Toronto, Ontario -- November 14th 2017 -- InvestorsHub

NewsWire -- Artificial Intelligence company,

AnalytixInsight Inc. ("AnalytixInsight", or "Company")

(TSX

VENTURE:ALY) (OTCQB:ATIXF)

is pleased to announce that it will be enhancing its artificial

intelligence platform with a series of Blockchain initiatives which

will augment the Company's existing big data analytics engine with

distributed ledger technology. The Company's shares will also trade

on the OTCQB Marketplace under the symbol "ATIXF" effective

November 14, 2017.

Blockchain - The Company will evaluate and

pursue Blockchain initiatives, which are contiguous with its

artificial intelligence platform, using a distributed ledger

technology to reduce transaction costs and settlement times for its

users and partners in CapitalCube and Marketwall. The Company

believes these initiatives will enhance current revenues being

received from existing multi-year agreements with its partners.

CapitalCube - The Company's deep learning

platform currently processes more than 100 billion data

computations daily, using its analytics models and logical

arguments to generate insights. The platform provides financial

analytics and generates content on approximately 50,000 publicly

traded stocks and ETFs, attracting over 2 million user sessions

monthly. The platform's AI engine publishes more than 3,000 daily

articles. CapitalCube has partnership agreements with various

financial entities that include Euronext (European stock exchange

with 1,300 listed issuers), Thomson Reuters, The Wall Street

Journal and Yahoo Finance.

AnalytixInsight will pursue Blockchain offerings to enhance

CapitalCube's artificial intelligence platform, and partner

relationships as CapitalCube adds to its user base through its

channel partners.

Marketwall - The Company's 49% owned subsidiary

Marketwall, expects to deploy its mobile app for stock trading and

banking services in 2018. This is a part of the ongoing multi-year

revenue licensing partnership with Intesa Sanpaolo - Italy's

leading bank with 12.6 million customers. The mobile stock trading

application will directly interface with Intesa Sanpaolo's

established trading platform MarketHub, whose 2016 trading volume

exceeded EUR119 Billion on an average of 26,000 daily transactions.

Marketwall has also partnered with Samsung to pre-load the app on

certain Samsung devices in Europe.

AnalytixInsight will seek to develop a Blockchain distributed

ledger platform to reduce transaction costs and settlement times

for Marketwall, MarketHub and partners.

Prakash Hariharan, AnalytixInsight's Chairman and CEO,

commented: "A recent study by Deloitte shows there has been a

massive surge of new open source Blockchain projects globally, but

only a small percentage of these projects stay alive and achieve

meaningful scale. We believe that by working together with our

strategic partners we can create a meaningful impact within this

rapidly developing industry".

US Listing - AnalytixInsight has received

notice from the OTC Markets Group that it has met the requirements

to be upgraded to the OTCQB Marketplace effective November 14,

2017. The Company will now trade on the OTCQB under the symbol

"ATIXF". The Company will continue to also trade on the TSX-Venture

Exchange under the symbol "ALY". More than 80% of CapitalCube's

approximate 2 million monthly user session traffic is originated in

the United States.

The Company has granted incentive stock options to its

directors, officers, employees and consultants to purchase up to an

aggregate of 630,000 common shares in the capital stock of the

Company, exercisable for a period of five years, at a price of

$0.47 per share. The stock options vest immediately, subject to a

four month regulatory hold period. This grant of options is subject

to the approval of the TSX Venture Exchange.

ABOUT ANALYTIXINSIGHT INC. (www.AnalytixInsight.com)

AnalytixInsight's artificial intelligence platform transforms

data into narratives. AnalytixInsight's online portal CapitalCube

(www.capitalcube.com) algorithmically analyzes market

price data and regulatory filings to create insightful, actionable

narratives and research on approximately 50,000 global companies

and ETFs, providing high-quality financial research and content for

investors, information providers, finance portals and media.

AnalytixInsight holds a 49% interest in Marketwall, a mobile

platform for banking and stock trading (www.marketwallcorporate.com). AnalytixInsight owns

Euclides Technologies Inc. (www.euclidestech.com), a

workflow analytics systems integrator.

Forward Looking Information:

This press release contains "forward-looking information" within

the meaning of applicable Canadian securities legislation.

Forward-looking information includes, without limitation,

statements regarding the Company's ability to enhance its

artificial intelligence platform and develop Blockchain

initiatives; the growth of the Company's business operations; the

use of the Company's content by various parties; the trading of the

Company's common shares on the OTCQB® market, the Company's ability

to continue developing partnership relationships, and the granting

of stock options. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

AnalytixInsight,, as the case may be, to be materially different

from those expressed or implied by such forward-looking

information, including but not limited to: general business,

economic, competitive, geopolitical and social uncertainties; the

Company's technology and revenue generation; risks associated with

operation in the technology sector; ability to successfully

integrate new technology and employees; foreign operations risks;

and other risks inherent in the technology industry. Although

AnalytixInsight has attempted to identify important factors that

could cause actual results to differ materially from those

contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on

forward-looking information. AnalytixInsight does not undertake to

update any forward-looking information, except in accordance with

applicable securities laws.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION

SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE

TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE.

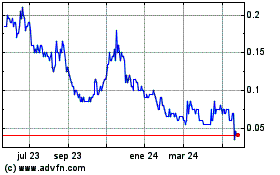

AnalytixInsight (TSXV:ALY)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

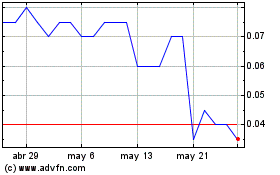

AnalytixInsight (TSXV:ALY)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024