Galantas Gold Corporation (the Company) (TSX VENTURE:GAL)(AIM:GAL) is pleased to

announce a revised estimate of gold resources, economic study, planning and

environmental update on its wholly owned, Omagh Gold Mine in Northern Ireland.

RESOURCE REVIEW

The revised estimate of resources is written in compliance with the Pan European

Reporting Code (PERC), Canadian Institute of Mining, Metallurgy and Petroleum

(CIM) standards and Canadian National Instrument (NI) 43-101.

----------------------------------------------------------------------------

RESOURCE ESTIMATE : GALANTAS 2014

CUT-OFF 2 g/t Au Increase

------------------------------------------------------------ over

RESOURCE TONNES GRADE Au Ozs GAL 2013

CATEGORY (Au g/t) report

----------------------------------------------------------------------------

MEASURED 138,241 7.24 32,202 55%

----------------------------------------------------------------------------

INDICATED 679,992 6.78 147,784 21.4%

----------------------------------------------------------------------------

INFERRED 1,373,879 7.71 341,123 15.4%

----------------------------------------------------------------------------

Minerals Resources that are not Mineral Reserves do not have demonstrated

economic viability.

Overall there has been a 19% increase in resources since the Galantas 2013

Resource Report (reported 12th June 2013) and a 60% increase in resources since

the 2012 Resource Report by ACA Howe International Ltd (reported 3rd July 2012).

The increases since 2012 largely relate to the Kearney and Joshua veins, since

this is where the drilling program has been concentrated. The drilling program

was mainly designed to focus on increasing the quantity of Measured and

Indicated resources on these two veins, to support potential bank funding

opportunities for the financing of production. The resource estimate for each

vein is tabulated below.

----------------------------------------------------------------------------

RESOURCE ESTIMATE BY VEIN : GALANTAS 2014

----------------------------------------------------------------------------

MEASURED INDICATED

----------------------------------------------------------------------------

TONNES GRADE Contained Tonnes GRADE Contained

Au (g/t) Au (oz) Au (g/t) Au (oz)

----------------------------------------------------------------------------

KEARNEY 76,936 7.48 18,490 383,220 6.66 82,055

----------------------------------------------------------------------------

JOSHUA 54,457 7.25 12,693 216,211 7.92 55,046

----------------------------------------------------------------------------

KERR 6,848 4.63 1,019 12,061 4.34 1,683

----------------------------------------------------------------------------

ELKINS 68,500 4.24 9,000

----------------------------------------------------------------------------

GORMLEYS

----------------------------------------------------------------------------

PRINCES

----------------------------------------------------------------------------

SAMMY'S

----------------------------------------------------------------------------

KEARNEY NORTH

----------------------------------------------------------------------------

TOTAL 138,241 7.25 32,202 679,992 6.78 147,784

----------------------------------------------------------------------------

-----------------------------------------------

RESOURCE ESTIMATE BY VEIN : GALANTAS 2014

-----------------------------------------------

INFERRED

-----------------------------------------------

Tonnes GRADE Contained

Au (g/t) Au (oz)

-----------------------------------------------

KEARNEY 909,277 6.61 193,330

-----------------------------------------------

JOSHUA 291,204 10.74 100,588

-----------------------------------------------

KERR 23,398 3.2 2,405

-----------------------------------------------

ELKINS 20,000 5.84 3,800

-----------------------------------------------

GORMLEYS 75,000 8.78 21,000

-----------------------------------------------

PRINCES 10,000 38.11 13,000

-----------------------------------------------

SAMMY'S 27,000 6.07 5,000

-----------------------------------------------

KEARNEY

NORTH 18,000 3.47 2,000

-----------------------------------------------

TOTAL 1,373,879 7.71 341,123

-----------------------------------------------

The resources are calculated at a cut-off grade of 2 g/t gold (Au), numbers are

rounded, gold grades are capped at 75 g/t gold and a minimum mining width of

0.9m has been applied.

Measured and Indicated resources on Kearney vein have increased to 100,545

ounces of gold (2014) from 69,000 ounces (2012). Measured and Indicated

resources on Joshua vein have increased to 67,739 ounces of gold (2014) from

15,800 ounces (2012). The Kearney and Joshua veins are the early targets of

underground mining. Combined Measured and Indicated resource category on these

two veins are estimated at 168,284 ounces of gold, with 293,918 ounces of gold

in the Inferred resource category. Both vein systems are open at depth.

