ValOro Resources Inc. Provides Additional Disclosure Respecting Its Information Circular for the Special Meeting to be Held o...

05 Diciembre 2018 - 7:00AM

ValOro Resources Inc. (TSX-V: VRO) provides the following

additional disclosure regarding its information circular dated

November 22, 2018. The circular was issued in connection with

ValOro’s special general meeting of securityholders being held on

December 19, 2018 to consider and, if appropriate, approve by

a special resolution the friendly merger of ValOro and Defiance

Silver Corp. (TSX-V: DEF).

Merger is a Business Combination under MI

61-101

The proposed merger of ValOro and Defiance is a

“business combination” under Multilateral Instrument 61-101

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”). As a result, certain valuation and minority approval

requirements apply to the merger.

Exemption from Formal Valuation

MI 61-101 requires that business combinations

shall be the subject of a formal valuation and that the valuation

be disclosed to the affected shareholders. MI 61-101 provides an

exemption from the valuation requirement which applies to ValOro,

namely that it is listed on the TSX Venture Exchange and no other

stock exchange.

Prior Valuations

Pursuant to MI 61-101, any valuations of ValOro

made within the preceding 24 months must be disclosed to the

affected shareholders. ValOro has not had, nor is it aware of, any

such valuations made within the preceding 24 months.

Prior Offers

Prior to accepting the offer to merge with

Defiance, ValOro received two offers from other companies in the

preceding 24 months.

The first was from a Toronto Stock Exchange

listed silver mining company with operations in Mexico which, on

June 7, 2018, offered to buy ValOro by way of a triangular merger

valuing ValOro at $7 million. The offer was subsequently withdrawn

by the offeror without being accepted by ValOro.

The second was from a Toronto Stock Exchange

listed mineral exploration company with various gold properties in

North and South America which, on August 16, 2018, offered to buy

ValOro’s Tepal Project for $2.76 million payable in three equal

cash payments to ValOro over one year. ValOro’s board rejected the

offer as, among other things, it did not provide any upside to

ValOro’s shareholders when compared to a share exchange.

Review and Approval Process by ValOro’s Board

In connection with settling the general terms of

the merger with Defiance, ValOro’s management carried out due

diligence examinations of Defiance and its San Acacio Silver

Project in Mexico and had several discussions and negotiations with

Defiance concerning the exchange ratio as to the number of Defiance

shares that would be offered for each ValOro share. Following the

terms of the merger being settled by ValOro’s and Defiance’s

respective CEOs and the due diligence being completed, ValOro’s

board held a conference call during which the merger and the

results of the due diligence were discussed. At the end of that

call, the board determined to proceed with the Transaction and a

Letter of Intent respecting the merger with Defiance was

signed.

In connection with the Board’s formal approval

of the merger, ValOro’s CEO, Dunham Craig, abstained from voting

due to his interest in the merger, namely, that the payment of the

balance of his retirement allowance from ValOro originally agreed

to in 2016 will be satisfied by the issuance of shares of

Defiance.

The merger was then announced and the parties’

respective legal counsel negotiated and settled the formal

agreement.

Minority Shareholder Approval Required

MI 61-101 requires that business combinations be

approved by a majority of shareholders other than the “interested

shareholders”. For the purposes of this transaction, the interested

shareholders of ValOro are Dunham Craig and Evelyn Abbott, both of

whom will receive shares of Defiance in satisfaction of their

respective retirement and severance obligations payable by

ValOro.

Dunham Craig owns 383,629 ValOro shares (1.78%

of the possible votes) and Evelyn Abbott owns 8,000 ValOro shares

(0.04% of the possible votes). Pursuant to MI 61-101, such ValOro

shares will be excluded for purposes of determining whether the

requisite shareholder approval has been obtained in accordance with

MI 61-101.

About ValOro Resources Inc.

ValOro Resources Inc. (VRO | TSX Venture

Exchange) is a mineral exploration and development company

focused on acquiring, exploring, and developing mineral resource

opportunities with the potential to host profitable mining

operations. The Company's primary focus is the 100% owned Tepal

Gold/Copper Project in Michoacán state, Mexico.

For Further Information Please

Contact:Dunham Craig President and Chief Executive

OfficerTel: 604-694-1742Email: dcraig@valoro.caWebsite:

www.valoro.ca

Neither the TSX Venture Exchange nor the

Investment Industry Regulatory Organization of Canadaaccepts

responsibility for the adequacy or accuracy of this release.

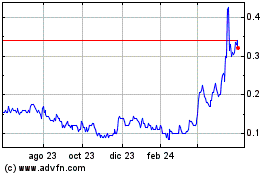

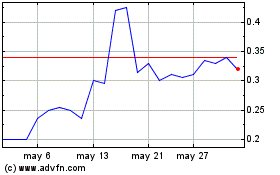

Defiance Silver (TSXV:DEF)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Defiance Silver (TSXV:DEF)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024