Perseus Mining Limited: Activities Report for December 2013 Quarter

27 Enero 2014 - 7:49PM

Marketwired Canada

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN

THE UNITED STATES

Perseus Mining Limited ("Perseus" or the "Company") (TSX:PRU)(ASX:PRU) reports

on its activities for the three month period ended 31 December 2013 (the

"Quarter"). An executive summary is provided below, however the full report is

available for download from www.perseusmining.com, www.asx.com.au and

www.sedar.com.

Full details of activities in the December Quarter, including reconciled

production and all-in site cash costs, will be included in the Company's

December 2013 Quarterly Activities Report that is scheduled to be released to

the market on 28 January 2014.

Operations - Edikan Gold Mine ("EGM"), Ghana

-- Gold production of 48,360oz in the Quarter, 6% higher than the previous

quarter. For the six months to December 2013 (the "Half Year"), gold

production totalled 94,190oz, in line with production guidance of

91,000oz to 101,000oz for the period;

-- Total all-in site unit costs (including production, royalties,

development and sustaining capital) were US$1,228/oz during the Quarter,

8.5% less than the prior quarter. For the Half Year; all-in site unit

costs were US$1,283/oz, 2.6% higher than the upper end of cost guidance

of US$1,250/oz;

-- Material improvements continued to be achieved during the Quarter in the

availability and metallurgical performance of the process plant, as well

as the unit costs of gold production;

-- Gold production guidance for the six months ending 30 June 2014 ("the

June Half Year") is unchanged at 99,000oz to109,000oz at an all-in site

cost in the range of US$1,050 to US$1,250/oz. For the full financial

year ending 30 June 2014, gold production guidance is also unchanged at

190,000oz to 210,000oz at an all-in site cost in the range of US$1,050

to US$1,250/oz;

-- A total of 44,617oz of gold was sold during the Quarter at an average

sales price of US$1,318/oz;

Development - Sissingue Gold Project ("Sissingue"), Cote d'Ivoire

-- Perseus remains committed to its decision to defer development of

Sissingue pending an assessment of the mineral potential of the nearby

Mahale prospect and / or more favourable market conditions;

Exploration - Ghana and Cote d'Ivoire

-- 28,568m of drilling completed in Cote d'Ivoire;

-- Significant drill intercepts from multiple prospects at the Mahale

Project in Cote d'Ivoire;

Corporate

-- Available cash and bullion of $28.2M as at 31 December 2013 (excluding

$10.6M in escrow and VAT receivable);

-- Forward sales contracts for 124,000oz of gold at a weighted average

price of US$1,463/oz were "in the money" by approximately US$31.6M at 31

December 2013;

-- Material progress made towards resolution of an outstanding VAT

liability of GHC93.0M (or US$39.4M) owed to Perseus Mining (Ghana)

Limited by the Ghanaian Government.

Program for the March 2014 Quarter

Edikan Gold Mine

-- Produce gold at a total all-in site cash cost that is in line with Half

Year guidance;

-- Continue to fine tune plant metallurgical performance and maximise SAG

mill throughput;

-- Continue training of operating and maintenance staff; and

-- Continue to implement business improvement initiatives across all

departments of the EGM and realise projected cost savings.

Sissingue Gold Mine Development Project

-- Review of project cost structure and development options; and

-- Review project economics and financing alternatives.

Tengrela Gold Exploration Project

-- Continue exploration for Mineral Resources on Mahale, Mbengue and Napie

exploration licences.

Jeffrey A Quartermaine

Managing Director and Chief Executive Officer

Forward Looking Information: This report contains forward-looking information

which is based on the assumptions, estimates, analysis and opinions of

management made in light of its experience and its perception of trends, current

conditions and expected developments, as well as other factors that management

of the Company believes to be relevant and reasonable in the circumstances at

the date that such statements are made, but which may prove to be incorrect.

Assumptions have been made by the Company regarding, among other things: the

price of gold, continuing commercial production at the Edikan Gold Mine without

any major disruption, development of a mine at Tengrela, the receipt of required

governmental approvals, the accuracy of capital and operating cost estimates,

the ability of the Company to operate in a safe, efficient and effective manner

and the ability of the Company to obtain financing as and when required and on

reasonable terms. Readers are cautioned that the foregoing list is not

exhaustive of all factors and assumptions which may have been used by the

Company. Although management believes that the assumptions made by the Company

and the expectations represented by such information are reasonable, there can

be no assurance that the forward-looking information will prove to be accurate.

Forward-looking information involves known and unknown risks, uncertainties, and

other factors which may cause the actual results, performance or achievements of

the Company to be materially different from any anticipated future results,

performance or achievements expressed or implied by such forward-looking

information. Such factors include, among others, the actual market price of

gold, the actual results of current exploration, the actual results of future

exploration, changes in project parameters as plans continue to be evaluated, as

well as those factors disclosed in the Company's publicly filed documents. The

Company believes that the assumptions and expectations reflected in the

forward-looking information are reasonable. Assumptions have been made

regarding, among other things, the Company's ability to carry on its exploration

and development activities, the timely receipt of required approvals, the price

of gold, the ability of the Company to operate in a safe, efficient and

effective manner and the ability of the Company to obtain financing as and when

required and on reasonable terms. Readers should not place undue reliance on

forward-looking information. Perseus does not undertake to update any

forward-looking information, except in accordance with applicable securities

laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Perseus Mining Limited

Jeff Quartermaine

Managing Director

+61 8 6144 1700 (Perth)

jeff.quartermaine@perseusmining.com

Nathan Ryan

Investor Relations

+61 (0) 420 582 887 (Melbourne)

nathan.ryan@nwrcommunications.com.au

Perseus Mining (TSX:PRU)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

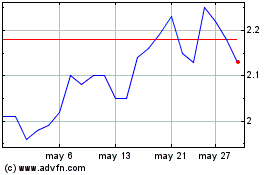

Perseus Mining (TSX:PRU)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024