REGULATORY CONTEXT

The economic study includes use of Measured and Indicated resources with a

restricted portion of Inferred resources, estimated for two veins (Joshua and

Kearney veins). The Inferred resources (which have lower statistical support

than Measured or Indicated Resources) are contiguous with Measured or Indicated

resources and / or lie within scheduled mining areas. The use of Inferred

resources, in a restricted qualifying manner, is permitted by the PERC code in

regard to economic studies but is excluded within NI 43-101, except within a

"Preliminary Economic Assessment (PEA)". In compliance with the disclosure

requirements of NI 43-101, it has been determined that the economic study

including associated inferred resources is deemed a Preliminary Economic

Assessment. PERC is an approved code is respect of NI 43-101. As part of PERC

requirements, a comparative study (Feasibility) is included in the detailed

technical report which does not include Inferred resources and also includes

studies on sensitivity to gold price.

In compliance with NI 43-101 2.3.3(a) "the preliminary economic assessment is

preliminary in nature, that it includes inferred mineral resources that are

considered too speculative geologically to have economic considerations applied

to them that would enable them to be categorized as mineral reserves and there

is no certainty that the preliminary economic assessment will be realized."

RESULTS OF THE ECONOMIC STUDY

The total of scheduled Measured and Indicated ounces utilised within the mining

study is 104,627 ounces. The Inferred resources scheduled in the economic study

are estimated at 60,635 ounces. Total Inferred resource estimated on the Joshua

and Kearney orebodies is 293,918 ounces of gold. The amount of Inferred

resources included in the economic estimate amounts to 20.6% of the total

Inferred resources estimated on these veins. Were Inferred resources excluded

within the mining plan, approximately 1 year would be removed from the estimate

of mine life and annual output would be reduced.

----------------------------------------------------------------------------

LOM Capital

Expenditure Year 1 Year 2 Year 3 Year 4

----------------------------------------------------------------------------

Capital Excluding

Leasable

Equipment GBP 1,679,432 GBP 4,149,604 GBP 422,355 GBP 390,534

----------------------------------------------------------------------------

Capital Leasable

Equipment GBP 1,273,469 GBP 1,334,177 GBP 0 GBP 0

----------------------------------------------------------------------------

Contingency 15% GBP 442,935 GBP 822,567 GBP 63,353 GBP 58,580

----------------------------------------------------------------------------

Working

Capital(i) GBP 1,000,000 GBP 0 GBP 0 GBP 0

----------------------------------------------------------------------------

GRAND TOTAL

(UKGBP) GBP 4,395,836 GBP 6,306,349 GBP 485,708 GBP 449,115

----------------------------------------------------------------------------

CDN$ TOTAL (1.83

CDN/GBP) $8,053,325 $11,553,294 $889,819 $822,756

----------------------------------------------------------------------------

----------------------------------------------------------

LOM Capital

Expenditure Year 5 Year 6 LOM

----------------------------------------------------------

Capital Excluding

Leasable

Equipment GBP 0 GBP 0 GBP 6,641,926

----------------------------------------------------------

Capital Leasable

Equipment GBP 0 GBP 0 GBP 2,607,646

----------------------------------------------------------

Contingency 15% GBP 0 GBP 0 GBP 1,387,436

----------------------------------------------------------

Working

Capital(i) GBP 0 GBP 0 GBP 1,000,000

----------------------------------------------------------

GRAND TOTAL

(UKGBP) GBP 0 GBP 0 GBP 11,637,007

----------------------------------------------------------

CDN$ TOTAL (1.83

CDN/GBP) $0 $0 $21,320,102

----------------------------------------------------------

LIFE OF MINE CAPITAL EXPENDITURE SUMMARY

(i)Working Capital includes payment delay for concentrate, VAT pre-payment

and 10% contingency

----------------------------------------------------------------------------

Gold Price GBP

750/oz Year 1 Year 2 Year 3 Year 4

----------------------------------------------------------------------------

Operating Costs GBP 5,693,338 GBP 10,430,904 GBP 11,964,071 GBP 11,261,136

----------------------------------------------------------------------------

Revenue GBP 5,354,810 GBP 15,597,318 GBP 20,264,230 GBP 19,238,279

----------------------------------------------------------------------------

Cash flow (UKGBP) -GBP 338,528 GBP 5,166,414 GBP 8,300,158 GBP 7,977,143

Cash flow

(1.83CDN/GBP) -$620,312 $9,467,531 $15,210,123 $14,616,519

----------------------------------------------------------------------------

-----------------------------------------------------------------

Gold Price GBP

750/oz Year 5 Year 6 LOM

-----------------------------------------------------------------

Operating Costs GBP 10,830,431 GBP 8,459,001 GBP 58,638,882

-----------------------------------------------------------------

Revenue GBP 19,774,130 GBP 11,741,821 GBP 91,970,588

-----------------------------------------------------------------

Cash flow (UKGBP) GBP 8,943,699 GBP 3,282,820 GBP 33,331,706

Cash flow

(1.83CDN/GBP) $16,388,344 $6,015,374 $61,074,685

-----------------------------------------------------------------

OPERATING CASH FLOW AT AN AVERAGE GOLD PRICE OF UKGBP 750 PER OUNCE

At a gold price of UKGBP 750 / ounce (USD$1260 at $1.68/UKGBP), the pre-tax

operating surplus after capital expenditure estimates an Internal Rate of Return

of 72% and, at an 8% discount rate, a net present value of approximately UKGBP

14.5m (CDN$26.6m) and a cash cost of production of UKGBP 394 per ounce (USD$662

at $1.68/UKGBP). The study scheduled approximately 36% of the combined resources

identified on the Kearney and Joshua veins.

