NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Perseus Mining Limited ("Perseus" or the "Company") (TSX:PRU)(ASX:PRU) is

pleased to announce details of its revised Life of Mine Plan ("LOMP") for the

Edikan Gold Mine ("EGM") in Ghana, West Africa.

HIGHLIGHTS

-- The revised LOMP is based on seven open pits designed using US$1,200/oz

pit shells, containing 6% less gold than the previous LOMP but requiring

mining of 15% less ore and waste, resulting in material cash flow

benefits.

-- Production and cost guidance for FY 2014 of +/- 200,000 ounces at an

all-in site cash cost(1) of +/- US$1,100/ounce remains unchanged.

-- For the period from FY2015 to FY2018, average gold production increases

with an increase in grade relative to FY2014 to 240,000 ounces/year at

an average all-in site cash cost of US$1,050/ounce.

-- The LOMP estimates average gold production of 230,000 ounces/year at an

all-in site cash cost of US$937/ounce from FY2014 to FY2024.

-- The independent estimate of the Ore Reserves for the EGM as at 1 July

2013 indicates Proved and Probable Ore Reserves totalling 82.7 million

tonnes of ore grading 1.1 g/t of gold and containing 2.925 million

ounces of gold.

Comments from Perseus's Managing Director, Jeff Quartermaine

"The revised Life of Mine Plan for the Edikan Gold Mine represents a robust and

financially attractive way forward for our flagship operation. The plan clearly

indicates that at a gold price of US$1,200/ounce, a significant amount of

cashflow can be generated at Edikan, and at even lower gold prices the operation

remains viable, based on our assumptions.

Going forward, our financial performance will continue to be highly leveraged to

the gold price and operational improvements, and the revised LOMP represents an

important element in our ongoing efforts to improve our operating performance on

the EGM site."

(1)All in site cash costs include direct production costs, royalties, investment

in waste stripping and sustaining capital expenditure. It does not include

exploration expenditure, income taxes or corporate costs.

MINERAL RESOURCES

Following an infill drilling programme on the EGM mining leases in the period up

to early June 2013, an updated Mineral Resource estimate was prepared for the

Company by mining consultants, RungePincockMinarco ("RPM") in accordance with

the JORC Code - 2004 Edition. A detailed summary of the current Mineral Resource

estimate for each of the mineral deposits identified to date on the EGM mining

leases, calculated using a 0.40 g/t gold cut-off grade, was published in

Perseus's June 2013 Quarterly Report.

In summary, the revised global Measured and Indicated Mineral Resource estimate

for the EGM, which takes into account mining depletion as at 30 April 2013, was

estimated as 162.5 million tonnes grading 1.1g/t gold and containing 5.7 million

ounces of gold. A further 77.4 million tonnes of material grading 1.0g/t gold

and containing a further 2.4 million ounces of gold were classified as an

Inferred Mineral Resource. Details of these estimates are shown below in Tables

1 and 2 respectively.

Table 1: EGM Measured and Indicated Mineral Resources

----------------------------------------------------------------------------

Weathering Measured Indicated

Domain

-----------------------------------------------------------------

Grade Contained Grade Contained

'000 (g/t Gold '000 (g/t Gold

Tonnes Au(1)) (oz) Tonnes Au) (oz)

----------------------------------------------------------------------------

Oxides 220 1.5 10,600 600 0.8 16,000

----------------------------------------------------------------------------

Transition 764 1.1 28,100 3,100 1.2 119,700

----------------------------------------------------------------------------

Fresh 81,220 1.1 2,917,700 76,610 1.0 2,603,200

----------------------------------------------------------------------------

TOTAL 82,204 1.1 2,956,400 80,310 1.0 2,738,900

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Weathering Measured + Indicated

Domain

------------------------------------------------------------------

Contained

'000 Grade Gold

Tonnes (g/t Au) (oz)

