INNOVATE Corp. (“INNOVATE” or the “Company”) (NYSE: VATE) announced

today its consolidated results for the second quarter.

Financial Summary

| (in millions, except per share

amounts) |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2023 |

|

2022 |

|

Increase / (Decrease) |

|

2023 |

|

2022 |

|

Increase / (Decrease) |

|

Revenue |

$ |

368.8 |

|

|

$ |

392.2 |

|

|

(6.0 |

)% |

|

$ |

686.7 |

|

|

$ |

805.0 |

|

|

(14.7 |

)% |

| Net loss attributable to

common stockholders |

$ |

(10.5 |

) |

|

$ |

(13.6 |

) |

|

22.8 |

% |

|

$ |

(20.7 |

) |

|

$ |

(27.2 |

) |

|

23.9 |

% |

| Basic and Diluted loss per

share - Net loss attributable to common stockholders |

$ |

(0.13 |

) |

|

$ |

(0.18 |

) |

|

27.8 |

% |

|

$ |

(0.27 |

) |

|

$ |

(0.35 |

) |

|

22.9 |

% |

| Total Adjusted EBITDA(1) |

$ |

16.5 |

|

|

$ |

12.1 |

|

|

36.4 |

% |

|

$ |

21.4 |

|

|

$ |

23.6 |

|

|

(9.3 |

)% |

(1) Reconciliation of GAAP to Non-GAAP measures

follows

Commentary“INNOVATE reported

strong second quarter results with revenue of $368.8 million

and adjusted EBITDA of $16.5 million, as our operating

segments are capitalizing on attractive market opportunities," said

Avie Glazer, Chairman of INNOVATE. “The strength in the second

quarter was driven by INNOVATE's Infrastructure segment which

expanded adjusted EBITDA margin by approximately 100 basis points.

We also remain excited by developments and opportunities in the

Life Sciences segment as MediBeacon completed the Phase 3

Transdermal GFR Pivotal Study and filed the Clinical Study Report

with FDA. At Spectrum, adjusted EBITDA grew both sequentially and

year-over-year."

"We are deeply saddened by Wayne Barr's passing

and greatly appreciate his leadership and many significant

contributions to INNOVATE. Wayne's strategic vision and operating

expertise were instrumental in setting INNOVATE on a path toward

future success, and we were fortunate to have him as our CEO,"

Glazer added. "We are confident that Paul Voigt, building on his

prior experience with the Company and each of our three operating

segments, will help INNOVATE capitalize on opportunities to unlock

value and deliver returns for shareholders."

Second Quarter 2023

Highlights

- On May 9, 2023, the Company

consummated the purchase of all of the Series A Fixed-to-Floating

Rate Perpetual Preferred Stock (the “Series A Preferred”) issued by

DBM Global Intermediate Holdco Inc. held by Continental General

Insurance Company (“CGIC”) for $42.2 million, including

$0.4 million of accrued dividends, consisting of

$7.1 million of cash and a $35.1 million unsecured note

that is due in 2026. The purchase was precipitated by a redemption

notice received from CGIC, which notice was permitted to be

delivered by CGIC under the terms of the Series A Preferred.

Infrastructure

- DBM Global Inc. ("DBMG") reported

second quarter 2023 revenue of $362.4 million, a decrease of 5.2%,

compared to $382.1 million in the prior year quarter. Net Income

was $7.0 million, compared to $6.8 million for the prior year

quarter. Adjusted EBITDA increased to $23.5 million from

$20.9 million in the prior year quarter.

- DBM Global grew Adjusted EBITDA

margin to 6.5% in the second quarter, an expansion of approximately

100 basis points year-over-year.

- DBM Global’s reported backlog and

adjusted backlog, which takes into consideration awarded but not

yet signed contracts, was $1.5 billion as of June 30, 2023,

compared to $1.8 billion as of December 31, 2022.

Life Sciences

- R2 Technologies, Inc. ("R2") has now shipped 284 GLACIAL®

devices globally.

- MediBeacon completed the Phase 3 Transdermal GFR Pivotal Study

and filed the Clinical Study Report with FDA.

- MediBeacon submitted the Transdermal GFR Medical Device

Regulation application in Europe.

- MediBeacon research related to Transdermal GFR use in

monitoring acute kidney function changes was published in the peer

reviewed journal of American Society for Artificial Internal

Organs.

- MediBeacon received formal feedback from FDA on future clinical

study plans related to Gastroenterology, Ophthalmology and Surgical

Visualization.

Spectrum

- Broadcasting appointed Matt Katrosar as Chief Executive Officer

in July. Most recently, Mr. Katrosar served as Vice President of

Sales for Paramount Global where he led the company’s streaming and

programmatic sales functions.

- Linear broadcast TV networks are seeing indications of

stabilization in the second quarter and are looking ahead to a

stronger 2024.

- New business opportunities are emerging in other areas,

including religious networks and FAST channels looking for

"over-the-air" distribution.

