Atico Reports 1.58 Mt at 4.45% Cu and 3.17 g/t Au Inferred Mineral Resources at El Roble Mine, Colombia

26 Junio 2013 - 8:02AM

Marketwired Canada

Atico Mining Corporation (TSX VENTURE:ATY)(PINKSHEETS:ATCMF) is pleased to

announce that an initial NI 43-101 mineral resource estimate for its El Roble

project has established an inferred mineral resource of 1.58 million tonnes at

4.45% Cu and 3.17 g/t Au using a cut-off grade of 0.72% Cu Eq. All of these

announced resources occur at depth below the existing El Roble mine workings. In

the coming months, Atico will continue to further drill test the extensions of

the defined inferred mineral resources at depth and strike, as well as other

prospective areas.

Fernando E. Ganoza, CEO, commented: "We are extremely pleased with the outcome

of our initial mineral resource estimate for El Roble mine. The grades continue

to be remarkable at depth and the volume is very encouraging given the deposit

is still open at depth and along strike." Mr. Ganoza added, "The resource

estimate, along with the recently completed engineering studies and assessment

of current operations, support Atico's plan to exercise the option agreement

this year and quickly bring newly discovered resources into production using the

existing operating mine and mill infrastructure."

The resource estimate was prepared in accordance with the definitions in the

Canadian National Instrument 43-101 and based on data from 30 drill holes

totaling 6,084 meters completed by Atico, during 2012 and up to February 20,

2013. An additional 33 drill holes totaling 1,784 meters completed by Minera El

Roble (MINER), current operator of the mine and independently reviewed, logged

and sampled by Atico were also included. Mr. Michael Lechner and Mr. Donald

Earnest have acted as independent qualified persons, as defined by the Canadian

National Instrument 43-101 and have reviewed and approved the resource estimate.

Inferred Resource Estimate Table

---------------------------

Contained Metal

----------------------------------------------------------------------------

Cu Eq Cu Eq

Cutoff Tonnes Cu Eq Cu Au Ag Cu Lbs Au oz Lbs

(%) (000) (%) (%) (g/t) (g/t) (000) (000) (000)

