Atico Closes Equity Financing and Enters Into Debt Financing Agreement

19 Septiembre 2013 - 2:21PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION,

DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN

OR INTO THE UNITED STATES.

Atico Mining Corporation ("Atico" or the "Company") (TSX

VENTURE:ATY)(PINKSHEETS:ATCMF) is pleased to announce that further to its news

releases dated August 15, 2013 and September 17, 2013, it has closed its

brokered private placement (the "Brokered Offering") of 24,600,000 units at a

price of C$0.45 per unit (the "Units") for gross proceeds of C$11,070,000 and

its non-brokered private placement (the "Non-brokered Offering" and together

with the Brokered Offering, the "Offering") of 11,869,744 Units for gross

proceeds of approximately C$5,341,385. The Company is also pleased to announce,

as part of the Brokered Offering, the closing of the Agents' Option (defined

below) of 6,700,000 Units at a price of $0.45 per Unit for additional gross

proceeds of C$3,015,000.

Each Unit consists of one common share of the Company and one-half of one common

share purchase warrant (each whole common share warrant, a "Warrant"). Each

Warrant is exercisable into one common share of the Company until September 19,

2015 at an exercise price of C$0.65 per common share.

Brokered Private Placement

The Brokered Private Placement was led by Canaccord Genuity Corp. (the "Lead

Agent") on behalf of a syndicate of agents including Stifel Nicolaus Canada Inc.

and Stonecap Securities Inc. (collectively, the "Agents"). The Agents arranged

for the sale of 24,600,000 Units and exercised the option granted to the Agents

by the Company (the "Agents' Option") to arrange for the purchase and sale of an

additional 6,700,000 Units.

The Agents received a cash commission in an aggregate amount of C$814,050 in

connection with the Brokered Offering (inclusive of the Agents' Option). In

addition, as additional consideration for the provision of strategic and ongoing

advice as to the Company's capital strategy, the Lead Agent received 400,000

units (the "Corporate Finance Fee Units"). Each Corporate Finance Fee Unit has

the same characteristics of a Unit, except that the Warrants comprising the

Corporate Finance Fee Units are non-transferable.

Non-brokered Private Placement

The Company also closed its previously announced Non-brokered Offering of

11,869,744 Units. In connection with the Non-brokered Offering, certain finders

received a cash commission of up to 6% of the gross proceeds raised by such

finder.

Debt Financing

The Company is also pleased to announce that, further to its news releases dated

August 15, 2013 and September 17, 2013, it has entered into a definitive

agreement with Trafigura Pte. Ltd. ("Trafigura") with respect to a senior

secured repayable debt facility of US$8,000,000 (the "Debt Financing"). Once an

initial advance is made under the Debt Financing, the funds will have a

repayment term of 48 months, with annual carried interest of LIBOR plus 9%,

payable quarterly, subject to a 12 month grace period (with the first repayment

date being 15 months from the date of the first advance).

General

All securities issued pursuant to the Offering are subject to a hold period

expiring January 20, 2014.

The proceeds raised under the Offering and the Debt Financing will be used for

the exercise of the El Roble property option, capital expenditure, exploration

and for general working capital purposes.

About Atico Mining Corporation

Atico is a growth oriented, copper and gold exploration and development company

focused on mining opportunities in Latin America. The company's primary property

is the El Roble project. The company is selectively pursuing additional

acquisition opportunities. For more information, please visit our website at

www.aticomining.com.

ON BEHALF OF THE BOARD

Fernando E. Ganoza, CEO, Atico Mining Corporation

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

No securities regulatory authority has either approved or disapproved of the

contents of this news release. The securities being offered have not been, and

will not be, registered under the United States Securities Act of 1933, as

amended (the "U.S. Securities Act"), or any state securities laws, and may not

be offered or sold in the United States, or to, or for the account or benefit

of, a "U.S. person" (as defined in Regulation S of the U.S. Securities Act)

unless pursuant to an exemption therefrom. This press release is for information

purposes only and does not constitute an offer to sell or a solicitation of an

offer to buy any securities of the Company in any jurisdiction.

Cautionary Note Regarding Forward-Looking Statements

This announcement includes certain "forward-looking statements" within the

meaning of Canadian securities legislation. All statements, other than

statements of historical fact, included herein, including, without limitation,

the use of net proceeds, are forward-looking statements. Forward-looking

statements involve various risks and uncertainties and are based on certain

factors and assumptions. There can be no assurance that such statements will

prove to be accurate, and actual results and future events could differ

materially from those anticipated in such statements. Important factors that

could cause actual results to differ materially from the Company's expectations

include uncertainties relating to the use of proceeds and other risks and

uncertainties disclosed under the heading "Risk Factors" in the prospectus of

the Company dated March 2, 2012 filed with the Canadian securities regulatory

authorities on the SEDAR website at www.sedar.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Atico Mining Corporation

Igor Dutina

Investor Relations

+1.604.633.9022

www.aticomining.com

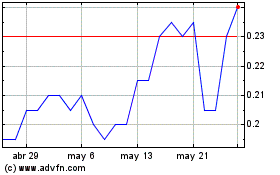

Atico Mining (TSXV:ATY)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

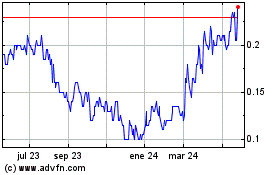

Atico Mining (TSXV:ATY)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024