- For the second quarter of 2023,

Broadcasting reported revenue of $5.7 million, compared to

$9.1 million in the prior year quarter. The decrease was

primarily driven by the elimination of advertising revenues at

Azteca, which ceased operations on December 31, 2022. This was

partially offset by an increase in station revenues, which launched

new markets and networks with its customers in the current

period.

- For the second quarter of 2023,

Broadcasting reported Net Loss of $5.3 million compared to $5.7

million in the prior year quarter. Adjusted EBITDA was

$0.8 million, compared to Adjusted EBITDA of $0.4 million

in the prior year quarter.

Second Quarter 2023 Financial Highlights

- Revenue: For the

second quarter of 2023, INNOVATE's consolidated revenue was $368.8

million, a decrease of 6.0%, compared to $392.2 million for the

prior year quarter. The decrease was primarily driven by our

Infrastructure segment, and, to a lesser extent, our Spectrum

segment. The decline at the Infrastructure segment was driven by

lower revenue at DBMG's industrial maintenance and repair business

and the timing of projects at the commercial structural steel

fabrication business. Revenues at our Spectrum segment decreased

primarily as a result of the termination of HC2 Network, Inc.

("Network") and its associated Azteca America network ("Azteca")

content on December 31, 2022.

| |

|

REVENUE by OPERATING SEGMENT |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2023 |

|

2022 |

|

Increase / (Decrease) |

|

2023 |

|

2022 |

|

Increase / (Decrease) |

|

Infrastructure |

|

$ |

362.4 |

|

$ |

382.1 |

|

$ |

(19.7 |

) |

|

$ |

674.1 |

|

$ |

784.3 |

|

$ |

(110.2 |

) |

| Life Sciences |

|

|

0.7 |

|

|

1.0 |

|

|

(0.3 |

) |

|

|

1.2 |

|

|

1.8 |

|

|

(0.6 |

) |

| Spectrum |

|

|

5.7 |

|

|

9.1 |

|

|

(3.4 |

) |

|

|

11.4 |

|

|

18.9 |

|

|

(7.5 |

) |

| Consolidated INNOVATE |

|

$ |

368.8 |

|

$ |

392.2 |

|

$ |

(23.4 |

) |

|

$ |

686.7 |

|

$ |

805.0 |

|

$ |

(118.3 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Net Loss: For the

second quarter of 2023, INNOVATE reported a Net Loss attributable

to common stockholders of $10.5 million, or $0.13 per fully

diluted share, compared to a Net Loss of $13.6 million, or

$0.18 per fully diluted share, for the prior year quarter. The

decrease in Net Loss was due to a net increase in gross profit, and

reductions in other operating expenses, depreciation and

amortization and selling, general and administrative expenses

("SG&A"). The increase in gross profit was primarily due to the

increase in our Infrastructure segment due to timing of higher

margin projects at the commercial structural steel fabrication

business, which was partially offset by lower contribution at the

industrial maintenance and repair business. The decrease in Net

Loss was partially offset by an increase in interest expense

attributable to higher interest rates, increased amortization of

debt issuance costs on the debt, and higher outstanding principal

balances.

| |

|

NET INCOME (LOSS) by OPERATING SEGMENT |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2023 |

|

2022 |

|

Increase / (Decrease) |

|

2023 |

|

2022 |

|

Increase / (Decrease) |

|

Infrastructure |

|

$ |

7.0 |

|

|

$ |

6.8 |

|

|

$ |

0.2 |

|

|

$ |

9.0 |

|

|

$ |

12.9 |

|

|

$ |

(3.9 |

) |

| Life Sciences |

|

|

(2.9 |

) |

|

|

(5.3 |

) |

|

|

2.4 |

|

|

|

(5.7 |

) |

|

|

(9.4 |

) |

|

|

3.7 |

|

| Spectrum |

|

|

(5.3 |

) |

|

|

(5.7 |

) |

|

|

0.4 |

|

|

|

(10.3 |

) |

|

|

(9.1 |

) |

|

|

(1.2 |

) |

| Non-operating Corporate |

|

|

(8.2 |

) |

|

|

(9.5 |

) |

|

|

1.3 |

|

|

|

(20.1 |

) |

|

|

(20.8 |

) |

|

|

0.7 |

|

| Other and eliminations |

|

|

(0.5 |

) |

|

|

1.3 |

|

|

|

(1.8 |

) |

|

|

8.2 |

|

|

|

1.6 |

|

|

|

6.6 |

|

| Net loss attributable to

INNOVATE Corp. |

|

$ |

(9.9 |

) |

|

$ |

(12.4 |

) |

|

|

2.5 |

|

|

$ |

(18.9 |

) |

|

$ |

(24.8 |

) |

|

$ |

5.9 |

|

| Less: Preferred dividends |

|

|

0.6 |

|

|

|

1.2 |

|

|

|

(0.6 |

) |

|

|

1.8 |

|

|

|

2.4 |

|

|

|

(0.6 |

) |

| Net loss attributable to

common stockholders |

|

$ |

(10.5 |

) |

|

$ |

(13.6 |

) |

|

$ |

3.1 |

|

|

$ |

(20.7 |

) |

|

$ |

(27.2 |

) |

|

$ |

6.5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Adjusted EBITDA:

