Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

15 Julio 2024 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

SCHEDULE TO

TENDER OFFER STATEMENT

UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

X FINANCIAL

(Name of Subject Company (Issuer) and Filing Person (as Offeror))

American Depositary Shares

(Title of Class of Securities)

98372W202

(CUSIP Number of Class of Securities)

Mr. Frank Fuya Zheng, Chief Financial Officer

Telephone: +86-755-8628 2977

Email: frank.zheng@xiaoying.com

7-8F, Block A, Aerospace Science and Technology Plaza

No. 168, Haide Third Avenue, Nanshan District

Shenzhen, 518067, the People’s Republic of China

(Name, address and telephone number of person authorized

to receive notices and communications on behalf of filing persons)

With copies to:

Lawrence S. Venick, Esq.

Loeb & Loeb LLP

2206-19 Jardine House

1 Connaught Road Central

Hong Kong SAR

+852-3923-1111

☐

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes to designate any transactions to which the statement relates:

☐ third-party tender offer subject to Rule 14d-1.

☒ issuer tender offer subject to Rule 13e-4.

☐ going-private transaction subject to Rule 13e-3.

☐ amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

☐ Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

☐ Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

INTRODUCTORY STATEMENT

This Amendment No. 2 (the “Amendment”) amends and supplements the Tender Offer Statement on Schedule TO (the “Schedule TO”) filed by X Financial, an exempted company incorporated with limited liability under the laws of the Cayman Islands (“X Financial” or the “Company”), with the Securities and Exchange Commission on June 5, 2024, as amended on June 17, 2024. The Schedule TO relates to the offer by the Company to purchase up to 2 million American Depositary Shares (the “ADSs”) of the Company, each representing six Class A ordinary shares, par value $0.0001 per share, at a price of $4.52 per ADS (“Purchase Price”), as defined in the Offer to Purchase (defined below), to the seller in cash, less any applicable withholding taxes and without interest. The Company’s offer was made upon the terms and subject to the conditions set forth in the Offer to Purchase, dated June 5, 2024 (together with any amendments or supplements thereto, the “Offer to Purchase”), the related Letter of Transmittal (together with any amendments or supplements thereto, the “Letter of Transmittal”) and other related materials as may be amended or supplemented (collectively, with the Offer to Purchase and the Letter of Transmittal, the “Tender Offer”). Copies of the Offer to Purchase and the Letter of Transmittal were previously filed as Exhibits (a)(1)(A) and (a)(1)(B) to the Schedule TO, respectively.

Only those items amended or supplemented are reported in this Amendment. Except as specifically provided herein, the information contained in the Schedule TO remains unchanged, and this Amendment does not modify any of the information previously reported on the Schedule TO. You should read this Amendment together with the Schedule TO, the Offer to Purchase and the Letter of Transmittal, as each may be amended or supplemented from time to time.

This Amendment is being filed to report the results of the Tender Offer and is intended to satisfy the reporting requirements of Rule 13e-4(c)(4) promulgated under the Securities Exchange Act of 1934, as amended. All information in the Tender Offer and the Schedule TO is expressly incorporated by reference herein.

Item 11. Additional Information

Item 11 is hereby amended and supplemented as follows:

The Tender Offers expired at 5:00 P.M., New York City time, on July 12, 2024. Based on the final results provided by Broadridge Corporate Issuer Solutions, LLC, the depositary for the Tender Offer (the “Depositary”), 2,026,640 ADSs were validly tendered and not properly withdrawn at the Purchase Price. The Company determined to accept for purchase up to an additional 26,640 ADSs. Accordingly, there will be no proration and the Company has accepted for purchase all of 2,026,640 ADSs validly tendered and not properly withdrawn in the Tender Offer. The Depositary will promptly pay for all ADSs accepted for purchase in accordance with the terms and conditions of the Tender Offer.

The Company has 186,872,295 Class A ordinary shares (including Class A ordinary shares represented by ADSs) outstanding following payment for the ADSs purchased in the Tender Offer.

