Abcourt Announces the Last Closing of a Non-Brokered Private Placement

05 Septiembre 2013 - 4:28PM

Marketwired Canada

THIS PRESS RELEASE IS NOT FOR DISTRIBUTION TO THE UNITED STATES NEWSWIRE

SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Mr. Renaud Hinse, President and Chief Executive Officer of Abcourt Mines Inc.

(TSX VENTURE:ABI)(BERLIN:AML)(FRANKFURT:AML) (the "Company") announced today

that the Company closed a second and last tranche of a non-brokered private

placement of up to $700,000 in units (the "Units") and up to $500,000 in

flow-through shares, on the following terms.

Each Unit offered at a price of $0.07 each is comprised of one Class B share (a

"common share") of the Company and of one half (1/2) common share purchase

warrant and each common share offered on a flow-through basis (a "Flow-Through

Share") was offered at a price of $0.085 each. Each full warrant comprised in a

Unit will entitle the holder thereof to purchase one common share of the Company

over a period of 12 months from the date of closing at a price of $0.10.

At the first closing announced by press release dated August 22, 2013, the

Company issued 7,190,000 Units (and not 719 Units as indicated by mistake in

that press release) for an amount of $503,300 and 2,916,647 Flow-Through Shares

for an amount of $247,915. At this second closing, the Company issued 230,000

Units for an amount of $16,100 and 376,000 Flow-Through Shares for an amount of

$31,960. In aggregate, the Company issued 7,420,000 common shares and 3,710,000

warrants allowing the purchase of 3,710,00 common shares and 3,292,647

Flow-Through Shares pursuant to that private placement, representing a total

subscription amount of $799,275.

The proceeds from the Flow-Through Shares will be used by the Company primarily

to further advance the Elder Gold Mine project in the Abitibi region in the

Province of Quebec and the proceeds from the Units will be allocated to working

capital.

The private placement is subject to customary conditions and the final approval

of the TSX Venture Exchange. The securities issued and sold will be subject to a

four month hold period under applicable securities legislation.

This press release does not constitute an offer to sell, or a solicitation of an

offer to buy, any securities of the Company and shall not constitute an offer,

solicitation or sale in any jurisdiction in which such an offer, solicitation,

or sale would be unlawful.

About Abcourt Mines Inc.

Abcourt Mines Inc. is an exploration and development company with strategically

located properties in northwestern Quebec, Canada. The Elder Mine with 43-101

gold resources, the Abcourt-Barvue Project with 43-101 silver-zinc ore reserves

and resources and the Aldermac property with historical copper-zinc resources

are all former producers. Abcourt is now focused on bringing the Elder and

Abcourt-Barvue projects back into production with Elder as the first priority.

At the same time the company is working on other projects (Aldermac, Vezza,

Jonpol and Vendome) to increase its mineral resources inventory. A 43-101

resource calculation was completed in July, 2012, for the Elder Mine. A positive

PEA report was prepared on Elder mine in the Fall of 2012 by Roche Limited,

Consulting Group. A positive 43-101 feasibility study was completed by GENIVAR

in 2007 on the Abcourt-Barvue Project. In addition, mill equipment was

purchased. To know more about Abcourt, please visit our web site at

www.abcourt.com and SEDAR.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Renaud Hinse

President and CEO

819 768-2857 / 450 446-5511

819 768-5475 / 450 446-3550 (FAX)

rhinse@abcourt.com

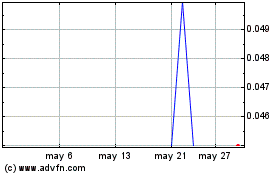

Abcourt Mines (TSXV:ABI)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Abcourt Mines (TSXV:ABI)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024