Aleafia Health Inc. (TSX:AH, OTCQB:ALEAF)

(“

Aleafia” or the “

Corporation”)

announces today that the Corporation and certain of its Canadian

subsidiaries, Emblem Corp., Emblem Cannabis Corporation, Emblem

Realty Ltd., Growwise Health Limited, Canabo Medical Corporation,

Aleafia Inc., Aleafia Farms Inc., Aleafia Brands Inc., Aleafia

Retail Inc., 2672533 Ontario Inc., and 2676063 Ontario Inc.

(collectively, the “

Aleafia Group”) have been

granted an order (the “

Initial Order”) from the

Ontario Superior Court of Justice (Commercial List) (the

“

Court”) under the Companies’ Creditors

Arrangement Act (the “

CCAA”), in order to

restructure their business and financial affairs.

On July 14, 2023, Aleafia announced the mutual

termination of the binding letter agreement (the “Letter

Agreement”) entered into between Red White & Bloom

Brands Inc. (“RWB”) and Aleafia on June 6, 2023 in

respect of the proposed business combination transaction. In

addition, pursuant to an assignment of indebtedness and security

dated June 6, 2023, NE SPC II LP assigned to RWB, all indebtedness

of Aleafia and certain of its affiliates in connection with the

loan agreement made as of December 24, 2021, as amended on March

28, 2022, June 17, 2022, April 26, 2023, May 15, 2023, and May 31,

2023 (the “Aleafia Senior Secured Loan

Agreement”). Aleafia is currently in breach of certain

covenants under the Aleafia Senior Secured Loan Agreement, RWB has

not waived any outstanding breaches and, on July 24, 2023, RWB

issued demand letters and notices to enforce security under Section

244 of the Bankruptcy and Insolvency Act (Canada).

In light of, among other things, financial

pressures resulting from obligations owing to creditors (including

under the Aleafia Senior Secured Loan Agreement), challenging

factors impacting the cannabis industry and the termination of the

Letter Agreement, and after careful consideration of all available

alternatives and consultation with legal and financial advisors,

the board of directors of each member of the Aleafia Group

determined that it was in the best interest of the Aleafia Group

and its stakeholders to seek creditor protection under the

CCAA.

The Initial Order provides for, among other

things: (i) a stay of proceedings in favour of the Aleafia Group;

(ii) the approval of debtor-in-possession financing (“DIP

Financing”) in accordance with the DIP Term Sheet (as

described below); and (iii) the appointment of KSV Restructuring

Inc. as monitor of the Aleafia Group (in such capacity, the

“Monitor”). The DIP Loan (as described below) is

anticipated to fund the operations of the Aleafia Group in the

ordinary course through the duration of the CCAA proceedings.

The stay of proceedings and DIP Financing will

provide the Aleafia Group with the time and stability required to

consider potential restructuring transactions and maximize the

value of its assets for the benefit of its creditors and other

stakeholders. This may include the sale of all or substantially all

of the business or assets of the Aleafia Group through a

court-supervised sale process. In that regard, the Aleafia Group

intends to seek Court approval to launch a sale and investment

solicitation process for its business and assets (the

“SISP”) promptly following the Initial Order. The

SISP is expected to be administered by the Monitor, with the

assistance of the Aleafia Group. Additional details in respect of

the SISP will be disclosed shortly.

In order to fund the CCAA proceedings and other

short-term working capital requirements, Aleafia has executed a DIP

term sheet with RWB dated as of July 24, 2023 (the “DIP

Term Sheet”) pursuant to which RWB has agreed to advance

DIP Financing in the amount of $6,600,000 (the “DIP

Loan”). The continued availability of the DIP Loan is

conditional on, among other things, certain conditions being

satisfied, including the Initial Order remaining in effect.

It is anticipated that the Toronto Stock

Exchange (“TSX”) will halt trading of the

Corporation’s common shares and, as a result of having filed for

protection under the CCAA, will place the Corporation under

delisting review. There can be no assurance as to the outcome of

such review or the continued qualification for listing on the

TSX.

Additional information regarding the CCAA

proceedings – including all of the Court materials filed in the

CCAA proceedings – may be found at the Monitor’s website:

https://www.ksvadvisory.com/insolvency-cases/case/aleafia

About Aleafia:

The Corporation is a federally licensed Canadian

cannabis company offering cannabis products in Canadian adult-use

and medical markets and in select international markets, including

Australia and Germany. The Corporation operates a virtual medical

cannabis clinic staffed by physicians and nurse practitioners which

provide health and wellness services across Canada.

The Corporation owns three licensed cannabis

production facilities and operates a strategically located

distribution centre all in the province of Ontario, including the

largest, outdoor cannabis cultivation facility in Canada. The

Corporation produces a diverse portfolio of cannabis and cannabis

derivative products including dried flower, pre-roll, milled,

vapes, oils, capsules, edibles, sublingual strips and topicals.

Cautionary Statement Regarding

Forward-Looking Information

This news release includes certain

“forward-looking statements” under applicable Canadian securities

legislation that are not historical facts. Forward-looking

statements involve risks, uncertainties, and other factors that

could cause actual results, performance, prospects, and

opportunities to differ materially from those expressed or implied

by such forward-looking statements. Forward-looking statements in

this news release include, but are not limited to, Aleafia’s

objectives and intentions, the availability of DIP Financing, the

outcome of the CCAA proceedings and the SISP, and the trading and

listing of the Corporation’s common shares on the TSX.

Forward-looking statements are necessarily based on a number of

estimates and assumptions that, while considered reasonable, are

subject to known and unknown risks, uncertainties and other factors

which may cause actual results and future events to differ

materially from those expressed or implied by such forward-looking

statements. Such factors include, but are not limited to: general

business, economic and social uncertainties; litigation,

legislative, environmental and other judicial, regulatory,

political and competitive developments; delay or failure to receive

board, shareholder or regulatory approvals; future cannabis

pricing; cannabis cultivation yields; costs of inputs; its ability

to market products successfully to its anticipated clients;

reliance on key personnel and contracted relationships with third

parties; the ability to complete any future potential transactions

in connection with the SISP in CCAA proceedings and the terms and

conditions thereof; the availability of DIP Financing; the

application of federal, state, provincial, county and municipal

laws; the impact of increasing competition; those additional risks

set out in Aleafia’s public documents filed on SEDAR at

www.sedar.com, including its annual information form for the

financial year ended March 31, 2023; and other matters discussed in

this news release related to the CCAA proceedings and the SISP.

Although Aleafia believes that the assumptions and factors used in

preparing the forward-looking statements are reasonable, undue

reliance should not be placed on these statements, which only apply

as of the date of this news release, and no assurance can be given

that such events will occur in the disclosed time frames or at all.

Except where required by law, Aleafia disclaims any intention or

obligation to update or revise any forward-looking statement,

whether as a result of new information, future events, or

otherwise.

For Investor & Media Relations

IR@Aleafiahealth.comLEARN MORE: www.AleafiaHealth.com

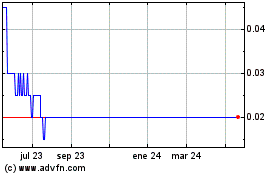

Aleafia Health (TSX:AH)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

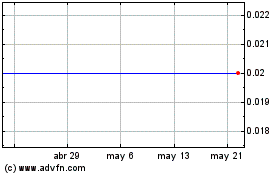

Aleafia Health (TSX:AH)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024