Abcourt Closes of a Non-Brokered Private Placement of $563,000

02 Octubre 2012 - 10:54AM

Marketwired Canada

Mr. Renaud Hinse, President and Chief Executive Officer of Abcourt Mines Inc.

(TSX VENTURE:ABI)(BERLIN:AML)(FRANKFURT:AML) (the "Company") announces that the

Company has completed a non-brokered private placement of $563,360 consisting in

1,742,000 Class B share (a "common share") units of the Company (the "Units") at

a price of $0.10 per Unit and 3,243,000 Class B units to be issued as

"flow-through" units (the "Flow-Through Units") at a price of $0.12 per

Flow-Through Unit. Each Unit consists of one common share and one-half common

share purchase warrant of the Company. Each full warrant entitles the holder

thereof to purchase one common share of the Company over a period of 24 months

from the date of closing at a price of $0.14 (year 1) and $0.16 (year 2). Each

Flow-Through Unit consists of one flow-through share and one-half of one common

share purchase warrant of the Company. Each full warrant entitles the holder

thereof to purchase one common share of the Company over a period of 12 months

from the date of closing at a price of $0.20.

The proceeds from the Flow-Through Units will be used by the Company primarily

to further advance the Elder Gold Mine project in the Abitibi region in the

Province of Quebec and to complete a diamond drilling program on the Jonpol

property and the proceeds from the Units will be allocated to working capital.

No finder's fees were paid for this private placement. The securities issued and

sold under this private placement are subject to a four month hold period under

applicable securities legislation, expiring on February 3, 2013. The placement

is subject to final approval of the TSX Venture Exchange.

Including this private placement, but excluding the shares that may be issued

upon the exercise of the warrants, the Company has 167,019,772 Class B shares

(common shares) issued and outstanding.

The Common Shares and Flow-Through Shares have not been and will not be

registered under the United States Securities Act of 1933, as amended (the "U.S.

Securities Act"), or any state securities laws of the United States and, subject

to certain exceptions and in compliance with the registration requirements of

the U.S. Securities Act and applicable state securities laws or pursuant to

exemptions therefrom, may not be offered, sold or delivered, directly or

indirectly, within the United States or to, or for the account or benefit of,

"U.S. persons" (as defined in Regulation D under the U.S. Securities Act) ("U.S.

Persons"). This press release does not constitute an offer to sell or a

solicitation to buy any of the securities offered hereby within the United

States or to U.S. Persons.

About Abcourt Mines Inc.

Abcourt Mines Inc. is an exploration and development company with strategically

located properties in Northwestern Quebec, Canada. The Elder mine with 43-101

gold resources, the Abcourt-Barvue project with 43-101 silver-zinc ore reserves

and resources and the Aldermac property with historical copper-zinc resources

are all former producers. Abcourt is now focused on bringing the Elder and

Abcourt-Barvue projects back in production with Elder as the first priority. At

the same time, it is working on other projects (Aldermac, Vezza, Jonpol and

Vendome), to increase its mineral resources inventory. An updated 43-101

resource calculation was completed in May 2012 for the Elder mine. A positive

43-101 feasibility study was completed by GENIVAR in 2007 on the Abcourt-Barvue

project. In addition, mill equipment was purchased. To know more about Abcourt,

please consult our web site www.abcourt.com and SEDAR at www.sedar.com under

"Abcourt Mines Inc".

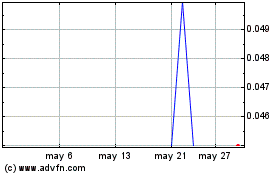

Abcourt Mines (TSXV:ABI)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Abcourt Mines (TSXV:ABI)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024