For the second quarter of 2023, Total Adjusted EBITDA, was $16.5

million, compared to Total Adjusted EBITDA of $12.1 million

for the prior year quarter. The increase in Adjusted EBITDA was

primarily driven by timing of higher margin projects at the

commercial structural steel and fabrication business at our

Infrastructure segment and our Life Science segment primarily due

to Pansend's net carrying amount of its investment in MediBeacon

being zero, which resulted in no additional losses being recognized

in our equity investment in MediBeacon in the current period, and a

decrease in SG&A expenses at R2. Additionally contributing to

the increase in Adjusted EBITDA was the Spectrum segment due to the

elimination of Network's EBITDA losses in the comparable period as

a result the termination of Network. The increase was partially

offset by the Infrastructure segment driven by lower contributions

at the industrial maintenance and repair business and Banker Steel

due to timing and size of projects, as well as an increase in

SG&A. The increase was also partially offset by the elimination

of equity method income from our investment in HMN, which was sold

on March 6, 2023.

| |

|

|

|

|

|

|

|

| ADJUSTED

EBITDA by OPERATING SEGMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2023 |

|

2022 |

|

Increase / (Decrease) |

|

2023 |

|

2022 |

|

Increase /(Decrease) |

|

Infrastructure |

$ |

23.5 |

|

|

$ |

20.9 |

|

|

$ |

2.6 |

|

|

$ |

39.8 |

|

|

$ |

41.4 |

|

|

$ |

(1.6 |

) |

| Life Sciences |

|

(3.9 |

) |

|

|

(7.5 |

) |

|

|

3.6 |

|

|

|

(11.7 |

) |

|

|

(13.3 |

) |

|

|

1.6 |

|

| Spectrum |

|

0.8 |

|

|

|

0.4 |

|

|

|

0.4 |

|

|

|

1.2 |

|

|

|

1.7 |

|

|

|

(0.5 |

) |

| Non-operating Corporate |

|

(3.4 |

) |

|

|

(3.4 |

) |

|

|

— |

|

|

|

(6.9 |

) |

|

|

(8.0 |

) |

|

|

1.1 |

|

| Other and eliminations |

|

(0.5 |

) |

|

|

1.7 |

|

|

|

(2.2 |

) |

|

|

(1.0 |

) |

|

|

1.8 |

|

|

|

(2.8 |

) |

| Total Adjusted EBITDA |

$ |

16.5 |

|

|

$ |

12.1 |

|

|

$ |

4.4 |

|

|

$ |

21.4 |

|

|

$ |

23.6 |

|

|

$ |

(2.2 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Balance Sheet: As

of June 30, 2023, INNOVATE had cash and cash equivalents,

excluding restricted cash, of $28.8 million compared to $80.4

million as of December 31, 2022. On a stand-alone basis, as of

June 30, 2023, the Non-operating Corporate segment had cash

and cash equivalents of $9.5 million compared to $9.1 million at

December 31, 2022.

Subsequent to the quarter, on July 31, 2023,

INNOVATE drew an additional $7.0 million under the Revolving

Credit Agreement, increasing the outstanding balance to

$20.0 million.

Conference Call

INNOVATE will host a live conference call to

discuss its second quarter 2023 financial results and operations

today at 4:30 p.m. ET. The Company will post an earnings

supplemental presentation in the Investor Relations section of the

INNOVATE website at innovate-ir.com to accompany the

conference call. Dial-in instructions for the conference call and

the replay follows.

- Live Webcast and

Call. A live webcast of the conference

call can be accessed by interested parties through the Investor

Relations section of the INNOVATE website at innovate-ir.com.

- Dial-in: 1-888-886-7786 (Domestic Toll Free) / 1-416-764-8658

(Toll/International)

- Participant Entry Number: 85848080

- Conference

Replay*

- Dial-in: 1-844-512-2921 (Domestic

Toll Free) / 1-412-317-6671 (Toll/International)

- Conference Number: 85848080

*Available approximately two hours after the end of the

conference call through August 23, 2023.

About INNOVATE Corp.

INNOVATE Corp., is a portfolio of best-in-class

assets in three key areas of the new economy – Infrastructure, Life

Sciences and Spectrum. Dedicated to stakeholder capitalism,

INNOVATE employs approximately 3,800 people across its

subsidiaries. For more information, please visit:

www.INNOVATECorp.com.

Contacts

Investor Contact:Anthony

Rozmusir@innovatecorp.com(212) 235-2691

Media Contact:ReevemarkPaul

Caminiti/Pam Greene/Luc HerbowyINNOVATE.Team@reevemark.com(212)

433-4600

Non-GAAP Financial Measures

In this press release, INNOVATE refers to

certain financial measures that are not presented in accordance

with U.S. generally accepted accounting principles (“GAAP”),

including Total Adjusted EBITDA (excluding discontinued operations)

and Adjusted EBITDA for its operating segments.