----------------------------------------------------------------------------

Oxides 820 1.1 26,600

----------------------------------------------------------------------------

Transition 3,860 1.2 147,800

----------------------------------------------------------------------------

Fresh 157,840 1.1 5,520,900

----------------------------------------------------------------------------

TOTAL 162,520 1.1 5,695,300

----------------------------------------------------------------------------

Note 1: Denotes grams per tonne of gold

Table 2: EGM Inferred Mineral Resources

----------------------------------------------------------------------------

Weathering Domain Inferred

-----------------------------------------------------

Contained

'000 Grade Gold

Tonnes (g/t Au) (oz)

----------------------------------------------------------------------------

Oxides 2,763 1.2 102,700

----------------------------------------------------------------------------

Transition 3,284 1.1 113,700

----------------------------------------------------------------------------

Fresh 71,400 1.0 2,213,400

----------------------------------------------------------------------------

TOTAL 77,447 1.0 2,429,800

----------------------------------------------------------------------------

SCENARIO PLANNING

Based on the revised Mineral Resource estimate, the Company examined a range of

development scenarios with the objective of identifying the scenario that would

maximise the net present value of the EGM. This exercise involved varying key

parameters such as the pit development sequence, applying technical assumptions

that reflected actual operating parameters, and working within known constraints

such as the expected timing of access to new mining areas. The planning exercise

was required to achieve the following objectives:

1. Minimise investment in FY2014 without compromising the future by mining

ore from existing pits (Fobinso and AF Gap) and reclaiming ore from

existing ore stockpiles;

2. Commence development of Eastern Pits as early as possible after July

2014;

3. Include new pits (Chirawewa and Bokitsi) not previously included in Ore

Reserves;

4. Give priority to cash generation over marginal gold production; and

5. Preserve the capacity to expand pits in a higher gold price environment.

Based on this work, the following pit development schedule was developed:

http://media3.marketwire.com/docs/904344_graph_1015.pdf.

ORE RESERVES

Following completion of the above, mining consultant RPM was commissioned to

complete an independent estimate of the Ore Reserves for the EGM as at 1 July

2013 in accordance with the requirements of the Australasian Code for Reporting

of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code, 2004

Edition).

The Ore Reserves, which include material from seven open pits including Abnabna,

Fobinso, Fetish, Chirawewa, Bokitsi, Esuajah North and Esuajah South plus

stockpiles, are as follows:

Table 3: EGM Proved and Probable Ore Reserves

----------------------------------------------------------------------------

Contained

Tonnes Grade Gold

Category (Mt) (g/t gold) (oz)

----------------------------------------------------------------------------

Proved 59.6 1.1 2,177,300

----------------------------------------------------------------------------

Probable 23.1 1.1 835,700

----------------------------------------------------------------------------

TOTAL 82.7 1.1 2,924,500

----------------------------------------------------------------------------

Notes:

1. Estimate has been rounded to reflect accuracy

2. All the estimates are on a dry tonne basis

The Ore Reserve estimate for the EGM was based on actual operating performance

and ongoing test work and applied the following criteria:

1. Proven and Probable Mineral Reserves found within the economic pit

limits designed based on Measured and Indicated Mineral Resources;

2. Gold metal price US$1,200/ounce;

3. Key mining parameters include:

a. Mining recovery 100%, mining dilution varies by deposit as result

of block regularisation resulting in a range, due to multiple block

models used, of between 3-12%;

b. Overall pit slopes of 30 to 50 degrees inclusive of berms spaced at

between 5m and 20m vertically and berm widths of 5m to 12m. These

parameters were derived from ongoing geotechnical studies commenced

by George Orr and Associates in August 2012;

c. Pit ramps have been designed for the current 777 truck fleet and

are set at a net 16m (single lane) to 26m (dual lane);

d. Vertical mining advance has been set at 60 to 80m/year based on the

size of the pit.

4. Ore cut-off grades are based on the gold price and mining parameters

described in (2) and (3) above and are as follows:

Table 4: Cut-off grades

----------------------------------------------------------------------------

Material Type Gold Grade (g/t)

----------------------------------------------------------------------------

Oxide 0.6

----------------------------------------------------------------------------

Transitional 0.5

----------------------------------------------------------------------------

Sulphide 0.4

----------------------------------------------------------------------------

5. Gold processing recovery ranging from 61% for oxide to 88% for fresh

rock.

