss on debt extinguishment

—

3

—

3

Business transformation costs (3)

14

4

29

9

Other adjustments (4)

—

—

4

—

Tax impact of adjustments and adjusted

effective tax rate (5)

(6

)

(7

)

(14

)

(27

)

Adjusted net income

$

4

$

47

$

2

$

117

Diluted weighted average shares

outstanding

60.0

61.0

59.9

61.3

Adjusted EPS (6)

$

0.07

$

0.78

$

0.03

$

1.92

(1)

(Gain) loss on sale of assets and other

asset charges, as reflected here, does not include losses on sales

of receivables under the accounts receivable monetization program,

which are included in Loss (gain) on sale of assets and other asset

charges on the Consolidated Statements of Operations and are not

adjusted in the calculation of Adjusted EPS. Fiscal 2024 includes a

$21 million non-cash asset impairment charge related to one of our

corporate-owned office locations in the first quarter of fiscal

2024.

(2)

Reflects surplus, non-operating property

depreciation and interest expense.

(3)

Reflects costs associated with business

transformation initiatives, primarily including third-party

consulting costs and licensing costs, which are included within

Operating expenses in the Condensed Consolidated Statements of

Operations.

(4)

Primarily reflects third-party

professional service fees related to shareholder negotiations.

(5)

Represents the tax effect of the pre-tax

adjustments using an adjusted effective tax rate. The adjusted

effective tax rate is calculated based on adjusted net income

before tax, and its impact reflects the exclusion of changes to

uncertain tax positions, valuation allowances, tax impacts related

to the vesting of share-based compensation awards and discrete GAAP

tax items which could impact the comparability of the operational

effective tax rate. The Company believes using this adjusted

effective tax rate will provide better consistency across the

interim reporting periods since each of these discrete items can

cause volatility in the GAAP tax rate that is not indicative of the

underlying ongoing operations of the Company. By providing this

non-GAAP measure, management intends to provide investors with a

meaningful, consistent comparison of the Company’s effective tax

rate on ongoing operations.

(6)

Adjusted earnings per share amounts are

calculated using actual unrounded figures.

Calculation of net debt to

Adjusted EBITDA leverage ratio (unaudited)

(in millions, except ratios)

January 27, 2024

Current portion of long-term debt and

finance lease liabilities

$

12

Long-term debt

2,176

Long-term finance lease liabilities

7

Less: Cash and cash equivalents

(34

)

Net carrying value of debt and finance

lease liabilities

2,161

Adjusted EBITDA (1)

$

497

Adjusted EBITDA leverage ratio

4.3x

(1)

Adjusted EBITDA for purposes of this

calculation reflects the summation of the trailing four quarters

ended January 27, 2024. Refer to the following table for the

reconciliation of Adjusted EBITDA trailing four quarters.

Reconciliation of trailing

four quarters Net loss including noncontrolling interests to

Adjusted EBITDA (unaudited)

(in millions)

52-Week Period Ended January

27, 2024

Net loss including noncontrolling

interests

$

(112

)

Adjustments to net loss including

noncontrolling interests:

Less net income attributable to

noncontrolling interests

(3

)

Net periodic benefit income, excluding

service cost

(22

)

Interest expense, net

145

Other income, net

(2

)

Benefit for income taxes

(51

)

Depreciation and amortization

309

Share-based compensation

31

LIFO charge

82

Restructuring, acquisition and integration

related expenses

11

Loss on sale of assets and other asset

charges

58

Multiemployer pension plan withdrawal

charges

1

Other retail expense

1

Business transformation costs

45

Other adjustments

4

Adjusted EBITDA (1)

$

497

(1)

Adjusted EBITDA for purposes of this

calculation reflects the summation of the trailing four quarters

ended January 27, 2024.

Reconciliation of Net cash

(used in) provided by operating activities to Free cash flow

(unaudited)

13-Week Period Ended

26-Week Period Ended

(in millions)

January 27, 2024

January 28, 2023

January 27, 2024

January 28, 2023

Net cash provided by (used in) operating

activities

$

183

$

532

$

(71

)

$

270

Payments for capital expenditures

(67

)

(84

)

(141

)

(151

)

Free cash flow

$

116

$

448

$

(212

)

$

119

Reconciliation of Payments for

capital expenditures to Capital and cloud implementation

expenditures (unaudited)

13-Week Period Ended

26-Week Period Ended

(in millions)

January 27, 2024

January 28, 2023

January 27, 2024

January 28, 2023

Payments for capital expenditures

$

67

$

84

$

141

$

151

Cloud technology implementation

expenditures (1)

8

2

17

3

Capital and cloud implementation

expenditures

$

75

$

86

$

158

$

154

(1)

Cloud technology implementation

expenditures are included in operating activities in the Condensed

Consolidated Statements of Cash Flows.