Adjusted EBITDA

Management believes that Adjusted EBITDA

provides investors with meaningful information for gaining an

understanding of our results as it is frequently used by the

financial community to provide insight into an organization’s

operating trends and facilitates comparisons between peer

companies, since interest, taxes, depreciation, amortization and

the other items listed in the definition of Adjusted EBITDA below

can differ greatly between organizations as a result of differing

capital structures and tax strategies. Adjusted EBITDA can also be

a useful measure of a company’s ability to service debt. While

management believes that non-U.S. GAAP measurements are useful

supplemental information, such adjusted results are not intended to

replace our U.S. GAAP financial results. Using Adjusted EBITDA as a

performance measure has inherent limitations as an analytical tool

as compared to net income (loss) or other U.S. GAAP financial

measures, as this non-GAAP measure excludes certain items,

including items that are recurring in nature, which may be

meaningful to investors. As a result of the exclusions, Adjusted

EBITDA should not be considered in isolation and does not purport

to be an alternative to net income (loss) or other U.S. GAAP

financial measures as a measure of our operating performance.

Adjusted EBITDA excludes the results of operations and any

consolidating eliminations of our previous Insurance segment.

The calculation of Adjusted EBITDA, as defined

by us, consists of Net income (loss) attributable to INNOVATE

Corp., excluding discontinued operations, if applicable;

depreciation and amortization; other operating (income) loss, which

is inclusive of (gain) loss on sale or disposal of assets, lease

termination costs, asset impairment expense and FCC reimbursements;

interest expense; other (income) expense, net; income tax expense

(benefit); non-controlling interest; share-based compensation

expense; restructuring and exit costs; non-recurring items; and

acquisition and disposition costs.

Cautionary Statement Regarding

Forward-Looking Statements

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995: This press release

contains, and certain oral statements made by our representatives

from time to time may contain, "forward-looking statements."

Generally, forward-looking statements include information

describing actions, events, results, strategies and expectations

and are generally identifiable by use of the words “believes,”

“expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,”

“projects,” “may,” “will,” “could,” “might,” or “continues” or

similar expressions. Such forward-looking statements are based on

current expectations and inherently involve certain risks,

assumptions and uncertainties. The forward-looking statements in

this press release include, without limitation, any statements

regarding INNOVATE’s plans and expectations for future growth and

ability to capitalize on potential opportunities, the achievement

of INNOVATE’s strategic objectives, expectations for performance of

new projects and realization of revenue from the backlog at DBM

Global, anticipated success from the launch of new products in the

Life Sciences segment, anticipated performance of new channels and

LPTV frequencies and expanded uses for LPTV channels in the

Spectrum segment, and changes in macroeconomic and market

conditions and market volatility (including developments and

volatility arising from the COVID-19 pandemic), including interest

rates, the value of securities and other financial assets, and the

impact of such changes and volatility on INNOVATE’s financial

position. Such statements are based on the beliefs and assumptions

of INNOVATE’s management and the management of INNOVATE’s

subsidiaries and portfolio companies.

The Company believes these judgments are

reasonable, but you should understand that these statements are not

guarantees of performance, results or the creation of stockholder

value and the Company’s actual results could differ materially from

those expressed or implied in the forward-looking statements due to

a variety of important factors, both positive and negative,

including those that may be identified in subsequent statements and

reports filed with the Securities and Exchange Commission (“SEC”),

including in our reports on Forms 10-K, 10-Q, and 8-K. Such

important factors include, without limitation: our dependence on

distributions from our subsidiaries to fund our operations and

payments on our obligations; the impact on our business and

financial condition of our substantial indebtedness and the

significant additional indebtedness and other financing obligations

we may incur; our dependence on key personnel; volatility in the

trading price of our common stock; the impact of recent supply

chain disruptions, labor shortages and increases in overall price

levels, including in transportation costs; interest rate

environment; developments relating to the ongoing hostilities in

Ukraine; increased competition in the markets in which our

operating segments conduct their businesses; our ability to

successfully identify any strategic acquisitions or business

opportunities; uncertain global economic conditions in the markets

in which our operating segments conduct their businesses; changes

in regulations and tax laws; covenant noncompliance risk; tax

consequences associated with our acquisition, holding and

disposition of target companies and assets; our ability to remain

in compliance with the listing standards of the New York Stock

Exchange; the ability of our operating segments to attract and

retain customers; our expectations regarding the timing, extent and

effectiveness of our cost reduction initiatives and management’s

ability to moderate or control discretionary spending; our

expectations and timing with respect to any strategic dispositions

and sales of our operating subsidiaries, or businesses; the

possibility of indemnification claims arising out of divestitures

of businesses; and our possible inability to raise additional

capital when needed or refinance our existing debt, on attractive

terms, or at all.