6. Processing throughput 7.5Mtpa.

7. Mining operating costs based on rates negotiated in November 2009 with

mining contractor (African Mining Services) adjusted for historical rise

and fall factors, currently at 25% for load and haul cost and 10% for

other mining costs and additional US$2.15/t ore for crusher feed haulage

from the Eastern Pits. The average life of mine mining cost is US$3.43/t

of material moved.

8. Unit processing costs are assumed to be US$9.05/t of ore processed plus

a further US$0.09/t of ore processed for refining costs. A General and

Administration unit cost of US$2.82/t of ore processed has been assumed,

which equates to approximately US$2 million per month.

LIFE OF MINE PLAN

Based on the Ore Reserves stated above, the production profile for the EGM for

next five years is currently expected to be as follows:

Table 5: LOMP Production Statistics

----------------------------------------------------------------------------

----------------------------------------------------------------------------

LOMP

Parameter FY2014 FY2015 FY2016 FY2017 FY2018 Avg(1,2)

----------------------------------------------------------------------------

Ore mined (Mt) 5.3 7.7 9.7 9.4 7.4 8.7

Waste mined (Mt) 22.9 26.6 26.5 26.4 28.8 25.1

Strip ratio (t:t) 4.3 3.5 2.7 2.8 3.9 2.9

Ore processed (Mt) 7.5 7.4 7.5 7.5 7.5 7.5

Head grade (g/t) gold 1.0 1.2 1.2 1.1 1.2 1.1

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Gold production (kozs) 200 240 240 230 245 230

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Notes: 1. Assumes mining occurs over 9 years from 1 July 2013.

2. Assumes processing of ore over 11 years from 1 July 2013.

Processing of low grade ore stockpile is scheduled to continue

for a further 3 months beyond 30 June 2024 at a lower production

rate and is not included in the above data.

Compared to the previous LOMP for EGM, which was based on the 2012 Ore Reserve,

the updated LOMP results in the following:

- Tonnes of ore and waste moved - Down by 15%

- Life of mine strip ratio - Down by 16%

- Head grade - Steady

- Contained gold in Ore Reserve - Down by 6%

- Life of mine - Increased by 0.6 years to 2024

On a pit by pit basis, the technical parameters of each pit are as follows:

Table 6: Comparison LOMP Production

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Pit 2012 LOMP(1,2)

------------------------------------------------------------

Waste Ore Grade Gold Strip

(Mt) (Mt) (g/t) (koz) Ratio

----------------------------------------------------------------------------

AF Gap 78.1 29.8 1.1 1,015 2.6

Fobinso 40.1 11.5 1.2 429 3.5

----------------------------------------------------------------------------

Sub-total 118.2 41.3 1.1 1,444 2.9

Fetish 53.7 15.8 1.1 576 3.4

Esuajah Sth 73.8 8.2 1.9 493 9.0

Esuajah Nth 32.5 17.1 0.9 501 1.9

Chirawewa - - - - -

Bokitsi - - - - -

ROM S/pile - 4.4 0.6 89 -

----------------------------------------------------------------------------

----------------------------------------------------------------------------

TOTAL 278.2 86.9 1.1 3,109 3.2

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Pit 2013 LOMP(1,3)

------------------------------------------------------------

Waste Ore Grade Gold Strip

(Mt) (Mt) (g/t) (koz) Ratio

----------------------------------------------------------------------------

AF Gap 63.4 27.5 1.1 954 2.8

Fobinso 30.6 9.3 1.1 330 3.6

----------------------------------------------------------------------------

Sub-total 94.0 36.8 1.1 1,283 2.6

Fetish 29.8 13.9 0.9 442 2.1

Esuajah Sth 56.2 6.9 1.7 382 7.2

Esuajah Nth 22.2 15.7 0.9 465 1.4

Chirawewa 11.2 2.9 1.1 106 3.8

Bokitsi 13.3 2.1 2.3 158 6.3

ROM S/pile - 4.4 0.6 89 -

----------------------------------------------------------------------------

----------------------------------------------------------------------------

TOTAL 226.7 82.7 1.1 2,925 2.7

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Notes: 1. Based on Measured and Indicated Mineral Resources only, adjusted

for mining depletion to 30 June 2013.

