Conducted by Frost & Sullivan and commissioned by WEX, the

report offers insights for organizations managing mixed-energy

fleets across markets in Europe, North America, and

Asia-Pacific.

A new study by Frost & Sullivan commissioned by WEX (NYSE:

WEX), the global commerce platform simplifying the business of

running a business, reveals that mixed-energy fleets are projected

to increase given anticipated commercial EV adoption rates.

According to the study, 80% of mixed-energy fleet operators intend

for at least 25% of their fleets to be comprised of electric

vehicles (EVs) by 2030 and 42% stated that half or more of their

fleet would be composed of EVs by 2030.

“The Commercial EV Transition: Global Insights on a Mixed-Energy

Fleet Future,” a 2024 global survey, offers comprehensive insights

for organizations to navigate and capitalize on the shift to

electrification in Europe, North America, and Asia-Pacific. The

transition to a mixed-energy fleet – which integrates both EVs and

internal combustion engine (ICE) vehicles – is not a one-time

switch but a gradual process. Adoption rates for EVs can vary

significantly depending on factors such as the region, industry,

and an organization’s scope and size. Understanding the underlying

dynamics can be crucial for optimizing operations and achieving

long-term benefits.

“Organizations know EVs can benefit commercial fleets, but

electrification is a gradual process that involves more than just

vehicle replacement,” said Carlos Carriedo, Chief Operating

Officer, Americas Payments & Mobility at WEX. “This report’s

findings indicate a fleet manager’s focus isn't on 'if' or 'when'

to transition but on 'how best.' A key strategy is recognizing the

value of mixed-energy fleets for a smooth and effective shift to

electrification.”

"Operators will maintain a mix of traditional and electric

vehicles for the foreseeable future, introducing complexities in

operations, infrastructure, energy sourcing, and payments,”

Carriedo continued. “A mixed-energy fleet approach mitigates risk,

allowing businesses to adapt, learn, and, if they desire,

transition fully to electric mobility when the infrastructure is

ready."

Key findings include:

- Decarbonization is the key driver of the transition: 70%

say it is an “important” or “cornerstone” component of their

business strategy, and only 3% are not considering decarbonization

at all. This underscores its importance to organizations’

strategies for cost savings, sustainability, and brand image.

- Operational efficiency is paramount during the

transition: Despite electrification challenges such as high

upfront costs (64%), 50% of surveyed organizations have already

invested in charging infrastructure.

- Streamlining charging and payments is crucial: A

substantial proportion (78%) of organizations have charging

on-site, though charging en-route and at home were also widely

used. Ninety percent of fleets have the same payment options for

Internal Combustion Engine (ICE) and EVs. Dual ICE/EV payment card

availability ranks as the top influencing factor when choosing a

payment card.

- Smart digital solutions could help future-proof fleets:

Over half of the respondents (58%) struggle with route planning,

while 49% struggle to collect data, and 40% face challenges

integrating fleet management software for ICE vehicles and

EVs.

“The findings indicate that while the transition to EVs is

underway, it's not without challenges. With 78% of fleets charging

onsite and 62% using public facilities, issues like identifying the

best use cases, the best vehicles for those use cases, and the best

charging strategies for those vehicles across a complex public and

private infrastructure are significant," said Jay Collins, SVP

& GM, EV & Mobility at WEX. "The mixed fleet adoption

strategy enables businesses to acclimate to the nuances of EV

integration gradually, ensuring operational efficiency throughout

the transition period."

The report also highlights the broader industry implications,

noting that the top three challenges for fleet operators are the

cost of fuel (67%), operational costs (66%), and profit margins

(59%). These challenges reflect fleet managers' pressures to manage

expenses and maintain profitability while transitioning to new

technologies and sustainable practices.

With over four decades of expertise and experience in managing

how fleet data flows through an organization, WEX is now

integrating EV into that experience to help organizations

effectively adopt and manage the mixed-energy fleet transition

lifecycle to drive their financial, operational, and sustainability

goals, backed with WEX’s continued commitment to data security and

privacy. WEX has over 600,000 commercial fleet customers worldwide,

including more than 19.4 million vehicles serviced globally as of

Q2 2024.

About the Fleet Study

These are the findings of a Frost & Sullivan study

commissioned by WEX between February-March 2024. Frost &

Sullivan interviewed mixed-energy fleet operators from over 500

organizations across seven markets in Europe (273 respondents), the

United States (110 respondents), and two markets in Asia-Pacific

(120 respondents) about their journey toward electrification. Each

decision-maker surveyed had at least one EV in their fleet when

surveyed.

A free copy of “The Commercial EV Transition: Global Insights on

a Mixed-Energy Fleet Future”’ can be downloaded here. Market-level

insights can be viewed for the United Kingdom, Belgium, the

Netherlands, Luxembourg, France, Germany, Italy, the United States,

Australia, and New Zealand.

About WEX

WEX (NYSE: WEX) is the global commerce platform that simplifies

the business of running a business. WEX has created a powerful

ecosystem that offers seamlessly embedded, personalized solutions

for its customers around the world. Through its rich data and

specialized expertise in simplifying benefits, reimagining

mobility, and paying and getting paid, WEX aims to make it easy for

companies to overcome complexity and reach their full potential.

For more information, please visit www.wexinc.com.

Forward-Looking Statements

This press release contains forward-looking statements

including, but not limited to, statements about the transition to

and adoption of mixed-energy commercial fleets. Any statements in

this press release that are not statements of historical facts are

forward-looking statements. When used in this press release, the

words “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “plan,” “project,” “will,” “positions,”

“confidence,” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain such words. Forward-looking statements relate to

our future expectations, and are not historical facts and

accordingly involve known and unknown risks and uncertainties and

other factors that may cause the actual results to be materially

different from future results expressed or implied by these

forward-looking statements, including whether the transition to and

adoption of mixed-energy commercial fleets will continue as

currently expected; as well as other risks and uncertainties

identified in Item 1A of our Annual Report on Form 10-K for the

year ended December 31, 2023, filed with the Securities and

Exchange Commission on February 23, 2024 and subsequent filings

with the Securities and Exchange Commission. The forward-looking

statements speak only as of the date of this press release and

undue reliance should not be placed on these statements. The

Company disclaims any obligation to update any forward-looking

statements as a result of new information, future events, or

otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240918260333/en/

Media: WEX Julie Lydon, 415-816-9397 Julie.Lydon@wexinc.com

Investors: WEX Steve Elder, 207-523-7769 Steve.Elder@wexinc.com

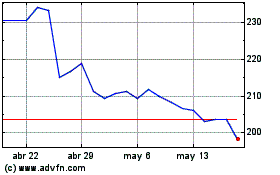

WEX (NYSE:WEX)

Gráfica de Acción Histórica

De Sep 2024 a Oct 2024

WEX (NYSE:WEX)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024