Broadridge Corporate Issuer Solutions, LLC, is also serving as the information agent for the Tender Offer. For all questions relating to the Tender Offer, please contact: Broadridge Corporate Issuer Solutions, LLC, Telephone (855) 793-5068 (toll-free), email shareholder@broadridge.com.

On July 15, 2024, the Company issued a press release announcing the final results of the Tender Offer. A copy of such press release is attached as Exhibit (a)(5) to this Schedule TO and is incorporated herein by reference.

Item 12. Exhibits.

See the Exhibit Index immediately following the signature page. The information contained in Item 12 of the Schedule TO and the Exhibit Index is hereby amended and supplemented to add the following:

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: July 15, 2024

X FINANCIAL

By:

/s/ Yue (Justin) Tang

Yue (Justin) Tang

Chief Executive Officer and Chairman

EXHIBIT INDEX

| |

Exhibit No.

|

|

|

Description

|

|

| |

(a)(1)(A)*

|

|

|

|

|

| |

(a)(1)(B)*

|

|

|

|

|

| |

(a)(1)(C)*

|

|

|

|

|

| |

(a)(1)(D)*

|

|

|

|

|

| |

(a)(1)(E)*

|

|

|

|

|

| |

(a)(1)(F)*

|

|

|

|

|

| |

(a)(5)(A)*

|

|

|

|

|

| |

(a)(5)(B)

|

|

|

|

|

| |

(d)(1)*

|

|

|

|

|

| |

(d)(2)*

|

|

|

|

|

| |

107

|

|

|

|

|

*

Filed Previously

Exhibit (a)(5)(B)

X Financial Announces Results of Tender Offer

SHENZHEN, China, July 15, 2024 /PRNewswire/ -- X Financial (NYSE: XYF)

(the “Company” or “we”), a leading online personal finance company in China, announced today the results of its

previously announced tender offer (the “Tender Offer”) to purchase up to 2 million American Depositary Shares (the “ADSs”)

of the Company, each representing six Class A ordinary shares, par value $0.0001 per share, at a price of $4.52 per ADS, less any

applicable withholding taxes, less a cancellation fee of $0.05 per ADS accepted for purchase in the Tender Offer that will be paid to

The Bank of New York Mellon, the Company’s ADS depositary (the “ADSs Depositary”), and without interest. The Tender

Offer expired at 5:00 P.M., New York City time, on July 12, 2024.

Based on the results, a total of 2,026,640 ADSs were validly tendered

and not withdrawn. The Company announced that the aggregate amount of ADSs that the Company intends to purchase is increased from the previously

announced 2,000,000 to 2,026,640 to accept for purchase all ADSs validly tendered and not validly withdrawn. Except as described in this

press release, the terms and conditions of the Tender Offers set forth in the Offer to Purchase remain unchanged.

“We are happy to execute this ADS buyback and provide liquidity

to securityholders who were seeking an exit, at a premium to the prevailing market price, and at the same time provide remaining securityholders

who did not want to participate an opportunity to increase their relative percentage ownership in X Financial at no additional cost to

them,” commented Mr. Frank Fuya Zheng, CFO of X Financial. “We are dedicated to navigating the evolving economic landscape

while ensuring the sustainable success of our business and returning value to our shareholders, and we plan to employ different methods,

such dividends and shares buyback, as and when profitability and smooth operations allow. We are confident in our position as a public

company and will drive long-term returns for our shareholders,” concluded Mr. Zheng.

Following completion of the Tender Offer, the Company expects to have

186,872,295 Class A ordinary shares (including Class A ordinary shares represented by ADSs) outstanding.

The information agent and depositary for the Tender Offer is Broadridge

Corporate Issuer Solutions, LLC (“Broadridge”). Broadridge will promptly pay for all of the ADSs accepted for purchase in

accordance with the terms and conditions of the Tender Offer. For all questions relating to the Tender Offer, please contact: Broadridge

Corporate Issuer Solutions, LLC, Telephone (855) 793-5068 (toll-free), email shareholder@Broadridge.com.