2. Based on August 2012 Proved and Probable Ore Reserve; 0.4g/t and

0.5g/t cut-off, sub-blocks.

3. Based on the June 2013 Measured and Indicated Mineral Resource;

Oxide - 0.6g/t cut-off; Transitional - 0.5g/t cut-off; Fresh -

0.4g/t cut-off, regular block.

Applying the stated unit cost assumptions to this production profile, the

forecast unit all-in site cash costs for the EGM are estimated to be as follows:

Table 7: LOMP Costs(1)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

US$/oz Cost FY2014 FY2015 FY2016 FY2017 FY2018 LOMP Avg

----------------------------------------------------------------------------

Mining 479 481 474 551 486 410

Processing 344 282 291 293 276 297

General & Admin. 118 95 95 96 88 91

Sub-Total 941 858 860 940 851 799

Royalty 79 82 82 78 78 79

Sustaining Capital 87 80 79 101 94 60

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total All-in Site Cost 1,107 1,020 1,021 1,119 1,022 937

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Note 1: Before taking silver credits of US$5/oz into account .

These estimated unit costs are based on the following assumptions:

1. Mining costs include the total cash cost of mining both ore and waste

(including pre-strip) during the period. Mining costs are based on

contracted rates negotiated in November 2009 with mining contractor,

African Mining Services, adjusted for historical rise and fall factors

(currently at 25% for Load and Haul cost and 10% for other mining costs)

and an additional US$2.15/t ore for crusher feed haulage from the

Eastern Pits. The average life of mine mining cost is US$3.43/t of

material moved.

2. Unit processing costs are assumed to be US$9.05/t of ore processed plus

a further US$0.09/t of ore processed for refining costs. This cost is

based on actual costs adjusted to remove one-off costs incurred in

recent periods that related to one-off maintenance events, electricity

back-pay etc.

3. A General and Administration unit cost of US$2.82/t of ore processed has

been assumed, which equates to approximately US$2 million per month.

4. Future costs do not include estimates of inflation, nor do they assume

that the benefits of cost optimisation programmes being implemented

across the EGM site will be realised;

5. Royalty is based on a US$1,200/oz gold price and assumes a 5% royalty

paid to the Ghanaian government and a 1.5% royalty payable to Franco

Nevada;

6. Sustaining capital expenditure is estimated at US$151 million for the

remaining life of mine, or on average US$13.7 million per year for 11

years of processing. This estimate includes the cost of site

rehabilitation net of equipment salvage value in the final year of the

mine. The single largest item of forecast capital expenditure relates to

the cost of compensating landowners for loss of crops, structures and

livelihood as well as the cost of relocation housing. This accounts for

slightly more than half of the sustaining capital estimate and includes

expenditure associated with accessing open pits on both the western and

eastern sides of the mining lease. The use of underground mining

techniques on the Esuajah South Resource could result in a material

decrease in the estimate. However, as the feasibility of using this

mining technique has not yet been demonstrated, it has been assumed that

open pit methods requiring relocation of infrastructure and dwellings

will be applied.

It is intended that the EGM LOMP will be reassessed annually taking into account

any incremental Mineral Resources delineated during the preceding period and any

revisions to design parameters (including, but not limited to, gold price and

operating costs) in the design of the pit shells.

