Perseus Mining Limited: Edikan Gold Mine Operations Update

18 Septiembre 2013 - 2:52AM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Perseus Mining Limited ("Perseus" or the "Company") (TSX:PRU)(ASX:PRU) is

pleased to provide an update on recent operating performance at its Edikan Gold

Mine ("EGM") in Ghana, West Africa.

Highlights

-- Gold production of 32,250 ounces for July and August 2013 combined;

-- Company remains on target to achieve production guidance of 99,000 -

109,000 ounces of gold in the six months to 31 December 2013;

-- A comprehensive Budget Improvement Programme has been implemented to

improve operational efficiency and eliminate any non-essential costs.

Benefits starting to be reflected in all-in site cash cost;

-- Company is on track to achieve cost guidance of US$1,000-1,200/oz for

the six months to 31 December 2013;

-- Results from revised Edikan Life of Mine planning exercise indicate

smaller pit shells resulting in an overall 6% reduction in contained

gold but a 16% reduction in strip ratio and a 15% reduction in material

movements (after mining depletion to 30 June 2013); and

-- Finalisation of the optimisation of the Edikan Life of Mine plan is on

track for release of full details in the September 2013 Quarterly

Activities Report.

Comments from Perseus's Managing Director, Jeff Quartermaine

"We're encouraged by our start to the new financial year, having recorded a much

improved performance at Edikan for the first two months of the September

Quarter. We've implemented a series of programmes aimed at improving

productivity across the Company. The results of these initiatives are gradually

filtering through and we expect they will be more evident in the form of

continuous improvement in the months ahead.

Documentation of our updated life of mine plan for Edikan is nearing completion

and the full results will be published in our September 2013 Quarterly

Activities Report. In revising the life of mine plan we've given priority to the

generation of profit and cash flow ahead of marginal gold production. This

strategy has slightly reduced the amount of gold that we will produce over the

life of the Edikan mine but results in materially less investment in mining and

processing than would otherwise be the case, which in the current economic

climate is very important."

Gold Production

Gold production at the EGM during the September 2013 Quarter to date has closely

tracked Company budgets, with the following results:

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Month Gold Produced (ozs)

----------------------------------------------------------------------------

July 2013 16,730

August 2013 15,520

Quarter to date 32,250

----------------------------------------------------------------------------

----------------------------------------------------------------------------

During the two-month period, the primary crusher crushed 1,098,600 tonnes of

primary ore at a rate of 1,285wtph. At an assumed run time of 75%, this equates

to a crushing rate of 8.4MTPA.

A total of 1,144,300 tonnes of ore, comprising approximately 10% oxide ore and

90% primary ore, was processed through the SAG mill at an average throughput

rate of 890 dry metric tonnes per hour. At this rate, and assuming a steady

state utilisation of 8,000 hours per annum (i.e. 91.3%), the annual processing

rate would be 7.1MTPA.

The average grade of ore fed to the mill during the period was 1.05 g/t gold and

the recovery rate was 83.4%.

Of the technical parameters referred to above, all were broadly in line with

targets, with the exception of the SAG mill throughput rate which at 7.1MTPA

(annualised) was lower than the target of 7.5MTPA as a result of a deliberate

strategy to reduce mill liner wear ahead of a general mill reline, scheduled for

early September 2013.

The production performance in the first two months of the new financial year

ensures the Company remains on target to achieve guidance production of 99,000 -

109,000 ounces of gold in the six months ending 31 December 2013.

Cash Operating Costs

The Company has commenced implementation of a comprehensive Budget Improvement

Programme aimed at enhancing operational efficiency and eliminating any

non-essential costs from its cost base at the EGM and in the corporate office.

Important initiatives undertaken to date include, but are not limited to,

reducing the fees and salaries of all directors by 15%, placing a freeze on

bonuses, reducing headcounts where possible without damaging operational

capability and working co-operatively with key contractors to generate

productivity gains that benefit both parties.

The impact of a number of the cost-saving initiatives has been immediately

evident in the unit costs recorded for the Quarter to date. Other improvements

will take longer to realise but should be evident over the balance of this

financial year.

On a Quarter to date basis, the all-in site cash cost (including direct

production cost, royalty, sustaining capital, plus investment in waste stripping

and stockpile build up) has averaged US$1,227 per ounce. This represents a

material improvement relative to the June 2013 Quarter and indicates that the

Company is on track to achieve its cost guidance for the six months ending 31

December 2013 of US$1,000 to US$1,200 per ounce.

Revised Life of Mine Plan

In the June 2013 Quarter Perseus prepared a revised estimate of Mineral

Resources at the EGM taking into account mining depletion to April 2013 plus

recent drill results. This estimate was published in the June 2013 Quarter

Report.

