Bayshore Petroleum Corp.

(“

Bayshore” or the “

Company”)

(TSXV: BSH) is pleased to announce that it has entered into a

letter of intent (the “

Letter of Intent”) dated

effective May 17, 2021 outlining the general terms and conditions

with respect to the acquisition (the

“

Acquisition”) by Bayshore of all the issued and

outstanding share capital of Infinitum Copper Corp.

(“

Infinitum”). The Acquisition of Infinitum will

constitute a reverse takeover under Policy 5.2 of the TSX Venture

Exchange (the “

Exchange”), and is subject to

approval of the Exchange. This news release will be followed by a

further comprehensive news release setting out additional details

of the Acquisition in accordance with Exchange Policy 5.2.

Business of Infinitum & the Adelita

Copper Project

Infinitum is a privately held British Columbia

company, which holds an option to acquire an 80% interest in the

Adelita Property, Sonora State, Mexico, from Minaurum Gold Inc.

(TSXV: MGG; “Minaurum”).

The Adelita project is a copper-gold-silver

skarn mineralization and porphyry project. A 40 meter-long adit had

been driven on the Cerro Grande prospect in the central part of the

project area during the 1960s. Unknown operators opened the Las

Trancas prospect, a shear zone hosting copper oxide in the

southwestern part of the project area prior to 2005, and conducted

minor production from these areas.

An exploration program including drilling,

airborne geophysics and drilling have shown significant magnetic

anomalies parallel to the dominant mineralized trend at Cerro

Grande, suggesting blind targets for future drilling and

demonstrated 300 meters of vertical continuity on the Cerro Grande

skarn target discovery with the porphyry target still undrilled.

Seven target areas have been identified.

The project is located on the southern tip of

Sonora State, and lies in a regional belt of porphyry mines and

prospects including Cobre del Mayo’s Piedras Verdes porphyry Copper

mine and adjacent to Pan American Silver's Alamo Dorado

mine.

Upon exercise of the option, Infinitum and

Minaurum will form a joint venture (on an initial 80/20 basis) to

undertake further work on the Adelita property.

Conditions of Closing the

Acquisition

The closing of the Acquisition will include the

following:

|

1. |

Infinitum closing of a total finance of $4 million in two

tranches; |

| 2. |

BSH will (a) restructure its

existing business and consolidate of its total outstanding shares

to three million (3,000,000) shares (Consolidated

Shares); and |

| 3. |

The execution of a definitive

agreement between Bayshore and Infinitum. |

The closing will also be subject to the

following:

- receipt of all

regulatory and third party approvals, including the approval of the

Exchange;

- approval of the

shareholders of Bayshore and Infinitum;

- satisfactory due

diligence by each party of the other;

- no material

adverse changes to the businesses of Bayshore or Infinitum;

- receipt of

required financial statements of Infinitum and NI 43-101 technical

reports on the material properties of Infinitum, each in form and

substance reasonably satisfactory to Bayshore; and

- other customary

conditions to closing.

Transactions on Closing

Upon completion of the Acquisition, BSH

will:

|

(i) |

issue BSH Consolidated Shares to the holders of Infinitum shares on

a one-for-one basis. It is anticipated Infinitum will have

26,450,000 outstanding Infinitum shares at closing; and |

|

(ii) |

issue BSH Consolidated Shares to

Minaurum on the basis that Minaurum will hold 16% of the aggregate

number of BSH Consolidated Shares outstanding on closing (such that

Minaurum will receive 5,609,524 BSH Consolidated Shares, more or

less). |

It is anticipated that current shareholders of

Bayshore will own approximately 11.34% of the outstanding common

shares of Bayshore upon completion of the Acquisition.

It is also anticipated that Bayshore will change

its name to a name determined by Infinitum in connection with

completion of the Acquisition.

On closing, the Company’s Board of Directors and

management team will be reconstituted to consist of a number of

directors determined by Infinitum. The names and a description of

the new directors will be set out in a further comprehensive news

release to follow in accordance with Exchange Policy 5.2.

Shareholder Approval

The Acquisition will be a “Reverse Takeover”

under the policies of the Exchange and therefore will require

approval of the shareholders of Bayshore.

It is anticipated that Bayshore will seek

approval of its shareholders either at a special meeting of

shareholders to be held on or before July 30, 2021 (the

“Bayshore Shareholder Meeting”), or, if permitted

by the Exchange, by the written consent of the holders of a

majority of Bayshore’s outstanding shares. It is anticipated

shareholders will be requested to approve: (A) the Acquisition, (B)

the change of name of Bayshore to such name as may be specified by

Infinitum, (C) the election of new directors, (D) the

Consolidation, (E) any change of control which may arise pursuant

to the Acquisition, (F) the continuation of Bayshore from Alberta

to British Columbia, and (G) such other matters that may be

reasonably required in order to give effect to the Acquisition.

Definitive Agreement

The Letter of Intent contemplates that the

Acquisition will be completed through a definitive agreement (the

“Definitive Agreement”) that is to be negotiated

by Bayshore and Infinitum, which will contain customary

representations and warranties for similar transactions.

Trading Halt

Trading of the common shares of Bayshore has

been and will remain halted pending further filings with the

Exchange.

On Behalf of the Board of Directors

of Bayshore Petroleum Corp.

Peter Ho

Chief Executive Officer / Director

CAUTIONARY STATEMENTS

Completion of the transaction is subject to a

number of conditions, including but not limited to, Exchange

acceptance and, if applicable, disinterested shareholder approval.

Where applicable, the transaction cannot close until the required

shareholder approval is obtained. There can be no assurance that

the transaction will be completed as proposed or at all.

Investors are cautioned that, except as

disclosed in the management information circular or filing

statement to be prepared in connection with the transaction, any

information released or received with respect to the transaction

may not be accurate or complete and should not be relied upon.

Trading in the securities of Bayshore should be considered highly

speculative.

The TSX Venture Exchange Inc. has in no way

passed upon the merits of the proposed transaction and has neither

approved nor disapproved the contents of this news release.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION: This news release may include

certain “forward-looking statements” under applicable Canadian

securities legislation. Forward-looking statements include, but are

not limited to, statements with respect to: closing of the

Acquisition, satisfaction of conditions precedent including raising

funds, exercise of the option to acquire an interest in the Adelita

property, future work to be carried on the Adelita Property; use of

funds; and the business and operations of Infinitum and Bayshore.

Forward-looking statements are necessarily based upon several

estimates and assumptions that, while considered reasonable, are

subject to known and unknown risks, uncertainties, and other

factors which may cause the actual results and future events to

differ materially from those expressed or implied by such

forward-looking statements. There is no assurance any of the

forward-looking statements will be completed as described herein,

or at all. Such factors include, but are not limited to: general

business, economic, competitive, political and social

uncertainties; operating and technical difficulties in connection

with mineral exploration and development activities, lack of

investor interest in financing; requirements for additional

capital; future prices of copper; changes in general economic

conditions; accidents, delays or the failure to receive board,

shareholder or regulatory approvals, including the required

permits; results of current exploration and testing; changes in

laws, regulations and policies affecting mining operations; and

title disputes. There can be no assurance that such statements will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on forward

looking statements. Bond Resources disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or

otherwise.

Contact:

Peter HoChief Executive Officer and

Directorpeter.ho@bayshorepetroleum.com+1 (403) 630 4355

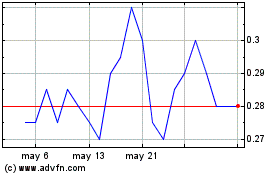

Minaurum Gold (TSXV:MGG)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Minaurum Gold (TSXV:MGG)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024