----------------------------------------------------------------------------

0.5 1,627 6.19 4.33 3.10 11.10 155,420 162 221,968

----------------------------------------------------------------------------

0.6 1,597 6.30 4.41 3.15 11.25 155,205 162 221,747

----------------------------------------------------------------------------

0.72 1,581 6.35 4.45 3.17 11.30 155,090 161 221,267

----------------------------------------------------------------------------

0.8 1,581 6.35 4.45 3.17 11.30 155,090 161 221,267

----------------------------------------------------------------------------

0.9 1,579 6.36 4.46 3.18 11.31 155,112 161 221,335

----------------------------------------------------------------------------

1.0 1,556 6.44 4.51 3.21 11.41 154,811 161 220,855

----------------------------------------------------------------------------

1.1 1,554 6.45 4.52 3.22 11.42 154,806 161 220,914

----------------------------------------------------------------------------

1.2 1,515 6.58 4.63 3.26 11.58 154,491 159 219,710

----------------------------------------------------------------------------

1.3 1,463 6.77 4.78 3.33 11.72 154,052 157 218,295

----------------------------------------------------------------------------

1.4 1,431 6.90 4.88 3.36 11.80 154,045 154 217,621

----------------------------------------------------------------------------

1.5 1,430 6.90 4.89 3.36 11.80 154,011 154 217,469

----------------------------------------------------------------------------

1.6 1,406 6.99 4.96 3.38 11.82 153,731 153 216,608

----------------------------------------------------------------------------

1.7 1,386 7.07 5.03 3.40 11.80 153,509 152 215,970

----------------------------------------------------------------------------

1.8 1,345 7.23 5.15 3.46 11.92 152,794 150 214,325

----------------------------------------------------------------------------

1.9 1,326 7.30 5.22 3.47 11.96 152,669 148 213,343

----------------------------------------------------------------------------

2.0 1,283 7.48 5.35 3.55 12.21 151,356 147 211,514

----------------------------------------------------------------------------

Note: Copper equivalency estimates were derived using metal prices of US$

3.59/lb for Copper and US$ 1472/oz for gold

Resource Estimate Methodology

Data obtained from the Atico diamond drill program were used to construct

three-dimensional geometric wireframes representing the massive sulfide zones

extending below the 2000 level in the El Roble mine. These zones (named Maximus,

Goliath, Apolo, Andromeda, Orion, Transformador, Zeus, Aquiles, and Ares) were

used to constrain the estimation of an NI 43-101 compliant inferred resource at

El Roble mine. Copper, gold, silver, lead, zinc and cobalt grades were estimated

for 5m x 5m x 5m blocks within the wireframes. Prior to estimation of the block

grades, copper grades were capped at 20% Cu, gold was capped at 20g/t Au and

silver was capped at 100g/t Ag. A three-pass inverse distance cubed (1/d3)

method was used for the block grade estimates, along a trend plane having an

azimuth of 320 degrees and a minus 75-degree dip to the north. The first pass

used search distances along strike and down dip of 25m, and 5m perpendicular to

the trend plane. The second pass used search distances along strike and down dip

of 75m, and 10m perpendicular to the trend plane. The third pass used search

distances along strike and down dip of 150m, and 20m perpendicular to the trend

plane. The first pass required a minimum of one composite and allowed a maximum

of three composites, with no more than one composite per drill hole. The second

pass required a minimum of three composites and allowed a maximum of six

composites, with a limit of two composites per drill hole, while the third pass

required a minimum of three composites, a maximum of eight composites allowed

and a limit of two composites per drill hole. The first pass resulted in grade

estimates for 56 percent of the blocks. The second pass resulted in 26 percent

of the blocks receiving grade estimates, while the third pass resulted in grade

estimates for the remaining 18 percent of the blocks.

In the opinion of Atico and its Qualified Persons, the methodology used is

appropriate and provides a reasonable estimate of the copper and gold content of

inferred mineral resources for the El Roble deposit that conform to NI 43-101

guidelines. The wireframes interpreted by Atico as part of the estimation

process provide an excellent guide for the planned in-fill drilling and other

work required to estimate measured and indicated mineral resources and an

eventual mineral reserve estimate.

A NI 43-101 technical report will be filed on www.sedar.com and posted on the

company's website within 45 days of this news release.

El Roble drill program and exploration update

On-going underground drilling at El Roble mine is currently focused on further

defining the interpreted boundaries of the Maximus and Goliath massive sulfide

bodies, which are considered primary targets for mining operations below the

2000 level given their close proximity to current mine workings. Nine drill

holes have been planned for this purpose and are scheduled to be completed in

early July. The underground program will continue at the south end of the known

mineralized strike length and below the 2000 level, with the goal of discovering

additional massive sulfide bodies.

Drilling at El Roble mine was interrupted in April (see news releases dated

April 15, 2013 and April 23, 2013) with news flow further delayed in May due to

consecutive failure of holes 31a, 31b and 32 caused by ground conditions. The

company expects the drilling results news flow will resume in early July.

The company recently completed 1,329 meters of drilling in 4 drill holes at the

Archie area. Drill results have confirmed strong continuity of the favorable

black chert formation to the north of El Roble mine with presence of

chalcopyrite and pyrite stringers up to 5 cm in length, but massive sulphide

mineralization was not intercepted. The company is evaluating the results from

the Archie area and conducting additional interpretation of the zone. The drill

program at Archie will be revised as a result of the enhanced understanding of

the area.

Target preparation work has been completed at Santa Anita anomaly with 8 drill

targets defined within this area. Work in the San Lorenzo prospective target has

begun and includes in-fill geochemical sampling, structural interpretation,

detailed geological mapping and interpretation of geophysical anomalies. In

addition, surface soil and rock geochemistry and geology work continues in newly

identified as well as known target areas to better understand and prioritize

drilling targets.

El Roble operation assessment update

In the first quarter of 2013, the company initiated a comprehensive assessment

of the El Roble mine operation through technical and engineering studies aimed

at gaining a thorough understanding of the existing mining operation. Studies

produced by engineering firms and independent consultants have assessed the

potential to scale up the mill and processing facilities, the mine's design and

optimization, the tailings dam expansion and the operation's environmental

standards.