Based on this revised estimate, and applying a set of technical assumptions that

reflect actual operating parameters, detailed plans have been developed for

mining Measured and Indicated Mineral Resources. This is collectively referred

to in this Update as the EGM Life of Mine Plan or "LOMP".

In preparing the LOMP, the following objectives were adopted:

-- Minimise investment in FY2014 without compromising the future by mining

ore from existing pits (Fobinso and AF Gap) and reclaiming ore from

existing ore stockpiles;

-- Resume development of Eastern Pits from July 2014;

-- Include new pits (Chirawira and Bokitsi) not previously included in Ore

Reserves;

-- Give priority to cash generation over marginal gold production;

-- Preserve the capacity to expand pits in a higher gold price environment;

-- Use revised technical parameters that reflect actual experience,

including US$1,200/oz pit shells; 0.5g/t cut-off grade; and updated

mining and processing costs and current mill availability, throughput

and recovery rates.

Compared to the previous life of mine plan for EGM which was based on the 2012

Ore Reserve, the updated LOMP resulted in the following:

- Tonnes of ore and waste moved - Down by 15%

- Life of mine strip ratio - Down by 16%

- Head grade - Steady

- Contained gold in Ore Reserve - Down by 6%

- Life of mine - Increased by 0.6 years to 2025

On a pit by pit basis, the technical parameters of each pit are as follows:

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Pit 2012 LOMP(1,2,3)

------------------------------------------------------------

Grade Strip Ratio

Waste (Mt) Ore (Mt) (g/t) Au (koz) (t:t)

----------------------------------------------------------------------------

AF Gap 78.1 29.8 1.1 1,015 2.6

Fobinso 40.1 11.5 1.2 429 3.5

----------------------------------------------------------------------------

Sub-total 118.2 41.3 1.1 1,444 2.9

Fetish 53.7 15.8 1.1 576 3.4

Esuajah Sth 73.8 8.2 1.9 493 9.0

Esuajah Nth 32.5 17.1 0.9 501 1.9

Chirawira - - - - -

Bokitsi - - - - -

ROM S/pile - 4.4 0.6 89 -

----------------------------------------------------------------------------

----------------------------------------------------------------------------

TOTAL 278.2 86.9 1.1 3,109 3.2

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Pit (Updated) 2013 LOMP(1,4,5)

------------------------------------------------------------

Grade Strip Ratio

Waste (Mt) Ore (Mt) (g/t) Au (koz) (t:t)

----------------------------------------------------------------------------

AF Gap 63.4 27.5 1.1 954 2.8

Fobinso 30.6 9.3 1.1 330 3.6

----------------------------------------------------------------------------

Sub-total 94.0 36.8 1.1 1,283 2.6

Fetish 29.8 13.9 0.9 442 2.1

Esuajah Sth 56.2 6.9 1.7 382 7.2

Esuajah Nth 22.2 15.7 0.9 465 1.4

Chirawira 11.2 2.9 1.1 106 3.8

Bokitsi 13.3 2.1 2.3 158 6.3

ROM S/pile - 4.4 0.6 89 -

----------------------------------------------------------------------------

----------------------------------------------------------------------------

TOTAL 226.7 82.7 1.1 2,925 2.7

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Notes: 1. Based on Measured and Indicated Mineral Resources only adjusted

for mining depletion to 30 June 2013.

2. Based on August 2012 Proven and Probable Ore Reserve.

3. 0.4g/t and 0.5g/t cut-off, sub-blocks.

4. Based on the June 2013 Measured and Indicated Mineral Resource

5. Oxide - 0.6g/t cut-off; Transitional - 0.5g/t cut-off; Fresh -

0.4g/t cut-off, regular block.

Based on the above, the production profile for the EGM for next five years is

currently expected to be as follows:

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LOM

Parameter FY2014 FY2015 FY2016 FY2017 FY2018 Average(1,2)

----------------------------------------------------------------------------

Ore mined (Mt) 5.3 7.7 9.7 9.4 7.4 8.7

Waste mined (Mt) 22.9 26.6 26.5 26.4 28.8 25.1

Strip ratio (t:t) 4.3 3.5 2.7 2.8 3.9 2.9

Ore processed (Mt) 7.5 7.4 7.5 7.5 7.5 7.5

Head grade (g/t) gold 1.0 1.2 1.2 1.1 1.2 1.1

Gold production (kozs) 200 240 240 230 245 230

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Notes: 1. Assumes mining occurs over 9 years from 1 July 2013

2. Assumes processing of ore over 11 years from 1 July 2013.

Processing of low grade ore stockpile is scheduled to continue

for a further 14 months beyond 30 June 2023 at a lower production

rate and is not included in the above data.

