Norsk Hydro: Hydro signs new USD 1,000 million revolving credit facility

16 Febrero 2024 - 1:01AM

Norsk Hydro ASA has on February 15, 2024, signed a USD 1,000

million revolving multi-currency credit

facility.

The facility, which is available for general corporate purposes,

carries a two-year tenor with a one-year extension option and

replaces Hydro’s undrawn USD 1,300 million revolving credit

facility. The entire amount is also available as a sub-facility

swingline to cover short-term liquidity needs.

Credit Agricole CIB and DNB acted as the coordinating Mandated

Lead Arrangers and Bookrunners on the transaction.

In addition, Danske Bank and ING acted as the Bookrunners, while

BNP Paribas, Citibank, Goldman Sachs Bank, Handelsbanken, JP

Morgan, Nordea Bank, and SEB participated in the transaction as

Mandated Lead Arrangers.

DNB will act as Facility Agent and Documentation

Agent.

Investor contact: Martine Rambøl Hagen +47 91708918

Martine.Rambol.Hagen@hydro.com

Media contact: Anders Vindegg +47 93864271

Anders.Vindegg@hydro.com

This information is subject to the disclosure requirements

pursuant to Section 5-12 the Norwegian Securities Trading Act

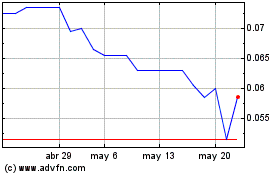

Lucapa Diamond (TG:NHY)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

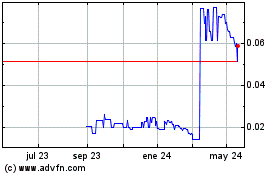

Lucapa Diamond (TG:NHY)

Gráfica de Acción Histórica

De May 2023 a May 2024