Vanguard Investments Canada Inc. announced today that five new

equity Canada-domiciled exchange-traded funds (Vanguard ETFs™) will

begin trading this morning on Toronto Stock Exchange (TSX).

Vanguard, which entered the Canadian market in December 2011 and

saw its Canadian ETFs surpass $1 billion in assets earlier this

year, now offers 16 low-cost, high-quality ETFs.

Vanguard

ETF™ Benchmark Index

AnnualManagementFee1(% of

NAV)

TSXTickerSymbol

Vanguard FTSE Canada All Cap Index ETF FTSE Canada All Cap

Index 0.12% VCN

Vanguard FTSE Developed ex North America

Index ETF

FTSE Developed ex North America Index

0.28%2

VDU Vanguard U.S. Dividend Appreciation Index ETF

(CAD-hedged) NASDAQ US Dividend Achievers Select Index (CAD

hedged) 0.28%2 VGH Vanguard U.S. Dividend

Appreciation Index ETF NASDAQ US Dividend Achievers Select

Index 0.28%2 VGG Vanguard U.S. Total Market Index ETF

CRSP US Total Market Index 0.15%2 VUN

“Vanguard ETFs are distinguished in the market by low-cost,

broadly diversified portfolios,” said Atul Tiwari, principal and

managing director of Vanguard Investments Canada. “Our new ETFs

follow this same principle, enabling financial advisors and

investors to better construct broadly diversified portfolios at a

low cost.”

Vanguard also announced reduced management fees for Vanguard

FTSE Emerging Markets Index ETF (VEE) and Vanguard FTSE Developed

ex North America Index ETF (CAD-hedged) (VEF). Effective today, the

management fee of VEE fell to 0.33% from 0.49% and, effective July

24, 2013, the management fee of VEF fell to 0.28% from 0.37%. With

the addition of the five new ETFs, Vanguard’s lineup of 16 ETFs

will feature an industry-low average management fee of 0.21%.*

Additionally, Vanguard expects to launch two new fixed income

Canada-domiciled ETFs in the near future.

Vanguard

ETF™

Benchmark Index

AnnualManagementFee1(% of

NAV)

TSXTickerSymbol

Vanguard U.S. Aggregate Bond Index ETF (CAD-hedged) Barclays

U.S. Aggregate Float Adjusted Index (CAD Hedged) 0.25%2

VBU Vanguard Global ex-U.S. Aggregate Bond Index ETF

(CAD-hedged) Barclays Global Aggregate ex-USD Float Adjusted

RIC Capped Index (CAD Hedged) 0.35%2 VBG

About Vanguard

Vanguard Investments Canada Inc. is a wholly owned indirect

subsidiary of The Vanguard Group, Inc. and manages more than $1

billion (CAD) in assets. Vanguard is one of the world’s largest

investment management companies and a leading provider of

company-sponsored retirement plan services. Vanguard manages more

than $2.5 trillion in global assets, including $285 billion in

global ETF assets. Vanguard has offices in the United States,

Canada, Europe, Australia and Asia. The firm offers more than 160

funds to U.S. investors and more than 80 additional funds,

including ETFs, to clients in the other markets in which the firm

operates.

Vanguard operates under a unique operating structure. Unlike

firms that are publicly held or owned by a small group of

individuals, The Vanguard Group is owned by Vanguard’s US-domiciled

funds and ETFs. Those funds, in turn, are owned by Vanguard

clients. This unique mutual structure aligns Vanguard interests

with those of its investors and drives the culture, philosophy, and

policies throughout the Vanguard organization worldwide. As a

result, Canadian investors benefit from Vanguard’s stability and

experience, low-cost investing, and client focus. For more

information, please visit vanguardcanada.ca.

All asset figures are as of July 31, 2013, unless otherwise

noted.

*As of August 12, 2013

1The table reflects management fees payable by the Vanguard ETFs

to Vanguard Investments Canada Inc. as reported in the prospectus

of the Vanguard ETFs. As the Vanguard ETFs are newly formed and

have not yet completed a fiscal period, information in relation to

the actual MERs does not exist. MERs for the Vanguard ETFs will

first be calculated at the end of their first fiscal period.

Vanguard expects that the MERs of the Vanguard ETFs will be

substantially similar to their management fees, as it is expected

that the only additional fees and expenses that will be borne by

the Vanguard ETFs and included in the MER calculation will be any

goods and services and/or harmonized sales tax payable by the

Vanguard ETFs. Currently, Vanguard Investments Canada Inc. has

agreed to pay the ongoing operating expenses of the Vanguard ETF’s

independent review committee rather than charging those expenses to

the Vanguard ETFs. It may discontinue paying such expenses at any

time. MERs for ETFs are generally higher than management fees for

ETFs.