Although INNOVATE believes its expectations and

assumptions regarding its future operating performance are

reasonable, there can be no assurance that the expectations

reflected herein will be achieved. These risks and other important

factors discussed under the caption “Risk Factors” in our most

recent Annual Report on Form 10-K filed with the SEC, and our other

reports filed with the SEC could cause actual results to differ

materially from those indicated by the forward-looking statements

made in this press release.

You should not place undue reliance on

forward-looking statements. All forward-looking statements

attributable to INNOVATE or persons acting on its behalf are

expressly qualified in their entirety by the foregoing cautionary

statements. All such statements speak only as of the date made, and

unless legally required, INNOVATE undertakes no obligation to

update or revise publicly any forward-looking statements, whether

as a result of new information, future events or otherwise.

| |

|

INNOVATE CORP.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(in millions, except per share

amounts)(Unaudited) |

| |

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Revenue |

|

$ |

368.8 |

|

|

$ |

392.2 |

|

|

$ |

686.7 |

|

|

$ |

805.0 |

|

| Cost of revenue |

|

|

316.2 |

|

|

|

341.9 |

|

|

|

590.5 |

|

|

|

704.9 |

|

| Gross

profit |

|

|

52.6 |

|

|

|

50.3 |

|

|

|

96.2 |

|

|

|

100.1 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

41.1 |

|

|

|

42.1 |

|

|

|

82.8 |

|

|

|

84.7 |

|

|

Depreciation and amortization |

|

|

5.6 |

|

|

|

6.9 |

|

|

|

11.9 |

|

|

|

13.8 |

|

|

Other operating loss (income) |

|

|

0.1 |

|

|

|

1.7 |

|

|

|

(0.3 |

) |

|

|

1.3 |

|

| Income (loss) from

operations |

|

|

5.8 |

|

|

|

(0.4 |

) |

|

|

1.8 |

|

|

|

0.3 |

|

| Other (expense) income: |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(16.3 |

) |

|

|

(12.5 |

) |

|

|

(31.9 |

) |

|

|

(25.1 |

) |

|

Loss from equity investees |

|

|

(0.3 |

) |

|

|

(0.5 |

) |

|

|

(4.3 |

) |

|

|

(1.0 |

) |

|

Other income, net |

|

|

0.3 |

|

|

|

1.5 |

|

|

|

16.8 |

|

|

|

1.4 |

|

| Loss from operations

before income taxes |

|

|

(10.5 |

) |

|

|

(11.9 |

) |

|

|

(17.6 |

) |

|

|

(24.4 |

) |

|

Income tax expense |

|

|

(1.2 |

) |

|

|

(2.0 |

) |

|

|

(2.1 |

) |

|

|

(3.6 |

) |

| Net loss |

|

|

(11.7 |

) |

|

|

(13.9 |

) |

|

|

(19.7 |

) |

|

|

(28.0 |

) |

|

Net loss attributable to non-controlling interests and redeemable

non-controlling interests |

|

|

1.8 |

|

|

|

1.5 |

|

|

|

0.8 |

|

|

|

3.2 |

|

| Net loss attributable

to INNOVATE Corp. |

|

|

(9.9 |

) |

|

|

(12.4 |

) |

|

|

(18.9 |

) |

|

|

(24.8 |

) |

|

Less: Preferred dividends |

|

|

0.6 |

|

|

|

1.2 |

|

|

|

1.8 |

|

|

|

2.4 |

|

| Net loss attributable

to common stockholders |

|

$ |

(10.5 |

) |

|

$ |

(13.6 |

) |

|

$ |

(20.7 |

) |

|

$ |

(27.2 |

) |

| |

|

|

|

|

|

|

|

|

| Loss per share - basic and

diluted |

|

$ |

(0.13 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.27 |

) |

|

$ |

(0.35 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average common shares

outstanding - basic and diluted |

|

|

77.9 |

|

|

|

77.5 |

|

|

|

77.8 |

|

|

|

77.4 |

|

| |

|

INNOVATE CORP.CONDENSED CONSOLIDATED BALANCE SHEET(in

millions, except share amounts)(Unaudited) |

| |

| |

|

June 30,2023 |

|

|

December 31,2022 |

|

| Assets |

|

|

|

|

|

Current assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

28.8 |

|

|

$ |

80.4 |

|

|

Accounts receivable, net |

|

|

293.6 |

|

|

|

254.9 |

|

|

Contract assets |

|

|

175.3 |

|

|

|

165.1 |

|

|

Inventory |

|

|

19.9 |

|

|

|

18.9 |

|

|

Restricted cash |

|

|

— |

|

|

|

0.3 |

|

|

Other current assets |

|

|

13.6 |

|

|

|

16.8 |

|

|

Total current assets |

|

|

531.2 |

|

|

|

536.4 |

|

|

Investments |

|

|

7.4 |

|

|

|

59.5 |

|

|

Deferred tax asset |

|

|

1.7 |

|

|

|

1.7 |

|

|

Property, plant and equipment, net |

|

|

161.5 |

|

|

|

165.0 |

|

|

Goodwill |

|

|

127.0 |

|

|

|

127.1 |

|

|

Intangibles, net |

|

|

182.6 |

|

|

|

190.1 |

|

|

Other assets |

|

|

68.1 |

|

|

|

71.9 |

|

| Total

assets |

|

$ |

1,079.5 |

|

|

$ |

1,151.7 |

|

| Liabilities, temporary

equity and stockholders’ deficit |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Accounts payable |