The Technical Report (Galantas 2014) was prepared by the Galantas Gold

Corporation Geological and Mining Team under the supervision of R. Phelps C.Eng

MIMMM (President & CEO, Galantas Gold Corporation), a Qualified Person for the

purposes of NI 43-101 and the AIM Rules, who has reviewed and approved this

release. The Company intends to file the complete Technical Report on SEDAR

within 45 days of this release, as required by NI 43-101.

PLANNING UPDATE

The permitting process for the underground mine has been detailed and exhaustive

but has now reached the final stage. The Company is advised that the final

consultation response (from Natural Heritage, Northern Ireland Environment

Agency) has been received and is positive. The Company understands a timeline

within three months is possible for a final determination but the timing of such

is not in the Company's hands.

POSITIVE ENVIRONMENTAL COMPLIANCE UPDATE

The Company has received confirmation from the Northern Ireland Environment

Agency that 2013 marked another year of strict environmental compliance with

regulatory standards for out-flow water from the Omagh Gold-Mine.

COMMENT

Roland Phelps, President & CEO, Galantas Gold Corporation, commented, "Our

detailed geological, mining and economic studies demonstrate the excellent

potential of an underground mine at Omagh. With planning permits approaching the

final stage of determination, we are looking forward to building a sound

business that will provide local jobs within a safe environment. We haven't yet

found the limits of most of the veins we have discovered. Taking operations

underground allows production from a substantial gold resource that we expect

will continue to reveal itself, by underground drilling, as much larger than we

have already demonstrated. We are expecting to build the underground operations

to an initial target of around 32,000 ounces per year, based on what we already

know, increasing as additional resources are identified. Our ownership of an

existing processing plant, tailings facility and land package is a considerable

advantage in terms of minimising the capital required and we expect to make full

use of these assets."

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS: This press release contains

forward-looking statements within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian securities

laws, including resource estimates, economic estimates and technical studies,

for the Omagh Gold project. Forward-looking statements are based on estimates

and assumptions made by Galantas in light of its experience and perception of

geological interpretation, historical trends, current conditions and expected

future developments, as well as other factors that Galantas believes are

appropriate in the circumstances. Many factors could cause Galantas' actual

results, the performance or achievements to differ materially from those

expressed or implied by the forward looking statements, including: gold price

volatility; discrepancies between actual and estimated production, actual and

estimated metal grades and geologically interpreted widths, actual and estimated

metallurgical recoveries; actual and estimated costs; mining operational risk;

regulatory and permitting restrictions, including environmental regulatory

restrictions and liability; risks of sovereign involvement; speculative nature

of gold exploration; dilution; competition; loss of key employees; additional

funding requirements; planning and other permitting issues; and defective title

to mineral claims or property. These factors and others that could affect

Galantas's forward-looking statements are discussed in greater detail in the

section entitled "Risk Factors" in Galantas' Management Discussion & Analysis of

the financial statements of Galantas and elsewhere in documents filed from time

to time with the Canadian provincial securities regulators and other regulatory

authorities. These factors should be considered carefully, and persons reviewing

this press release should not place undue reliance on forward-looking

statements. Galantas has no intention and undertakes no obligation to update or

revise any forward-looking statements in this press release, except as required

by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

Galantas Gold Corporation Issued and Outstanding Shares total 76,697,156.

FOR FURTHER INFORMATION PLEASE CONTACT:

Galantas Gold Corporation

L. Jack Gunter P.Eng

Chairman

+44 (0) 2882 241100

Galantas Gold Corporation

Roland Phelps C.Eng

President & CEO

+44 (0) 2882 241100

info@galantas.com

www.galantas.com

Charles Stanley Securities (AIM Nominated Adviser)

Mark Taylor

+44 (0)20 7149 6000

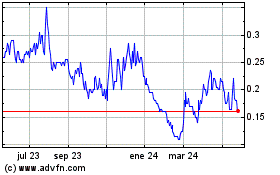

Galantas Gold (TSXV:GAL)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

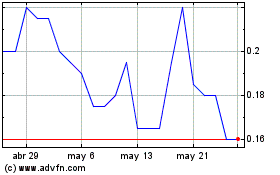

Galantas Gold (TSXV:GAL)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025