2This Vanguard ETF™ invests primarily in a U.S.-domiciled

Vanguard fund. To ensure that there is no duplication of management

fees chargeable in connection with the Vanguard ETF and its

investment in the Vanguard fund, the management fee payable by the

Vanguard ETF to Vanguard Investments Canada Inc. set out above is

reduced by the aggregate of the management fee payable by the

Vanguard fund to an affiliate of Vanguard Investments Canada Inc.

and certain expenses of the Vanguard fund that are paid directly by

the Vanguard fund (together, the “Vanguard fund total expense

ratio”). The Vanguard fund total expense ratio is embedded in the

market value of the Vanguard fund shares in which the Vanguard ETF

invests.

Commissions, management fees and expenses all may be

associated with the Vanguard ETFs™. This offering is only made by

prospectus. The prospectus contains important detailed information

about the securities being offered. Copies are available from

Vanguard Investments Canada Inc. at

www.vanguardcanada.ca. Please read the prospectus before

investing. ETFs are not guaranteed, their values change frequently,

and past performance may not be repeated.

Investing in Vanguard ETFs involves risk, including the risk of

error in tracking the underlying index. All investments, including

those that seek to track an index, are subject to risk, including

the possible loss of principal. The performance of an index in not

an exact representation of any particular investment, as you cannot

invest directly in an index.

Vanguard ETFs are not in any way sponsored, endorsed, sold, or

promoted by FTSE International Limited (“FTSE”) or the London Stock

Exchange Group companies (“LSEG”) (together the “Licensor

Parties”), and none of the Licensor Parties make any claim,

prediction, warranty, or representation whatsoever, expressly or

impliedly, either as to (i) the results to be obtained from the use

of a FTSE Index (the “Index”) (upon which a Vanguard ETF is based),

(ii) the figure at which the Index is said to stand at any

particular time on any particular day or otherwise, or (iii) the

suitability of the Index for the purpose to which it is being put

in connection with the Vanguard ETF. None of the Licensor Parties

have provided or will provide any financial or investment advice or

recommendation in relation to the Index to Vanguard or to its

clients. The Index is calculated by FTSE or its agent. None of the

Licensor Parties shall be (a) liable (whether in negligence or

otherwise) to any person for any error in the Index or (b) under

any obligation to advise any person of any error therein. All

rights in the Index vest in FTSE. “FTSE®” is a trademark of LSEG

and is used by FTSE under licence.

“Dividend Achievers” is a trademark of The NASDAQ OMX Group,

Inc. (collectively, with its affiliates, “NASDAQ OMX”) and has been

licensed for use by The Vanguard Group, Inc. Vanguard exchange

traded funds are not sponsored, endorsed, sold, or promoted by

NASDAQ OMX and NASDAQ OMX makes no representation regarding the

advisability of investing in the funds. NASDAQ OMX MAKES NO

WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE VANGUARD

EXCHANGE TRADED FUNDS.

Vanguard ETFs are not sponsored, endorsed, sold, or promoted by

the University of Chicago or its Center for Research in Security

Prices, and neither the University of Chicago nor its Center for

Research in Security Prices makes any representation regarding the

advisability of investing in the funds.

The Vanguard ETFs are not sponsored, endorsed, sold or promoted

by Barclays. Barclays does not make any representation regarding

the advisability of the Vanguard ETFs or the advisability of

investing in securities generally. Barclays' only relationship with

Vanguard is the licensing of the index which is determined,

composed and calculated by Barclays without regard to Vanguard or

the Vanguard ETFs. Barclays has no obligation to take the needs of

Vanguard or the owners of the Vanguard ETFs into consideration in

determining, composing or calculating the index. Barclays has no

obligation or liability in connection with administration,

marketing or trading of the Vanguard ETFs.

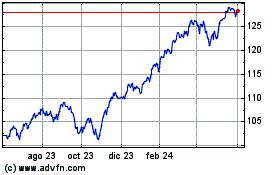

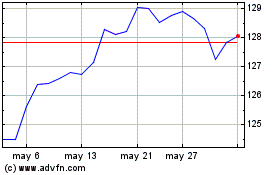

Vanguard S&P 500 Index ETF (TSX:VFV)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Vanguard S&P 500 Index ETF (TSX:VFV)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024