Galantas Gold Corporation: Share Consolidation and Private Placing to Raise £500,000

08 Abril 2014 - 8:00AM

Marketwired

Galantas Gold Corporation: Share Consolidation and Private Placing

to Raise £500,000

TORONTO, ONTARIO--(Marketwired - Apr 8, 2014) - Galantas Gold

Corporation (TSX-VENTURE:GAL) (AIM:GAL) ("Galantas" or the

"Corporation") today announces that the Board is seeking regulatory

approval of documents relating to the consolidation of the

Corporation's issued and outstanding share capital (the

"Consolidation"), exchange of shares for debt and the private

placement of shares.

Galantas announced on 23rd January 2014 that the Consolidation

was passed at a Special Meeting of Shareholders on 16th January

2014, with determination of the consolidation ratio by the

Directors. The Directors have determined that the Consolidation

will be on the basis of 5 old shares for 1 new share. The action is

being undertaken to improve on the current trading price for the

Company's securities as it falls below the minimum price

requirements for private placements as set out by TSX Venture

Exchange Corporate Finance Policy 4.1.

Subject to Exchange approvals, the consolidation is scheduled to

be effective at opening on the TSX Venture Exchange and AIM on

Monday 14th April 2014, from which date the existing issued share

capital will be cancelled and replaced by the new Common Shares in

consolidated form.

Application has been made for the Galantas Depositary Interests

to be traded on AIM with effect from 14th April 2014 under the

ISIN: CA36315W2022 and SEDOL: BKSZT76.

A private placement of new shares is expected to complete

following consolidation. A minimum of 10 million units will be

subscribed at UK£0.05 (five pence) / CDN$0.09375 per unit. Each

unit will comprise 1 new ordinary share and 1 warrant (the

"Placement"). Each warrant will entitle the holder to purchase 1

further new ordinary share at UK£0.10 (ten pence) per share for a

period of two years from the date on which the subscription is

closed. The Placement will raise a minimum of UK£500,000. The new

ordinary shares issued pursuant to the Placement are subject to a

four month hold period. The new ordinary shares and warrants to be

issued pursuant to the placement represent approximately 23.2 per

cent of the enlarged issued share capital (at the minimum placing

amount).

Coincident with the placement (and following the Consolidation),

subject to TSX Venture Exchange approval, the Corporation will also

undertake an exchange of existing debt for new ordinary shares, as

set out in the circular to shareholders issued 16th December 2013

and approved by Shareholders at the Special Meeting of Shareholders

16th January 2014. Roland Phelps (President & Chief Executive)

will exchange a loan of CDN$1,346,730 (UK£716,256) for 14,365,120

new ordinary shares representing 16.6 per cent of the enlarged

issued share capital. Leo O'Shaughnessy (Chief Financial Officer)

will exchange a loan of CDN$30,046 for 320,491 new ordinary shares,

representing 0.4 per cent of the enlarged issued share capital.

Following the exchange of debt for equity Mr Phelps and Mr

O'Shaughnessy will hold 24.9 per cent and 0.4 per cent of the

Galantas enlarged issued share capital respectively (at the minimum

placing amount). Loans due to certain other third party creditors

have also agreed to settlement of amounts owed totalling UK£21,976,

through the issue of 439,520 new ordinary shares, representing 0.5

per cent of the enlarged issued share capital. No Warrants will be

attached to the new ordinary shares issued in relation to any of

the equity for debt exchange.

In compliance with TSX Venture Exchange requirements, Galantas

shareholders on the Canadian register will receive a Letter of

Transmittal, which they are required to return, together with their

original share certificate, for which they will then receive the

issue of a new certificate. Galantas shareholders on the Jersey

register will be mailed with new certificates without further

action required on their part. Current share certificates will no

longer be valid after close of business on 11h April 2014. The

accounts of shareholders who hold shares or depositary interests in

electronic form will be adjusted automatically.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Galantas Gold CorporationJack Gunter P.EngChairman+44 (0) 2882

241100Galantas Gold CorporationRoland Phelps C.Eng.President &

CEO+44 (0) 2882 241100info@galantas.comwww.galantas.comCharles

Stanley Securities (Nominated Adviser)Mark Taylor+44 (0)20 7149

6000

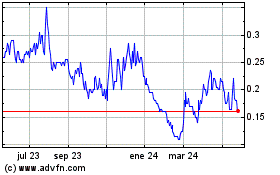

Galantas Gold (TSXV:GAL)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

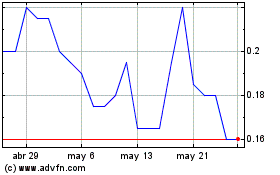

Galantas Gold (TSXV:GAL)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025