AnalytixInsight Inc. Provides Details on Sale of Subsidiary

04 Junio 2014 - 5:02PM

Marketwired

AnalytixInsight Inc. Provides Details on Sale of Subsidiary

- OMT Technologies Inc., a subsidiary of AnalytixInsight, being

sold in exchange for cancellation of all related debt

- AnalytixInsight to be debt-free commencing in or around Q3

2014.

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Jun 4, 2014) - Big

data analytics company AnalytixInsight Inc. (the "Company" or

"AnalytixInsight") (TSX-VENTURE:ALY) has entered into a Share

Purchase Agreement dated June 4, 2014, pursuant to which the

Company has agreed to dispose (the "Transaction") of its wholly

owned subsidiary, OMT Technologies Inc. ("OMT"), to 652420 B.C.

Ltd. (the "Purchaser"). The Purchaser is a privately held company

incorporated under the laws of British Columbia. Subject to the

receipt of all necessary regulatory and shareholder approvals, the

Purchaser shall acquire all of the issued and outstanding

securities of OMT. In exchange, the Purchaser shall forgive and

cancel all of the debt owed by the Company to the Purchaser in the

approximate amount of $4,416,038.22 plus accrued interest. It is

anticipated that the Transaction will constitute a reviewable

transaction under the policies of the TSX Venture Exchange (the

"Exchange").

The Transaction was first considered as part of the Company's

acquisition of CapitalCube Corp in 2013. After the completion of

the Transaction, the Company will be debt-free commencing on or

around Q3 2014.

"This transaction provides a couple of advantages to us," said

Chaith Kondragunta, CEO of AnalytixInsight. "Our balance sheet is

stronger and the spinoff allows us to focus on our core business of

big data analytics. We are now well placed to execute with respect

to our strong pipeline of institutional customers and strategic

partnerships, primarily with financial institutions and business

media companies. We expect to announce these in the coming

quarters."

Completion of the Transaction is subject to a number of

conditions, including the receipt of all required shareholder,

regulatory and third party consents, including Exchange approval,

and satisfaction of other customary closing conditions. The

Exchange has in no way passed upon the merits of the proposed

Transaction and has neither approved nor disapproved the contents

of this press release.

On behalf of the Board of Directors of ANALYTIXINSIGHT INC.

Prakash Hariharan, Chairman

ABOUT ANALYTIXINSIGHT INC.

AnalytixInsight Inc.'s technology platform helps transform data

into narratives. The Company's online portal www.capitalcube.com

and mobile platform Stockwall provide high-quality financial

research and content for investors, information providers, finance

portals and media. The Company's disruptive technology

algorithmically analyzes market price data and regulatory filings

to create insightful, actionable narratives and research on

approximately 50,000 global companies and ETFs - all available as a

cloud-based, SAAS offering. This platform capability is extensible

to other asset classes and sectors to generate insightful research

reports.

CapitalCube and Stockwall have existing business relationships

with leading global financial and media institutions. For more

information about CapitalCube visit www.capitalcube.com. For more

information about Stockwall visit www.stock-wall.com.

Regulatory Statements

This press release contains "forward-looking information"

within the meaning of applicable Canadian securities legislation.

Forward-looking information includes, without limitation,

statements regarding the Transaction and the debt forgiveness.

Generally, forward-looking information can be identified by the use

of forward-looking terminology such as "plans", "expects" or "does

not expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates" or "does not anticipate", or

"believes", or variations of such words and phrases or state that

certain actions, events or results "may", "could", "would", "might"

or "will be taken", "occur" or "be achieved". Forward-looking

information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of

activity, performance or achievements of AnalytixInsight Inc., as

the case may be, to be materially different from those expressed or

implied by such forward-looking information, including but not

limited to: general business, economic, competitive, geopolitical

and social uncertainties; the Company's technology and revenue

generation; risks associated with operation in the technology

sector; ability to successfully integrate new technology and

employees; foreign operations risks; and other risks inherent in

the technology industry. Although AnalytixInsight has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. Stetson does not undertake

to update any forward-looking information, except in accordance

with applicable securities laws.

NEITHER TSX-VENTURE EXCHANGE NOR ITS REGULATION SERVICES

PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE

TSX-VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE.

For further information relating to

AnalytixInsight,CapitalCube.Com, and Stockwall:AnalytixInsight

Inc.Abha Dawesar646.435.1561www.analytixinsight.comKin

CommunicationsFreddie Leigh604.684.6730

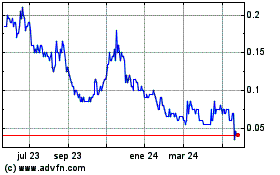

AnalytixInsight (TSXV:ALY)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

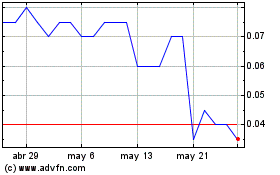

AnalytixInsight (TSXV:ALY)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024