Jeffrey A Quartermaine, Managing Director and Chief Executive Officer

Competent Person Statement

The information in this report that relates to Mineral Resources for the Edikan

Gold Mine (Tables 1 and 2 of this Report) is based on information compiled by Mr

Trevor Stevenson a Competent Person who is a Fellow of the Australasian

Institute of Mining and Metallurgy and a CP Geo. Mr Stevenson is a full time

employee of RungePincockMinarco. Mr Stevenson has sufficient experience that is

relevant to the style of mineralisation and type of deposit under consideration

and to the activity that is being undertaken to qualify as a Competent Person as

defined in the 2004 edition of the 'Australasian Code for Reporting of

Exploration Results, Minerals Resources and Ore Reserves' and to qualify as a

"Qualified Person" under National Instrument 43-101 - Standards of Disclosure

for Mineral Projects ("NI 43-101"). Mr Stevenson consents to the inclusion in

the report of the matters based on his information in the form and context that

the information appears.

The information in this report that relates to the Ore Reserves of the Edikan

Gold Mine (Table 3 of this Report), is based on information compiled and

reviewed by Mr Joe McDiarmid, who is a Chartered Professional Member of the

Australasian Institute of Mining and Metallurgy, and is an employee of

RungePincockMinarco Ltd. Joe McDiarmid has sufficient experience which is

relevant to the style of mineralisation and type of deposit under consideration

and to the activity being undertaken to qualify as a Competent Person as defined

in the 2004 Edition of the 'Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves' and to qualify as a "Qualified

Person" under National Instrument 43-101 - Standards of Disclosure for Mineral

Projects ("NI 43-101"). Joe McDiarmid consents to the inclusion in the report of

the matters based on his information in the form and context in which it

appears.

Caution Regarding Forward Looking Information:

This report contains forward-looking information which is based on the

assumptions, estimates, analysis and opinions of management made in light of its

experience and its perception of trends, current conditions and expected

developments, as well as other factors that management of the Company believes

to be relevant and reasonable in the circumstances at the date that such

statements are made, but which may prove to be incorrect. Assumptions have been

made by the Company regarding, among other things: the price of gold, continuing

commercial production at the Edikan Gold Mine without any major disruption,

development of a mine at Tengrela, the receipt of required governmental

approvals, the accuracy of capital and operating cost estimates, the ability of

the Company to operate in a safe, efficient and effective manner and the ability

of the Company to obtain financing as and when required and on reasonable terms.

Readers are cautioned that the foregoing list is not exhaustive of all factors

and assumptions which may have been used by the Company. Although management

believes that the assumptions made by the Company and the expectations

represented by such information are reasonable, there can be no assurance that

the forward-looking information will prove to be accurate. Forward-looking

information involves known and unknown risks, uncertainties, and other factors

which may cause the actual results, performance or achievements of the Company

to be materially different from any anticipated future results, performance or

achievements expressed or implied by such forward-looking information. Such

factors include, among others, the actual market price of gold, the actual

results of current exploration, the actual results of future exploration,

changes in project parameters as plans continue to be evaluated, as well as

those factors disclosed in the Company's publicly filed documents. The Company

believes that the assumptions and expectations reflected in the forward-looking

information are reasonable. Assumptions have been made regarding, among other

things, the Company's ability to carry on its exploration and development

activities, the timely receipt of required approvals, the price of gold, the

ability of the Company to operate in a safe, efficient and effective manner and

the ability of the Company to obtain financing as and when required and on

reasonable terms. Readers should not place undue reliance on forward-looking

information. Perseus does not undertake to update any forward-looking

information, except in accordance with applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

To discuss any aspect of this announcement, please contact:

Managing Director:

Jeff Quartermaine

+61 8 6144 1700

jeff.quartermaine@perseusmining.com (Perth)

Investor Relations:

Nathan Ryan

+61 (0) 420 582 887

nathan.ryan@nwrcommunications.com.au (Melbourne)

Rebecca Greco

+1 416 822 6483

fighouse@yahoo.com (Toronto)

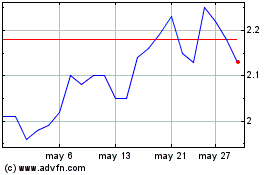

Perseus Mining (TSX:PRU)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Perseus Mining (TSX:PRU)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024