Galantas Announces 34% Increase in Resources at Omagh Gold Mine

12 Junio 2013 - 8:00AM

Marketwired Canada

Galantas Gold Corporation (TSX VENTURE:GAL) (AIM:GAL) is pleased to announce a

summary of an updated resource estimate relating to its wholly owned,

operational, gold project at Omagh, County Tyrone, Northern Ireland.

The resource estimate is based on drilling results received up to 5th May 2013.

The following table summarises the block model estimate and compares it to the

previous estimate by ACA Howe, which was based on drilling results up to 8th

June 2012 :

ACA Howe 2012 report Galantas 2013 report

Drilling to 8th June 2012 Drilling to 5thMay 2013

MINERALISED RESOURCE CUT-OFF 2.5 g/t Au (gold) CUT-OFF 2.5 g/t Au (gold)

ZONE CATEGORY Grade Grade

TONNES (Au g/t) Au ozs TONNES (Au g/t) Au ozs

KEARNEY MEASURED 0 0 0 55,896 6.09 10,941

KEARNEY INDICATED 270,900 7.94 69,000 327,542 6.56 69,057

KEARNEY INFERRED 490,000 8.54 135,000 831,860 6.16 164,651

JOSHUA MEASURED 13,000 6.48 2,800 59,002 4.92 9,331

JOSHUA INDICATED 66,800 6.27 13,000 250,140 5.32 42,804

JOSHUA INFERRED 173,000 8.48 47,000 395,886 6.45 82,148

ELKINS INDICATED 68,500 4.24 9,000 68,500 4.24 9,000

ELKINS INFERRED 20,000 5.84 3,800 20,000 5.84 3,800

KERR MEASURED 2,250 6.75 500 2,250 6.75 500

KERR INDICATED 5,400 5.03 900 5,400 5.03 900

KERR INFERRED 26,000 4.58 4,000 26,000 4.58 4,000

GORMLEYS INFERRED 75,000 8.78 21,000 75,000 8.78 21,000

GARRY'S INFERRED 0 0.00 0 0 0.00 0

PRINCES INFERRED 10,000 38.11 13,000 10,000 38.11 13,000

SAMMY'S INFERRED 27,000 6.07 5,000 27,000 6.07 5,000

KEARNEY INFERRED 18,000 3.47 2,000 18,000 3.47 2,000

NORTH

TOTALS MEASURED 15,250 6.52 3,300 77,919 5.87 20,772

INDICATED 411,600 7.01 92,000 651,582 5.85 121,761

INFERRED 839,000 8.53 231,000 1,403,746 6.54 295,599

Note: Rounded numbers, gold grades capped at 75g/t. Cut-off grade of 2.5g/t

Au & a minimum mining width of 0.9 metres. Mineral resources that are not

mineral reserves do not have demonstrated economic viability.

The drilling program, subsequent to June 2012, was targeted to increase the

amount of Measured and Indicated Resources, to increase the confidence of loan

finance providers, related to the potential development of an underground mine.

The drilling target was achieved. There has been an overall increase in

Resources classified as Measured and Indicated from a total of 95,300 troy

ounces gold (2012) to 142,533 troy ounces gold (an increase of 50%) and a 28%

increase in Resources classified as Inferred, from 231,000 troy ounces gold

(2012) to 295,599 troy ounces gold (2013). The overall increase is 34%. The

unaudited, estimated cost of the drilling program (subsequent to 8th June 2012)

was approximately GBP 927,000.

The database used in the 2013 resource estimate contains results from 299

surface diamond drill holes and 540 channels. Sampling methodology, security &

verification followed standard procedures previously detailed on April 5th 2006

and the samples were analysed (gold by fire assay with atomic absorption finish

and other metals by ICP-ORE) at OMAC Laboratory Ltd (now ALS Minerals Division),

an independent, ISO 17025 laboratory, of Galway, Ireland. The core drilling

methodology was that as described on 15th September 2011.

The Company intends to file a complete Technical Report on SEDAR within 45 days

of this release, as required by NI 43-101.

Roland Phelps, President & CEO, Galantas Gold Corporation commented, "The 2013

Resource Estimate is an important milestone in the development of an underground

gold mine on our Omagh site. A revised economic study can now be initiated and

loan finance discussions will continue when that is complete. Planning permits

continue to progress, with final additional information now being prepared for

consultation."

Roland Phelps, B.Sc., C.Eng, MIMMM, President & CEO, Galantas Gold Corporation

is the Qualified Person (QP) for the NI.43-101 Report on the Resource Estimate

of the Omagh Gold Deposit (2013). Data collection procedures and the preparation

of the resource estimate has been carried out under his supervision and he has

reviewed and approved the contents of this press release. The QP is not

independent of the Company. The financial component of this disclosure has been

reviewed by Leo O' Shaughnessy (Chief Financial Officer, Galantas Gold

Corporation) and is based upon local financial data prepared under his

supervision.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS: This press release contains

forward-looking statements within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian securities

laws, including drilling intersections and analyses, for the Omagh Gold project.

Forward-looking statements are based on estimates and assumptions made by

Galantas in light of its experience and perception of geological interpretation,

historical trends, current conditions and expected future developments, as well

as other factors that Galantas believes are appropriate in the circumstances.

Many factors could cause Galantas' actual results, the performance or

achievements to differ materially from those expressed or implied by the forward

looking statements, including: gold price volatility; discrepancies between

actual and estimated production, actual and estimated metal grades and

geologically interpreted widths, actual and estimated metallurgical recoveries;

actual and estimated costs; mining operational risk; regulatory restrictions,

including environmental regulatory restrictions and liability; risks of

sovereign involvement; speculative nature of gold exploration; dilution;

competition; loss of key employees; additional funding requirements; planning

and other permitting issues; and defective title to mineral claims or property.

These factors and others that could affect Galantas's forward-looking statements

are discussed in greater detail in the section entitled "Risk Factors" in

Galantas' Management Discussion & Analysis of the financial statements of

Galantas and elsewhere in documents filed from time to time with the Canadian

provincial securities regulators and other regulatory authorities. These factors

should be considered carefully, and persons reviewing this press release should

not place undue reliance on forward-looking statements. Galantas has no

intention and undertakes no obligation to update or revise any forward-looking

statements in this press release, except as required by law.

Galantas Gold Corporation Issued and Outstanding Shares total 256,210,395.

FOR FURTHER INFORMATION PLEASE CONTACT:

Galantas Gold Corporation

Jack Gunter P.Eng

Chairman

+44 (0) 2882 241100

Galantas Gold Corporation

Roland Phelps C.Eng

President & CEO

+44 (0) 2882 241100

info@galantas.com

www.galantas.com

Investor Relations :

Courtenay Heading (Maclir Consulting Ltd)

(UK) +44 (0) 7624 424 455

c.heading@galantas.com

Charles Stanley Securities (Nominated Adviser)

Mark Taylor

+44 (0)20 7149 6000

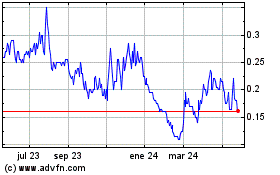

Galantas Gold (TSXV:GAL)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

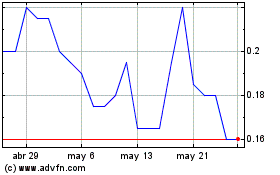

Galantas Gold (TSXV:GAL)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025