FISCAL 2024

OUTLOOK

Reconciliation of 2024 outlook

for estimated Net loss attributable to United Natural Foods, Inc.

to Adjusted net (loss) income and estimated Adjusted EPS

(unaudited)

Fiscal Year Ending August 3,

2024

(in millions, except per share

amounts)

Low Range

Estimate

High Range

Net loss attributable to United Natural

Foods, Inc.

$

(101

)

$

(65

)

Restructuring, acquisition and integration

related expenses

2

LIFO charge

25

Loss on sale of assets and other asset

charges (1)

13

Business transformation costs

51

Tax impact of adjustments and adjusted

effective tax rate (2)

(23

)

Adjusted net (loss) income

$

(33

)

$

3

Diluted weighted average shares

outstanding

59

60

Adjusted EPS (3)

$

(0.56

)

$

0.06

(1)

Loss on sale of assets and other asset

charges, as reflected here, does not include losses on sales of

receivables under the accounts receivable monetization program,

which are included in Loss (gain) on sale of assets and other asset

charges on the Consolidated Statements of Operations and are not

adjusted in the calculation of Adjusted EPS.

(2)

The estimated adjusted effective tax rate

excludes the potential impact of changes in uncertain tax

positions, tax impacts related to the vesting of share-based

compensation awards and valuation allowances. Refer to the

reconciliation for adjusted effective tax rate.

(3)

Adjusted (loss) earnings per share amounts

as presented include rounding.

Reconciliation of 2024 outlook

for Net loss attributable to United Natural Foods, Inc. to Adjusted

EBITDA (unaudited)

Fiscal Year Ending August 3,

2024

(in millions)

Low Range

Estimate

High Range

Net loss attributable to United Natural

Foods, Inc.

$

(101

)

$

(65

)

Benefit for income taxes

(36

)

(22

)

LIFO charge

25

Interest expense, net

161

Depreciation and amortization

314

Share-based compensation and other

42

Net periodic benefit income, excluding

service costs

(15

)

Loss on sale of assets and other asset

charges

32

Restructuring, acquisition and integration

related expenses

2

Business transformation costs

51

Adjusted EBITDA

$

475

$

525

Reconciliation of estimated

2024 and actual 2023 U.S. GAAP effective tax rate to adjusted

effective tax rate (unaudited)

Estimated Fiscal

2024

Actual Fiscal 2023

U.S. GAAP effective tax rate

22

%

(329

)%

Discrete quarterly recognition of GAAP

items (1)

43

%

270

%

Tax impact of other charges and

adjustments (2)

(37

)%

139

%

Changes in valuation allowances (3)

1

%

(57

)%

Other (4)

(3

)%

—

%

Adjusted effective tax rate (4)

26

%

23

%

Note: As part of the year-end reconciliation, we update the

reconciliation of the GAAP effective tax rate for actual results.

(1)

Reflects changes in tax laws, uncertain

tax positions, the tax impacts related to the exercise of

share-based compensation awards and any prior-year deferred tax or

payable adjustments. This includes prior-year Internal Revenue

Service or other tax jurisdiction audit adjustments.

(2)

Reflects the tax impact of pre-tax

adjustments that are excluded from pre-tax income when calculating

Adjusted EPS.

(3)

Reflects changes in valuation allowances

related to changes in judgment regarding the realizability of

deferred tax assets or current year operations.

(4)

The Company establishes an estimated

adjusted effective tax rate at the beginning of the fiscal year

based on the best available information. The Company re-evaluates

its estimated adjusted effective tax rate as appropriate throughout

the year and adjusts for any material changes. The actual adjusted

effective tax rate at the end of the fiscal year is based on actual

results and accordingly may differ from the estimated adjusted

effective tax rate used during the year.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240306821992/en/

INVESTOR CONTACTS: Steve Bloomquist Vice President,

Investor Relations 952-828-4144 sbloomquist@unfi.com

Kristyn Farahmand Senior Vice President, Investor Relations and

Transformation Finance 401-213-2160 kristyn.farahmand@unfi.com

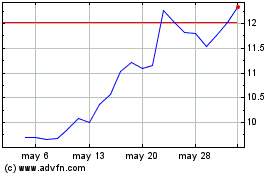

United Natural Foods (NYSE:UNFI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

United Natural Foods (NYSE:UNFI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024