The LOMP will be reassessed annually taking into account any incremental Mineral

Resources discovered during the preceding period and any revised design

parameters including but not limited to gold price and operating costs, in the

design of the pit shells.

On this basis it should be noted that the above does not alter the production

guidance previously released to the market for the 12 months ending 30 June 2014

of 190,000 to 210,000 ounces of gold at an all-in site cost of US$1,000 to

US$1,200 per ounce.

Full details of the 2013 EGM Proven and Probable Ore Reserve estimates and the

EGM LOMP will be published in Perseus's September 2013 Quarterly Report.

Jeffrey A Quartermaine, Managing Director and Chief Executive Officer

Competent Person Statement

The information in this report that relates to exploration results, mineral

resources or ore reserves is based on information compiled by Mr Kevin Thomson,

who is a Professional Geoscientist with the Association of Professional

Geoscientists of Ontario. Mr Thomson is an employee of the Company. Mr Thomson

has sufficient experience, which is relevant to the style of mineralisation and

type of deposit under consideration and to the activity which he is undertaking,

to qualify as a Competent Person as defined in the 2004 Edition of the

'Australasian Code for Reporting of Exploration Results, Mineral Resources and

Ore Reserves'") and to qualify as a "Qualified Person" under National Instrument

43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). Mr Thomson

consents to the inclusion in this report of the matters based on his information

in the form and context in which it appears. For a description of Perseus' data

verification process, quality assurance and quality control measures, the

effective date of the mineral resource and mineral reserve estimates contained

herein, details of the key assumptions, parameters and methods used to estimate

the mineral resources and reserves set out in this report and the extent to

which the estimate of mineral resources or mineral reserves set out herein may

be materially affected by any known environmental, permitting, legal, title,

taxation, socio-political, marketing or other relevant issues, readers are

directed to the technical report entitled "Technical Report - Central Ashanti

Gold Project, Ghana" dated May 30, 2011 and the technical report entitled

"Technical Report - Tengrela Gold Project, Cote d'Ivoire" dated December 22,

2010 in relation to the Edikan Gold Mine (formerly the Central Ashanti Gold

Project) and the Tengrela Gold Project respectively.

Caution Regarding Forward Looking Information: This report contains

forward-looking information which is based on the assumptions, estimates,

analysis and opinions of management made in light of its experience and its

perception of trends, current conditions and expected developments, as well as

other factors that management of the Company believes to be relevant and

reasonable in the circumstances at the date that such statements are made, but

which may prove to be incorrect. Assumptions have been made by the Company

regarding, among other things: the price of gold, continuing commercial

production at the Edikan Gold Mine without any major disruption, development of

a mine at Tengrela, the receipt of required governmental approvals, the accuracy

of capital and operating cost estimates, the ability of the Company to operate

in a safe, efficient and effective manner and the ability of the Company to

obtain financing as and when required and on reasonable terms. Readers are

cautioned that the foregoing list is not exhaustive of all factors and

assumptions which may have been used by the Company. Although management

believes that the assumptions made by the Company and the expectations

represented by such information are reasonable, there can be no assurance that

the forward-looking information will prove to be accurate. Forward-looking

information involves known and unknown risks, uncertainties, and other factors

which may cause the actual results, performance or achievements of the Company

to be materially different from any anticipated future results, performance or

achievements expressed or implied by such forward-looking information. Such

factors include, among others, the actual market price of gold, the actual

results of current exploration, the actual results of future exploration,

changes in project parameters as plans continue to be evaluated, as well as

those factors disclosed in the Company's publicly filed documents. The Company

believes that the assumptions and expectations reflected in the forward-looking

information are reasonable. Assumptions have been made regarding, among other

things, the Company's ability to carry on its exploration and development

activities, the timely receipt of required approvals, the price of gold, the

ability of the Company to operate in a safe, efficient and effective manner and

the ability of the Company to obtain financing as and when required and on

reasonable terms. Readers should not place undue reliance on forward-looking

information. Perseus does not undertake to update any forward-looking

information, except in accordance with applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Managing Director:

Jeff Quartermaine

+61 8 6144 1700

jeff.quartermaine@perseusmining.com (Perth)

Investor Relations:

Nathan Ryan

+61 (0) 420 582 887

nathan.ryan@nwrcommunications.com.au (Melbourne)

Rebecca Greco

+1 416 822 6483

fighouse@yahoo.com (Toronto)

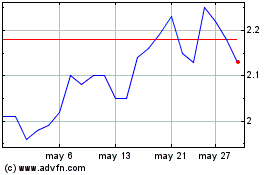

Perseus Mining (TSX:PRU)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Perseus Mining (TSX:PRU)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024