As part of this assessment, the company has validated the location and upgraded

the design of a new adit at the 1886 level, 114 meters below current mine

workings. The adit will provide access to new resources and allow building of an

underground drill platform from which diamond drilling can intercept the newly

discovered massive sulphide bodies perpendicular to their strike direction,

which the company believes is necessary to estimate measured and indicated

resources and, eventually, a mineral reserve estimate.

Qualified Person

Michael J. Lechner of Resource Modeling Inc. and Donald F. Earnest of Resource

Evaluation Inc. are the Qualified Persons as defined by National Instrument

43-101 and are responsible for the accuracy of the technical information in this

news release regarding the resource estimate.

Dr. Demetrius Pohl, Ph.D., AIPG Certified Geologist, a qualified person under NI

43-101 standards, and independent of the company is responsible for ensuring

that the information contained in this news release not related to the resource

estimate is an accurate summary of the original reports and data provided to or

developed by Atico Mining Corporation.

The El Roble Property

The El Roble property is the site of an operating underground copper and gold

mine with nominal capacity of 400 tonnes per day. Over the past 22 years the

mine has processed 1.5 million tonnes of ore at an average grade of 2.5% copper

and an estimated 2.5 g/t gold. Copper and gold mineralization at El Roble occurs

as volcanogenic massive sulfide ("VMS") lenses. Atico's underground drilling has

discovered additional high-grade mineralization below the mine workings.

Exploration on the surrounding 6,679 ha property over the past two years has

defined a productive contact and an enclosing package of host rocks that extend

10 kilometers across the property. The entire strike length is marked by ("VMS")

mineralization occurrence indicators.

About Atico Mining Corporation

Atico is a growth oriented, copper and gold exploration and development company

focused on mining opportunities in Latin America. The company's primary property

is the El Roble project. The company is selectively pursuing additional

acquisition opportunities. For more information, please visit our website at

www.aticomining.com.

ON BEHALF OF THE BOARD

Fernando E. Ganoza, CEO, Atico Mining Corporation

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

No securities regulatory authority has either approved or disapproved of the

contents of this news release. The securities being offered have not been, and

will not be, registered under the United States Securities Act of 1933, as

amended (the "U.S. Securities Act"), or any state securities laws, and may not

be offered or sold in the United States, or to, or for the account or benefit

of, a "U.S. person" (as defined in Regulation S of the U.S. Securities Act)

unless pursuant to an exemption therefrom. This press release is for information

purposes only and does not constitute an offer to sell or a solicitation of an

offer to buy any securities of the Company in any jurisdiction.

Cautionary Note Regarding Forward-Looking Statements

This announcement includes certain "forward-looking statements" within the

meaning of Canadian securities legislation. All statements, other than

statements of historical fact, included herein, without limitation the use of

net proceeds, are forward-looking statements. Forward-looking statements involve

various risks and uncertainties and are based on certain factors and

assumptions. There can be no assurance that such statements will prove to be

accurate, and actual results and future events could differ materially from

those anticipated in such statements. Important factors that could cause actual

results to differ materially from the Company's expectations include

uncertainties relating to interpretation of drill results and the geology,

continuity and grade of mineral deposits; uncertainty of estimates of capital

and operating costs; the need to obtain additional financing to maintain its

interest in and/or explore and develop the Company's mineral projects;

uncertainty of meeting anticipated program milestones for the Company's mineral

projects; and other risks and uncertainties disclosed under the heading "Risk

Factors" in the prospectus of the Company dated March 2, 2012 filed with the

Canadian securities regulatory authorities on the SEDAR website at

www.sedar.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Atico Mining Corporation

Igor Dutina

Investor Relations

+1.604.633.9022

info@aticomining.com

www.aticomining.com

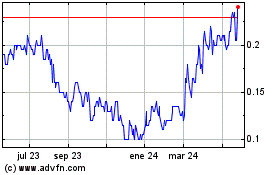

Atico Mining (TSXV:ATY)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

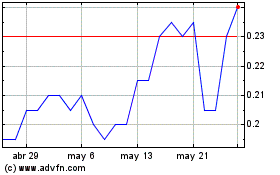

Atico Mining (TSXV:ATY)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024