|

$ |

188.7 |

|

|

$ |

202.5 |

|

|

Accrued liabilities |

|

|

73.3 |

|

|

|

65.4 |

|

|

Current portion of debt obligations |

|

|

222.4 |

|

|

|

30.6 |

|

|

Contract liabilities |

|

|

117.3 |

|

|

|

98.6 |

|

|

Other current liabilities |

|

|

17.2 |

|

|

|

20.1 |

|

|

Total current liabilities |

|

|

618.9 |

|

|

|

417.2 |

|

|

Deferred tax liability |

|

|

3.8 |

|

|

|

9.1 |

|

|

Debt obligations |

|

|

519.6 |

|

|

|

683.8 |

|

|

Other liabilities |

|

|

55.2 |

|

|

|

71.2 |

|

| Total

liabilities |

|

|

1,197.5 |

|

|

|

1,181.3 |

|

| Commitments and

contingencies |

|

|

|

|

| Temporary

equity |

|

|

|

|

|

Preferred stock Series A-3 and Series A-4, $0.001 par value |

|

|

17.0 |

|

|

|

17.6 |

|

|

Shares authorized: 20,000,000 as of both June 30, 2023 and

December 31, 2022 |

|

|

|

|

|

Shares issued and outstanding: 6,125 of Series A-3 and 10,000 of

Series A-4 as of both June 30, 2023 and December 31, 2022 |

|

|

|

|

|

Redeemable non-controlling interest |

|

|

(6.9 |

) |

|

|

43.4 |

|

| Total temporary

equity |

|

|

10.1 |

|

|

|

61.0 |

|

| Stockholders’

deficit |

|

|

|

|

|

Common stock, $0.001 par value |

|

|

0.1 |

|

|

|

0.1 |

|

|

Shares authorized: 160,000,000 as of both June 30, 2023 and

December 31, 2022 |

|

|

|

|

|

Shares issued: 80,722,983 and 80,216,028 as of June 30, 2023

and December 31, 2022, respectively |

|

|

|

|

|

Shares outstanding: 79,234,991 and 78,787,768 as of June 30,

2023 and December 31, 2022, respectively |

|

|

|

|

|

Additional paid-in capital |

|

|

327.0 |

|

|

|

330.1 |

|

|

Treasury stock, at cost: 1,487,992 and 1,428,260 shares as of

June 30, 2023 and December 31, 2022, respectively |

|

|

(5.4 |

) |

|

|

(5.3 |

) |

|

Accumulated deficit |

|

|

(471.0 |

) |

|

|

(452.1 |

) |

|

Accumulated other comprehensive (loss) income |

|

|

(1.6 |

) |

|

|

5.9 |

|

| Total INNOVATE Corp.

stockholders’ deficit |

|

|

(150.9 |

) |

|

|

(121.3 |

) |

|

Non-controlling interest |

|

|

22.8 |

|

|

|

30.7 |

|

| Total stockholders’

