-Record Revenue of $21.5 Million in Q1 and New

Guidance of $77M - $81M-

Altius Minerals Corporation (TSX: ALS; OTCQX: ATUSF)

(“Altius” or “the Corporation”) expects to report record

attributable royalty revenue1 of approximately $21.5 million ($0.50

per share) for the quarter ended March 31, 2019. This represents an

increase of 36% compared to revenues of $15.8 million ($0.37 per

share) generated in the comparable quarter last year, and a 22%

increase in revenues compared to $17.6 million ($0.41 per share) in

Q4 2018.

The Corporation also announces that it is raising its full year

revenue guidance to $77 – $81 million from the previously published

estimate range of $67 – $72 million. This revision considered the

strong first quarter results, increased ownership of Labrador Iron

Ore Royalty Corporation and improved potash, base metal and iron

ore prices.

The first quarter results reflect growth across most commodity

segments relative to the prior and comparable year periods. In

particular, Chapada benefitted from strong Q4 2018 production, with

the timing of royalty payments having a positive impact on our Q1

2019, and Labrador Iron Ore Royalty Corporation recently declared a

dividend of $1.05 per share after three prior quarters of

constrained dividend payments. Revenue from the Corporation’s

royalty interest in the Voisey’s Bay mine is not yet known and has

been excluded in the $21.5 million expected in Q1, but it is not

expected to be material.

Noteworthy royalty portfolio developments during the quarter

include:

- Base metal prices have generally

improved thus far during 2019 on increasing future supply deficit

concerns;

- Iron ore prices have climbed since late

January as the market continues to digest the impact of the

catastrophe at the Corrego do Feijao mine in Brazil and related

supply losses;

- Potash royalties continued to benefit

from higher average prices and the ongoing ramp-up of production

volumes;

- Altius completed its first renewable

energy royalty acquisitions as part of a long-term strategy to

replace electrical coal royalties;

- Chapada continued to generate strong

exploration-based resource growth;

- The recently announced Chapada mine

sale to Lundin Mining is expected to lead to future copper

production optimization and capacity expansion;

- Significant capital has been allocated

by Teck Resources towards advancing a potential mine life expansion

project at Cardinal River;

- Hudbay Minerals Inc. announced the

extension of the 777 mine life until 2022;

- Excelsior Mining Corp. reported

continuing positive construction progress for its Gunnison project

with first production targeted for late 2019; and

- Altius acquired a 2% royalty on the

Curipamba polymetallic project in Ecuador with Adventus Zinc

Corporation (“Adventus”) and Salazar Resources Ltd. Adventus

announced improved metallurgy results on April 15th, 2019 and an

updated PEA and resource estimate is expected shortly.

Additional details relating to individual royalty performances

and asset level developments will be provided with the release of

full financial results, which Altius will release on May 7, 2019

after the close of market, with a conference call to follow on May

8, 2019.

Summary of attributable royalty revenue

Three months endedMarch 31,

2019

Three months endedMarch 31,

2018

Three months endedDec 31,

2018

(in thousands of Canadian dollars)

Base metals

7,325 7,189 7,419 Potash (1) 4,827 2,346 3,737 Iron ore (2) 4,233

1,103 2,097 Thermal (electrical) coal 3,268 4,099 3,064

Metallurgical coal 1,215 757 859 Other royalties and interest

679 311 439

Attributable royalty revenue

21,547 15,805

17,615 See non-IFRS measures section of our MD&A for

definition and reconciliation of attributable revenue (1) Potash Q1

2018 revenue reported 52.4% ownership which increased to 91.3%

following acquisition on March 23 2018 (2) Labrador Iron Ore

Royalty Corporation dividends received

Q1 2019 Financial Results Conference Call and Webcast

Information:

A conference call will be held on Wednesday, May 8, 2019,

starting at 9:00 a.m. EST to further discuss the quarter and

revised guidance for 2019. Our Annual and Special Meeting of

shareholders will take place in St John’s, NL at 1:00 pm NL time on

the same date. To participate in the conference call, use the

following dial-in numbers and conference ID, or join the webcast

on-line as detailed below.

Time:

9:00 a.m. EST on Wednesday, May 8, 2018

Dial-In Numbers:

+1-(866) 521-4909 toll free (US/ Canada) or +1-(647) 427-2311

Conference Title:

Altius Q1 2019 financial results

Webcast URL:

http://event.on24.com/wcc/r/1987321-1/DBD36C8F4B94EC861F0F316CA36DAA8E

The call will be webcast and archived on the Corporation’s

website for a limited time.

1 Attributable royalty revenue is a non‐IFRS measure and does

not have any standardized meaning prescribed under IFRS. For a

detailed description and examples of the reconciliation of

this measure, please see the Corporation’s MD&A disclosures for

prior quarterly and annual reporting periods, which are available

at http://altiusminerals.com/financial-statements

About Altius

Altius directly and indirectly holds diversified royalties and

streams which generate revenue from 15 operating mines. These

producing royalties are located in Canada and Brazil and provide

exposure to copper, zinc, nickel, cobalt, iron ore, potash, thermal

(electrical) and metallurgical coal. The portfolio also includes

development stage royalties in copper and renewable energy and

numerous predevelopment stage royalties covering a wide spectrum of

mineral commodities and jurisdictions. Altius also holds a

portfolio of junior equities that were generated from vending

exploration projects to industry partners in exchange for minority

equity interests and new royalties.

Altius has 42,861,796 common shares issued and outstanding that

are listed on Canada’s Toronto Stock Exchange. It is a member of

both the S&P/TSX Small Cap and S&P/TSX Global Mining

Indices.

Forward-Looking Information

This news release contains forward‐looking information. The

statements are based on reasonable assumptions and expectations of

management and Altius provides no assurance that actual events will

meet management's expectations. In certain cases, forward‐looking

information may be identified by such terms as "anticipates",

"believes", "could", "estimates", "expects", "may", "shall",

"will", or "would". Although Altius believes the expectations

expressed in such forward‐looking statements are based on

reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those projected. Mining exploration and development

is an inherently risky business. In addition, factors that could

cause actual events to differ materially from the forward-looking

information stated herein include any factors which affect

decisions to pursue mineral exploration on the relevant property

and the ultimate exercise of option rights, which may include

changes in market conditions, changes in metal prices, general

economic and political conditions, environmental risks, and

community and non-governmental actions. Such factors will also

affect whether Altius will ultimately receive the benefits

anticipated pursuant to relevant agreements. This list is not

exhaustive of the factors that may affect any of the

forward‐looking statements. These and other factors should be

considered carefully and readers should not place undue reliance on

forward-looking information. Altius does not undertake to update

any forward-looking information contained herein except in

accordance with securities regulation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190417005200/en/

Flora WoodorBen Lewis1.877.576.2209flora@altiusminerals.com

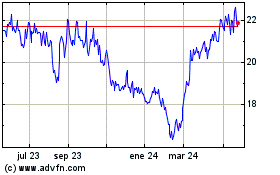

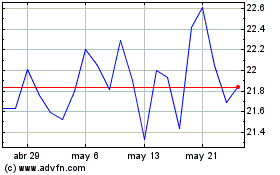

Altius Minerals (TSX:ALS)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Altius Minerals (TSX:ALS)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024