Argus Metals Corp. Announces $2,000,000 Private Placement

31 Enero 2012 - 3:05PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES

Argus Metals Corp. ("Argus" or the "Company") (TSX VENTURE:AML) announces its

intention to complete a non-brokered private placement of up to 20,000,000 units

of the Company (the "Units") at a price of $0.10 per Unit for gross proceeds of

up to $2,000,000. Each Unit will consist of one common share and one half common

share purchase warrant (a "Warrant"). Each whole Warrant will entitle the holder

to purchase one common share of the Company for a period of eighteen months from

the closing date at a price of $0.15 per common share.

The Company may pay finder's fees equal to 7.0% of subscription amounts found,

payable in cash or Units, plus issue finder's warrants in an amount equal to

7.0% of Units subscribed for, with each such finder's warrant exercisable into

one common share of the Company at a price of $0.10 for eighteen months from

closing.

Closing of the Offering is anticipated to occur on or before February 29, 2012

and is subject to receipt of applicable regulatory approvals including approval

of the TSX Venture Exchange. Securities issued under the Offering will be

subject to a four month hold period which will expire four months from the date

of closing.

The proceeds from the Offering will be used to continue exploration on the

Company's Yukon and Guyana exploration projects and for general working capital

purposes.

For additional information please visit the Company's website at

www.argusmetalscorp.com.

On behalf of the board of Directors,

Michael Collins, CEO and Director

The Units have not been registered under the United States Securities Act of

1933, as amended (US Securities Act), and may not be offered or sold in the

United States absent registration or an applicable exemption from registration

requirements. This news release does not constitute an offer to sell or a

solicitation of an offer to buy such Units in any jurisdiction in which such an

offer or sale would be unlawful.

Certain statements in this press release may be considered forward-looking

information, including those relating to the "expectations", "intentions" or

"plans" of the Company, there is no guarantee the PP will close on the basis

announced, or at all. Such information involves known and unknown risks,

uncertainties and other factors -- including the approvals of regulators,

availability of funds, the results of financing and exploration activities, the

interpretation of drilling results and other geological data, project cost

overruns or unanticipated costs and expenses and other risks identified by the

Company in its public securities filings -- that may cause actual events to

differ materially from current expectations. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak only as of the

date of this press release. The Company disclaims any intention or obligation to

update or revise any forward-looking statements, except to the extent required

by law, whether as a result of new information, future events or otherwise.

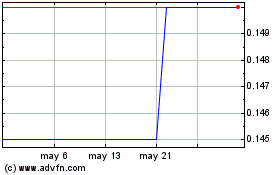

Akwaaba Mining (TSXV:AML)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

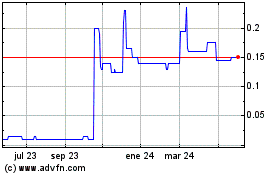

Akwaaba Mining (TSXV:AML)

Gráfica de Acción Histórica

De May 2023 a May 2024