About X Financial

X Financial (NYSE: XYF) is a leading online personal

finance company in China. The Company is committed to connecting borrowers on its platform with its institutional funding partners. With

its proprietary big data-driven technology, the Company has established strategic partnerships with financial institutions across multiple

areas of its business operations, enabling it to facilitate and originate loans to prime borrowers under a risk assessment and control

system.

For more information, please visit: http://ir.xiaoyinggroup.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning

of applicable U.S. securities laws, including statements about the Tender Offer, including the value of the ADSs to be offered to purchase

in the tender offer and whether the Tender Offer is actually consummated. Forward-looking statements may be identified by words such as

"seek", "believe", "plan", "estimate", "anticipate", “expect", "intend",

"continue", "outlook", "may", "will", "should", look forward” "could",

or "might", and other similar expressions. These forward-looking statements involve risks and uncertainties, as well as assumptions

that, if they do not fully materialize or prove incorrect, could cause our results to differ materially from those expressed or implied

by such forward-looking statements. Factors that could materially affect our business and financial results include, but are not limited

to, the factors described in the forward-looking statement disclosure and “Risk Factors” section of our most recent Annual

Report on Form 20-K. We do not have any intent, and disclaim any obligation, to update the forward-looking information to reflect

events that occur, circumstances that exist or changes in our expectations after the date of this press release, except as required by

law.

For more information, please contact:

X Financial

Mr. Frank Fuya Zheng

E-mail: ir@xiaoying.com

Christensen IR

In China

Mr. Rene Vanguestaine

Phone: +86-178-1749 0483

E-mail: rene.vanguestaine@christensencomms.com

In US

Ms. Linda Bergkamp

Phone: +1-480-614-3004

Email: linda.bergkamp@christensencomms.com

Exhibit 107

Calculation of Filing Fee Table

SC TO-I/A

(Form Type)

X Financial

(Exact Name of Registrant as Specified in its Charter)

Table 1 - Transaction Valuation

| | |

Transaction

Valuation | | |

Fee

Rate | | |

Amount of

Filing Fee | |

| Fees to Be Paid | |

$ | 9,160,412.8 | (1) | |

| 0.00014760 | | |

$ | 1,353 | (2) |

| Fees Previously Paid | |

$ | 9,040,000 | | |

| 0.00014760 | | |

$ | 1,335 | (3) |

| Total Transaction Valuation | |

$ | 9,040,000 | (1) | |

| | | |

| | |

| Total Fees Due for Filing | |

| | | |

| | | |

$ | 1,353 | (2) |

| Total Fees Previously Paid | |

| | | |

| | | |

$ | 1,335 | (3) |

| Total Fee Offsets | |

| | | |

| | | |

| - | |

| Net Fee Due | |

| | | |

| | | |

$ | 18 | |

| (1) |

The transaction valuation is estimated only for purposes of calculating the filing fee. This amount is based on the purchase of 2,026,640 American Depositary Shares (the “ADSs”) of X Financial, at a price of $4.52 per ADS, with a value of up to $9,160,412.8. |

| (2) |

The amount of the filing fee, calculated in accordance with Rule 0-11(b) of the Securities Exchange Act of 1934, as amended, equals $147.60 per $1,000,000 of the aggregate amount of the Transaction Valuation (or 0.01476% of the aggregate Transaction Valuation). The Transaction Valuation set forth above was calculated for the sole purpose of determining the filing fee and should not be used for any other purpose. |

| (3) | An aggregate fee of $1,335 was paid with the filing of the Schedule

TO-I by the Company (File No. 005-90893) on June 5, 2024. |

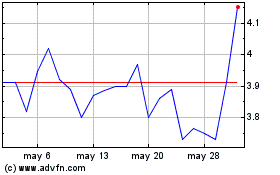

X Financial (NYSE:XYF)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

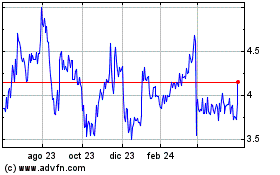

X Financial (NYSE:XYF)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024