deficit |

|

|

(128.1 |

) |

|

|

(90.6 |

) |

| Total liabilities,

temporary equity and stockholders’ deficit |

|

$ |

1,079.5 |

|

|

$ |

1,151.7 |

|

| |

|

INNOVATE CORP.RECONCILIATION OF NET INCOME

(LOSS) TO ADJUSTED EBITDA(Unaudited) |

| |

| (in millions) |

|

Three Months Ended June 30, 2023 |

| |

|

Infrastructure |

|

Life Sciences |

|

Spectrum |

|

Non-operating Corporate |

|

Other and Eliminations |

|

INNOVATE |

|

Net income (loss) attributable to INNOVATE Corp. |

|

$ |

7.0 |

|

|

$ |

(2.9 |

) |

|

$ |

(5.3 |

) |

|

$ |

(8.2 |

) |

|

$ |

(0.5 |

) |

|

$ |

(9.9 |

) |

| Adjustments to reconcile net

income (loss) to Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

4.1 |

|

|

|

0.1 |

|

|

|

1.3 |

|

|

|

0.1 |

|

|

|

— |

|

|

|

5.6 |

|

|

Depreciation and amortization (included in cost of revenue) |

|

|

4.0 |

|

|

|

0.1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4.1 |

|

|

Other operating loss |

|

|

0.1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.1 |

|

|

Interest expense |

|

|

3.4 |

|

|

|

0.7 |

|

|

|

3.4 |

|

|

|

8.8 |

|

|

|

— |

|

|

|

16.3 |

|

|

Other (income) expense, net |

|

|

(0.3 |

) |

|

|

(0.1 |

) |

|

|

1.9 |

|

|

|

(1.9 |

) |

|

|

0.1 |

|

|

|

(0.3 |

) |

|

Income tax expense (benefit) |

|

|

3.8 |

|

|

|

— |

|

|

|

— |

|

|

|

(2.6 |

) |

|

|

— |

|

|

|

1.2 |

|

|

Non-controlling interest |

|

|

0.7 |

|

|

|

(1.9 |

) |

|

|

(0.6 |

) |

|

|

— |

|

|

|

— |

|

|

|

(1.8 |

) |

|

Share-based compensation expense |

|

|

— |

|

|

|

0.1 |

|

|

|

— |

|

|

|

0.6 |

|

|

|

— |

|

|

|

0.7 |

|

|

Restructuring and exit costs |

|

|

0.5 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.5 |

|

|

Acquisition and disposition costs |

|

|

0.2 |

|

|

|

— |

|

|

|

0.1 |

|

|

|

(0.2 |

) |

|

|

(0.1 |

) |

|

|

— |

|

|

Adjusted EBITDA |

|

$ |

23.5 |

|

|

$ |

(3.9 |

) |

|

$ |

0.8 |

|

|

$ |

(3.4 |

) |

|

$ |

(0.5 |

) |

|

$ |

16.5 |

|

| (in millions) |

|

Three Months Ended June 30, 2022 |

| |

|

Infrastructure |

|

Life Sciences |

|

Spectrum |

|

Non-operating Corporate |

|

Other and Eliminations |

|

INNOVATE |

|

Net income (loss) attributable to INNOVATE Corp. |

|

$ |

6.8 |

|

|

$ |

(5.3 |

) |

|

$ |

(5.7 |

) |

|

$ |

(9.5 |

) |

|

$ |

1.3 |

|

$ |

(12.4 |

) |

| Adjustments to reconcile net

income (loss) to Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

5.3 |

|

|

|

— |

|

|

|

1.5 |

|

|

|

0.1 |

|

|

|

— |

|

|

6.9 |

|

|

Depreciation and amortization (included in cost of revenue) |

|

|

3.6 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

3.6 |

|

|

Other operating loss |

|

|

— |

|

|

|

— |

|

|

|

1.7 |

|

|

|

— |

|

|

|

— |

|

|

1.7 |

|

|

Interest expense |

|

|

2.2 |

|

|

|

— |

|

|

|

1.9 |

|

|

|

8.4 |

|

|

|

— |

|

|

12.5 |

|

|

Other (income) expense, net |

|

|

(1.4 |

) |

|

|

(0.2 |

) |

|

|

1.4 |

|

|

|

(1.2 |

) |

|

|

— |

|

|

(1.4 |

) |

|

Gain on sale or dissolution of subsidiary |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.1 |

) |

|

|

— |

|

|

(0.1 |

) |

|

Income tax expense (benefit) |

|

|

3.5 |

|

|

|

— |

|

|

|

— |

|

|

|

(1.5 |

) |

|

|

— |

|

|

2.0 |

|

|

Non-controlling interest |

|

|

0.7 |

|

|

|

(2.1 |

) |

|

|

(0.5 |

) |

|

|

— |

|

|

|

0.4 |

|

|

(1.5 |

) |

|

Share-based compensation expense |

|

|

— |

|

|

|

0.1 |

|

|

|

— |

|

|

|

0.4 |

|

|

|

— |

|

|

0.5 |

|

|

Non-recurring items |

|

|

0.1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

0.1 |

|

|

Acquisition and disposition costs |

|

|

0.1 |

|

|

|

— |

|

|

|

0.1 |

|

|

|

— |

|

|

|

— |

|

|

0.2 |

|

|

Adjusted EBITDA |

|

$ |

20.9 |

|

|

$ |

(7.5 |

) |

|

$ |

0.4 |

|

|

$ |

(3.4 |

) |

|

$ |

1.7 |

|

$ |

12.1 |

|

| |

|

INNOVATE CORP.RECONCILIATION OF NET INCOME

(LOSS) TO ADJUSTED EBITDA(Unaudited) |

| |

| (in millions) |

|

Six Months Ended June 30, 2023 |

| |

|

Infrastructure |

|

Life Sciences |

|

Spectrum |

|

Non-operating Corporate |

|

Other and Eliminations |

|

INNOVATE |

|

Net income (loss) attributable to INNOVATE Corp. |

|

$ |

9.0 |

|

|

$ |

(5.7 |

) |

|

$ |

(10.3 |

) |

|

$ |

(20.1 |

) |

|

$ |

8.2 |

|

|

$ |

(18.9 |

) |

| Adjustments to reconcile net

income (loss) to Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

9.0 |

|

|

|

0.2 |

|

|

|

2.6 |

|

|

|

0.1 |

|

|

|

— |

|

|

|

11.9 |

|

|

Depreciation and amortization (included in cost of revenue) |

|

|

7.9 |

|

|

|

0.1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

8.0 |

|

|

Other operating income |

|

|

— |

|

|

|

— |

|

|

|

(0.3 |

) |

|

|

— |

|

|

|

— |

|

|

|

(0.3 |

) |

|

Interest expense |

|

|

6.8 |

|

|

|

1.2 |

|

|

|

6.6 |

|

|

|

17.3 |

|

|

|

— |

|

|

|

31.9 |

|

|

Other (income) expense, net |

|

|

(0.5 |

) |

|

|

(4.0 |

) |

|

|

3.7 |

|

|

|

(3.5 |

) |

|

|

(12.5 |

) |

|

|

(16.8 |

) |

|

Income tax expense (benefit) |

|

|

4.9 |

|

|

|

— |

|

|

|

— |

|

|

|

(1.6 |

) |

|

|

(1.2 |

) |

|

|

2.1 |

|

|

Non-controlling interest |

|

|

0.9 |

|

|

|

(3.8 |

) |

|

|

(1.2 |

) |

|

|

— |

|

|

|

3.3 |

|

|

|

(0.8 |

) |

|

Share-based compensation expense |

|

|

— |

|

|

|

0.3 |

|

|

|

— |

|

|

|

0.9 |

|

|

|

— |

|

|

|

1.2 |

|

|

Restructuring and exit costs |

|

|

1.0 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1.0 |

|

|

Acquisition and disposition costs |

|

|

0.8 |

|

|

|

— |

|

|

|

0.1 |

|

|

|

— |

|

|

|

1.2 |

|

|

|

2.1 |

|

|

Adjusted EBITDA |

|

$ |

39.8 |

|

|

$ |

(11.7 |

) |

|

$ |

1.2 |

|

|

$ |

(6.9 |

) |

|

$ |

(1.0 |

) |

|

$ |

21.4 |

|

| (in millions) |

|

Six Months Ended June 30, 2022 |

| |

|

Infrastructure |

|

Life Sciences |

|

Spectrum |

|

Non-operating Corporate |

|

Other and Eliminations |

|

INNOVATE |

|

Net income (loss) attributable to INNOVATE Corp. |

|

$ |

12.9 |

|

|

$ |

(9.4 |

) |

|

$ |

(9.1 |

) |

|

$ |

(20.8 |

) |

|

$ |

1.6 |

|

|

$ |

(24.8 |

) |

| Adjustments to reconcile net

income (loss) to Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

10.6 |

|

|

|

0.1 |

|

|

|

3.0 |

|

|

|

0.1 |

|

|

|

— |

|

|

|

13.8 |

|

|

Depreciation and amortization (included in cost of revenue) |

|

|

7.3 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7.3 |

|

|

Other operating (income) loss |

|

|

(0.6 |

) |

|

|

— |

|

|

|

1.9 |

|

|

|

— |

|

|

|

— |

|

|

|

1.3 |

|

|

Interest expense |

|

|

4.4 |

|

|

|

— |

|

|

|

3.9 |

|

|

|

16.8 |

|

|

|

— |

|

|

|

25.1 |

|

|

Other (income) expense, net |

|

|

(1.3 |

) |

|

|

(0.1 |

) |

|

|

2.9 |

|

|

|

(2.8 |

) |

|

|

— |

|

|

|

(1.3 |

) |

|

Gain on sale or dissolution of subsidiary |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.1 |

) |

|

|

— |

|

|

|

(0.1 |

) |

|

Income tax expense (benefit) |

|

|

6.4 |

|

|

|

— |

|

|

|

— |

|

|

|

(2.8 |

) |

|

|

— |

|

|

|

3.6 |

|

|

Non-controlling interest |

|

|

1.3 |

|

|

|

(4.1 |

) |

|

|

(1.1 |

) |

|

|

— |

|

|

|

0.7 |

|

|

|

(3.2 |

) |

|

Share-based compensation expense |

|

|

— |

|

|

|

0.2 |

|

|

|

— |

|

|

|

1.1 |

|

|

|

— |

|

|

|

1.3 |

|

|

Non-recurring items |

|

|

0.1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.1 |

|

|

Acquisition and disposition costs |

|

|

0.3 |

|

|

|

— |

|

|

|

0.2 |

|

|

|

0.5 |

|

|

|

(0.5 |

) |

|

|

0.5 |

|

|

Adjusted EBITDA |

|

$ |

41.4 |

|

|

$ |

(13.3 |

) |

|

$ |

1.7 |

|

|

$ |

(8.0 |

) |

|

$ |

1.8 |

|

|

$ |

23.6 |

|

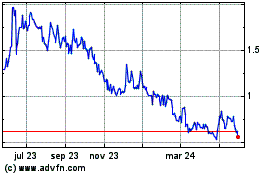

INNOVATE (NYSE:VATE)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

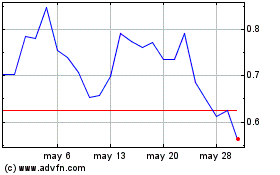

INNOVATE (NYSE:VATE)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024